Question: | HW # 5 : Due Sunday March 9 th You are the CFO of Adidas which is considering launching a new tennis racket. It

HW #: Due Sunday March th

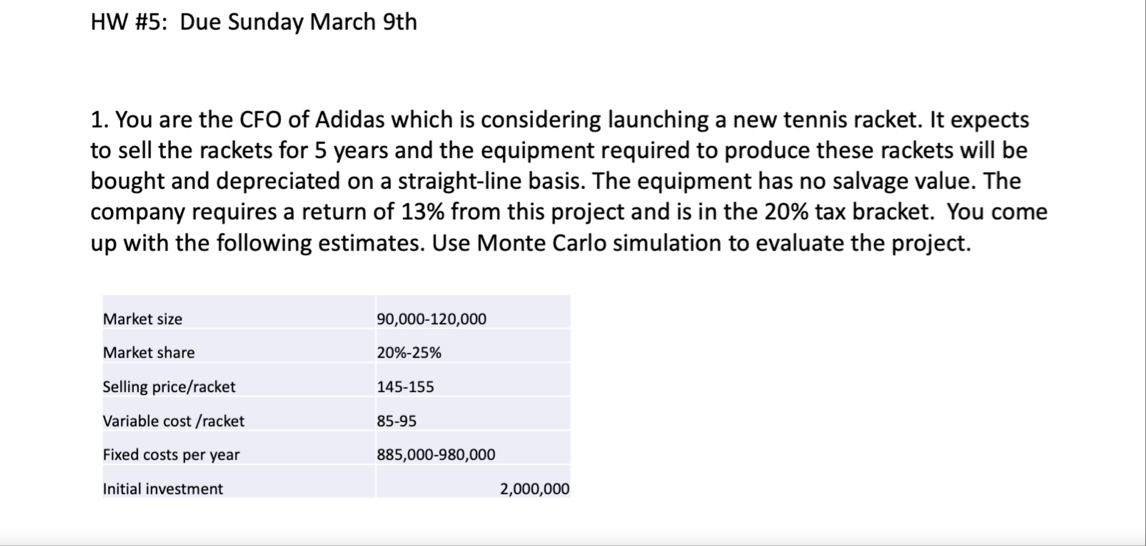

You are the CFO of Adidas which is considering launching a new tennis racket. It expects to sell the rackets for years and the equipment required to produce these rackets will be bought and depreciated on a straightline basis. The equipment has no salvage value. The company requires a return of from this project and is in the tax bracket. You come up with the following estimates. Use Monte Carlo simulation to evaluate the project.

tableMarket size,Market share,Selling priceracketVariable costracketFixed costs per year,Initial investment,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock