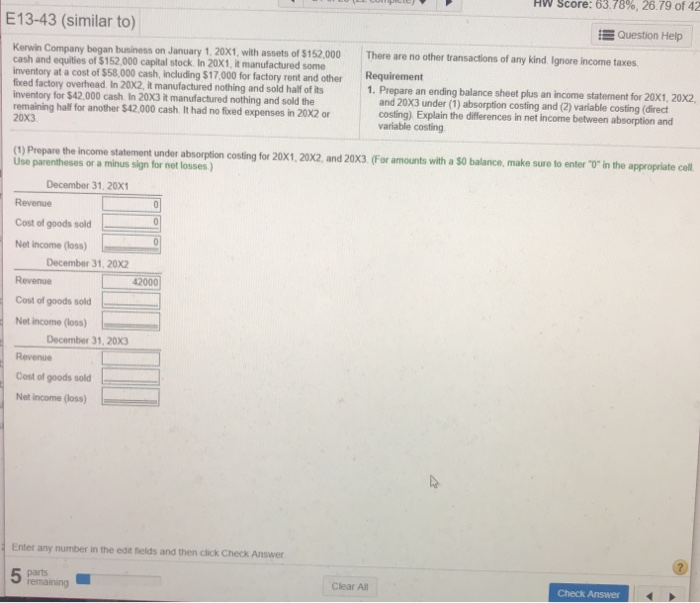

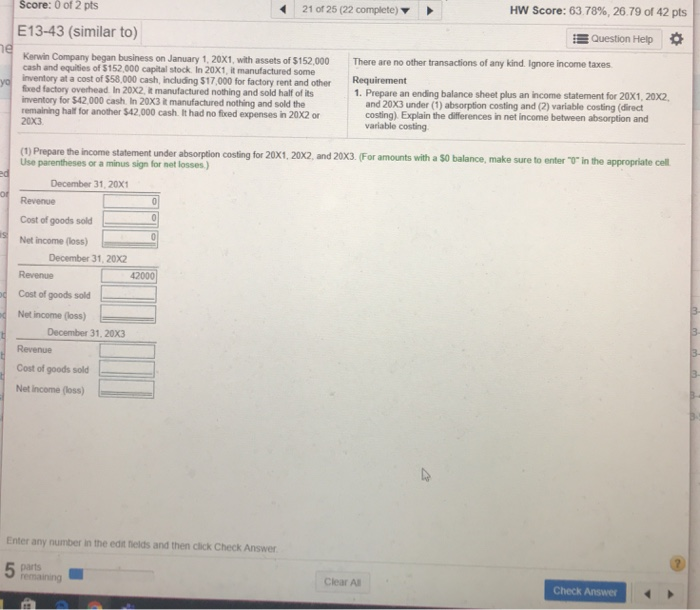

HW Score: 63.78% , 26.79 of 42 E13-43 (similar to) Question Help Kerwin Company began business on January 1, 20X1, with assets of $152,000 cash and equities of $152,000 capital stock. In 20X1, it manufactured some inventory at a cost of $58,000 cash, including $17,000 for factory rent and other fixed factory overhead. In 20X2, it manufactured nothing and sold half of its inventory for $42,000 cash. In 20X3 it manufactured nothing and sold the remaining half for another $42,000 cash. It had no fixed expenses in 20X2 or 20X3 There are no other transactions of any kind. Ignore income taxes Requirement 1. Prepare an ending balance sheet plus an income statement for 20X1, 20X2 and 20X3 under (1) absorption costing and (2) variable costing (direct costing) Explain the differences in net income between absorption and variable costing (1) Prepare the income statement under absorption costing for 20X1, 20X2, and 20X3. (For amounts with a $0 balance, make sure to enter "0" in the appropriate cell. Use parentheses or a minus sign for net losses) December 31, 20X1 Revenue C 0 Cost of goods sold Net income (loss) December 31, 20x2 42000 Revenue Cost of goods sold Net income (loss) December 31, 20X3 Revenue Cost of goods sold Net income (loss) 2 Enter any number in the edit fields and then click Check Answer 5 parts remaining Clear All Check Answer HW Score: 63.78%, 26.79 of 42 pts 21 of 25 (22 complete) Score: 0 of 2 pts E13-43 (similar to) Question Help e Kerwin Company began business on January 1, 20X1, with assets of $152,000 cash and equities of $152,000 capital stock. In 20X1, it manufactured some inventory at a cost of $58,000 cash, including $17,000 for factory rent and other There are no other transactions of any kind. Ignore income taxes Requirement yo fixed factory overhead In 20X2, it manufactured nothing and sold half of its inventory for $42,000 cash. In 20X3 it manufactured nothing and sold the remaining half for another $42,000 cash. It had no fixed expenses in 20X2 or 20X3 1. Prepare an ending balance sheet plus an income statement for 20X1, 20X2 and 20X3 under (1) absorption costing and (2) variable costing (direct costing). Explain the differences in net income between absorption and variable costing (1) Prepare the income statement under absorption costing for 20X1, 20X2, and 20X3. (For amounts with a $0 balance, make sure to enter "o in the appropriate cell Use parentheses or a minus sign for net losses) December 31, 20X1 Revenue Cost of goods sold Net income (loss) December 31, 20X2 42000 Revenue Cost of goods sold Net income (loss) December 31, 20x3 Revenue Cost of goods sold Net income (loss) Enter any number in the edit fields and then click Check Answer 5 parts remaining Clear All Check Answer HW Score: 63.78% , 26.79 of 42 E13-43 (similar to) Question Help Kerwin Company began business on January 1, 20X1, with assets of $152,000 cash and equities of $152,000 capital stock. In 20X1, it manufactured some inventory at a cost of $58,000 cash, including $17,000 for factory rent and other fixed factory overhead. In 20X2, it manufactured nothing and sold half of its inventory for $42,000 cash. In 20X3 it manufactured nothing and sold the remaining half for another $42,000 cash. It had no fixed expenses in 20X2 or 20X3 There are no other transactions of any kind. Ignore income taxes Requirement 1. Prepare an ending balance sheet plus an income statement for 20X1, 20X2 and 20X3 under (1) absorption costing and (2) variable costing (direct costing) Explain the differences in net income between absorption and variable costing (1) Prepare the income statement under absorption costing for 20X1, 20X2, and 20X3. (For amounts with a $0 balance, make sure to enter "0" in the appropriate cell. Use parentheses or a minus sign for net losses) December 31, 20X1 Revenue C 0 Cost of goods sold Net income (loss) December 31, 20x2 42000 Revenue Cost of goods sold Net income (loss) December 31, 20X3 Revenue Cost of goods sold Net income (loss) 2 Enter any number in the edit fields and then click Check Answer 5 parts remaining Clear All Check Answer HW Score: 63.78%, 26.79 of 42 pts 21 of 25 (22 complete) Score: 0 of 2 pts E13-43 (similar to) Question Help e Kerwin Company began business on January 1, 20X1, with assets of $152,000 cash and equities of $152,000 capital stock. In 20X1, it manufactured some inventory at a cost of $58,000 cash, including $17,000 for factory rent and other There are no other transactions of any kind. Ignore income taxes Requirement yo fixed factory overhead In 20X2, it manufactured nothing and sold half of its inventory for $42,000 cash. In 20X3 it manufactured nothing and sold the remaining half for another $42,000 cash. It had no fixed expenses in 20X2 or 20X3 1. Prepare an ending balance sheet plus an income statement for 20X1, 20X2 and 20X3 under (1) absorption costing and (2) variable costing (direct costing). Explain the differences in net income between absorption and variable costing (1) Prepare the income statement under absorption costing for 20X1, 20X2, and 20X3. (For amounts with a $0 balance, make sure to enter "o in the appropriate cell Use parentheses or a minus sign for net losses) December 31, 20X1 Revenue Cost of goods sold Net income (loss) December 31, 20X2 42000 Revenue Cost of goods sold Net income (loss) December 31, 20x3 Revenue Cost of goods sold Net income (loss) Enter any number in the edit fields and then click Check Answer 5 parts remaining Clear All Check