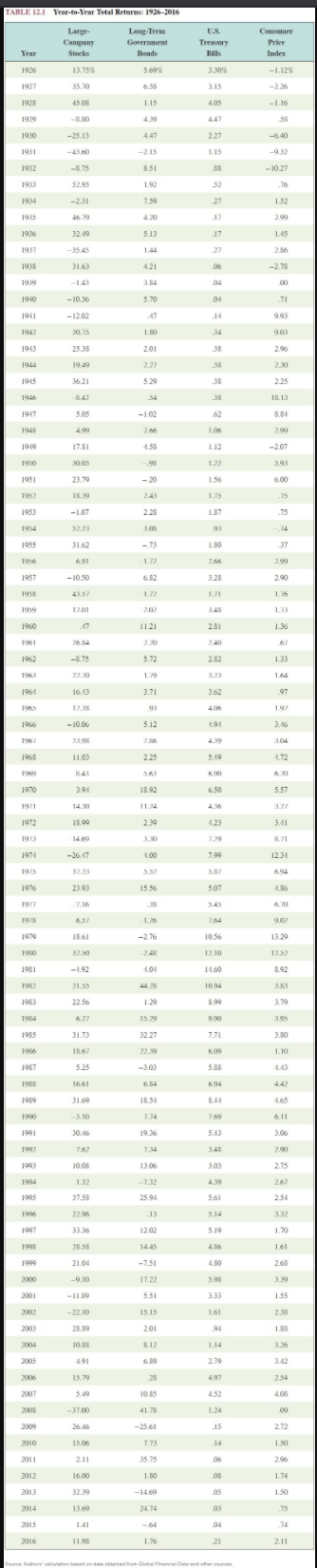

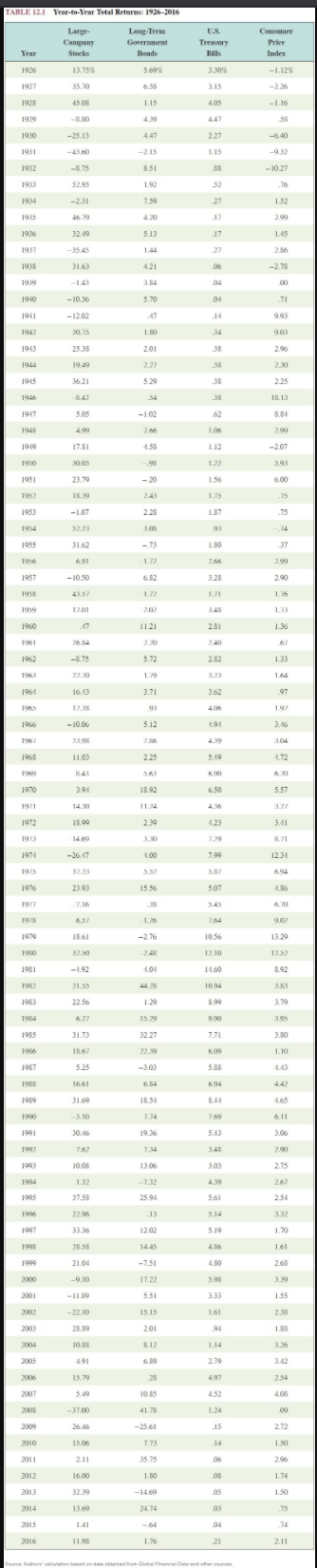

HW.12 - RWJ.12 (Module 5A) Saved 1 Refer to Table 12.1 and look at the period from 1970 through 1975. a. 10 points eBook Calculate the arithmetic average returns for large-company stocks and T-bills over this period. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. Calculate the standard deviation of the returns for large-company stocks and T-bills over this period. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) C-1. Calculate the observed risk premium in each year for the large-company stocks versus the T-bills. What was the average risk premium over this period? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c-2. Calculate the observed risk premium in each year for the large-company stocks versus the T-bills. What was the standard deviation of the risk premium over this period? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Hint References a. Large company stocks T-bills Large company stocks b. : % % % % % % T-bills C-1. Average risk premium C-2 Standard deviation Il 115 421 06 570 1.56 1.87 5.72 3.71 5.12 101 5.10 6.90 6.50 1.00 7.99 1556 5 18.54 8.44 19 5.00 13.06 12.02 -7.51 4.90 5.98 5.51 HW.12 - RWJ.12 (Module 5A) Saved 1 Refer to Table 12.1 and look at the period from 1970 through 1975. a. 10 points eBook Calculate the arithmetic average returns for large-company stocks and T-bills over this period. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. Calculate the standard deviation of the returns for large-company stocks and T-bills over this period. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) C-1. Calculate the observed risk premium in each year for the large-company stocks versus the T-bills. What was the average risk premium over this period? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c-2. Calculate the observed risk premium in each year for the large-company stocks versus the T-bills. What was the standard deviation of the risk premium over this period? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Hint References a. Large company stocks T-bills Large company stocks b. : % % % % % % T-bills C-1. Average risk premium C-2 Standard deviation Il 115 421 06 570 1.56 1.87 5.72 3.71 5.12 101 5.10 6.90 6.50 1.00 7.99 1556 5 18.54 8.44 19 5.00 13.06 12.02 -7.51 4.90 5.98 5.51