Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hyper Looper Commuter Systems Ltd (HLCS) is a company developing high tech transportation systems. HLCS had its initial public offer (IPO) of shares on 10th

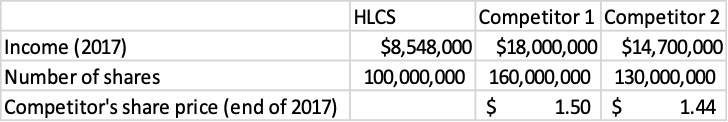

- Hyper Looper Commuter Systems Ltd (HLCS) is a company developing high tech transportation systems. HLCS had its initial public offer (IPO) of shares on 10th January 2018. The company had 100,000,000 shares on issue before the offer. The share offer was underwritten by BluSky Investments, with total costs of 5 percent of the offer value. The share offer consisted of 10,000,000 shares (no shares were sold by the existing shareholders in this offer). The fixed share offer (subscription) price was $1.00 per share. Subscriptions received by the underwriter at the offer close date were for a total of 10,000,000 shares. Total income and the total number of shares for HLCS and for two competitors, who both listed on the local stock exchange in 2015, are provided below.

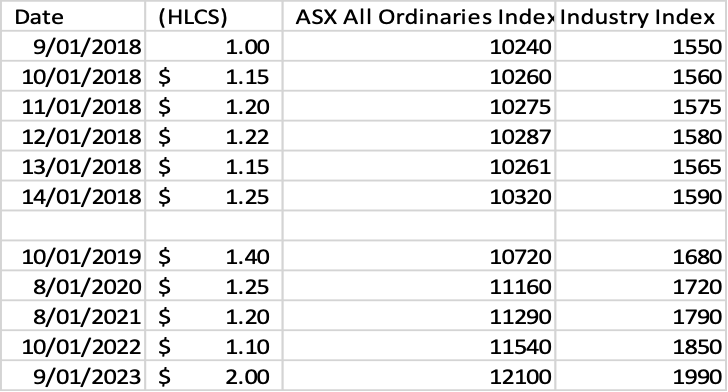

Furthermore, post-listing share prices for HLCS and market (and industry) index information are as follows:

Based on the above scenario answer the following questions:

[question is continued on the next page]

Based on the above scenario answer the following questions:

- Using relative valuation, what is you estimate of the value of HLCS?

- From the IPO companys perspective, is the share offer underpriced or overpriced and by how much by the end of the first trading day?

- What is the amount raised by the offer (after underwriting costs)? How much has the underwriter earned from the IPO?

- Comment on the listing day and subsequent returns performance of this initial public offer: 1) from the original owners perspective (i.e. those investors who held shares before the IPO was initiated), and 2) from the perspective of investors who bought into this IPO company at the offer subscription price. Note: assume that the systematic risk of the IPO company shares, the equity market and the industry are one and the same, that is, they are all equal to one (i.e. you are not required to risk-adjust the returns for this IPO).

- Overall, would you have invested in this IPO? (Note: outline the reasoning for your decision).

- Five years and four months after the IPO, HLCS Ltd has 1.5 million shares of stock outstanding at a price of $2.50 per share. The company would like to raise more money through a seasoned equity offering (SEO) and has announced a rights issue. The SEO plan requires 3 rights to purchase one new share at a price of $2.20 per share (i.e. for each three existing shares already held, an investor can buy one new share via this rights issue). What would be the total amount of money to be raised through the rights offering? What is the value of a right to buy one new share? What is the value of a right per each existing share?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started