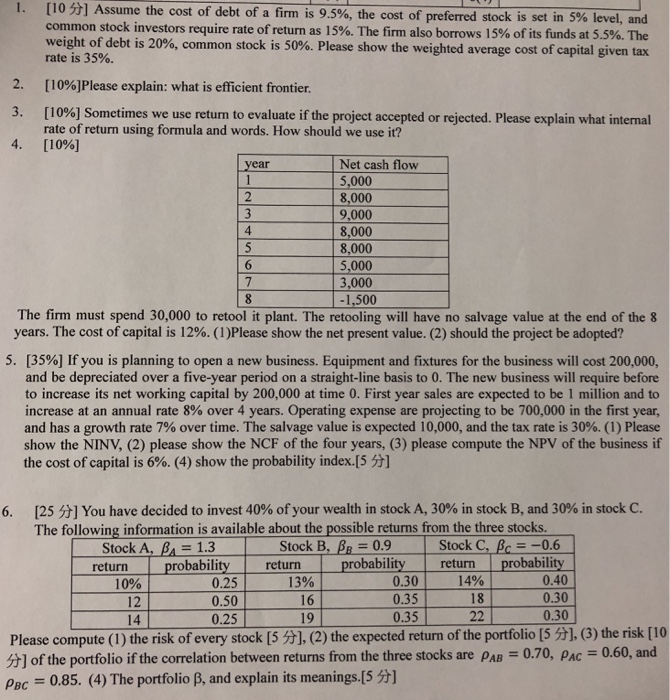

I. [10 S] Assume the cost of debt of a firm is 9.5%, the cost of preferred stock is set in 5% level, and common stock investors require rate of retu weight of debt is 20%, common stock is 50%. rate is 35%. Please show the weighted average cost of capital given tax [1096]Please explain: what is efficient frontier. 10% Sometimes we use retur n to evaluate ifthe project accepted or rejected. Please explain what internal rate of return using formula and words. How should we use it? [1090] 3 4. Net cash flow 5,000 8,000 9,000 8,000 8,000 5,000 3,000 year 4 1,500 The firm must spend 30,000 to retool it plant. The retooling will have no salvage value at the end of the 8 years. The cost of capital is 12%. ( 1 )Please show the net present value. (2) should the project be adopted? 5. [3596] If you is planning to open a new business. Equipment and fixtures for the business will cost 200,000 and be depreciated over a five-year period on a straight-line basis to 0. The new business will require before to increase its net working capital by 200,000 at time 0. First year sales are expected to be 1 million and to increase at an annual rate 8% over 4 years. Operating expense are projecting to be 700,000 in the first year, and has a growth rate 7% over time. The salvage value is expected 10,000, and the tax rate is 30%. (1) Please show the NINV, (2) please show the NCF of the four years, (3) please compute the NPV of the business if the cost ofcapital is 6%. (4) show the probability index.[5 ] ] You have decided to invest 40% ofyour wealth in stock A, 30% in stock B, and 30% in stock C. [25 The following information is available about the possible returns from the three stocks. 6. Stock C, Bc-0.6 probability return probability Stock B. -0.9 Stock A, BA 1.3 return probability return 10%-0.25 | 1390| 14% 0.50 0.25 16 19 0.30 0.35 0.35 0.40 0.30 0.30 14 Please compute (1) the risk of every stock [5 , (2) the expected return of the portfolio [5 ].(3) the risk [10 0.60, and ] of the portfolio if the correlation between returns from the three stocks are PaB-070, Pac pBc 0.85. (4) The portfolio B, and explain its meanings.[5 5)