I Accounting Workbook: Your accounting wOrkbook must include appropriate calculations, ratios, and notes. Be sure to complete all tabs in the

spreadsheet.

A. Create adjusting entries for financial statement preparation.

B. Create an adjusted trial balance for financial statement preparation.

C. Prepare financial statements for determining the company's financial position.

D. Calculate ratios for determining the company's financial health.

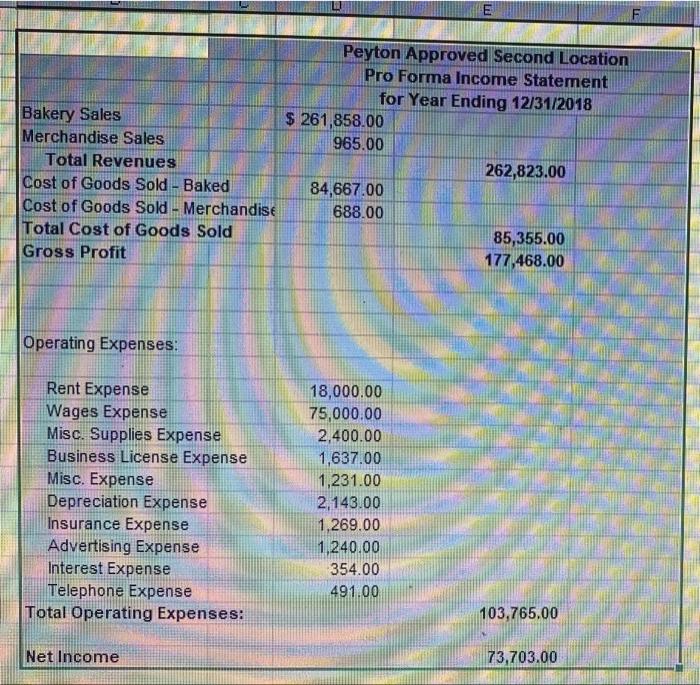

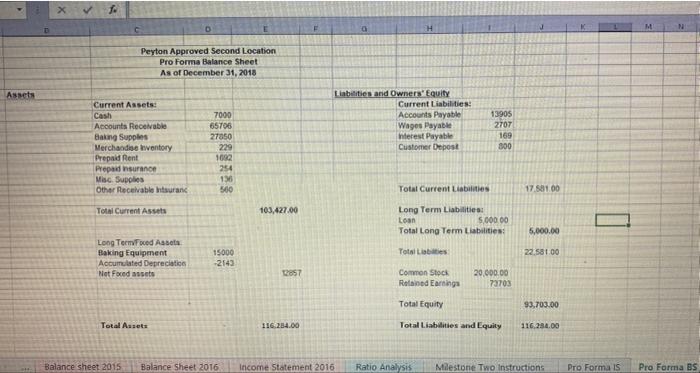

E. Create pro forma financial statements for predicting ability to meet future expansion goals.

F Peyton Approved Second Location Pro Forma Income Statement for Year Ending 12/31/2018 Bakery Sales $ 261,858.00 Merchandise Sales 965.00 Total Revenues 262,823.00 Cost of Goods Sold - Baked 84,667.00 Cost of Goods Sold - Merchandise 688.00 Total Cost of Goods Sold 85,355.00 Gross Profit 177,468.00 Operating Expenses: Rent Expense Wages Expense Misc. Supplies Expense Business License Expense Misc. Expense Depreciation Expense Insurance Expense Advertising Expense Interest Expense Telephone Expense Total Operating Expenses: 18,000.00 75,000.00 2,400.00 1,637.00 1,231.00 2,143.00 1,269.00 1,240.00 354.00 491.00 103,765.00 Net Income 73,703.00 1 d Peyton Approved Second Location Pro Forma Balance Sheet As of December 31, 2018 Assets Current Assets Cash Accounts Receivable Baking Supplies Merchandise ventory Prepaid Rent Prepaid insurance Misc Supplies Other Receivable insuranc Liabilities and Owners' Equity Current Liabilities: Accounts Payable Wages Payable Interest Payable Customer Depost 7000 65706 27350 229 1032 254 130 500 13905 2707 169 800 Total Current Liabilities 17.581.00 Total Current Assets 103.427.00 Long Term Liabilities Loan 5,000.00 Total Long Term Liabilities: 5,000.00 Total Libes 22.581 00 Long Termoed Assets Baking Equipment Accumulated Depreciatis Not Fored assets 15000 2143 857 Common Stock Roland Earnings 20,000.00 73703 Total Equity 93.700.00 Total Assets 116.234.00 Total Liabilities and Equity 116.234.00 Balance sheet 2015 Balance Sheet 2016 Income Statement 2016 Ratio Analysis Milestone Two Instructions Pro Forma IS Pro Forma BS F Peyton Approved Second Location Pro Forma Income Statement for Year Ending 12/31/2018 Bakery Sales $ 261,858.00 Merchandise Sales 965.00 Total Revenues 262,823.00 Cost of Goods Sold - Baked 84,667.00 Cost of Goods Sold - Merchandise 688.00 Total Cost of Goods Sold 85,355.00 Gross Profit 177,468.00 Operating Expenses: Rent Expense Wages Expense Misc. Supplies Expense Business License Expense Misc. Expense Depreciation Expense Insurance Expense Advertising Expense Interest Expense Telephone Expense Total Operating Expenses: 18,000.00 75,000.00 2,400.00 1,637.00 1,231.00 2,143.00 1,269.00 1,240.00 354.00 491.00 103,765.00 Net Income 73,703.00 1 d Peyton Approved Second Location Pro Forma Balance Sheet As of December 31, 2018 Assets Current Assets Cash Accounts Receivable Baking Supplies Merchandise ventory Prepaid Rent Prepaid insurance Misc Supplies Other Receivable insuranc Liabilities and Owners' Equity Current Liabilities: Accounts Payable Wages Payable Interest Payable Customer Depost 7000 65706 27350 229 1032 254 130 500 13905 2707 169 800 Total Current Liabilities 17.581.00 Total Current Assets 103.427.00 Long Term Liabilities Loan 5,000.00 Total Long Term Liabilities: 5,000.00 Total Libes 22.581 00 Long Termoed Assets Baking Equipment Accumulated Depreciatis Not Fored assets 15000 2143 857 Common Stock Roland Earnings 20,000.00 73703 Total Equity 93.700.00 Total Assets 116.234.00 Total Liabilities and Equity 116.234.00 Balance sheet 2015 Balance Sheet 2016 Income Statement 2016 Ratio Analysis Milestone Two Instructions Pro Forma IS Pro Forma BS