Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I almost have this question done, I just need help with the parts I got wrong please. Required information [The following information applies to the

I almost have this question done, I just need help with the parts I got wrong please.

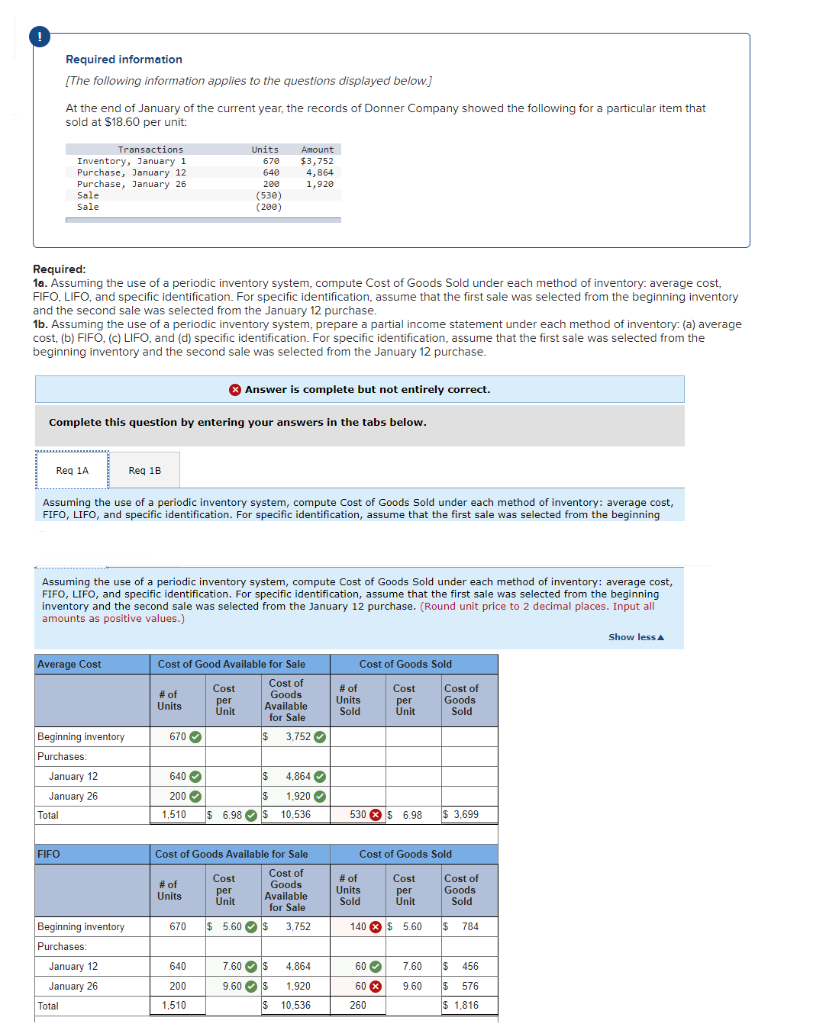

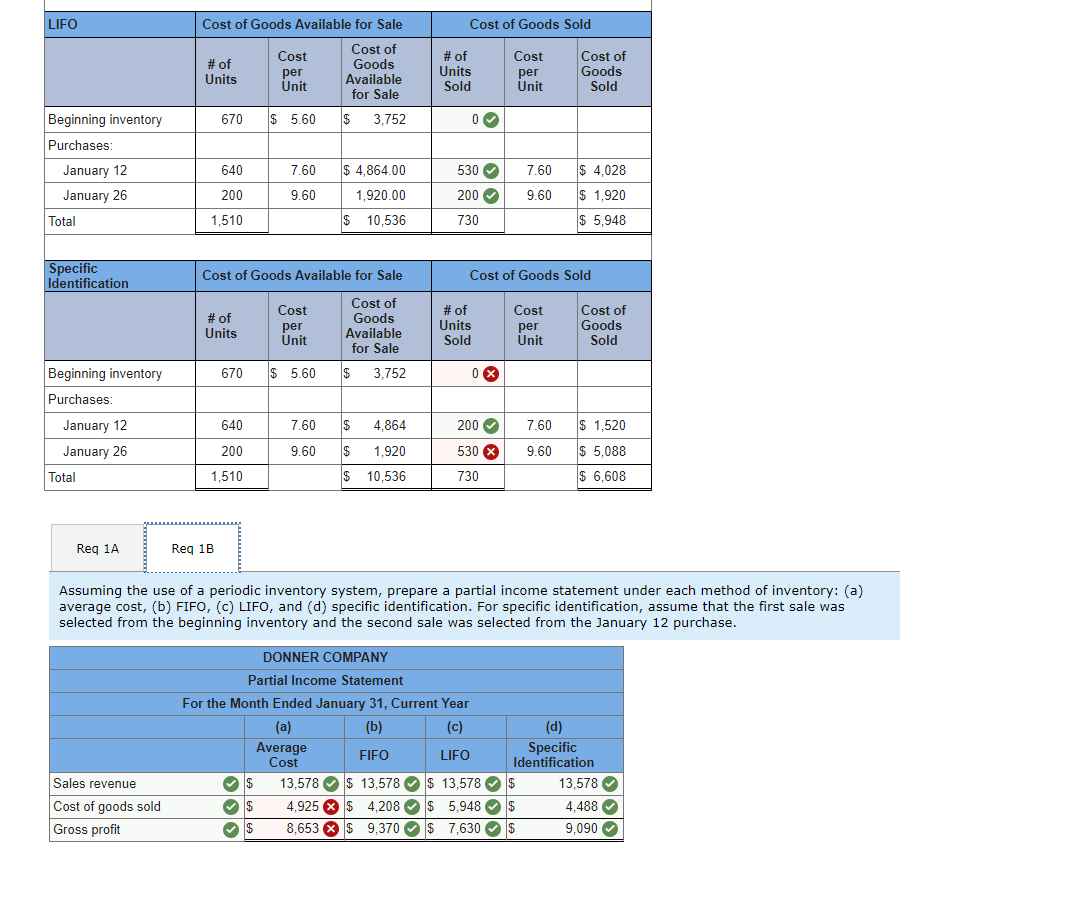

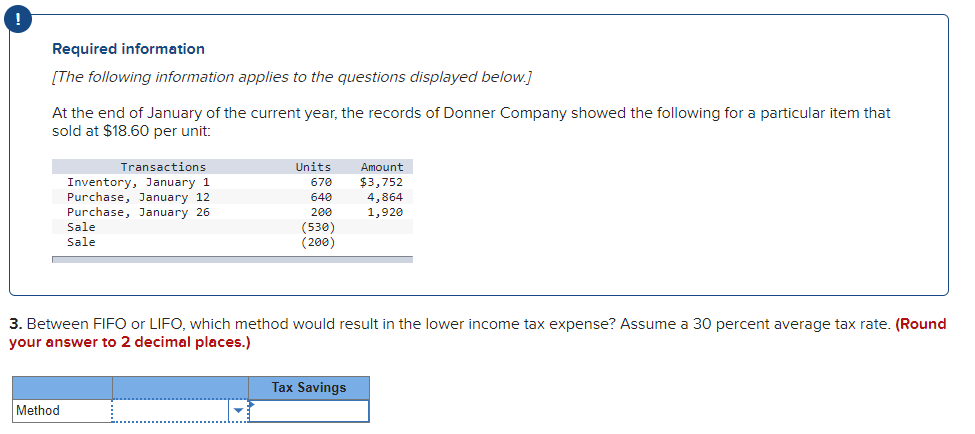

Required information [The following information applies to the questions displayed below.] At the end of January of the current year, the records of Donner Company showed the following for a particular item that sold at $18.60 per unit: Transactions Inventory, January 1 Purchase, January 12 Purchase, January 26 Sale Sale Units 670 640 200 (530) (200) Amount $3,752 4,864 1,920 Required: 1a. Assuming the use of a periodic inventory system, compute Cost of Goods Sold under each method of inventory. average cost, FIFO, LIFO, and specific identification. For specific identification, assume that the first sale was selected from the beginning inventory and the second sale was selected from the January 12 purchase. 1b. Assuming the use of a periodic inventory system, prepare a partial income statement under each method of inventory: (a) average cost. (b) FIFO. (C) LIFO, and (d) specific identification. For specific identification, assume that the first sale was selected from the beginning inventory and the second sale was selected from the January 12 purchase. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B Assuming the use of a periodic inventory system, compute Cost of Goods Sold under each method of inventory: average cost, FIFO, LIFO, and specific identification. For specific identification, assume that the first sale was selected from the beginning Assuming the use of a periodic inventory system, compute Cost of Goods Sold under each method of inventory: average cost, FIFO, LIFO, and specific identification. For specific identification, assume that the first sale was selected from the beginning inventory and the second sale was selected from the January 12 purchase. (Round unit price to 2 decimal places. Input all amounts as positive values.) Show less Average Cost Cost of Goods Sold Cost of Cost of Good Available for Sale Cost Cost of # of Goods Units per Available Unit for Sale 670 $ 3.752 # of Units Sold Cost per Unit Goods Sold Beginning inventory Purchases January 12 January 26 Total $ 4.864 640 200 1,510 $ 1.920 $ 6.98 $ 10,536 530 S 6.98 $ 3,699 FIFO Cost of Goods Sold Cost of Goods Available for Sale Cost Cost of # of Goods per Units Available Unit for Sale 670 $ 5.60 3,752 # of Units Sold Cost per Unit Cost of Goods Sold 140 X $ 5.60 $ $ 784 Beginning inventory Purchases January 12 60 7.60 640 200 January 26 7.60 $ 4,864 9.60$ 1,920 $ 10,536 9.60 60 X 260 $ 456 $ 576 $ 1,816 Total 1,510 LIFO Cost of Goods Sold Cost of Goods Available for Sale Cost of Cost # of Goods per Units Unit Available for Sale # of Units Sold Cost per Unit Cost of Goods Sold 670 $ 5.60 $ 3,752 0 Beginning inventory Purchases: January 12 January 26 Total 640 7.60 530 7.60 $ 4.028 $ 4,864.00 1,920.00 200 9.60 200 9.60 $ 1,920 1,510 $ 10,536 730 $ 5,948 Specific Identification Cost of Goods Available for Sale Cost of Goods Sold # of Units Cost per Unit Cost of Goods Available for Sale # of Units Sold Cost per Unit Cost of Goods Sold Beginning inventory 670 $ 5.60 $ 3,752 0 % Purchases 640 7.60 $ 4,864 200 7.60 $ 1,520 January 12 January 26 Total 200 9.60 $ 1,920 9.60 $ 5,088 530 X 730 1,510 $ 10.536 $ 6,608 Req 1A Reg 1B Assuming the use of a periodic inventory system, prepare a partial income statement under each method of inventory: (a) average cost, (b) FIFO, (C) LIFO, and (d) specific identification. For specific identification, assume that the first sale was selected from the beginning inventory and the second sale was selected from the January 12 purchase. DONNER COMPANY Partial Income Statement For the Month Ended January 31, Current Year (a) (b) (c) (d) Average FIFO LIFO Specific Cost Identification $ 13,578 $ 13,578$ 13,578$ 13,578 $ 4,925 X $ 4,208$ 5,948$ 4,488 8,653 $ 9,370 $ 7,630 $ 9,090 Sales revenue Cost of goods sold Gross profit oo Required information [The following information applies to the questions displayed below.] At the end of January of the current year, the records of Donner Company showed the following for a particular item that sold at $18.60 per unit: Transactions Inventory, January 1 Purchase, January 12 Purchase, January 26 Sale Sale Units 670 640 200 (530) (200) Amount $3,752 4,864 1,920 3. Between FIFO or LIFO, which method would result in the lower income tax expense? Assume a 30 percent average tax rate. (Round your answer to 2 decimal places.) Tax Savings MethodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started