Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i already asked #3 in one of my previous questions NORMAL DISTRIBUTION 5. For Question # 3, please draw a normal distribution below and tell

i already asked #3 in one of my previous questions

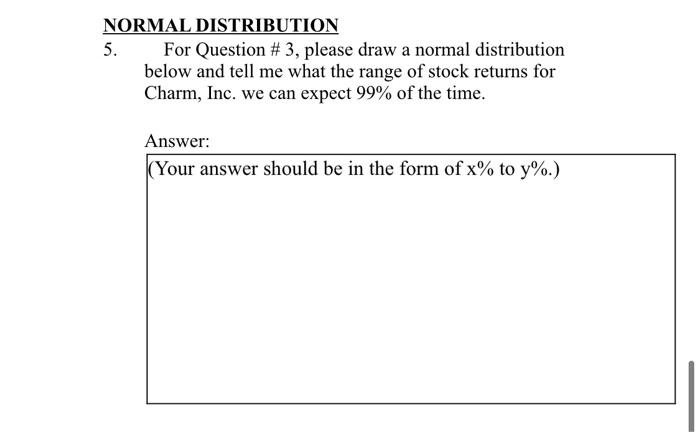

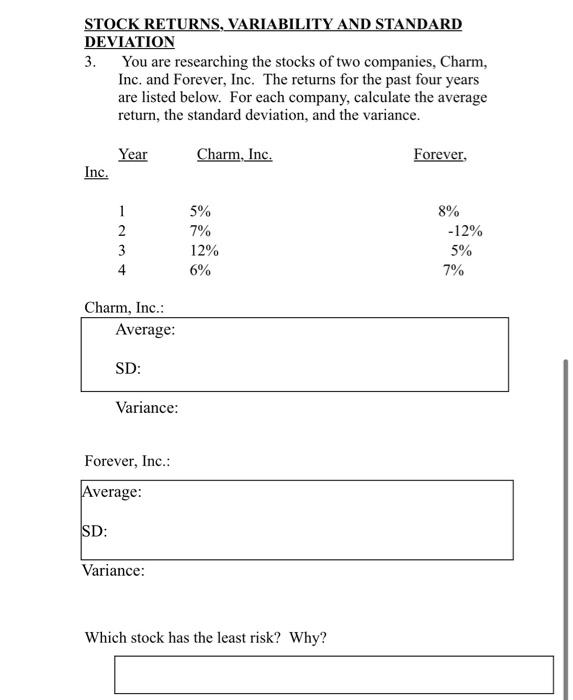

NORMAL DISTRIBUTION 5. For Question # 3, please draw a normal distribution below and tell me what the range of stock returns for Charm, Inc. we can expect 99% of the time. Answer: (Your answer should be in the form of x% to y%.) STOCK RETURNS, VARIABILITY AND STANDARD DEVIATION 3. You are researching the stocks of two companies, Charm, Inc. and Forever, Inc. The returns for the past four years are listed below. For each company, calculate the average return, the standard deviation, and the variance. Year Charm, Inc. Forever, Inc. AN 1 2 3 4 5% 7% 12% 6% 8% -12% 5% 7% Charm, Inc.: Average: SD: Variance: Forever, Inc.: Average: SD: Variance: Which stock has the least risk? Why Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started