I already asked a chegg experts on this question and the first numbers I was given were incorrect can it be redone please

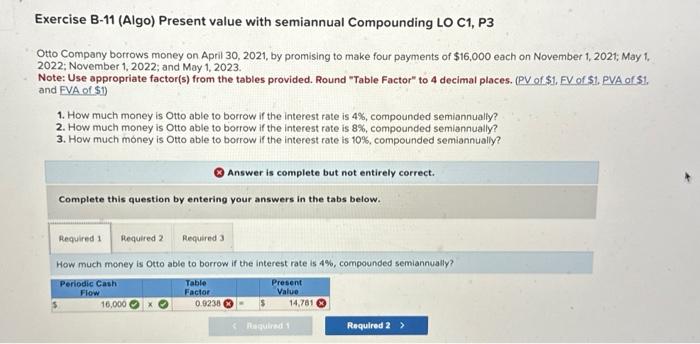

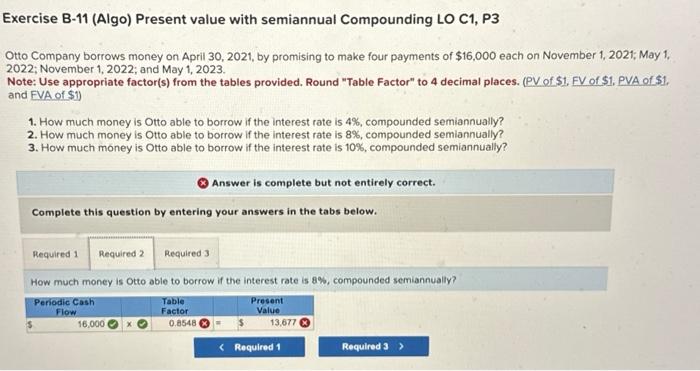

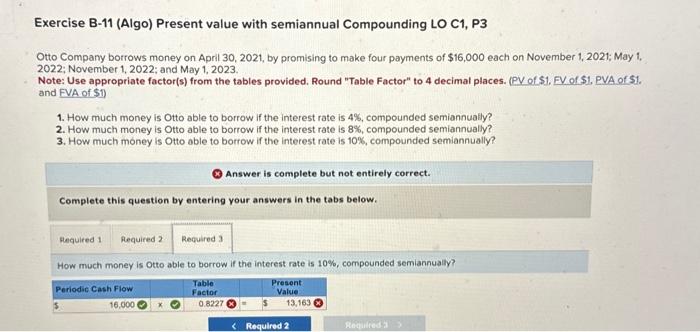

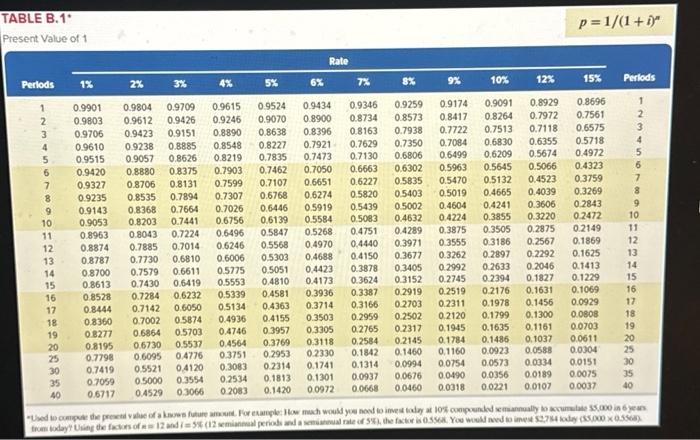

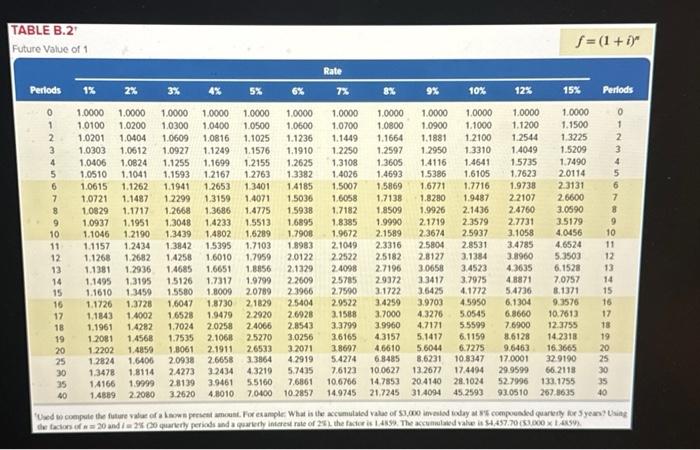

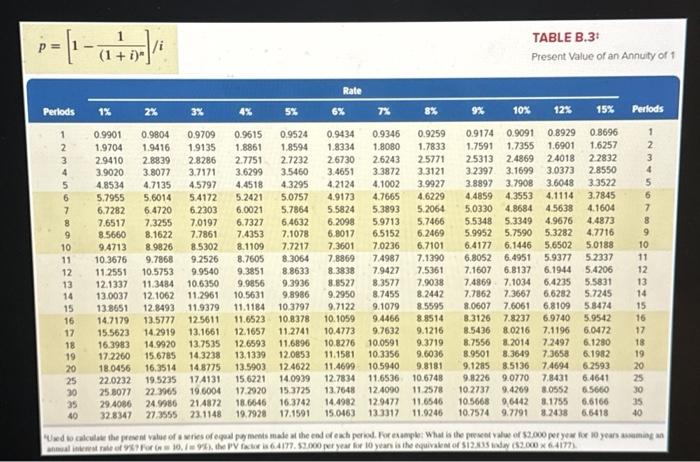

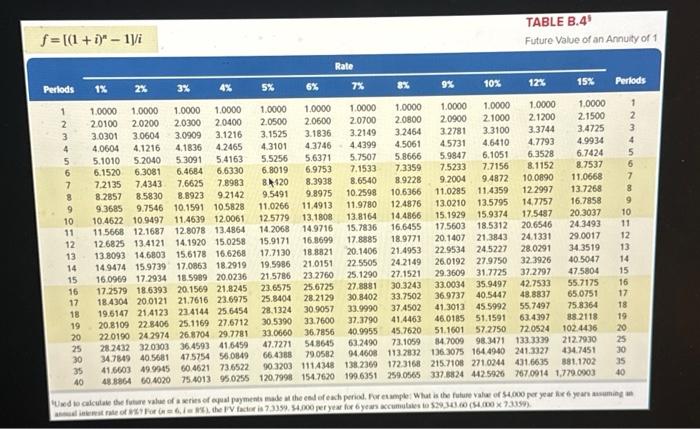

Exercise B-11 (Algo) Present value with semiannual Compounding LO C1, P3 Otto Company borrows money on April 30, 2021, by promising to make four payments of $16,000 each on November 1,2021; May 1, 2022; November 1, 2022; and May 1, 2023. Note: Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places. (PV of \$1, FV of S1, PVA of S1. and FVA of \$1) 1. How much money is Otto able to borrow if the interest rate is 4%, compounded semiannualiy? 2. How much money is Otto able to borrow if the interest rate is 8%, compounded semiannually? 3. How much money is Otto able to borrow if the interest rate is 10%, compounded semiannually? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. How much money is Otto able to borrow if the interest rate is 4%, compounded semiannually? Exercise B-11 (Algo) Present value with semiannual Compounding LO C1, P3 Otto Company borrows money on April 30, 2021, by promising to make four payments of $16,000 each on November 1, 2021; May 1, 2022; November 1, 2022; and May 1, 2023. Note: Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places. (PV of \$1, FV of \$1, PVA of \$1, and FVA of \$1) 1. How much money is Otto able to borrow if the interest rate is 4%, compounded semiannually? 2. How much money is Otto able to borrow if the interest rate is 8%, compounded semiannually? 3. How much money is Otto able to borrow if the interest rate is 10%, compounded semiannually? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. How much money is Otto able to borrow if the interest rate is 8%, compounded semiannually? Exercise B-11 (Algo) Present value with semiannual Compounding LO C1, P3 Otto Company borrows money on April 30, 2021, by promising to make four payments of $16,000 each on November 1, 2021; May 1 , 2022; November 1, 2022; and May 1, 2023. Note: Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places. (PV of S1, FV of S1, PVA of S1. and EVA of \$1) 1. How much money is Otto able to borrow if the interest rate is 4%, compounded semiannually? 2. How much money is Otto able to borrow if the interest rate is 8%, compounded semiannually? 3. How much money is Otto able to borrow if the interest rate is 10%, compounded semiannually? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. How moch money is Otto able to borrow if the interest rate is 10%, compounded semiannually? TABLE B.1* Present Value of 1 p=1/(1+i)n TABLE B.2' Future Value of 1 f=(1+i)n p=[1(1+i)n1]/i TABLE B. 3t Present Value of an Annuty of 1 f=[(1+i)n1]/i Future value of an Annuty of 1