I already habe PT 1 which is attached, If I could please get some help on part 2 & 3 with steps. Thank You.

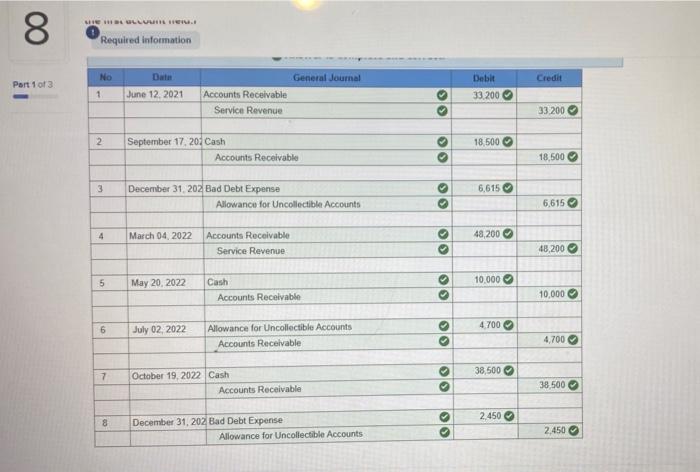

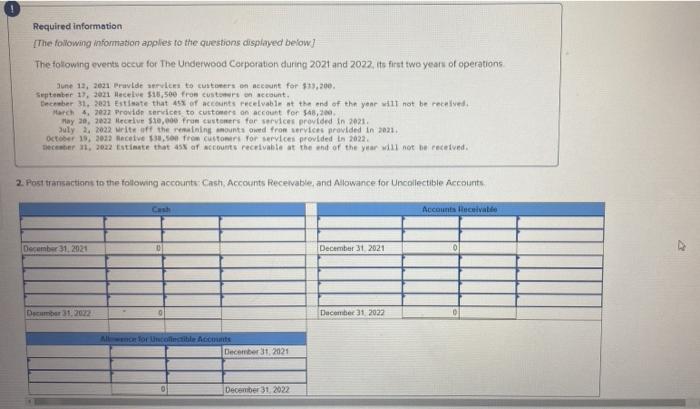

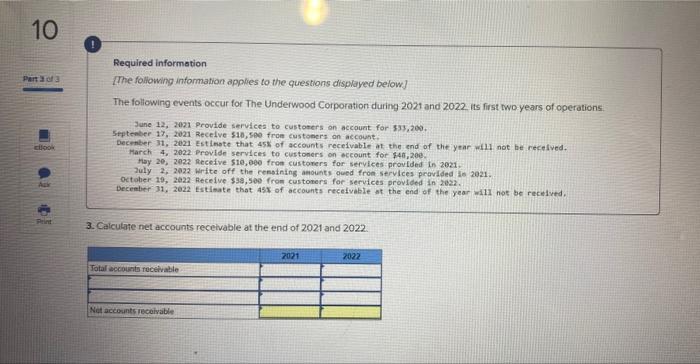

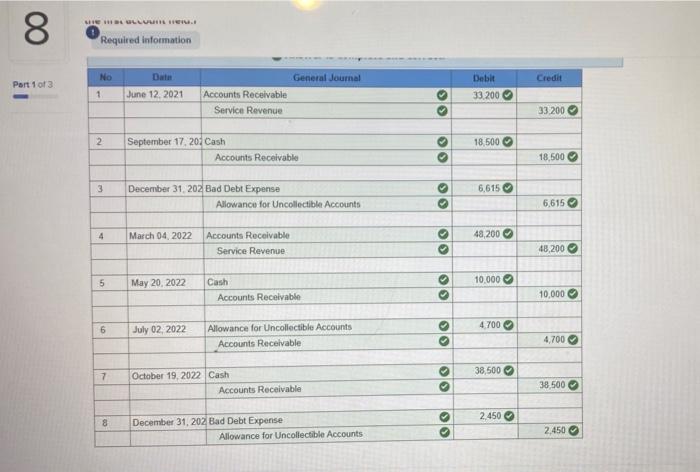

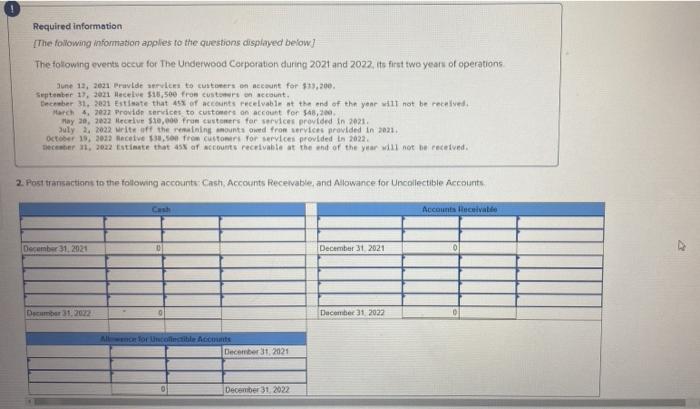

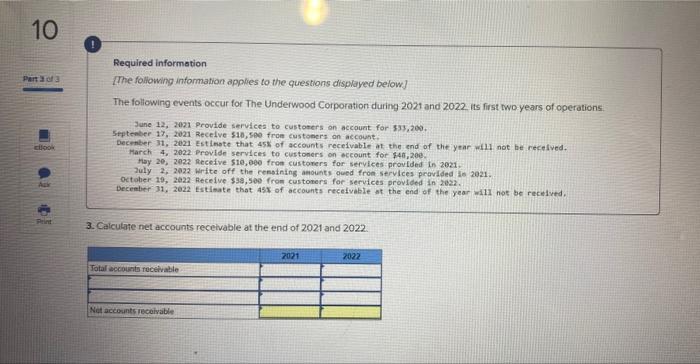

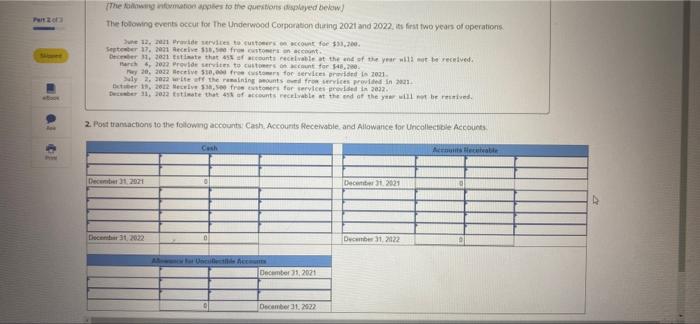

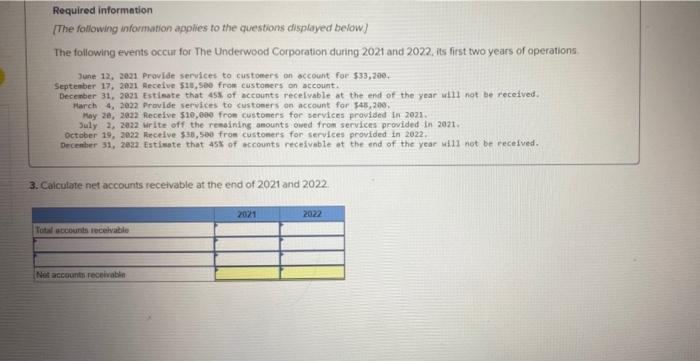

8 Part 1 of 3) THE HOLLOUT HER. Required information No Date June 12, 2021 September 17, 202 Cash December 31, 202 Bad Debt Expense March 04, 2022 May 20, 2022 July 02, 2022 October 19, 2022 Cash December 31, 202 Bad Debt Expense 1 2 3 4 5 6 7 8 General Journal Accounts Receivable Service Revenue Accounts Receivable Allowance for Uncollectible Accounts Accounts Receivable Service Revenue Accounts Receivable Allowance for Uncollectible Accounts Accounts Receivable Accounts Receivable Allowance for Uncollectible Accounts Cash 33 O O O O 33 O O 00 O Debit 33,200 18,500 6,615 48,200 10,000 4,700 38,500 2,450 Credit 33.200 18,500 6,615 48,200 10,000 4,700 38.500 2,450 Required information [The following information applies to the questions displayed below] The following events occur for The Underwood Corporation during 2021 and 2022, its first two years of operations June 12, 2021 Pravide services to customers on account for $33,200. September 17, 2021 Receive $18,500 from customers on account. December 31, 2021 Estimate that 45% of accounts receivable at the end of the year will not be received. March 4, 2022 Provide services to customers on account for $48,200, May 20, 2022 Receive $10,000 from customers for services provided in 2021. July 2, 2022 write off the remaining amounts owed from services provided in 2021. October 19, 2012 Receive $38,500 from customers for services provided in 2022. December 11, 2022 Estimate that 45% of accounts receivable at the end of the year will not be received. 2. Post transactions to the following accounts: Cash, Accounts Receivable, and Allowance for Uncollectible Accounts. Cash Accounts Receivable December 31, 2021 0 December 31, 2021 0 December 31, 2022 December 31, 2022 Allowance for Uncollectible Accounts 0 December 31, 2021 December 31, 2022 10 Part 3 of 3 look 10 to Required information. [The following information applies to the questions displayed below] The following events occur for The Underwood Corporation during 2021 and 2022. Its first two years of operations. June 12, 2021 Provide services to customers on account for $33,200. September 17, 2021 Receive $18,500 from customers on account. December 31, 2021 Estimate that 45% of accounts receivable at the end of the year will not be received. March 4, 2022 Provide services to customers on account for $40,200. May 20, 2022 Receive $10,000 from customers for services provided in 2021. July 2, 2022 write off the remaining amounts oued from services provided in 2021. October 19, 2022 Receive $38,500 from customers for services provided in 2022. December 31, 2022 Estimate that 45% of accounts receivable at the end of the year will not be received. 3. Calculate net accounts receivable at the end of 2021 and 2022. 2021 2022 Total accounts receivable Not accounts receivable Part 23 [The following information applies to the questions displayed below) The following events occur for The Underwood Corporation during 2021 and 2022, its first two years of operations. June 12, 2011 Provide services to customers on account for $33,200. September 17, 2021 Receive $18,500 from customers on account. December 31, 2021 estimate that 45% of accounts receivable at the end of the year will not be received. Barch 4, 2022 Provide services to customers on account for $48,200. Py 20, 2022 Receive $10,000 free customers for services provided in 2021. July 2, 2022 write off the remaining amounts oved from services provided in 2021. October 19, 2012 Receive 538,500 from customers for services provided in 2022. December 11, 2022 Estimate that 45% of accounts receivable at the end of the year will not be received. 2. Post transactions to the following accounts: Cash, Accounts Receivable, and Allowance for Uncollectible Accounts Cash Accounts Receivable December 31, 2021 101 December 31, 2021 December 31, 2022 December 31, 2122 A for Uncullectible Acco December 31, 2021 December 31, 2922 D Required information [The following information applies to the questions displayed below] The following events occur for The Underwood Corporation during 2021 and 2022, its first two years of operations. June 12, 2021 Provide services to customers on account for $33,200. September 17, 2021 Receive $18,500 from customers on account. December 31, 2021 Estimate that 45% of accounts receivable at the end of the year will not be received. March 4, 2022 Provide services to customers on account for $45,200. May 20, 2022 Receive $10,000 from customers for services provided in 2021. July 2, 2022 write off the remaining amounts owed from services provided in 2021. October 19, 2022 Receive $38,500 from customers for services provided in 2022. December 31, 2822 Estimate that 45% of accounts receivable at the end of the year will not be received. 3. Calculate net accounts receivable at the end of 2021 and 2022 2021 2022 Total accounts receivable Net accounts receivable