Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I also need help with the Double Declining Balance Deprecation Schedule! Thank you! On January 2, 2024, Nimble Delivery Service purchased a truck at a

I also need help with the Double Declining Balance Deprecation Schedule! Thank you!

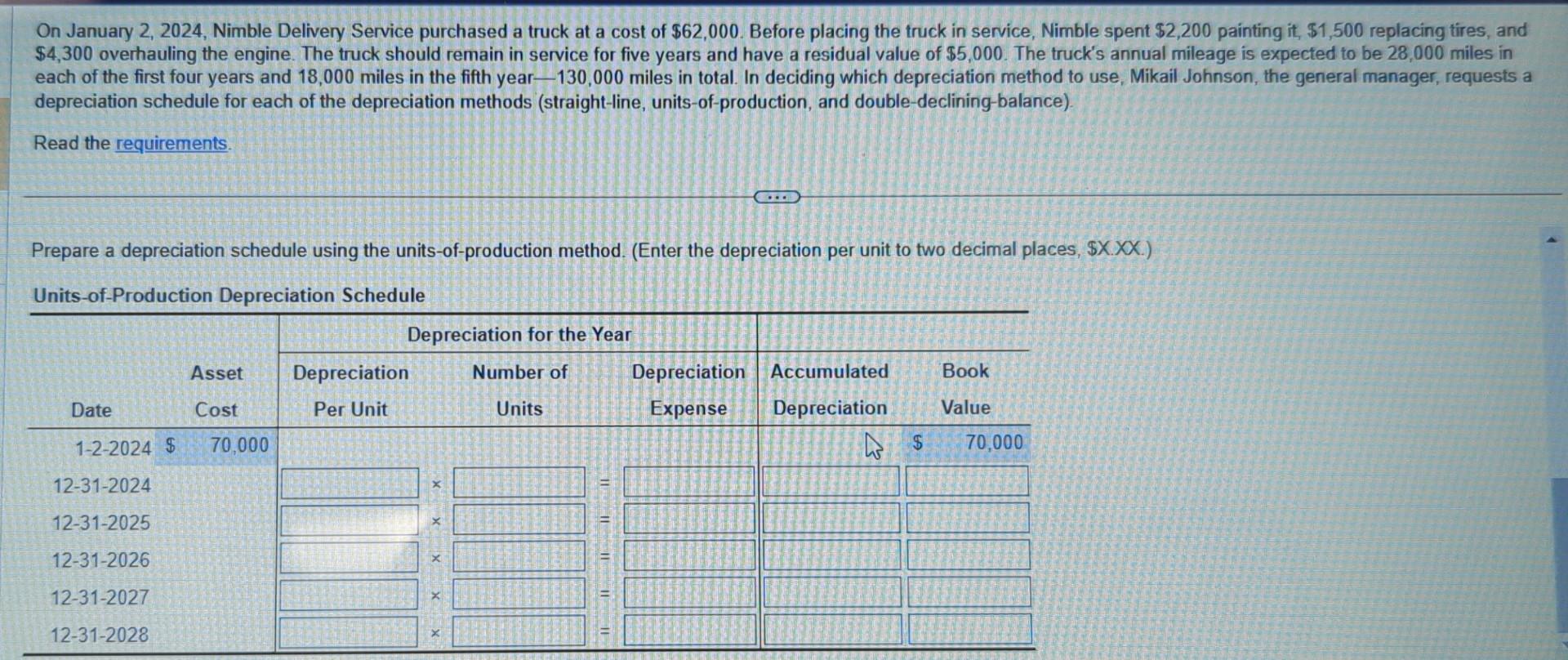

On January 2, 2024, Nimble Delivery Service purchased a truck at a cost of $62,000. Before placing the truck in service, Nimble spent $2,200 painting it, $1,500 replacing tires, and $4,300 overhauling the engine. The truck should remain in service for five years and have a residual value of $5,000. The truck's annual mileage is expected to be 28,000 miles in each of the first four years and 18,000 miles in the fifth year-130,000 miles in total. In deciding which depreciation method to use, Mikail Johnson, the general manager, requests a depreciation schedule for each of the depreciation methods (straight-line, units-of-production, and double-declining-balance). Read the requirements. Prepare a depreciation schedule using the units-of-production method. (Enter the depreciation per unit to two decimal places, $..XX.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started