Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i am completely lost on how do this worksheet. Any help would be much appreciated! Thanks! Nike has outstanding bonds with a total face value

i am completely lost on how do this worksheet. Any help would be much appreciated! Thanks!

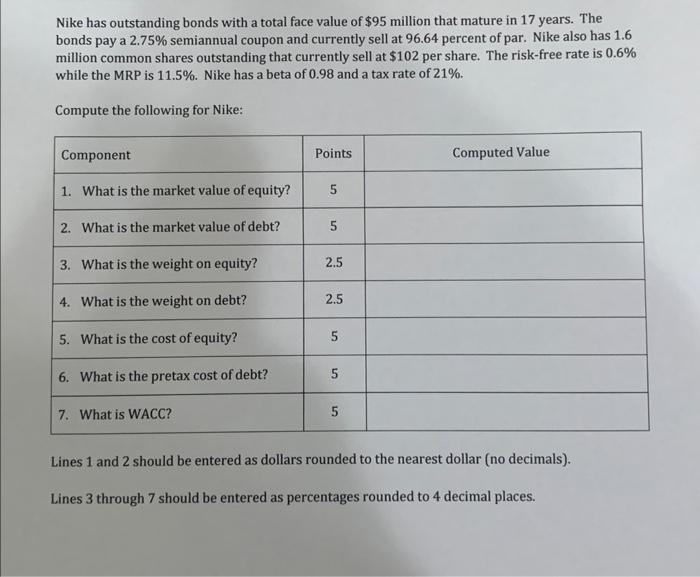

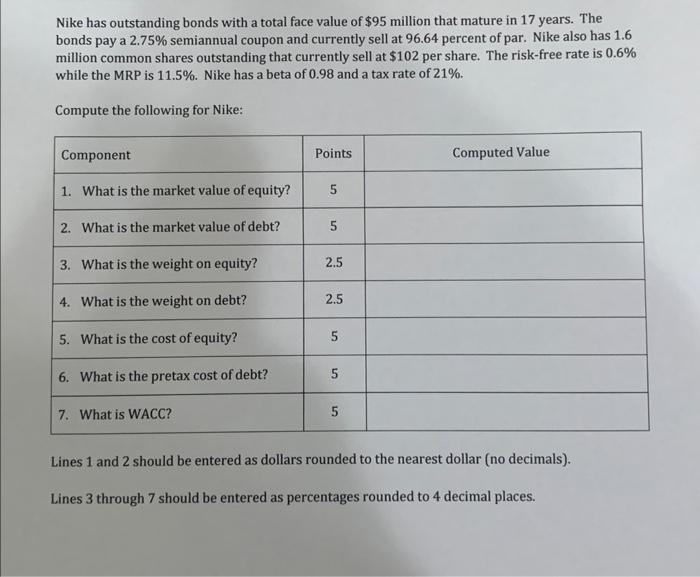

Nike has outstanding bonds with a total face value of $95 million that mature in 17 years. The bonds pay a 2.75% semiannual coupon and currently sell at 96.64 percent of par. Nike also has 1.6 million common shares outstanding that currently sell at $102 per share. The risk-free rate is 0.6% while the MRP is 11.5%. Nike has a beta of 0.98 and a tax rate of 21%. Compute the following for Nike: Lines 1 and 2 should be entered as dollars rounded to the nearest dollar (no decimals). Lines 3 through 7 should be entered as percentages rounded to 4 decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started