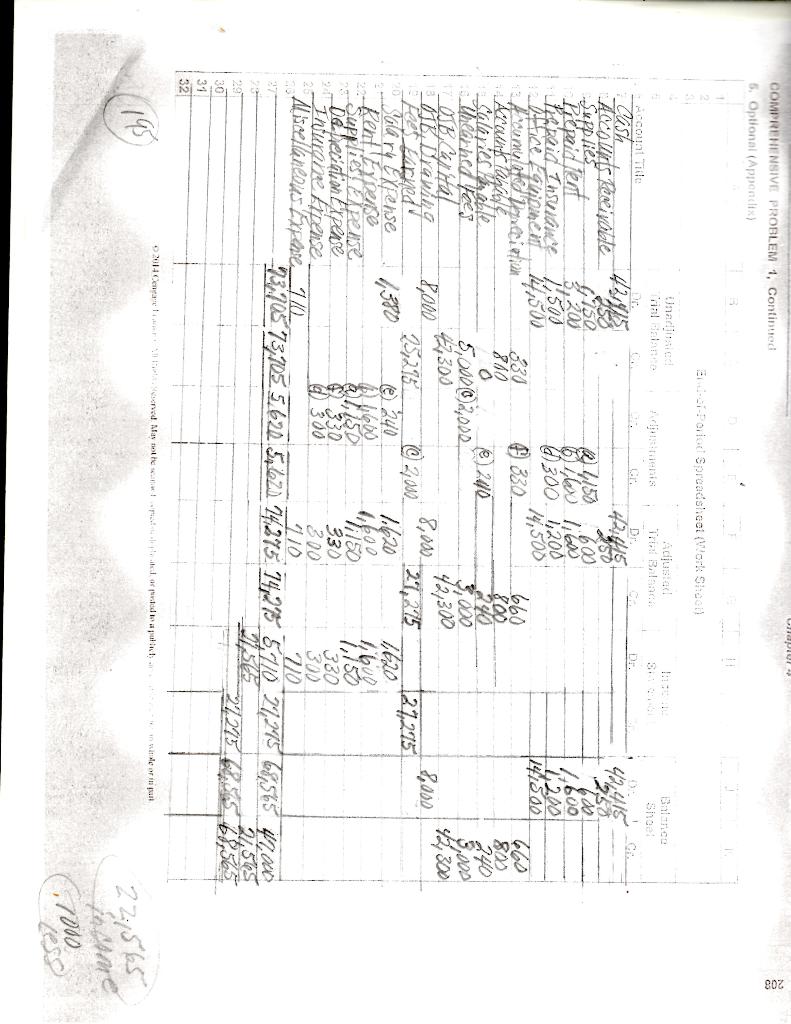

I am having a problem with the end-of-period Spreadsheet for my accounting class assignment. The net income for the month of February is suppose to be

$22, 565; I keep coming up with $21, 565. The ending cash amount is correct, which is $42, 415. Could you please help me solve the problem with the ending net income, that should e $22, 565. Thank you for your help. I am sending an attachment.

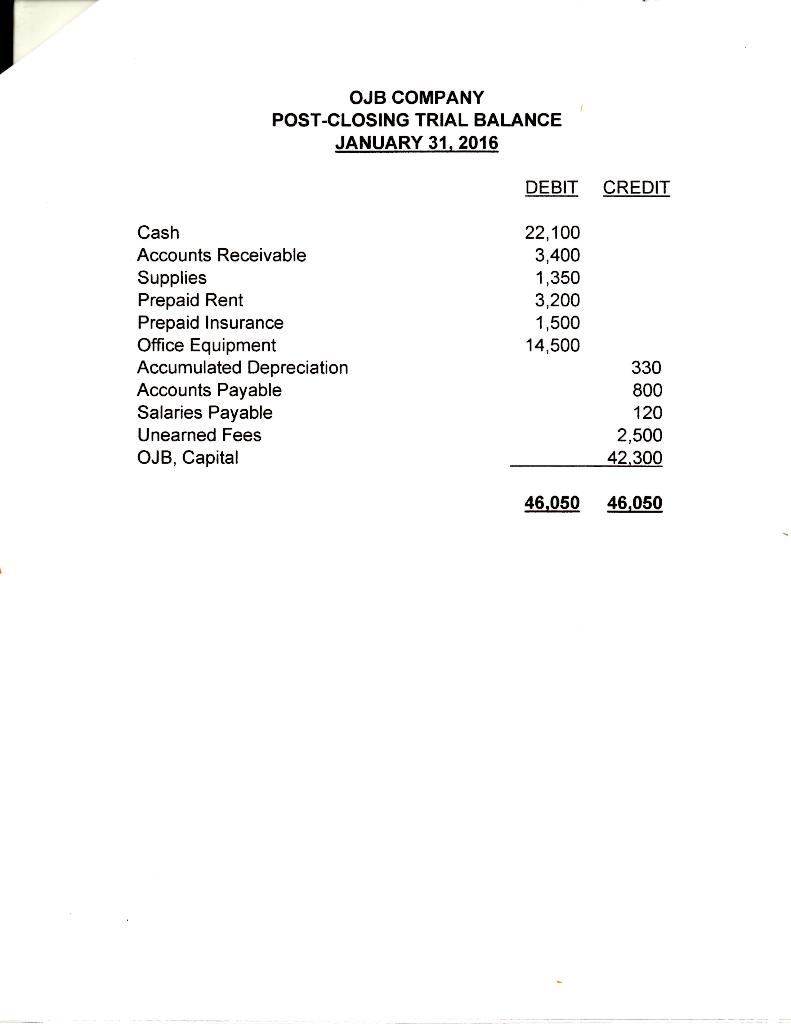

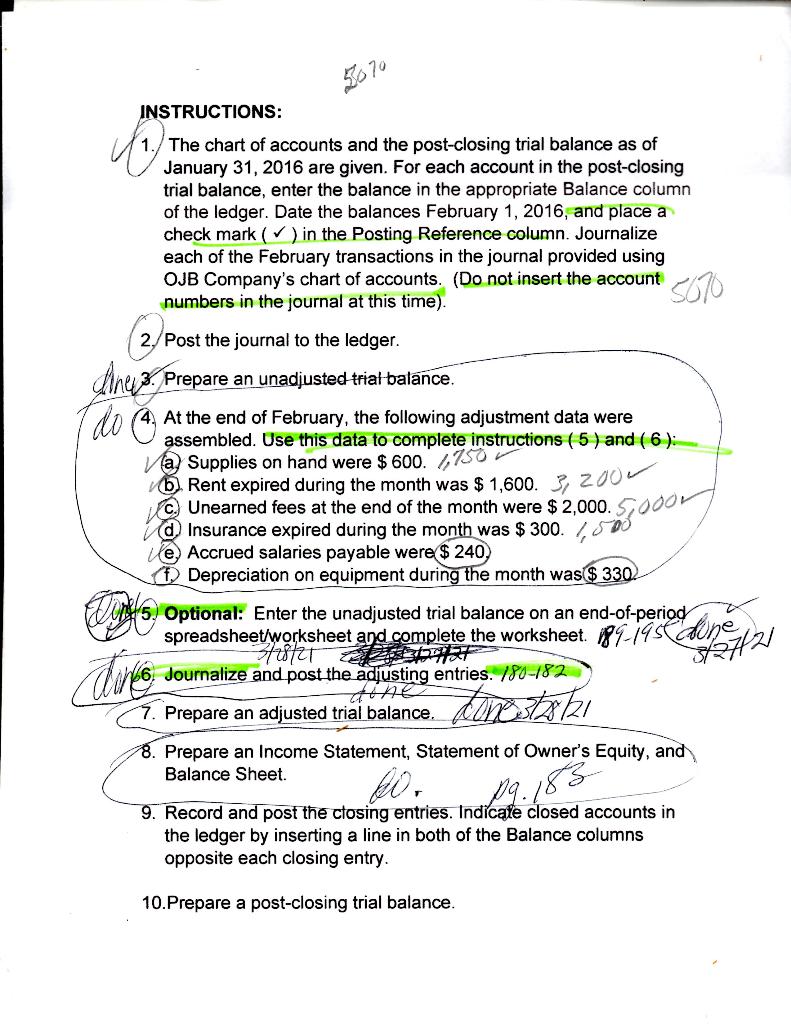

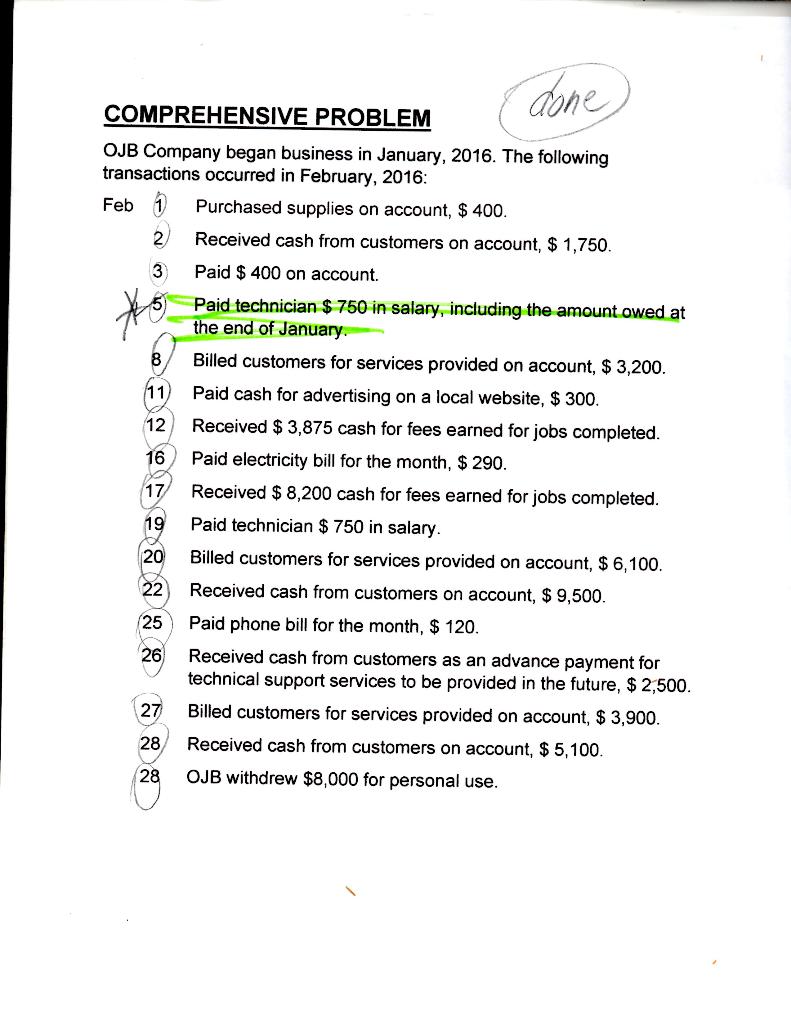

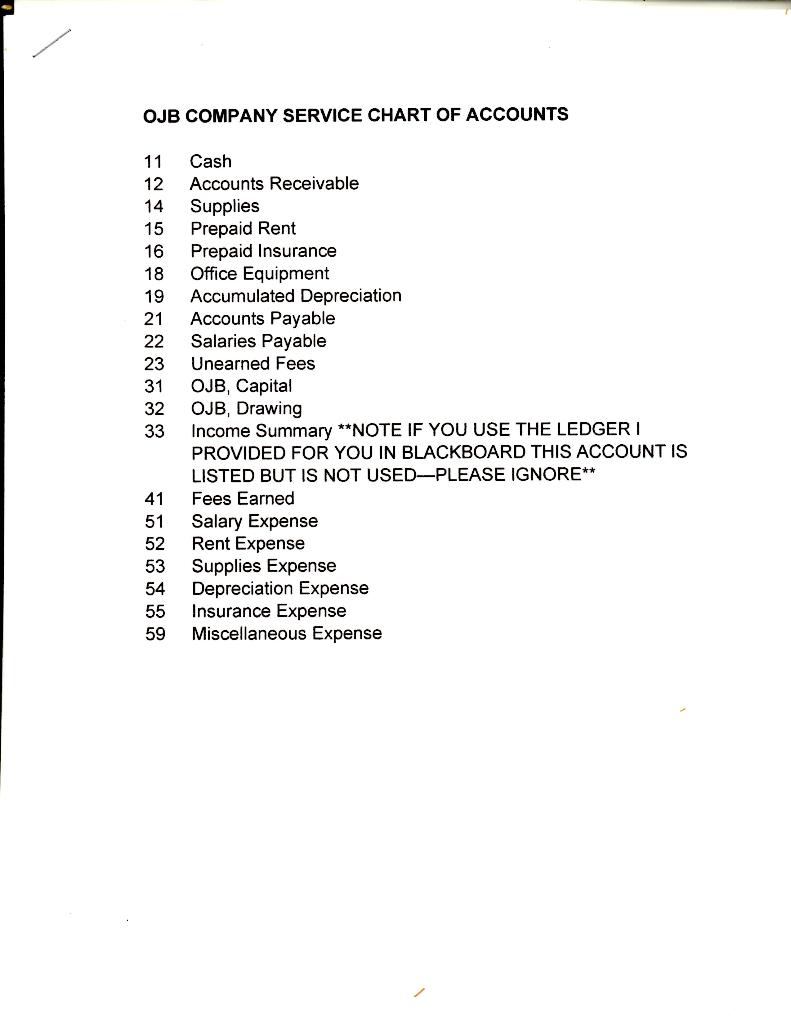

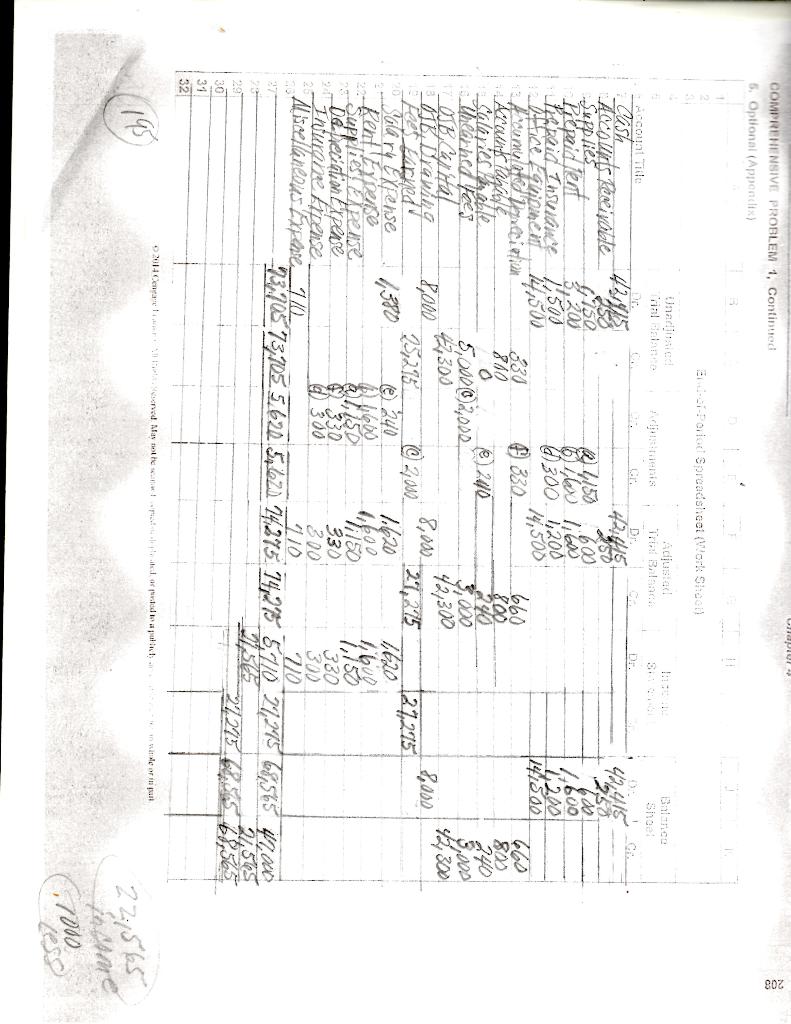

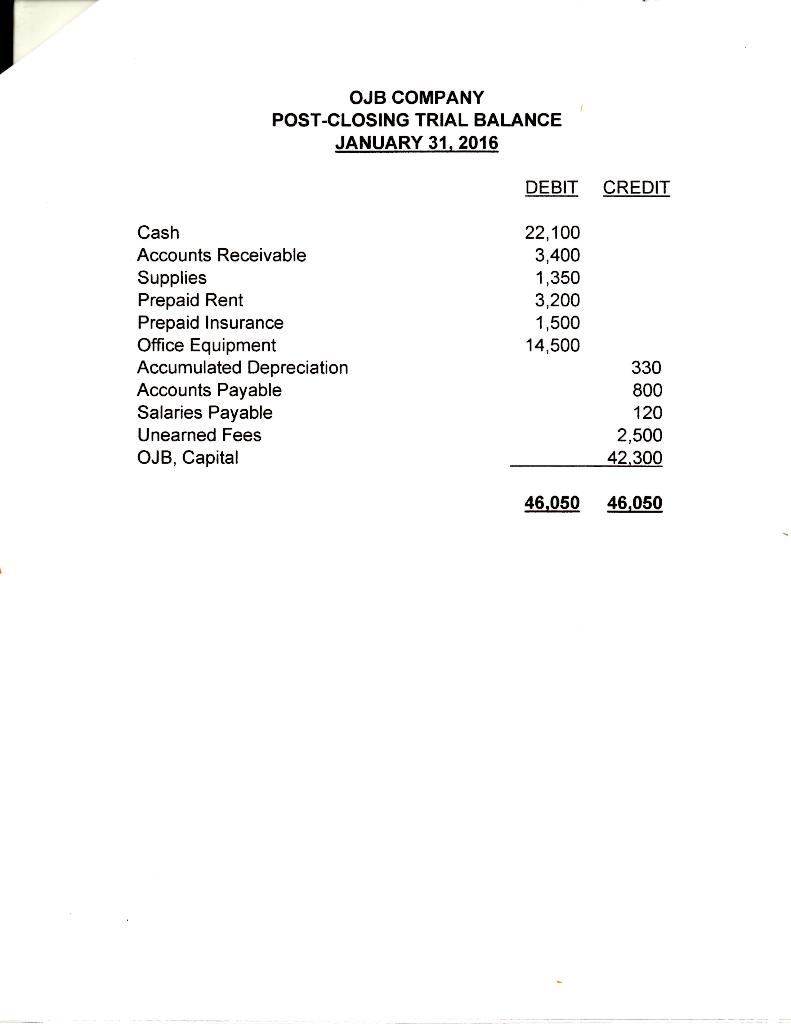

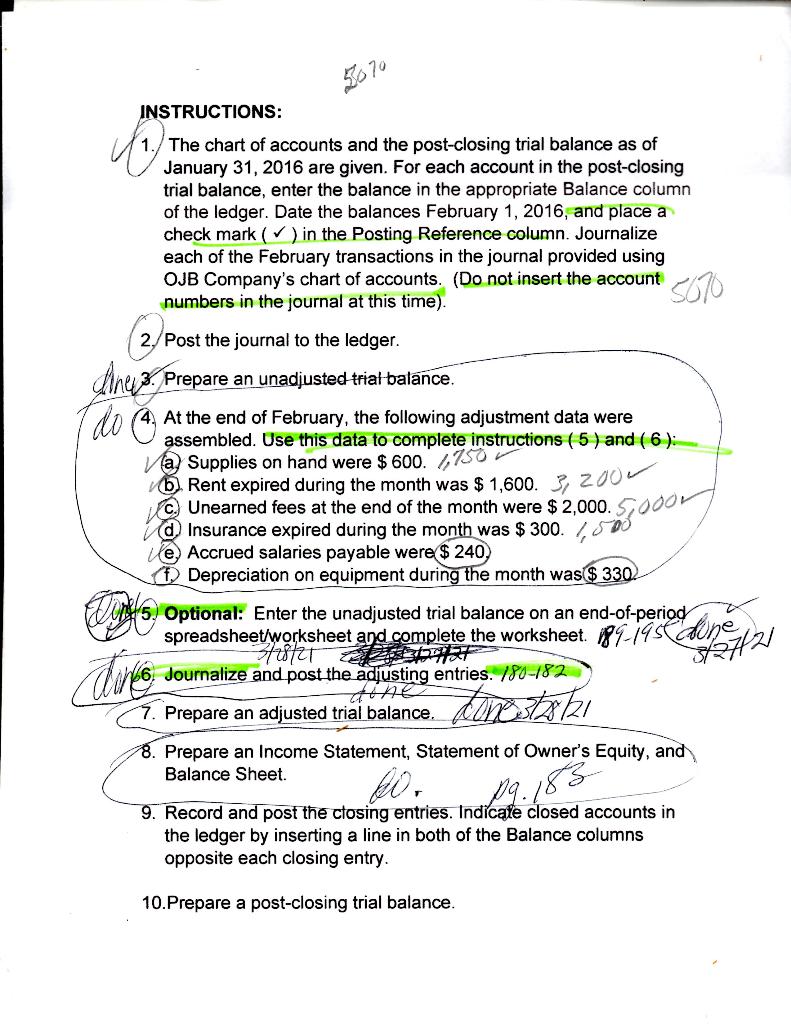

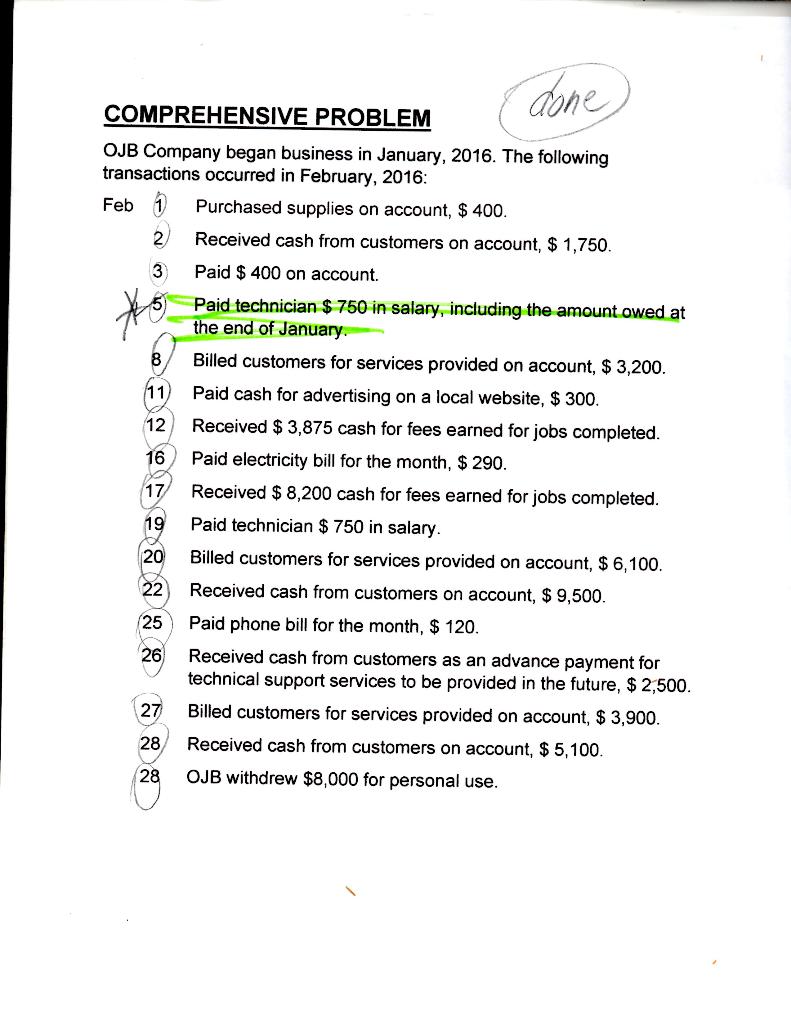

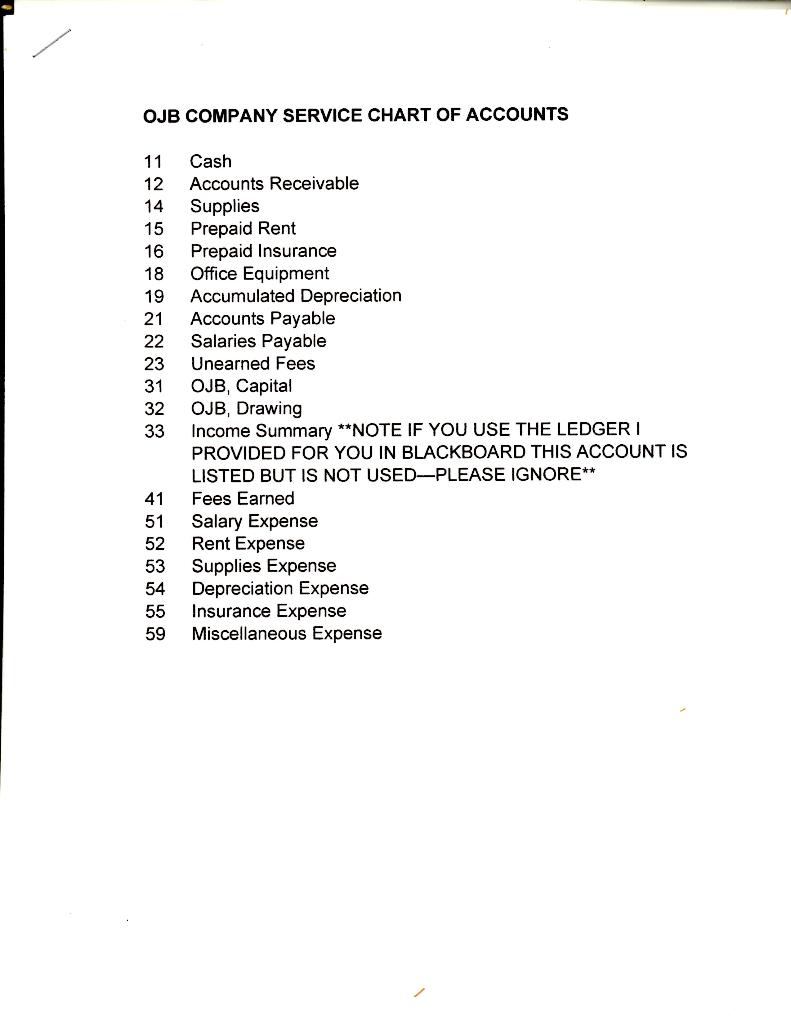

CHI 208 COMPREHENSIVE PROBLEM 1, Continued 5. Optional (Appendix) Portal Spreadsheet Work Shot) Adjustad Sheet Accouat The Dr. CA Halls Supplies 42:41 255 7,600 Olles 11.00 600 6300. 1200 14,500 o Shop trent Insurance 1500 4200 Promylete pacietishi 830 Account Tagebli 330 1147500 660 660 0240 800 5,000(0)2,000 300 2000 12,300 8.000 42300 2002 8000 1.620 127,2015 1,620 1,600 1000 Per Larned Dearning Salary Expense Seridian Expense 33 330 Inurgie Lipense 300 300 Aliscellaneous Expense_110 1110 20 73.70573105 5.620.5420 14295 74,275 5,710 21,2758,565 41,000 24545 30 31 2014 Cod Alastothewilde ideari 19 221565 7000 OJB COMPANY POST-CLOSING TRIAL BALANCE JANUARY 31, 2016 DEBIT CREDIT Cash Accounts Receivable Supplies Prepaid Rent Prepaid Insurance Office Equipment Accumulated Depreciation Accounts Payable Salaries Payable Unearned Fees OJB, Capital 22,100 3,400 1,350 3,200 1,500 14,500 330 800 120 2,500 42,300 46,050 46,050 5070 INSTRUCTIONS: 1./ The chart of accounts and the post-closing trial balance as of trial balance, enter the balance in the appropriate Balance column of the ledger. Date the balances February 1, 2016, and place a check mark () in the Posting Reference column. Journalize each of the February transactions in the journal provided using OJB Company's chart of accounts. (Do not insert the account numbers in the journal at this time). 8670 2. Post the journal to the ledger. dhe . Prepare an unadjusted trial balance. I do 6 $ 600.750 At the end of February, the following adjustment data were assembled. Use this data to complete instructions ( 5 ) and (6): a Supplies hand b) Rent expired during the month was $ 1,600. 3, 2000 Unearned fees at the end of the month were $ 2,000. d Insurance expired during the month was $ 300. e Accrued salaries payable were $ 240, (1) Depreciation on equipment during the month was $ 330 Motorooon Tots. Optional: Enter the unadjusted trial balance on an end-of-period spreadsheetworksheet and complete the worksheet. 189-195dine 517121 Journalize and post the adjusting entries. 180-182 7. Prepare an adjusted trial balance. Lovastiki 8. Prepare an Income Statement, Statement of Owner's Equity, and Balance Sheet wo. 09.185 9. Record and post the closing entries. Indicate closed accounts in the ledger by inserting a line in both of the Balance columns opposite each closing entry. 10.Prepare a post-closing trial balance. done COMPREHENSIVE PROBLEM OJB Company began business in January, 2016. The following transactions occurred in February, 2016: Feb 1 Purchased supplies on account, $ 400. 2 Received cash from customers on account, $ 1,750. 3 Paid $ 400 on account. Paid technician $ 750 in salary, including the amount owed at the end of January 8 Billed customers for services provided on account, $3,200. 11 Paid cash for advertising on a local website, $ 300. 12 Received $ 3,875 cash for fees earned for jobs completed. 16 Paid electricity bill for the onth, $ 290. 17 Received $ 8,200 cash for fees earned for jobs completed. 19 Paid technician $ 750 in salary. 20 Billed customers for services provided on account, $ 6,100. 22 Received cash from customers on account, $ 9,500. 25 Paid phone bill for the month, $ 120. 26 Received cash from customers as an advance payment for technical support services to be provided in the future, $2,500. 27 Billed customers for services provided on account, $3,900. 28 Received cash from customers on account, $ 5,100. 28 OJB withdrew $8,000 for personal use. OJB COMPANY SERVICE CHART OF ACCOUNTS 11 12 14 15 16 18 19 21 22 23 31 32 33 Cash Accounts Receivable Supplies Prepaid Rent Prepaid Insurance Office Equipment Accumulated Depreciation Accounts Payable Salaries Payable Unearned Fees OJB, Capital OJB, Drawing Income Summary **NOTE IF YOU USE THE LEDGER I PROVIDED FOR YOU IN BLACKBOARD THIS ACCOUNT IS LISTED BUT IS NOT USED-PLEASE IGNORE** Fees Earned Salary Expense Rent Expense Supplies Expense Depreciation Expense Insurance Expense Miscellaneous Expense 41 51 52 53 54 55 59