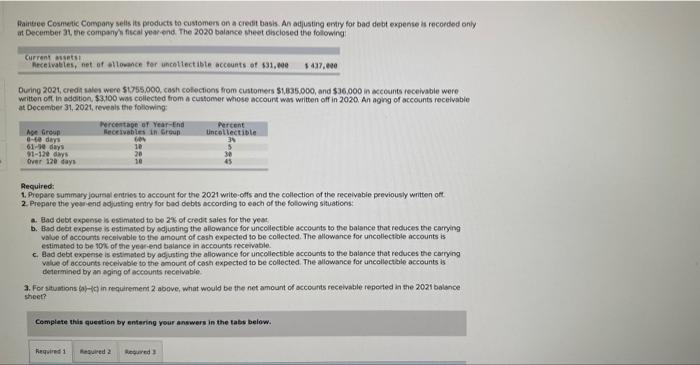

Aaintee Cosmetic Company seils its products ta customens on a ciecit basis. An adjusting entry for bad debt expente is mecorded only at December 3t, the compariyt ficcal year end. The 2020 baiance sheet disclosed the following During 2021, credi sales were 51755,000 , cash colections from custoniers 51,835.000, and $36.000 in accounts feceivable were weitten oft in adoition, $3,100 was collected trom a customer whose accours was witten off in 2020 . An aging of accounts recelvabie at December 31,2021 , revedis the following: Recuired: 1. Propare summary journal entries to accosnt for the 2021 wite-offs and the collection of the receivabie perviously witten oft 2. Prepare the yem end adjusting entry for bad debts according to each of the fotiowing situations: a. Had debt expense is estimated to be 29 of credt sales for the yeat, b. Bad deat expense is estimated by edjusting the allawance for uncollectible accounts to the batance that redices the carring value of accounts recelvable to the amount of cash expected to be collected. The allowance for uncollectible accounts is estimated to be 10k of the yeac end baiance in accounts receivable. c. Bad debt expense is ostimpted by adjusting the allowance for uncollectible accounts to the balance that reduces the carring value of accounts recehvable to the amount of cash expected to be collected. The allowance for ancollectale accounts is determined by an aging of accounts receivable. 3. For situmions (a)1ct in requirement 2 above, what would be the net amount of accourtis receivable reported in the 2021 balance sheet? Complate this queution by entaring your answers in the tabs below. Aaintee Cosmetic Company seils its products ta customens on a ciecit basis. An adjusting entry for bad debt expente is mecorded only at December 3t, the compariyt ficcal year end. The 2020 baiance sheet disclosed the following During 2021, credi sales were 51755,000 , cash colections from custoniers 51,835.000, and $36.000 in accounts feceivable were weitten oft in adoition, $3,100 was collected trom a customer whose accours was witten off in 2020 . An aging of accounts recelvabie at December 31,2021 , revedis the following: Recuired: 1. Propare summary journal entries to accosnt for the 2021 wite-offs and the collection of the receivabie perviously witten oft 2. Prepare the yem end adjusting entry for bad debts according to each of the fotiowing situations: a. Had debt expense is estimated to be 29 of credt sales for the yeat, b. Bad deat expense is estimated by edjusting the allawance for uncollectible accounts to the batance that redices the carring value of accounts recelvable to the amount of cash expected to be collected. The allowance for uncollectible accounts is estimated to be 10k of the yeac end baiance in accounts receivable. c. Bad debt expense is ostimpted by adjusting the allowance for uncollectible accounts to the balance that reduces the carring value of accounts recehvable to the amount of cash expected to be collected. The allowance for ancollectale accounts is determined by an aging of accounts receivable. 3. For situmions (a)1ct in requirement 2 above, what would be the net amount of accourtis receivable reported in the 2021 balance sheet? Complate this queution by entaring your answers in the tabs below