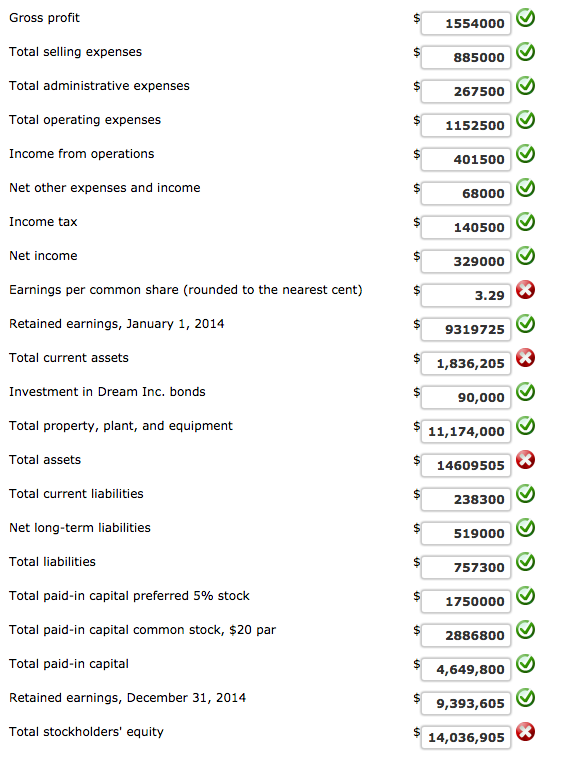

I am having trouble finding what I did wrong on these questions. Most of them are correct and were double checked on here, but some of the entrys given in the past of this comprehensive problem on this site were INCORRECT. Here is what I have so far, as to what the remaining correct numbers are, I would greatly appreciate it! :)

PROBLEM:

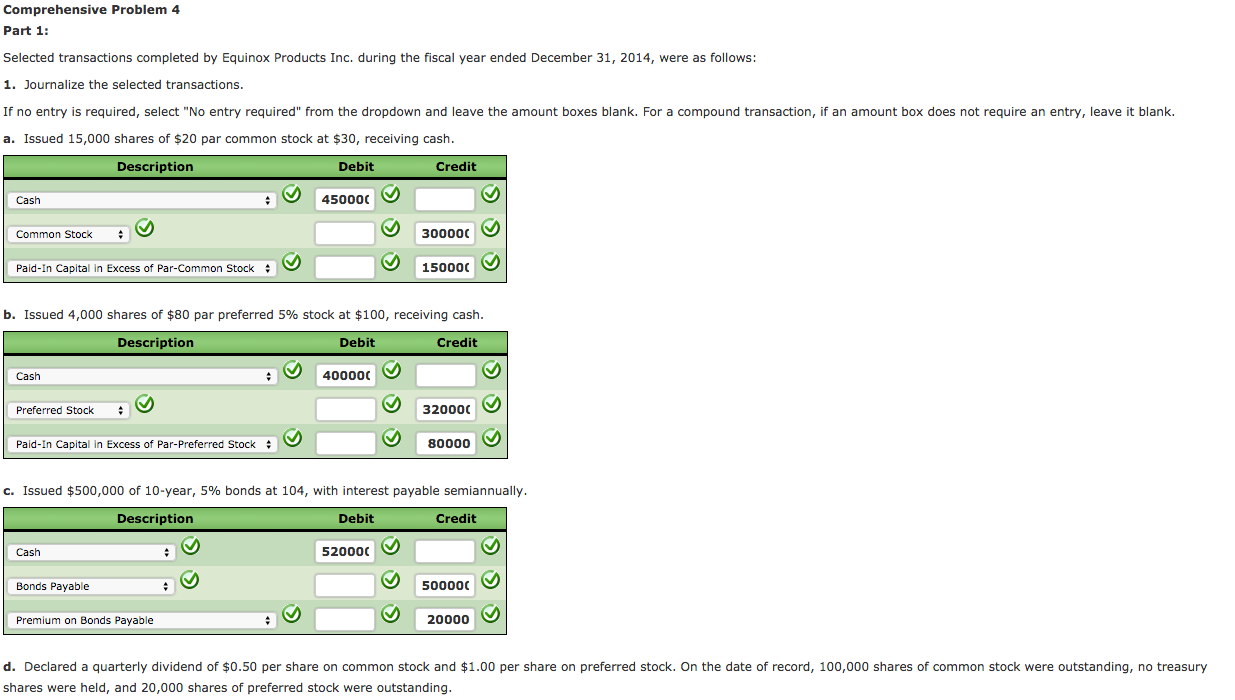

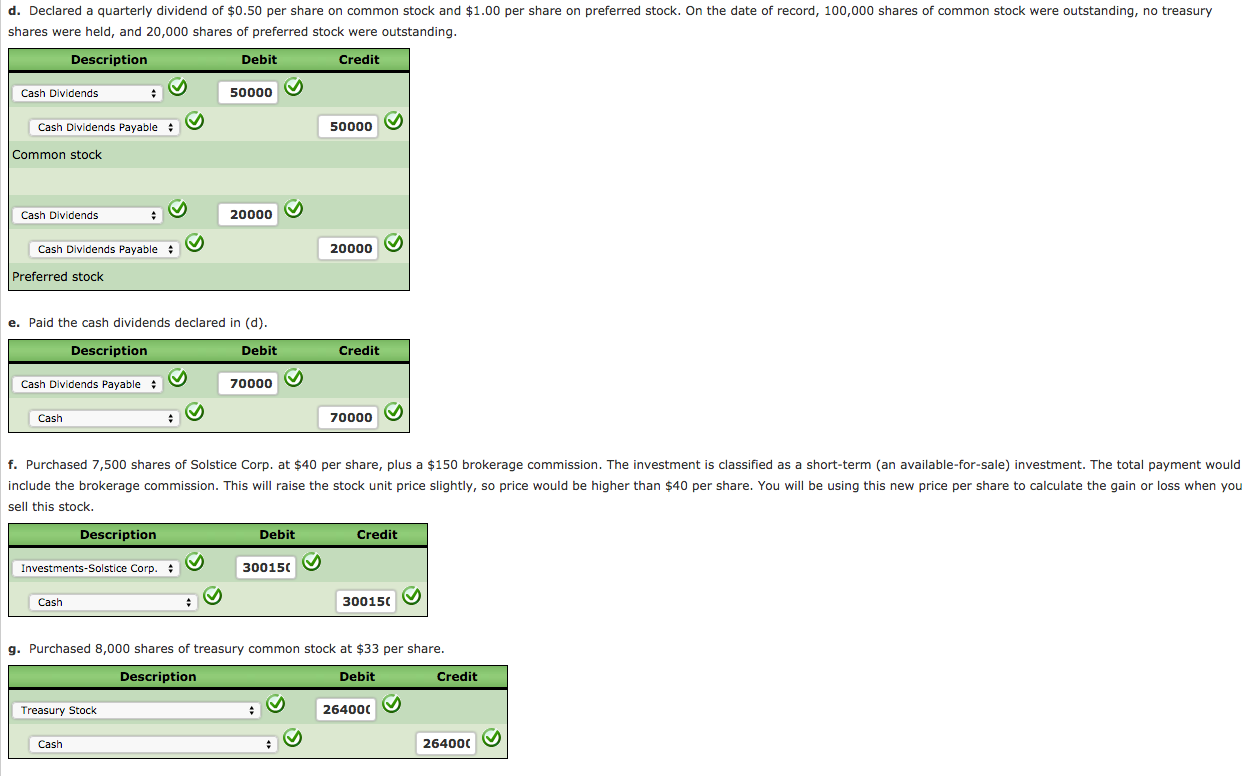

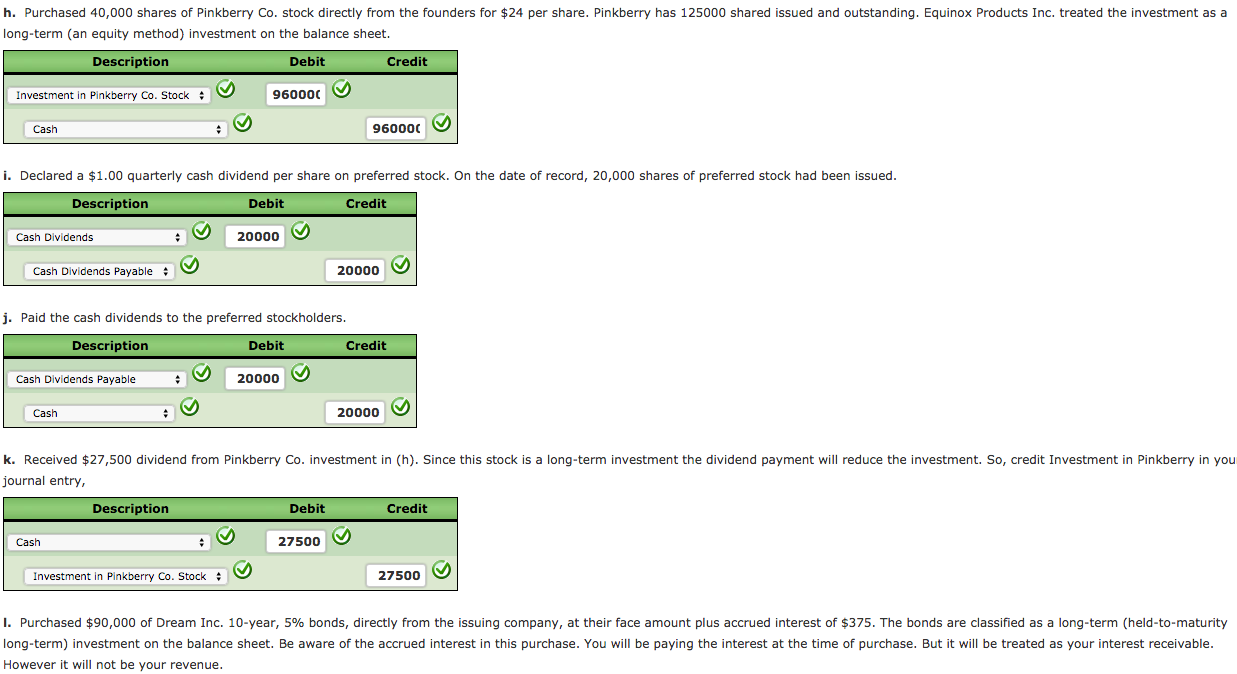

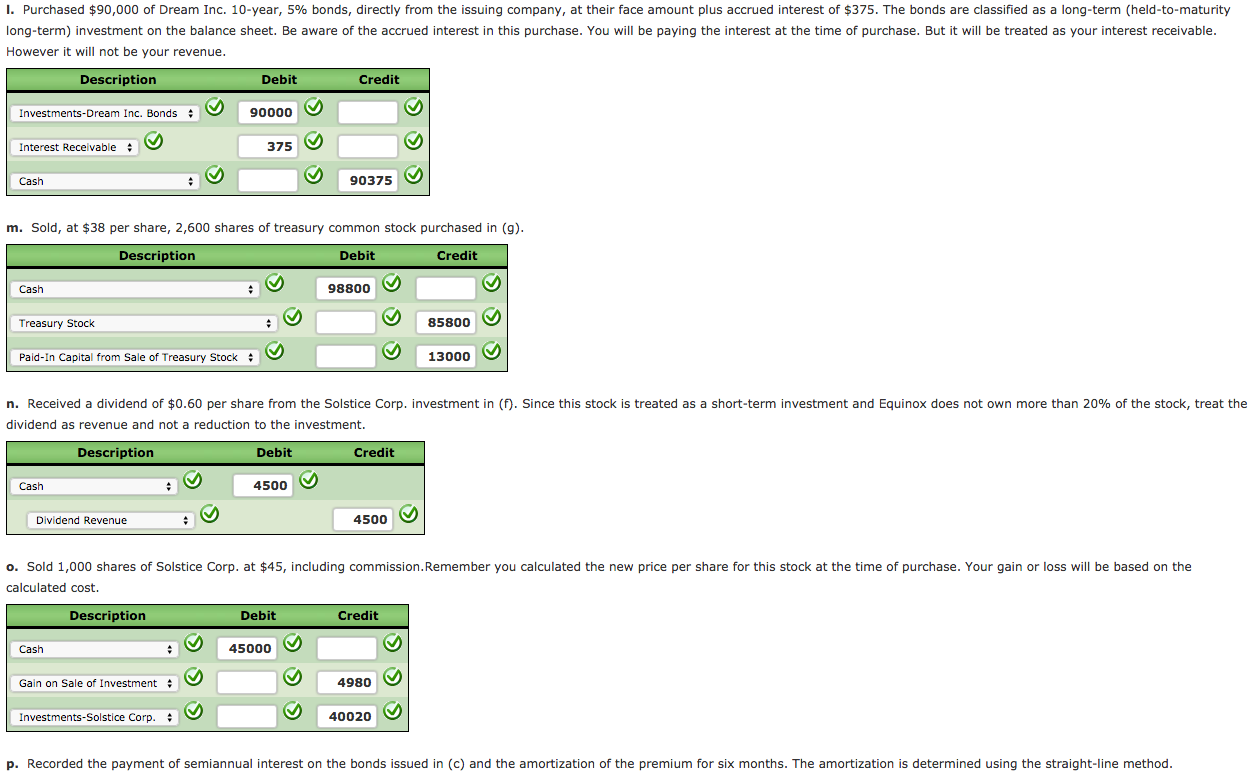

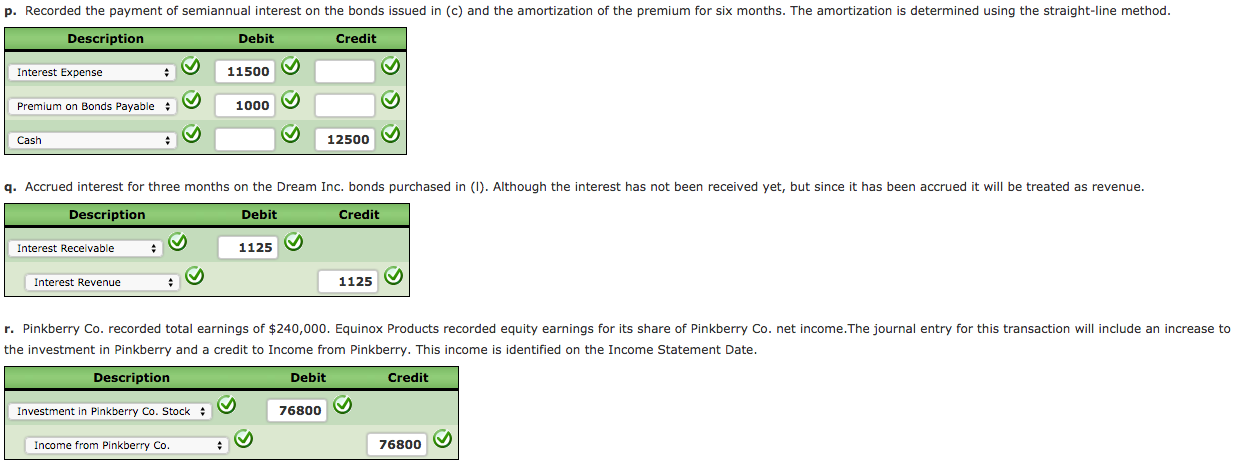

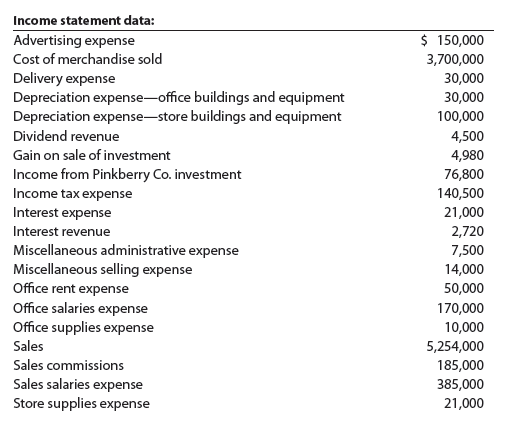

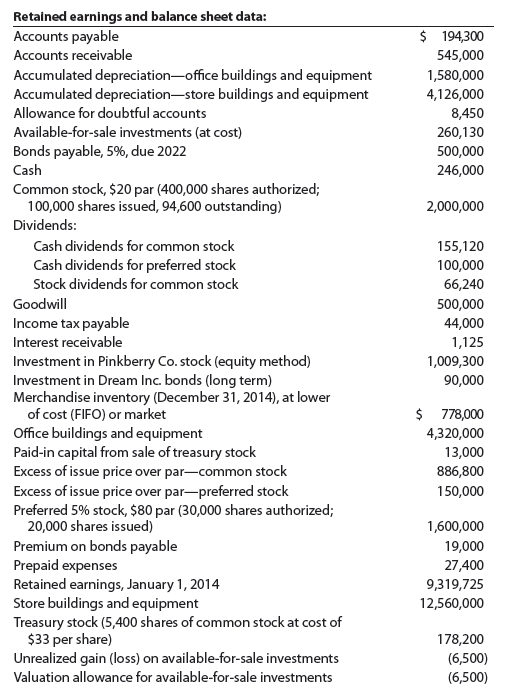

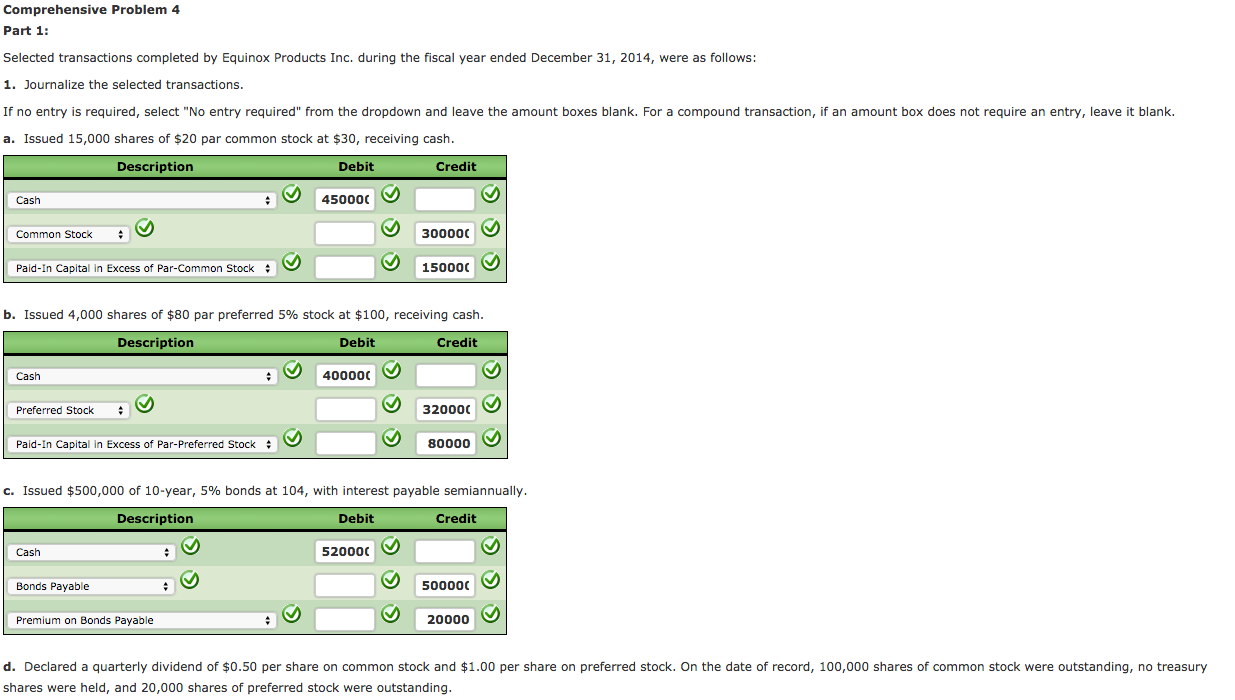

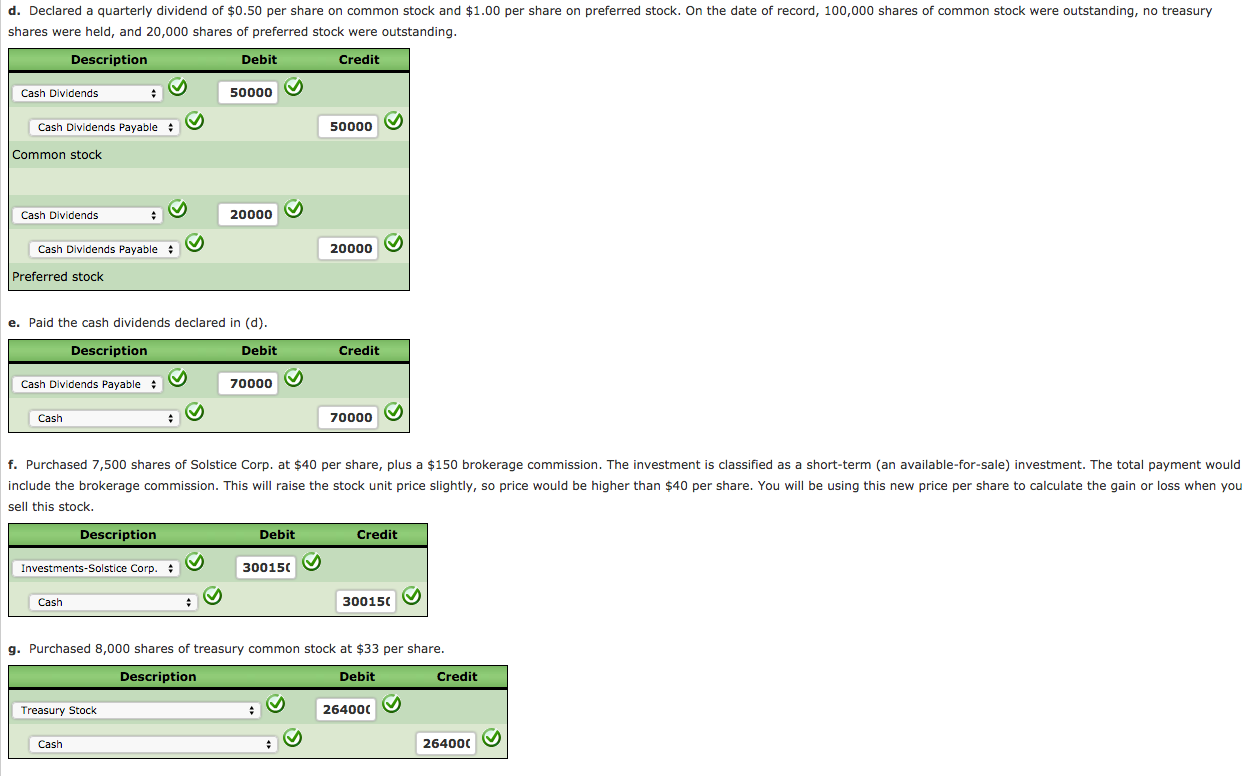

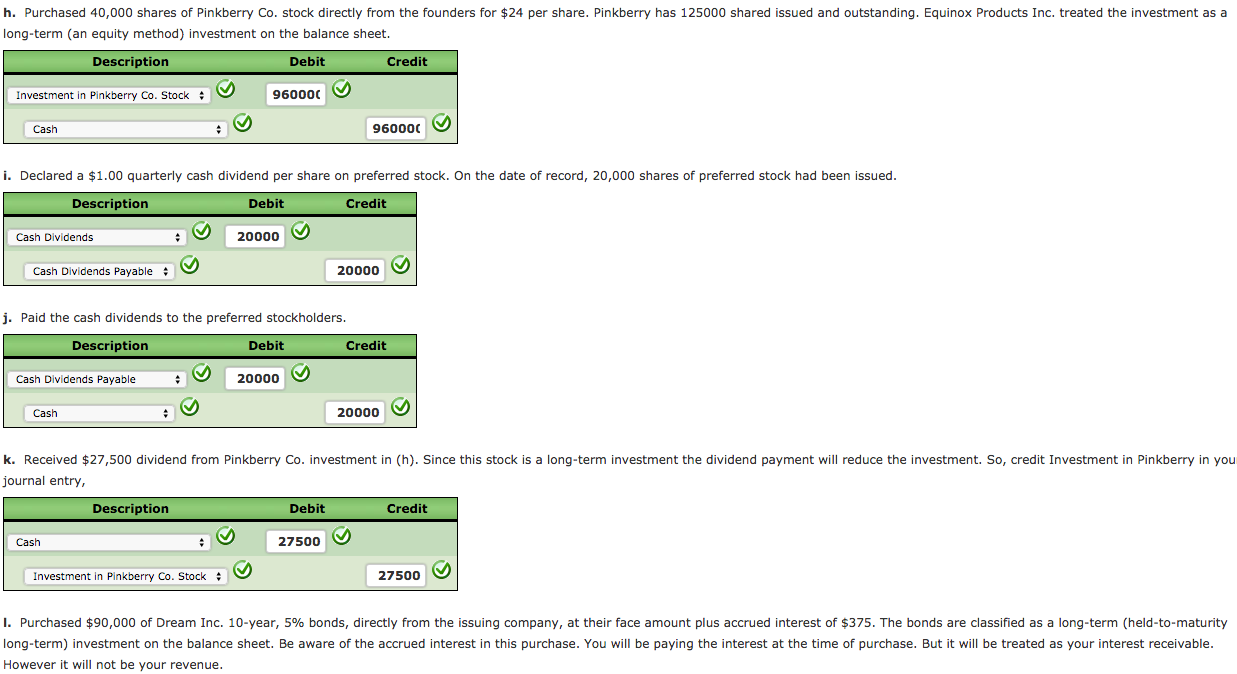

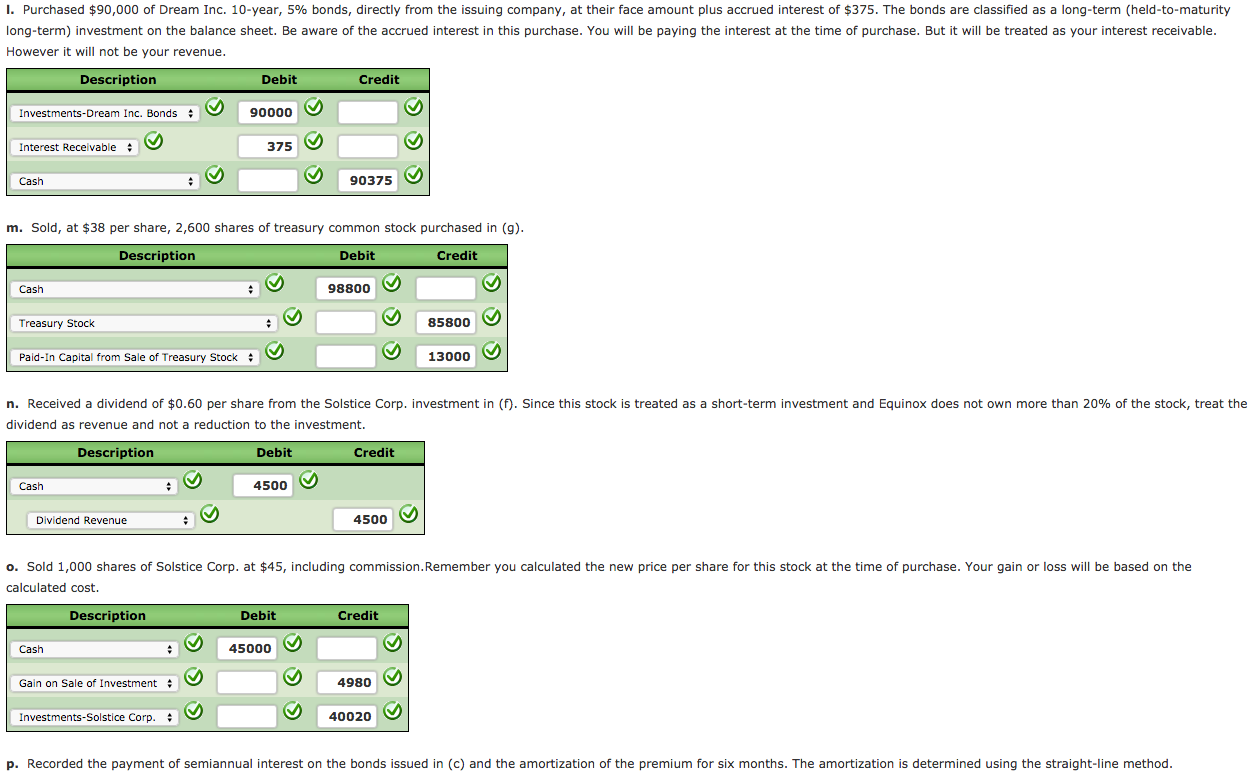

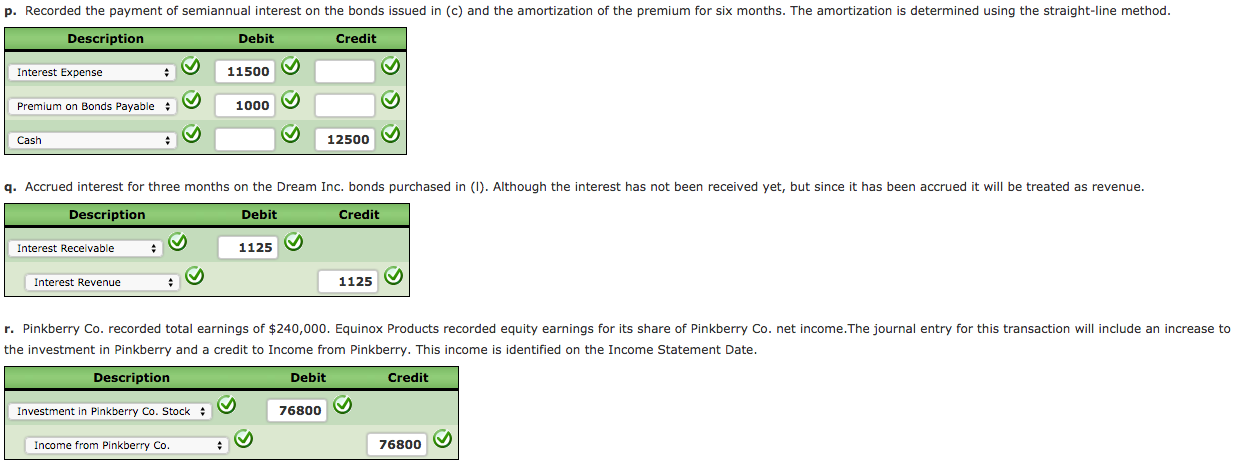

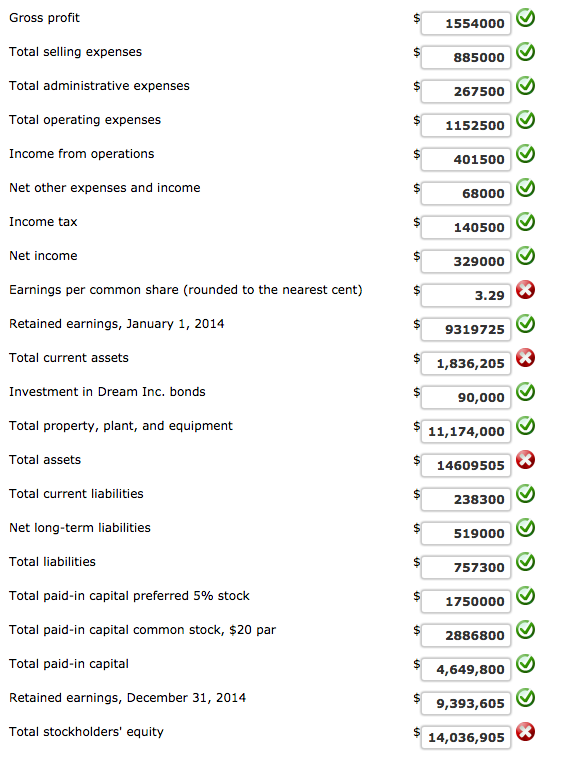

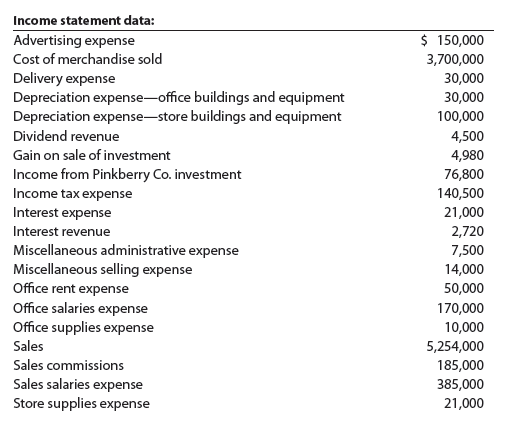

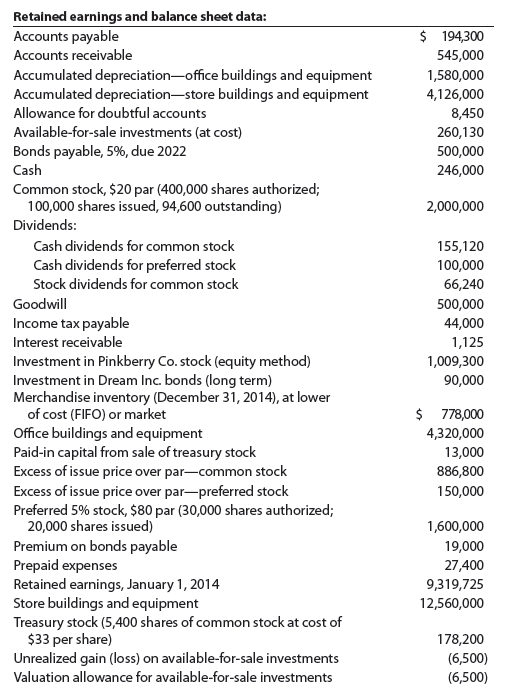

Part 1: Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2014, were as follows: Journalize the selected transactions. If no entry is required, select "No entry required" from the dropdown and leave the amount boxes blank. For a compound transaction, if an amount box does not require an entry, leave it blank, a. Issued 15,000 shares of $20 par common stock at $30, receiving cash. Issued 4,000 shares of $80 par preferred 5% stock at $100, receiving cash. Issued $500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. Declared a quarterly dividend of $0.50 per share on common stock and $1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. Paid the cash dividends declared in (d). Purchased 7,500 shares of Solstice Corp. at $40 per share, plus a $150 brokerage commission. The investment is classified as a short-term (an available-for-sale) investment. The total payment would include the brokerage commission. This will raise the stock unit price slightly, so price would be higher than $40 per share. You will be using this new price per share to calculate the gain or loss when you sell this stock. Purchased 8,000 shares of treasury common stock at $33 per share. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for $24 per share. Pinkberry has 125000 shared issued and outstanding. Equinox Products Inc. treated the investment as a long-term (an equity method) investment on the balance sheet. Declared a $1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. Paid the cash dividends to the preferred stockholders. Received $27,500 dividend from Pinkberry Co. investment in (h). Since this stock is a long-term investment the dividend payment will reduce the investment. So, credit Investment in Pinkberry in you journal entry, Purchased $90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of $375. The bonds are classified as a long-term (held-to-maturity long-term) investment on the balance sheet. Be aware of the accrued interest in this purchase. You will be paying the interest at the time of purchase. But it will be treated as your interest receivable. However it will not be your revenue. Sold, at $38 per share, 2,600 shares of treasury common stock purchased in (g). Received a dividend of $0.60 per share from the Solstice Corp. investment in (f). Since this stock is treated as a short-term investment and Equinox does not own more than 20% of the stock, treat the dividend as revenue and not a reduction to the investment. Sold 1,000 shares of Solstice Corp. at $45, including commission. Remember you calculated the new price per share for this stock at the time of purchase. Your gain or loss will be based on the calculated cost. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method. Accrued interest for three months on the Dream Inc. bonds purchased in (I). Although the interest has not been received yet, but since it has been accrued it will be treated as revenue. Pinkberry Co. recorded total earnings of $240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income.The journal entry for this transaction will include an increase to the investment in Pinkberry and a credit to Income from Pinkberry. This income is identified on the Income Statement Date