Answered step by step

Verified Expert Solution

Question

1 Approved Answer

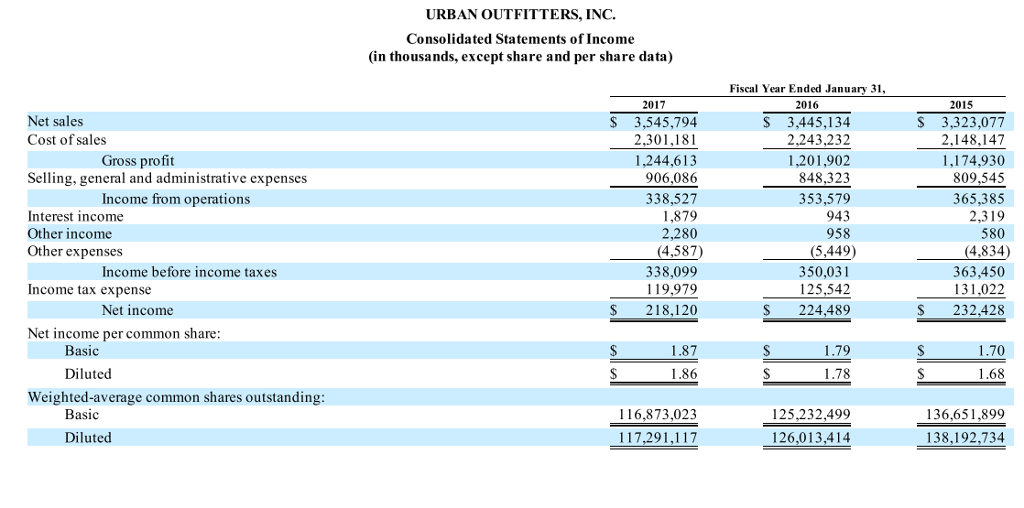

I am having trouble trying to compute Price-earning ration, I know it's market price per common share/ Earnings per share, but I do not understand

I am having trouble trying to compute Price-earning ration, I know it's market price per common share/ Earnings per share, but I do not understand where you find that information, in addition, I also need to compute Dividend yield (Annual cash dividends per share/Market price per share). Where do you find the Market Price Per Share?

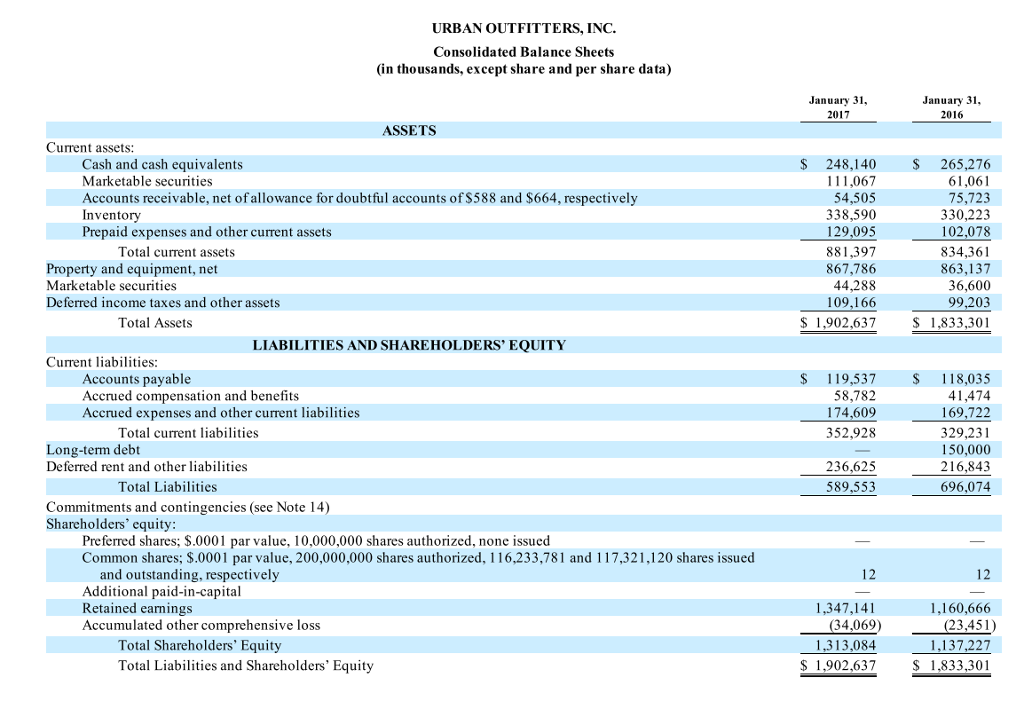

URBAN OUTFITTERS, INC. Consolidated Balance Sheets (in thousands, except share and per share data) January 31, 2017 January 31, 2016 $ 248,140 $ 265,276 111,067 61,061 54,505 75,723 338,590 330,223 129,095 102,078 881,397 834,361 867,786 863,137 44,288 36,600 109,166 99,203 $ 1,902,637 $ 1,833,301 ASSETS Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net of allowance for doubtful accounts of $588 and $664, respectively Inventory Prepaid expenses and other current assets Total current assets Property and equipment, net Marketable securities Deferred income taxes and other assets Total Assets LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Accounts payable Accrued compensation and benefits Accrued expenses and other current liabilities Total current liabilities Long-term debt Deferred rent and other liabilities Total Liabilities Commitments and contingencies (see Note 14) Shareholders' equity: Preferred shares; $.0001 par value, 10,000,000 shares authorized, none issued Common shares; $.0001 par value, 200,000,000 shares authorized, 116,233,781 and 117,321,120 shares issued and outstanding, respectively Additional paid-in-capital Retained earnings Accumulated other comprehensive loss Total Shareholders' Equity Total Liabilities and Shareholders' Equity $ 119,537 $ 118,035 58,782 41,474 174,609 169,722 352,928 329,231 150,000 236,625 216,843 589,553 696,074 12 1,347,141 (34,069) 1,313,084 $ 1,902,637 1,160,666 (23,451) 1,137,227 $ 1,833,301Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started