Answered step by step

Verified Expert Solution

Question

1 Approved Answer

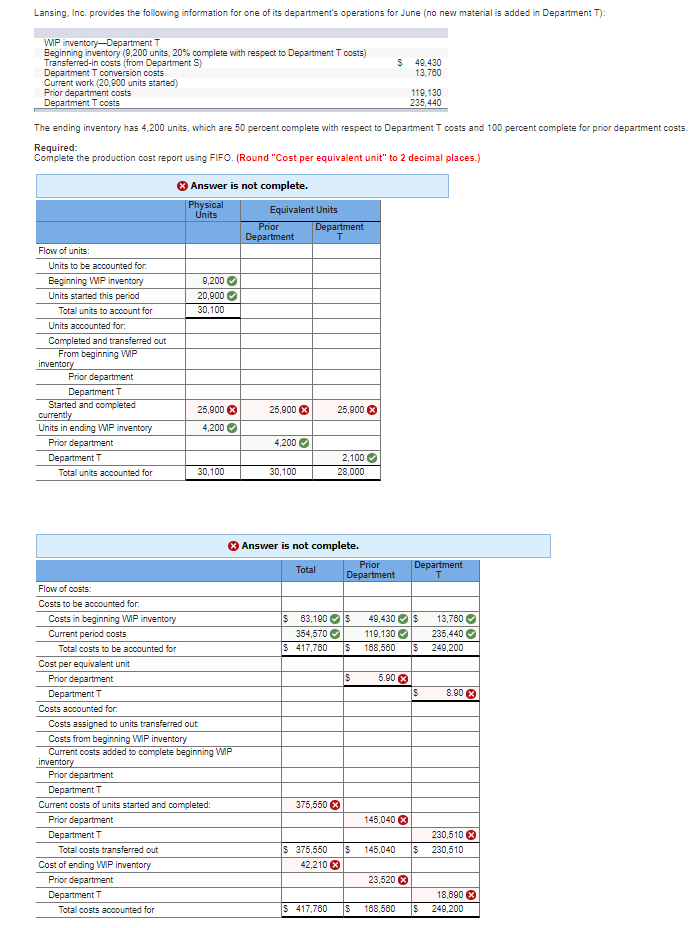

I am having trouble with this question. Can you please help? Lansing. Inc. provides the following information for one of its department's operations for June

I am having trouble with this question. Can you please help?

Lansing. Inc. provides the following information for one of its department's operations for June (no new material is added in Department T): MP inventory-Department T Beginning inventory (9,200 units, 20% complete with respect to Department T costs) Transferred-in costs (from Department S S 49,430 13,760 Current work (20,900 units started) Prior department costs 119,130 235,440 T cosis The ending inventory has 4,200 units, which are 50 percent complete with respect to Department T costs and 100 percent complete for prior department costs. Required: Complete the production cost report using FIFO. (Round "Cost per equivalent unit" to 2 decimal places.) Answer is not complete. Equivalent Units Units Flow of units Units to be accounted for Beginning WP inventory Units started this period 9,200 20,900 30,100 Total units to account for Units accounted for Completed and transferred out rom beginning MP Prior department arted and completed 25,900 4,200 590025900 Units in ending MP inventory Prior department 4,200 2,100 28,000 Total units accounted for 0,100 0,100 3 Answer is not complete. Total Flow of costs Costs to be accounted for Costs in beginning WIP Current period costs 5 63,190 49,430 13,760 119.130 235440 5 417,760 168,560 249,200 354,570 Total costs to be accounted for Cost per equivalent unit Prior department 5 5.90 5 8.90 Costs accounted for Costs assigned to units transfered out Costs from beginning WIP inventory costs added to complete beginning MP Prior department Current costs of units started and completed: 375,550 ) Prior department 145,040 230,510 5 375,550 145,040 230,510 Total costs transferred out Cost of ending WIP inventory 2,210 Prior department 23,520 3 18,890 * Total costs accounted for 5 417,760 168,560 249,200Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started