I am looking for help with questions 3, 4 and 5. My work for problems 1-2 and part of three are attached. I have highlighted what needs to be completed. Thank you.

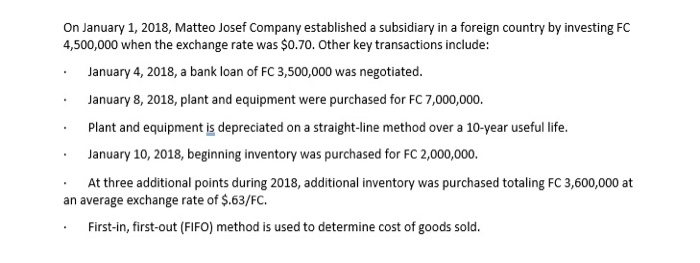

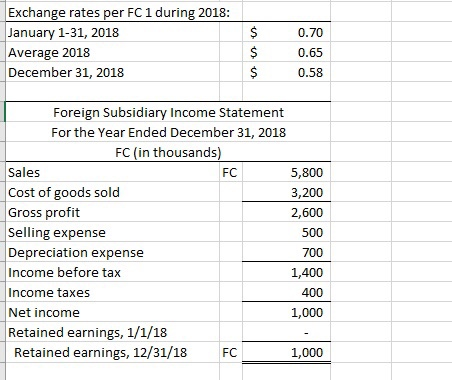

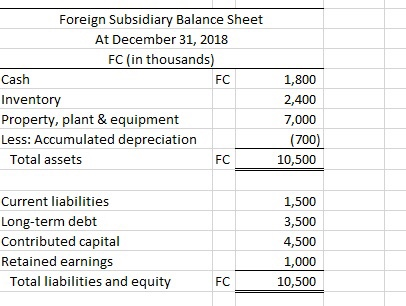

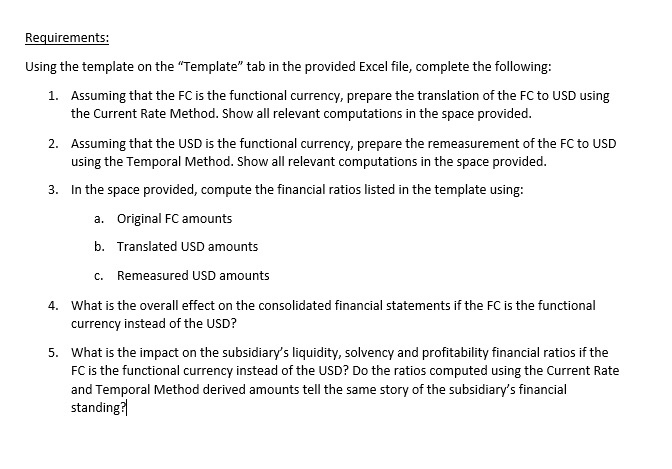

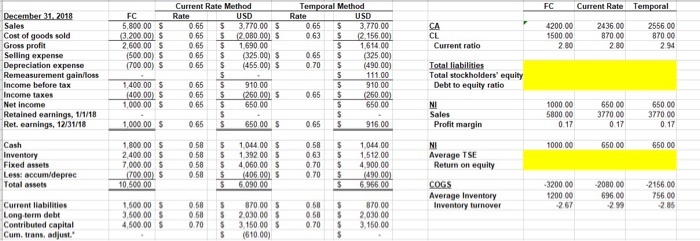

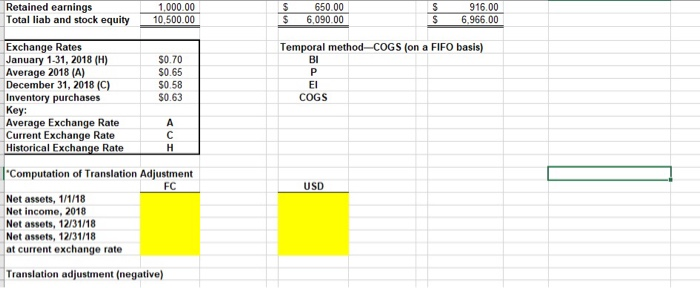

On January 1, 2018, Matteo Josef Company established a subsidiary in a foreign country by investing FC 4,500,000 when the exchange rate was $0.70. Other key transactions include: January 4, 2018, a bank loan of FC 3,500,000 was negotiated. January 8, 2018, plant and equipment were purchased for FC 7,000,000 Plant and equipment is depreciated on a straight-line method over a 10-year useful life. January 10, 2018, beginning inventory was purchased for FC 2,000,000. At three additional points during 2018, additional inventory was purchased totaling FC 3,600,000 at an average exchange rate of $.63/FC. First-in, first-out (FIFO) method is used to determine cost of goods sold. Exchange rates per FC 1 during 2018: January 1-31, 2018 Average 2018 December 31, 2018 $ $ $ 0.70 0.65 0.58 Foreign Subsidiary Income Statement For the Year Ended December 31, 2018 FC (in thousands) Sales FC 5,800 Cost of goods sold 3,200 Gross profit 2,600 Selling expense 500 Depreciation expense 700 Income before tax 1,400 Income taxes 400 Net income 1,000 Retained earnings, 1/1/18 Retained earnings, 12/31/18 FC 1,000 Foreign Subsidiary Balance Sheet At December 31, 2018 FC (in thousands) Cash FC Inventory Property, plant & equipment Less: Accumulated depreciation Total assets FC 1,800 2,400 7,000 (700) 10,500 Current liabilities Long-term debt Contributed capital Retained earnings Total liabilities and equity 1,500 3,500 4,500 1,000 10,500 FC Requirements: Using the template on the "Template" tab in the provided Excel file, complete the following: 1. Assuming that the FC is the functional currency, prepare the translation of the FC to USD using the Current Rate Method. Show all relevant computations in the space provided. 2. Assuming that the USD is the functional currency, prepare the remeasurement of the FC to USD using the Temporal Method. Show all relevant computations in the space provided. 3. In the space provided, compute the financial ratios listed in the template using: a. Original FC amounts b. Translated USD amounts c. Remeasured USD amounts 4. What is the overall effect on the consolidated financial statements if the FC is the functional currency instead of the USD? 5. What is the impact on the subsidiary's liquidity, solvency and profitability financial ratios if the FC is the functional currency instead of the USD? Do the ratios computed using the Current Rate and Temporal Method derived amounts tell the same story of the subsidiary's financial standing? Current Rate Method FC Current Rate Temporal Rate USD 0.65 CA 5.80000 $ (3.200 00) $ 2.600 00 $ 1500 00) $ 700.00) $ 4200.00 1500 00 0.65 065 065 065 065 $ $ $ 3.770.00 S 2 080 000 $ 1.690 00 (325.00) $ (455.00 $ 2436.00 2556.00 87000 8 70 00 2 802 .94 Current ratio 280 December 31, 2018 Sales Cost of goods sold Gross profit Selling expense Depreciation expense Remeasurement gain/loss Income before tax Income taxes Net Income Retained earnings, 1/1/18 Ret, earnings, 12/31/18 Temporal Method Rate USD 3.770 00 0.63 $ 12.156.00) 1614.00 0.65 $ (325.00) 070 5 (490.00) 111.00 910.00 0.65 $ (260.00) 650 00 Total liabilities Total stockholders' equity Debt to equity ratio $ 1.400.00 (400.00) S 1.000 00 0.65 0 65 065 5 $ $ 910.00 (260.00) $ 650 00 $ 100000 5800 00 0.17 65000 3 77000 0.17 650.00 3770.00 1.000. 00 0 653 650 00 065 Sales Profit margin $ 916.00 5 1000.00 650.00 650.00 0 0 Cash Inventory Fixed assets Less: accum deprec Total assets 1.800 00 $ 2.40000 $ 7.000.00 $ 700 00) $ 058 0.585 0.58 0.58 .58 .63 0.70 0.70 1044 00S 1.392.00 5 4.050.00 $ (406.00) $ 6090 00 $ $ $ 5 5 S $ $ 1.044.00 1.512.00 4.900.00 (490.00) 6.966 00 Average TSE Return on equity COGS Average Inventory Inventory turnover -320000 120000 2080 00 6 96 00 299 2156.00 756 00 285 0 S S Current liabilities Long term debt Contributed capital Cum, trans, adjust." 1.500 00S 3.500.00 $ 4,500.00 $ .58 058 0.70 $ $ 870 00 2030 00S 3.150.00 (510.00 0.58 0 58 0.70 870.00 203000 3.150.00 $ $ Retained earnings Total liab and stock equity 1.000.00 10,500.00 650.00 6,090.00 916.00 6.966.00 $ Temporal method-COGS (on a FIFO basis) Exchange Rates January 1-31, 2018 (H) Average 2018 (A) December 31, 2018 (C) Inventory purchases Key: Average Exchange Rate Current Exchange Rate Historical Exchange Rate $0.70 $0.65 $0.58 $0.63 COGS Computation of Translation Adjustment Isn Net assets, 1/1/18 Net income, 2018 Net assets, 12/31/18 Net assets, 12/31/18 at current exchange rate Translation adjustment (negative) On January 1, 2018, Matteo Josef Company established a subsidiary in a foreign country by investing FC 4,500,000 when the exchange rate was $0.70. Other key transactions include: January 4, 2018, a bank loan of FC 3,500,000 was negotiated. January 8, 2018, plant and equipment were purchased for FC 7,000,000 Plant and equipment is depreciated on a straight-line method over a 10-year useful life. January 10, 2018, beginning inventory was purchased for FC 2,000,000. At three additional points during 2018, additional inventory was purchased totaling FC 3,600,000 at an average exchange rate of $.63/FC. First-in, first-out (FIFO) method is used to determine cost of goods sold. Exchange rates per FC 1 during 2018: January 1-31, 2018 Average 2018 December 31, 2018 $ $ $ 0.70 0.65 0.58 Foreign Subsidiary Income Statement For the Year Ended December 31, 2018 FC (in thousands) Sales FC 5,800 Cost of goods sold 3,200 Gross profit 2,600 Selling expense 500 Depreciation expense 700 Income before tax 1,400 Income taxes 400 Net income 1,000 Retained earnings, 1/1/18 Retained earnings, 12/31/18 FC 1,000 Foreign Subsidiary Balance Sheet At December 31, 2018 FC (in thousands) Cash FC Inventory Property, plant & equipment Less: Accumulated depreciation Total assets FC 1,800 2,400 7,000 (700) 10,500 Current liabilities Long-term debt Contributed capital Retained earnings Total liabilities and equity 1,500 3,500 4,500 1,000 10,500 FC Requirements: Using the template on the "Template" tab in the provided Excel file, complete the following: 1. Assuming that the FC is the functional currency, prepare the translation of the FC to USD using the Current Rate Method. Show all relevant computations in the space provided. 2. Assuming that the USD is the functional currency, prepare the remeasurement of the FC to USD using the Temporal Method. Show all relevant computations in the space provided. 3. In the space provided, compute the financial ratios listed in the template using: a. Original FC amounts b. Translated USD amounts c. Remeasured USD amounts 4. What is the overall effect on the consolidated financial statements if the FC is the functional currency instead of the USD? 5. What is the impact on the subsidiary's liquidity, solvency and profitability financial ratios if the FC is the functional currency instead of the USD? Do the ratios computed using the Current Rate and Temporal Method derived amounts tell the same story of the subsidiary's financial standing? Current Rate Method FC Current Rate Temporal Rate USD 0.65 CA 5.80000 $ (3.200 00) $ 2.600 00 $ 1500 00) $ 700.00) $ 4200.00 1500 00 0.65 065 065 065 065 $ $ $ 3.770.00 S 2 080 000 $ 1.690 00 (325.00) $ (455.00 $ 2436.00 2556.00 87000 8 70 00 2 802 .94 Current ratio 280 December 31, 2018 Sales Cost of goods sold Gross profit Selling expense Depreciation expense Remeasurement gain/loss Income before tax Income taxes Net Income Retained earnings, 1/1/18 Ret, earnings, 12/31/18 Temporal Method Rate USD 3.770 00 0.63 $ 12.156.00) 1614.00 0.65 $ (325.00) 070 5 (490.00) 111.00 910.00 0.65 $ (260.00) 650 00 Total liabilities Total stockholders' equity Debt to equity ratio $ 1.400.00 (400.00) S 1.000 00 0.65 0 65 065 5 $ $ 910.00 (260.00) $ 650 00 $ 100000 5800 00 0.17 65000 3 77000 0.17 650.00 3770.00 1.000. 00 0 653 650 00 065 Sales Profit margin $ 916.00 5 1000.00 650.00 650.00 0 0 Cash Inventory Fixed assets Less: accum deprec Total assets 1.800 00 $ 2.40000 $ 7.000.00 $ 700 00) $ 058 0.585 0.58 0.58 .58 .63 0.70 0.70 1044 00S 1.392.00 5 4.050.00 $ (406.00) $ 6090 00 $ $ $ 5 5 S $ $ 1.044.00 1.512.00 4.900.00 (490.00) 6.966 00 Average TSE Return on equity COGS Average Inventory Inventory turnover -320000 120000 2080 00 6 96 00 299 2156.00 756 00 285 0 S S Current liabilities Long term debt Contributed capital Cum, trans, adjust." 1.500 00S 3.500.00 $ 4,500.00 $ .58 058 0.70 $ $ 870 00 2030 00S 3.150.00 (510.00 0.58 0 58 0.70 870.00 203000 3.150.00 $ $ Retained earnings Total liab and stock equity 1.000.00 10,500.00 650.00 6,090.00 916.00 6.966.00 $ Temporal method-COGS (on a FIFO basis) Exchange Rates January 1-31, 2018 (H) Average 2018 (A) December 31, 2018 (C) Inventory purchases Key: Average Exchange Rate Current Exchange Rate Historical Exchange Rate $0.70 $0.65 $0.58 $0.63 COGS Computation of Translation Adjustment Isn Net assets, 1/1/18 Net income, 2018 Net assets, 12/31/18 Net assets, 12/31/18 at current exchange rate Translation adjustment (negative)