I am not super good with excel and need help with this finance problem. I need help solving them but also what to put in excel. Thank you.

I have attached pictures of my template that has the questions and the explanations of the problem.

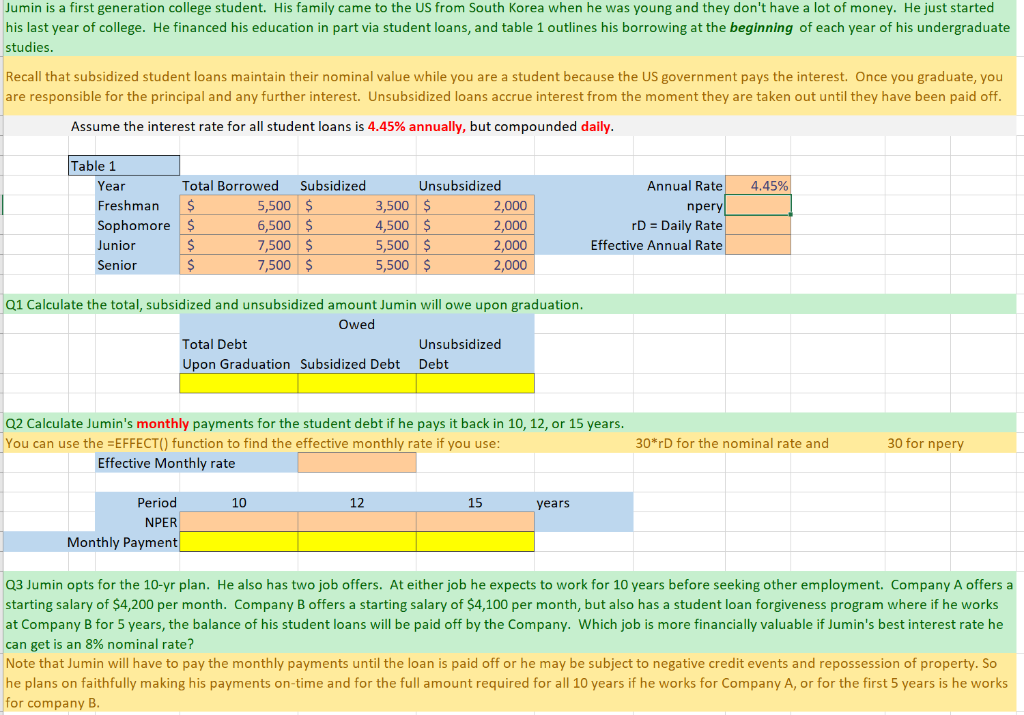

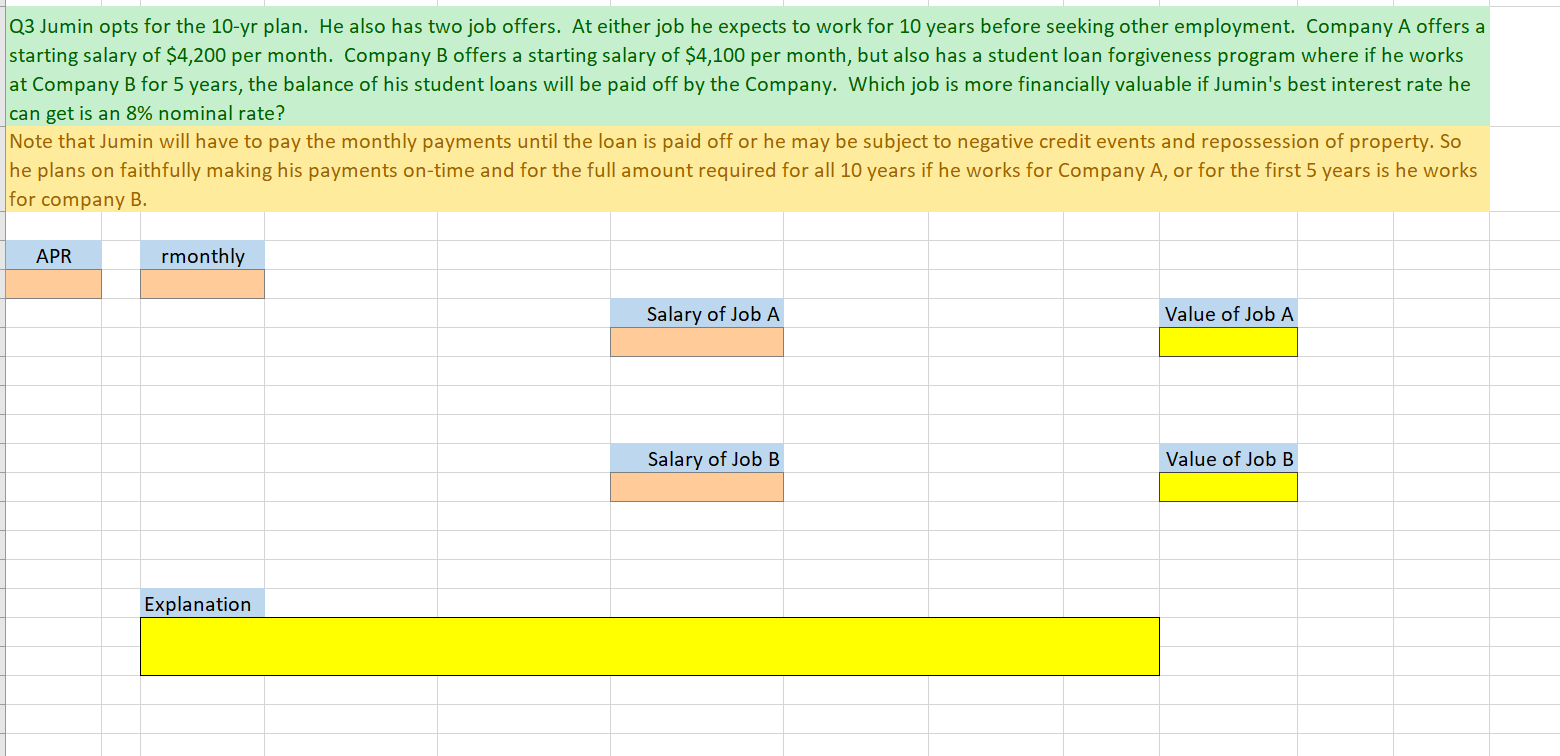

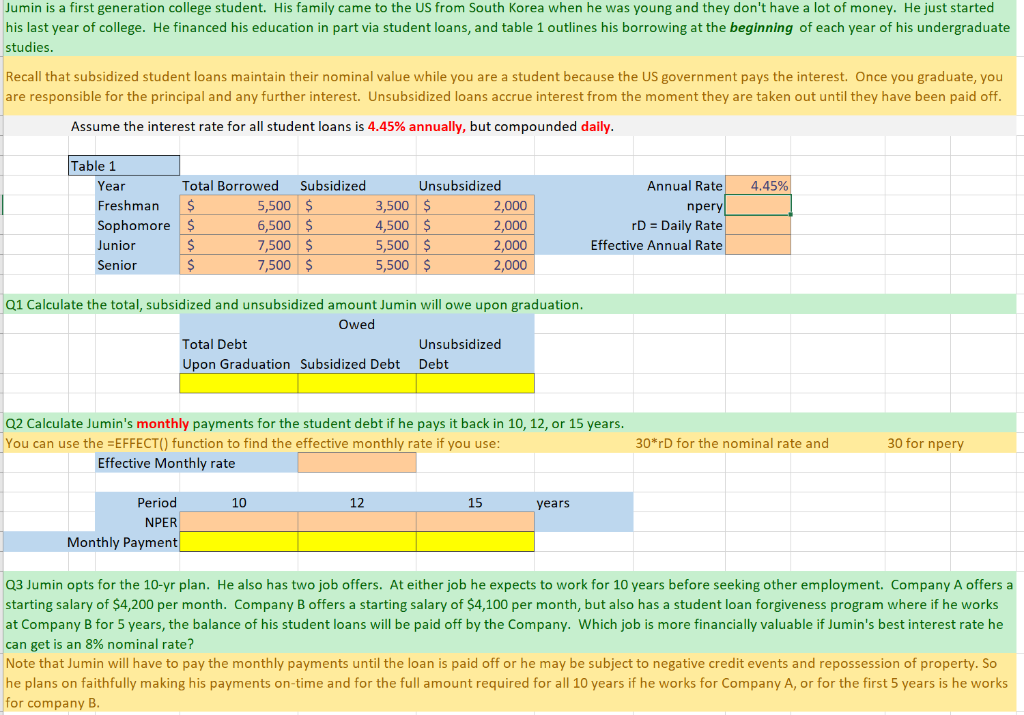

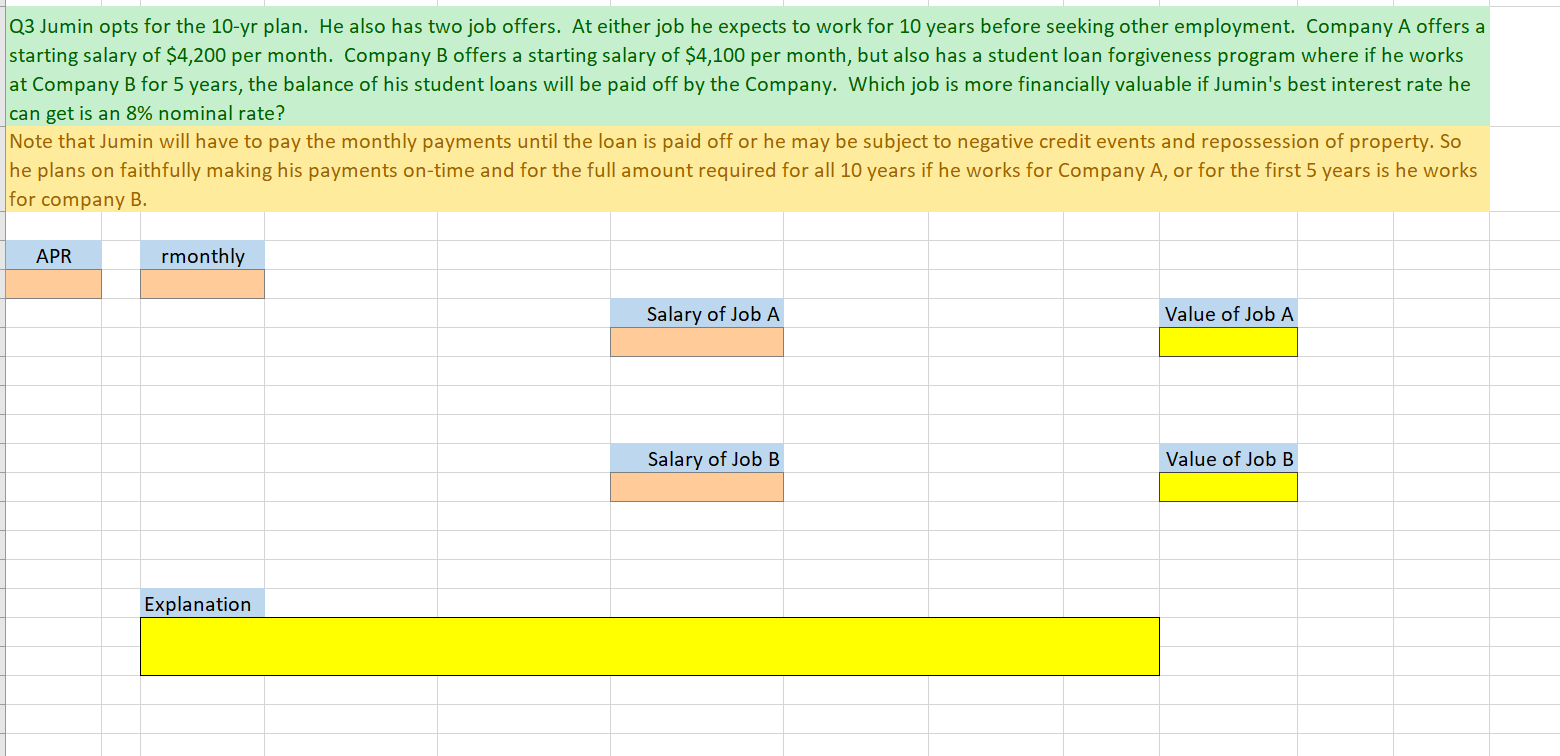

Jumin is a first generation college student. His family came to the US from South Korea when he was young and they don't have a lot of money. He just started his last year of college. He financed his education in part via student loans, and table 1 outlines his borrowing at the beginning of each year of his undergraduate studies. Recall that subsidized student loans maintain their nominal value while you are a student because the US government pays the interest. Once you graduate, you are responsible for the principal and any further interest. Unsubsidized loans accrue interest from the moment they are taken out until they have been paid off. Assume the interest rate for all student loans is 4.45% annually, but compounded daily. 4.45% Table 1 Year Total Borrowed Subsidized Freshman $ 5,500 $ Sophomore $ 6,500 $ Junior $ 7,500 $ Senior $ 7,500 $ Unsubsidized 3,500 $ 2,000 4,500 $ 2,000 5,500 $ 2,000 5,500 $ Annual Rate nperyl D = Daily Rate Effective Annual Rate 2,000 Q1 Calculate the total, subsidized and unsubsidized amount Jumin will owe upon graduation. Owed Total Debt Unsubsidized Upon Graduation Subsidized Debt Debt Q2 Calculate Jumin's monthly payments for the student debt if he pays it back in 10, 12, or 15 years. You can use the =EFFECT() function to find the effective monthly rate if you use: Effective Monthly rate 30*r for the nominal rate and 30 for npery 10 12 15 years Period NPER Monthly Payment 23 Jumin opts for the 10-yr plan. He also has two job offers. At either job he expects to work for 10 years before seeking other employment. Company A offers a starting salary of $4,200 per month. Company B offers a starting salary of $4,100 per month, but also has a student loan forgiveness program where if he works at Company B for 5 years, the balance of his student loans will be paid off by the Company. Which job is more financially valuable if Jumin's best interest rate he can get is an 8% nominal rate? Note that Jumin will have to pay the monthly payments until the loan is paid off or he may be subject to negative credit events and repossession of property. So he plans on faithfully making his payments on-time and for the full amount required for all 10 years if he works for Company A, or for the first 5 years is he works for company B. Q3 Jumin opts for the 10-yr plan. He also has two job offers. At either job he expects to work for 10 years before seeking other employment. Company A offers a starting salary of $4,200 per month. Company B offers a starting salary of $4,100 per month, but also has a student loan forgiveness program where if he works at Company B for 5 years, the balance of his student loans will be paid off by the Company. Which job is more financially valuable if Jumin's best interest rate he can get is an 8% nominal rate? Note that Jumin will have to pay the monthly payments until the loan is paid off or he may be subject to negative credit events and repossession of property. So he plans on faithfully making his payments on-time and for the full amount required for all 10 years if he works for Company A, or for the first 5 years is he works for company B. APR rmonthly Salary of Job A. Value of Job A Salary of Job B Value of Job B Explanation Jumin is a first generation college student. His family came to the US from South Korea when he was young and they don't have a lot of money. He just started his last year of college. He financed his education in part via student loans, and table 1 outlines his borrowing at the beginning of each year of his undergraduate studies. Recall that subsidized student loans maintain their nominal value while you are a student because the US government pays the interest. Once you graduate, you are responsible for the principal and any further interest. Unsubsidized loans accrue interest from the moment they are taken out until they have been paid off. Assume the interest rate for all student loans is 4.45% annually, but compounded daily. 4.45% Table 1 Year Total Borrowed Subsidized Freshman $ 5,500 $ Sophomore $ 6,500 $ Junior $ 7,500 $ Senior $ 7,500 $ Unsubsidized 3,500 $ 2,000 4,500 $ 2,000 5,500 $ 2,000 5,500 $ Annual Rate nperyl D = Daily Rate Effective Annual Rate 2,000 Q1 Calculate the total, subsidized and unsubsidized amount Jumin will owe upon graduation. Owed Total Debt Unsubsidized Upon Graduation Subsidized Debt Debt Q2 Calculate Jumin's monthly payments for the student debt if he pays it back in 10, 12, or 15 years. You can use the =EFFECT() function to find the effective monthly rate if you use: Effective Monthly rate 30*r for the nominal rate and 30 for npery 10 12 15 years Period NPER Monthly Payment 23 Jumin opts for the 10-yr plan. He also has two job offers. At either job he expects to work for 10 years before seeking other employment. Company A offers a starting salary of $4,200 per month. Company B offers a starting salary of $4,100 per month, but also has a student loan forgiveness program where if he works at Company B for 5 years, the balance of his student loans will be paid off by the Company. Which job is more financially valuable if Jumin's best interest rate he can get is an 8% nominal rate? Note that Jumin will have to pay the monthly payments until the loan is paid off or he may be subject to negative credit events and repossession of property. So he plans on faithfully making his payments on-time and for the full amount required for all 10 years if he works for Company A, or for the first 5 years is he works for company B. Q3 Jumin opts for the 10-yr plan. He also has two job offers. At either job he expects to work for 10 years before seeking other employment. Company A offers a starting salary of $4,200 per month. Company B offers a starting salary of $4,100 per month, but also has a student loan forgiveness program where if he works at Company B for 5 years, the balance of his student loans will be paid off by the Company. Which job is more financially valuable if Jumin's best interest rate he can get is an 8% nominal rate? Note that Jumin will have to pay the monthly payments until the loan is paid off or he may be subject to negative credit events and repossession of property. So he plans on faithfully making his payments on-time and for the full amount required for all 10 years if he works for Company A, or for the first 5 years is he works for company B. APR rmonthly Salary of Job A. Value of Job A Salary of Job B Value of Job B Explanation