Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i am not understanding the formula for getting the depreciation. the book is okay. i am.following step by step but my numbers are somehow wrong

i am not understanding the formula for getting the depreciation. the book is okay. i am.following step by step but my numbers are somehow wrong

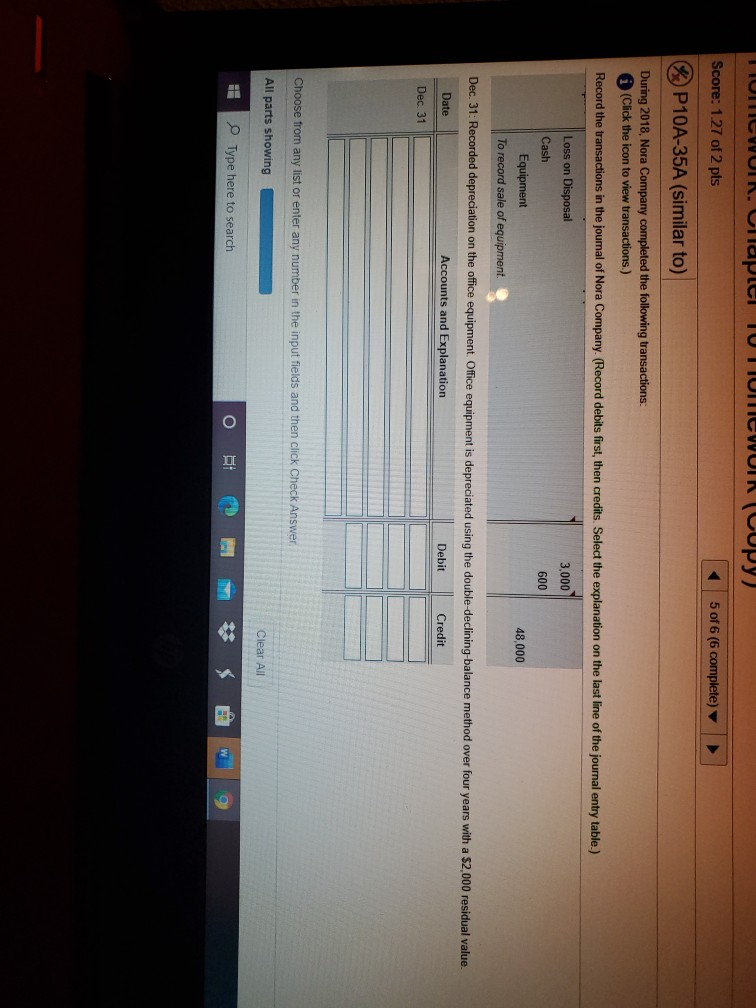

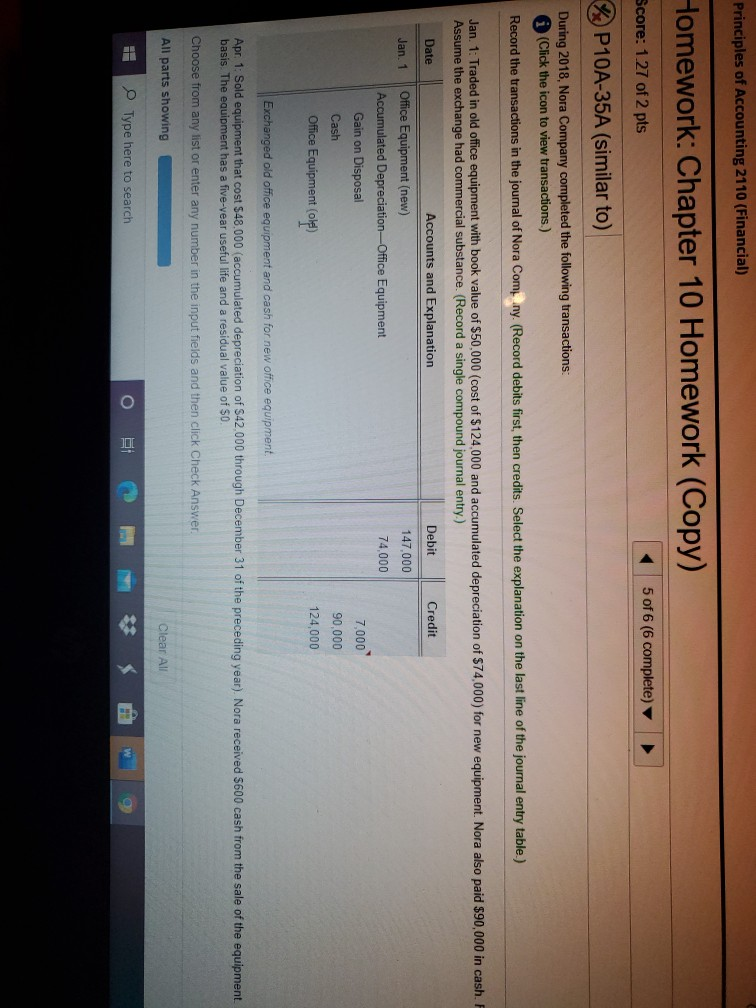

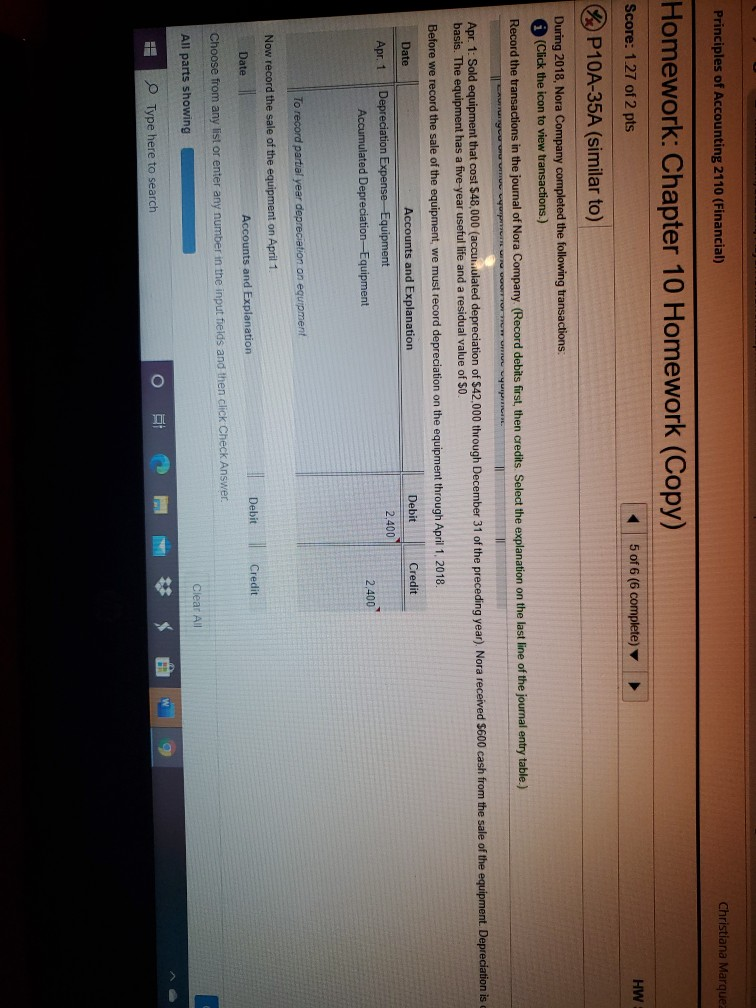

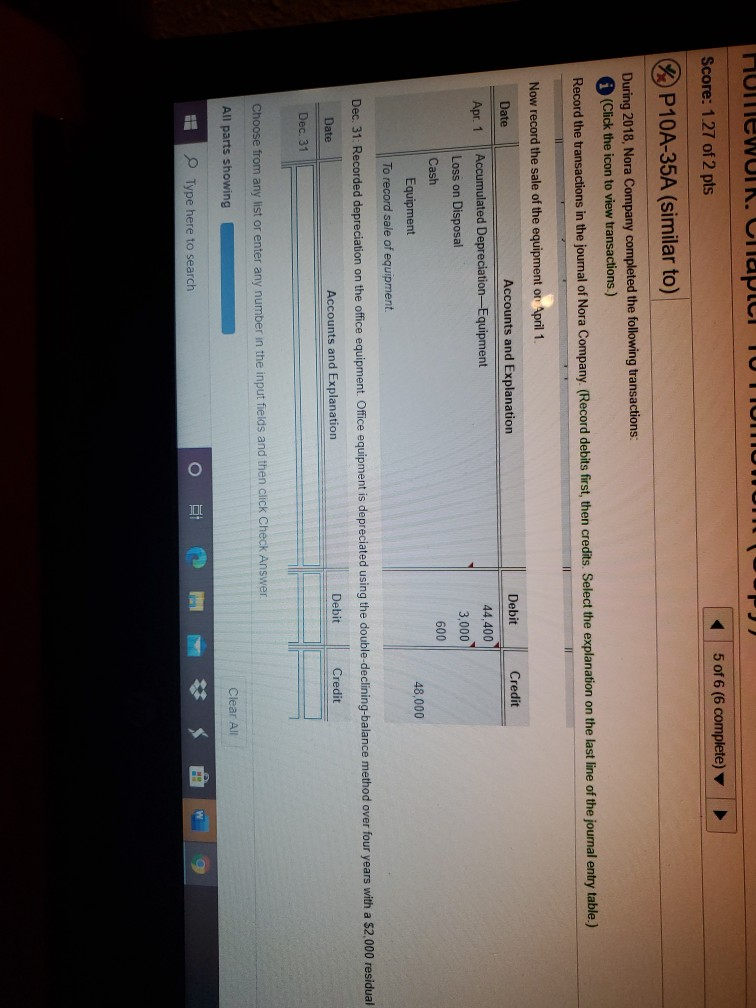

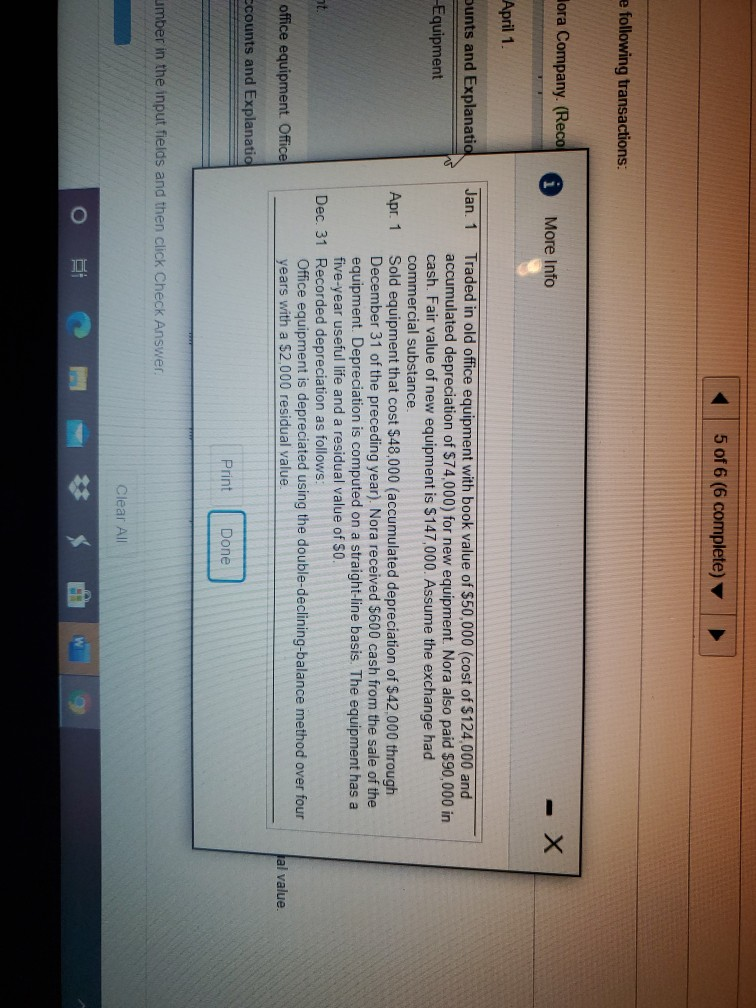

TIUMCWUIK. Cllapie TOTUMWOL (Copy) Score: 127 of 2 pts 5 of 6 (6 complete) P10A-35A (similar to) During 2018 Nora Company completed the following transactions: (Click the icon to view transactions.) Record the transactions in the journal of Nora Company. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) 3,000 600 Loss on Disposal Cash Equipment To record sale of equipment 48,000 Dec 31: Recorded depreciation on the office equipment Office equipment is depreciated using the double-declining-balance method over four years with a $2,000 residual value Date Accounts and Explanation Debit Credit Dec 31 Choose from any list or enter any number in the input fields and then click Check Answer All parts showing Clear All HE Type here to search O BI B W Principles of Accounting 2110 (Financial) Homework: Chapter 10 Homework (Copy) Score: 1.27 of 2 pts 5 of 6 (6 complete) P10A-35A (similar to) During 2018, Nora Company completed the following transactions: (Click the icon to view transactions.) Record the transactions in the journal of Nora Com ny. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Jan. 1: Traded in old office equipment with book value of $50,000 (cost of $124.000 and accumulated depreciation of $74,000) for new equipment. Nora also paid $90,000 in cash. F Assume the exchange had commercial substance. (Record a single compound journal entry) Date Accounts and Explanation Debit Credit Jan. 1 147,000 74.000 Office Equipment (new) Accumulated Depreciation Office Equipment Gain on Disposal Cash Office Equipment (ohet 7,000 90,000 124,000 Exchanged old office equipment and cash for new office equipment Apr 1: Sold equipment that cost $48.000 (accumulated depreciation of S42.000 through December 31 of the preceding year). Nora received $600 cash from the sale of the equipment basis. The equipment has a five-vear useful life and a residual value of $0. Choose from any list or enter any number in the input fields and then click Check Answer. All parts showing Clear All Type here to search $ w Principles of Accounting 2110 (Financial) Christiana Marque Homework: Chapter 10 Homework (Copy) HW 5 of 6 (6 complete) Score: 127 of 2 pts P10A-35A (similar to) During 2018, Nora Company completed the following transactions (Click the icon to view transactions.) Record the transactions in the journal of Nora Company (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) . Apr. 1: Sold equipment that cost $48,000 (accumulated depreciation of $42,000 through December 31 of the preceding year). Nora received $600 cash from the sale of the equipment. Depreciation is basis. The equipment has a five-year useful and a residual value of $0 Before we record the sale of the equipment, we must record depreciation on the equipment through April 1, 2018 Date Accounts and Explanation Debit Credit Apr. 1 Depreciation Expense Equipment 2.400 Accumulated Depreciation -Equipment 2.400 To record partial year depreciation on equipment Now record the sale of the equipment on April 1 Date Accounts and Explanation Debit Credit Choose from any list or enter any number in the input fields and then click Check Answer Clear All All parts showing W $ O Type here to search HUMEWUI. Chlapci TU TUMU 5 of 6 (6 complete) Score: 1.27 of 2 pts P10A-35A (similar to) During 2018Nora Company completed the following transactions: A (Click the icon to view transactions.) Record the transactions in the journal of Nora Company. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) II TI Now record the sale of the equipment on April 1 Debit Credit Date Apr. 1 Accounts and Explanation Accumulated Depreciation-Equipment Loss on Disposal Cash Equipment 44,400 3,000 600 48,000 To record sale of equipment Dec. 31: Recorded depreciation on the office equipment Office equipment is depreciated using the double-declining-balance method over four years with a $2,000 residual Date Accounts and Explanation Debit Credit Dec 31 Choose from any list or enter any number in the input fields and then click Check Answer All parts showing Clear All HE W O Type here to search 5 of 6 (6 complete) e following transactions: Hora Company. (Reco More Info - X April 1. unts and Explanatio W Equipment Jan. 1 Traded in old office equipment with book value of $50,000 (cost of $124,000 and accumulated depreciation of $74,000) for new equipment. Nora also paid $90,000 in cash. Fair value of new equipment is $147,000. Assume the exchange had commercial substance Apr. 1 Sold equipment that cost $48,000 (accumulated depreciation of $42.000 through December 31 of the preceding year). Nora received $600 cash from the sale of the equipment. Depreciation is computed on a straight-line basis. The equipment has a five-year useful life and a residual value of $0. Dec. 31 Recorded depreciation as follows: Office equipment is depreciated using the double-declining-balance method over four years with a $2.000 residual value t. office equipment Office lal value. scounts and Explanatio Print Done umber in the input fields and then click Check Answer Clear All

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started