Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am so lost about the banking game that professor put in the class, he said I can put any number in the sheet. Can

I am so lost about the banking game that professor put in the class, he said I can put any number in the sheet. Can you explain it? Thank you!

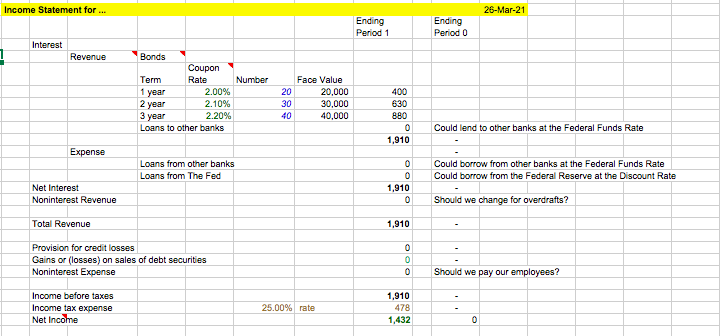

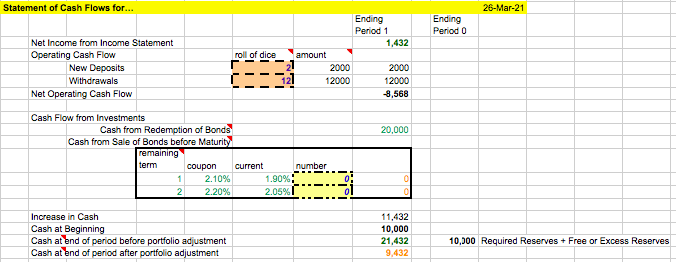

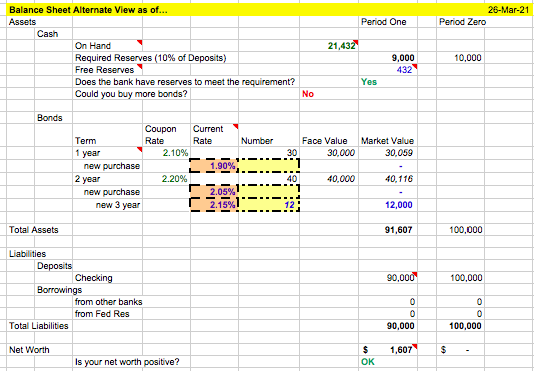

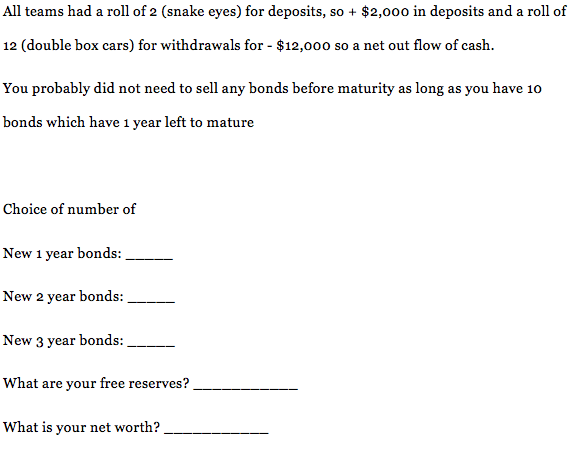

Income Statement for ... 26-Mar-21 Ending Period 1 Ending Period 0 Interest Revenue Number Bonds Coupon Term Rate 1 1 year 2.00% 2 year 2.10% 3 year 2.20% Loans to other banks 20 30 40 Face Value 20,000 30,000 40,000 400 630 880 0 1,910 Could lend to other banks at the Federal Funds Rate Expense Loans from other banks Loans from The Fed Could borrow from other banks at the Federal Funds Rate Could borrow from the Federal Reserve at the Discount Rate 0 0 1,910 0 Net Interest Noninterest Revenue Should we change for overdrafts? Total Revenue 1,910 Provision for credit losses Gains or losses) on sales of debt securities Noninterest Expense 0 0 0 Should we pay our employees? Income before taxes Income tax expense Net Income 25.00% rate 1,910 478 1,432 0 Statement of Cash Flows for... 26-Mar-21 Ending Period 1 Ending Periodo 1,432 roll of dice Net Income from Income Statement Operating Cash Flow New Deposits Withdrawals Net Operating Cash Flow : 1 lg. NN amount 2000 12000 2000 12000 8,568 20,000 Cash Flow from Investments Cash from Redemption of Bonds Cash from Sale of Bonds before Maturity remaining term coupon current 1 2.10% 1.90% 2 2.20% 2.05% number Increase in Cash Cash at Beginning Cash at end of period before portfolio adjustment Cash at bnd of period after portfolio adjustment 11,432 10,000 21,432 9,432 10,500 Required Reserves + Free or Excess Reserves 26-Mar-21 Period Zero Period One 21,432 Balance Sheet Alternate View as of... Assets Cash On Hand Required Reserves (10% of Deposits) Free Reserves Does the bank have reserves to meet the requirement? Could you buy more bonds? 10,000 9,000 432 Yes No Bonds Face Value 30,000 Market Value 30.059 30 Coupon Current Term Rate Rate Number 1 year 2.10% new purchase 1.90% 2 year 2.20% new purchase 2.05% new 3 year r2.15% 40,000 40.116 12,000 Total Assets 91,607 100,000 90.000 100,000 Liabilities Deposits Checking Borrowings from other banks from Fed Res Total Liabilities 0 0 90,000 0 0 100,000 Net Worth 1,607 $ $ OK Is your net worth positive? All teams had a roll of 2 (snake eyes) for deposits, so + $2,000 in deposits and a roll of 12 (double box cars) for withdrawals for - $12,000 so a net out flow of cash. You probably did not need to sell any bonds before maturity as long as you have 10 bonds which have 1 year left to mature Choice of number of New 1 year bonds: New 2 year bonds: New 3 year bonds: What are your free reserves? What is your net worthStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started