Answered step by step

Verified Expert Solution

Question

1 Approved Answer

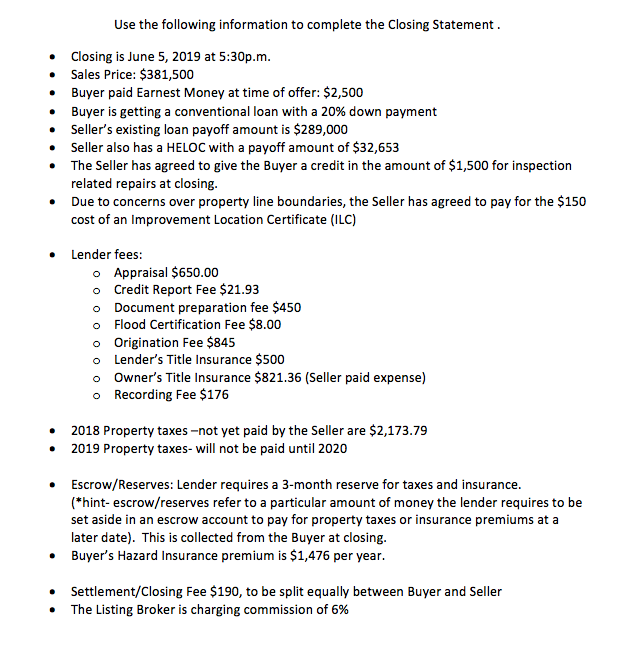

I am stuck, need help solving this closing statement. Use the following information to complete the Closing Statement. Closing is June 5, 2019 at 5:30p.m

I am stuck, need help solving this closing statement.

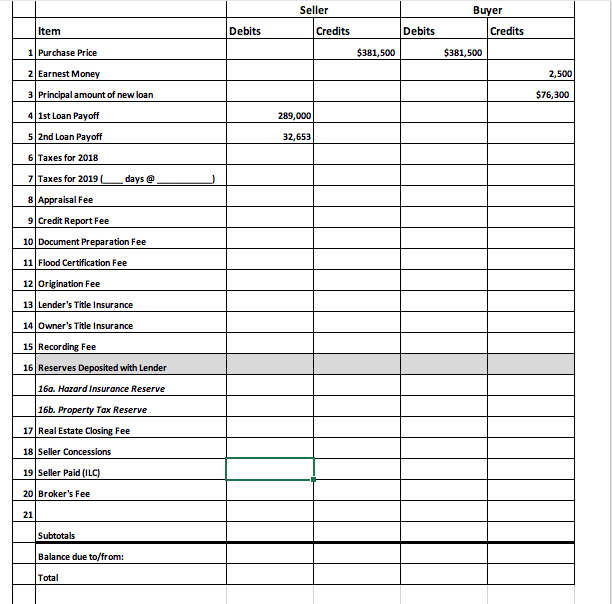

Use the following information to complete the Closing Statement. Closing is June 5, 2019 at 5:30p.m Sales Price: $381,500 Buyer paid Earnest Money at time of offer: $2,500 Buyer is getting a conventional loan with a 20% down payment Seller's existing loan payoff amount is $289,000 .Seller also has a HELOC with a payoff amount of $32,653 The Seller has agreed to give the Buyer a credit in the amount of $1,500 for inspection related repairs at closing .Due to concerns over property line boundaries, the Seller has agreed to pay for the $150 cost of an Improvement Location Certificate (ILC) . Lender fees: Appraisal $650.00 Credit Report Fee $21.93 Document preparation fee $450 Flood Certification Fee $8.00 Origination Fee $845 Lender's Title Insurance $500 Owner's Title Insurance $821.36 (Seller paid expense) Recording Fee $176 o o o o o o o o .2018 Property taxes-not yet paid by the Seller are $2,173.79 2019 Property taxes- will not be paid until 2020 Escrow/Reserves: Lender requires a 3-month reserve for taxes and insurance (*hint- escrow/reserves refer to a particular amount of money the lender requires to be set aside in an escrow account to pay for property taxes or insurance premiums at a later date). This is collected from the Buyer at closing Buyer's Hazard Insurance premium is $1,476 per year Settlement/Closing Fee $190, to be split equally between Buyer and Seller The Listing Broker is charging commission of 6% Seller Buyer Debits Debits Credits 1 Purchase Price $381,500 $381,500 2 Earnest Money 2,500 3 Principal amount of new loan $76,300 41st Loan Payoff 289,000 52nd Loan Payoff 32,653 6Taxes for 2018 Taxes for 2019( days @ 8 Appraisal Fee 9 Credit Report Fee 10 Document Preparation Fee 11 Flood Certification Fee 12 Origination Fee 13 Lender's Title Insurance 14 Owner's Title Insurance 15 Recording Fee 16 Reserves Deposited with Lender 16a. Hazard Insurance Reserve 16b. Property Tax Reserve 17 Real Estate Closing Fee 18 Seller Concessions 19 Seller Paid (ILC) 20 Broker's Fee 21 Subtotals Balance due to/from: Total Use the following information to complete the Closing Statement. Closing is June 5, 2019 at 5:30p.m Sales Price: $381,500 Buyer paid Earnest Money at time of offer: $2,500 Buyer is getting a conventional loan with a 20% down payment Seller's existing loan payoff amount is $289,000 .Seller also has a HELOC with a payoff amount of $32,653 The Seller has agreed to give the Buyer a credit in the amount of $1,500 for inspection related repairs at closing .Due to concerns over property line boundaries, the Seller has agreed to pay for the $150 cost of an Improvement Location Certificate (ILC) . Lender fees: Appraisal $650.00 Credit Report Fee $21.93 Document preparation fee $450 Flood Certification Fee $8.00 Origination Fee $845 Lender's Title Insurance $500 Owner's Title Insurance $821.36 (Seller paid expense) Recording Fee $176 o o o o o o o o .2018 Property taxes-not yet paid by the Seller are $2,173.79 2019 Property taxes- will not be paid until 2020 Escrow/Reserves: Lender requires a 3-month reserve for taxes and insurance (*hint- escrow/reserves refer to a particular amount of money the lender requires to be set aside in an escrow account to pay for property taxes or insurance premiums at a later date). This is collected from the Buyer at closing Buyer's Hazard Insurance premium is $1,476 per year Settlement/Closing Fee $190, to be split equally between Buyer and Seller The Listing Broker is charging commission of 6% Seller Buyer Debits Debits Credits 1 Purchase Price $381,500 $381,500 2 Earnest Money 2,500 3 Principal amount of new loan $76,300 41st Loan Payoff 289,000 52nd Loan Payoff 32,653 6Taxes for 2018 Taxes for 2019( days @ 8 Appraisal Fee 9 Credit Report Fee 10 Document Preparation Fee 11 Flood Certification Fee 12 Origination Fee 13 Lender's Title Insurance 14 Owner's Title Insurance 15 Recording Fee 16 Reserves Deposited with Lender 16a. Hazard Insurance Reserve 16b. Property Tax Reserve 17 Real Estate Closing Fee 18 Seller Concessions 19 Seller Paid (ILC) 20 Broker's Fee 21 Subtotals Balance due to/from: TotalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started