Answered step by step

Verified Expert Solution

Question

1 Approved Answer

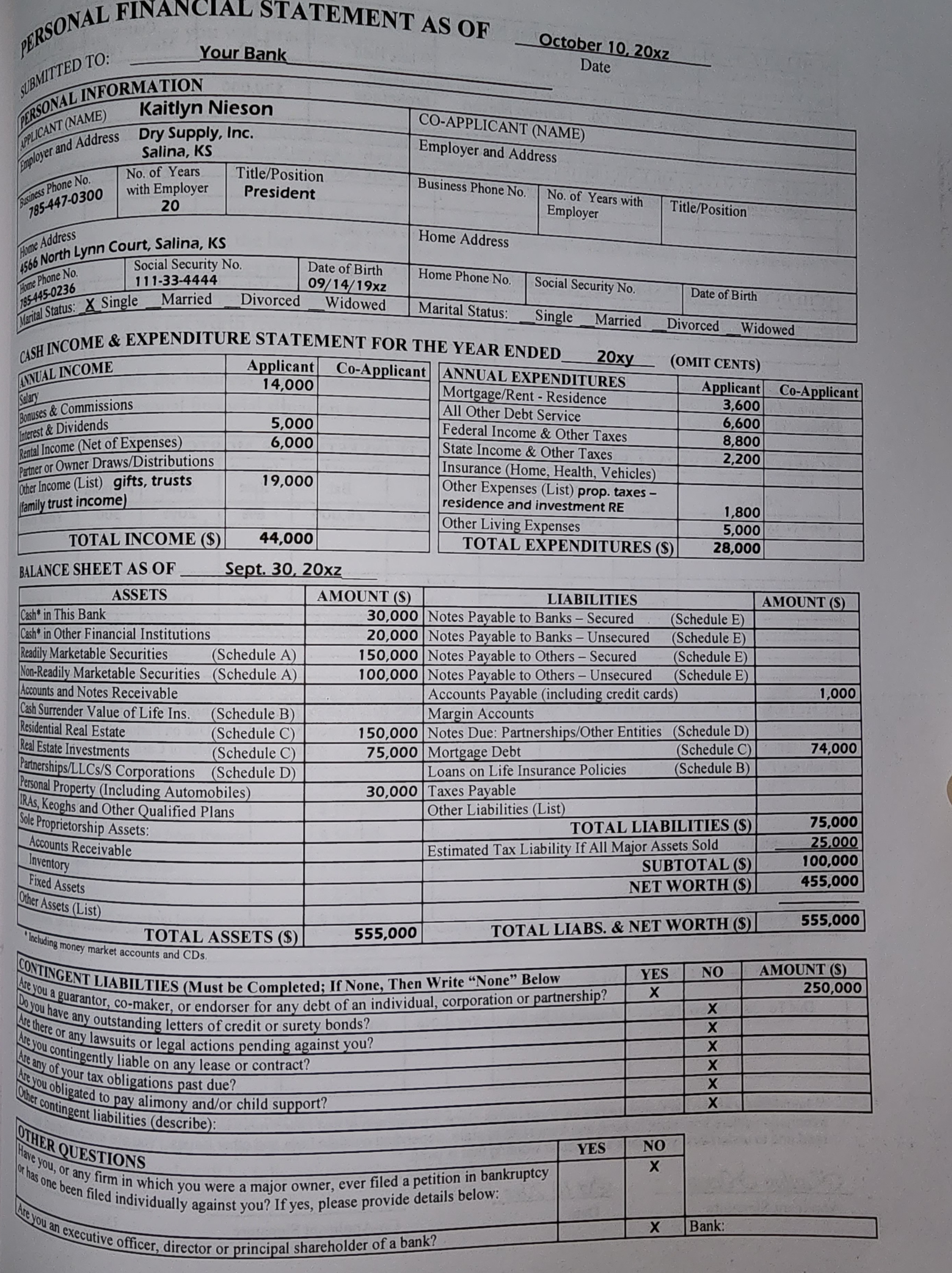

I am trying to answer the questions and getting stuck. PERSONAL FINANCIAL STATEMENT AS OF SUBMITTED TO: PERSONAL INFORMATION Kaitlyn Nieson APPLICANT (NAME) Employer and

I am trying to answer the questions and getting stuck.

PERSONAL FINANCIAL STATEMENT AS OF SUBMITTED TO: PERSONAL INFORMATION Kaitlyn Nieson APPLICANT (NAME) Employer and Address Dry Supply, Inc. Salina, KS Business Phone No. 785-447-0300 No. of Years with Employer 20 Home Address 4566 North Lynn Court, Salina, KS Phone No. Home 185-445-0236 Marital Status: X Single Social Security No. 111-33-4444 Date of Birth 09/14/19xz Married Divorced Widowed TOTAL INCOME ($) Title/Position President BALANCE SHEET AS OF ASSETS Accounts Receivable Inventory Fixed Assets Other Assets (List) Cash in This Bank Cash in Other Financial Institutions Readily Marketable Securities Non-Readily Marketable Securities Accounts and Notes Receivable Cash Surrender Value of Life Ins. Residential Real Estate Real Estate Investments Partnerships/LLCS/S Corporations Personal Property (Including Automobiles) IRAS, Keoghs and Other Qualified Plans Sole Proprietorship Assets: Including money market accounts and CDs. 5,000 6,000 CASH INCOME & EXPENDITURE STATEMENT FOR THE YEAR ENDED ANNUAL INCOME Salary Bonuses & Commissions Interest&Dividends Rental Income (Net of Expenses) Partner or Owner Draws/Distributions Other Income (List) gifts, trusts family trust income) 19,000 44,000 Sept. 30, 20xz (Schedule A) (Schedule A) (Schedule B) (Schedule C) (Schedule C) (Schedule D) TOTAL ASSETS ($) AMOUNT (S) CO-APPLICANT (NAME) Employer and Address Business Phone No. Home Address Home Phone No. Applicant Co-Applicant ANNUAL EXPENDITURES 14,000 Mortgage/Rent - Residence All Other Debt Service Federal Income & Other Taxes State Income & Other Taxes Insurance (Home, Health, Vehicles) Other Expenses (List) prop. taxes - residence and investment RE Other Living Expenses TOTAL EXPENDITURES ($) Marital Status: 555,000 October 10, 20xz Date No. of Years with Employer 30,000 Taxes Payable Social Security No. Single Married 20xy LIABILITIES 30,000 Notes Payable to Banks - Secured 20,000 Notes Payable to Banks - Unsecured 150,000 Notes Payable to Others - Secured 100,000 Notes Payable to Others - Unsecured Accounts Payable (including credit cards) Margin Accounts 150,000 Notes Due: Partnerships/Other Entities 75,000 Mortgage Debt Loans on Life Insurance Policies Other Liabilities (List) CONTINGENT LIABILTIES (Must be Completed; If None, Then Write "None" Below Are you a guarantor, co-maker, or endorser for any debt of an individual, corporation or partnership? Do you have any outstanding letters of credit or surety bonds? Are there or any lawsuits or legal actions pending against you? Are you contingently liable on any lease or contract? Are you obligated to pay alimony and/or child support? Are any of your tax obligations past due? Other contingent liabilities (describe): OTHER QUESTIONS Have you, or any firm in which you were a major owner, ever filed a petition in bankruptcy or has one been filed individually against you? If yes, please provide details below: Are you an executive officer, director or principal shareholder of a bank? Title/Position YES Divorced Widowed YES X NO X Date of Birth (OMIT CENTS) X TOTAL LIABILITIES (S) Estimated Tax Liability If All Major Assets Sold SUBTOTAL ($) NET WORTH ($) TOTAL LIABS. & NET WORTH ($) Applicant Co-Applicant 3,600 6,600 8,800 2,200 1,800 5,000 28,000 (Schedule E) (Schedule E) (Schedule E) (Schedule E) (Schedule D) (Schedule C) (Schedule B) NO XX X X X X X X Bank: AMOUNT (S) 1,000 74,000 75,000 25,000 100,000 455,000 555,000 AMOUNT (S) 250,000

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Personal Financial Statement Analysis for Kaitlyn Nieson Income and Expenses Kaitlyns total annual i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started