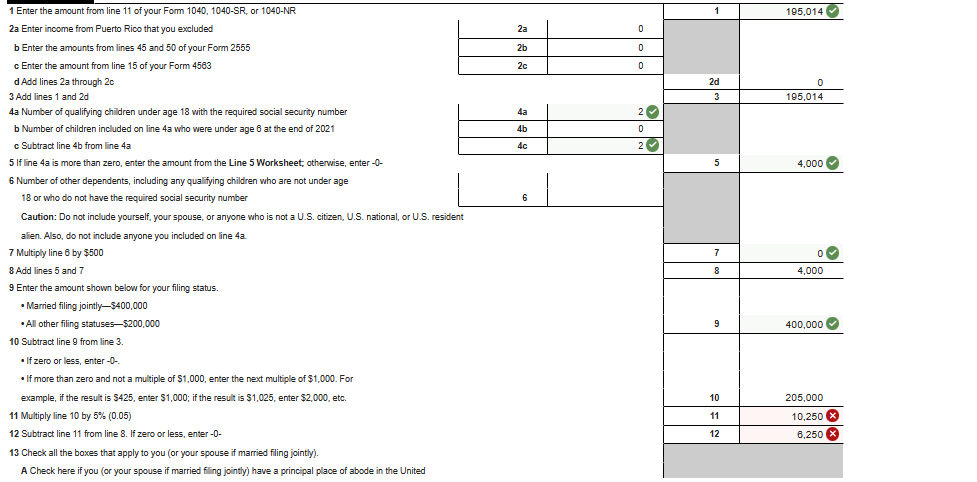

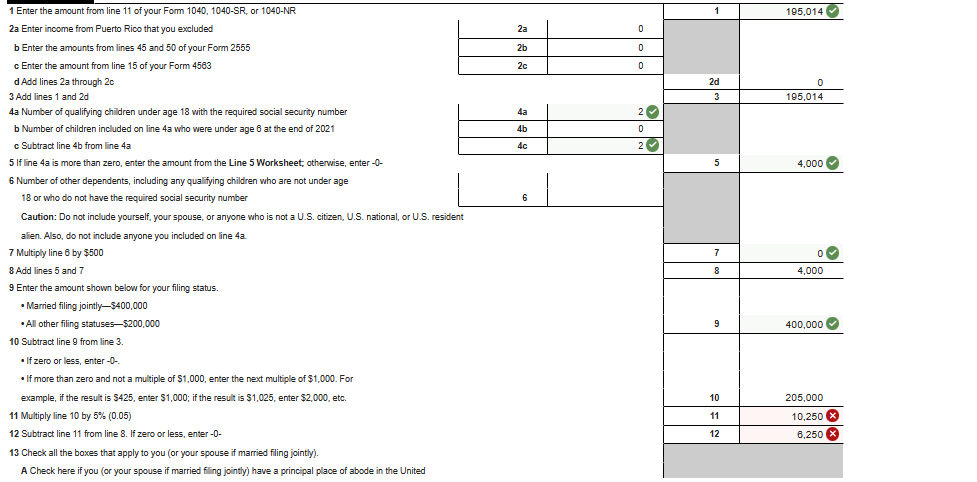

I am trying to complete form 8812. I have line 3 and line 9 completed but when I do the calculations for lines 10, 11, and 12 the system tells me they are incorrect.

Could you help with how to get these answers?

1 Enter the amount from line 11 of your Form 1040, 1040-SR, or 1040-NR 2a Enter income from Puerto Rico that you excluded b Enter the amounts from lines 45 and 50 of your Form 2555 c Enter the amount from line 15 of your Form 4563 \begin{tabular}{|c|c|} \hline 2a & 0 \\ \hline 2b & 0 \\ \hline 2c & 0 \\ \hline \end{tabular} d Add lines 2a through 2c 3 Add lines 1 and 2d 4a Number of qualifying children under age 18 with the required social security number b Number of children included on line 4a who were under age 6 at the end of 2021 c Subtract line 4b from line 4a 5 If line 4a is more than zero, enter the amount from the Line 5 Worksheet, otherwise, enter -0 - 6 Number of other dependents, including any qualifying children who are not under age 18 or who do not have the required social security number Caution: Do not include yourself, your spouse, or anyone who is not a U.S. citizen, U.S. national, or U.S. resident alien. Also, do not include anyone you included on line 43 . 7 Multiply line 6 by $500 8 Add lines 5 and 7 9 Enter the amount shown below for your filing status. - Married filing jointly- $400,000 - All other filing statuses $200,000 10 Subtract line 9 from line 3 . - If zero or less, enter -0 -. - If more than zero and not a multiple of $1,000, enter the next multiple of $1,000. For example, if the result is $425, enter $1,000; if the result is $1,025, enter $2,000, etc. 11 Multiply line 10 by 5%(0.05) 12 Subtract line 11 from line 8 . If zero or less, enter -0 - 13 Check all the boxes that apply to you (or your spouse if married fling jointly). A Check here if you (or your spouse if married filing jointly) have a principal place of abode in the United 1 Enter the amount from line 11 of your Form 1040, 1040-SR, or 1040-NR 2a Enter income from Puerto Rico that you excluded b Enter the amounts from lines 45 and 50 of your Form 2555 c Enter the amount from line 15 of your Form 4563 \begin{tabular}{|c|c|} \hline 2a & 0 \\ \hline 2b & 0 \\ \hline 2c & 0 \\ \hline \end{tabular} d Add lines 2a through 2c 3 Add lines 1 and 2d 4a Number of qualifying children under age 18 with the required social security number b Number of children included on line 4a who were under age 6 at the end of 2021 c Subtract line 4b from line 4a 5 If line 4a is more than zero, enter the amount from the Line 5 Worksheet, otherwise, enter -0 - 6 Number of other dependents, including any qualifying children who are not under age 18 or who do not have the required social security number Caution: Do not include yourself, your spouse, or anyone who is not a U.S. citizen, U.S. national, or U.S. resident alien. Also, do not include anyone you included on line 43 . 7 Multiply line 6 by $500 8 Add lines 5 and 7 9 Enter the amount shown below for your filing status. - Married filing jointly- $400,000 - All other filing statuses $200,000 10 Subtract line 9 from line 3 . - If zero or less, enter -0 -. - If more than zero and not a multiple of $1,000, enter the next multiple of $1,000. For example, if the result is $425, enter $1,000; if the result is $1,025, enter $2,000, etc. 11 Multiply line 10 by 5%(0.05) 12 Subtract line 11 from line 8 . If zero or less, enter -0 - 13 Check all the boxes that apply to you (or your spouse if married fling jointly). A Check here if you (or your spouse if married filing jointly) have a principal place of abode in the United