I am trying to determine if what I have on my journal entries are consistent with my T-Accounts, due to my Trial Balance sheet not equaling zero. Please help as much as you can. I realize I'm asking for a lot. Thanks in advance.

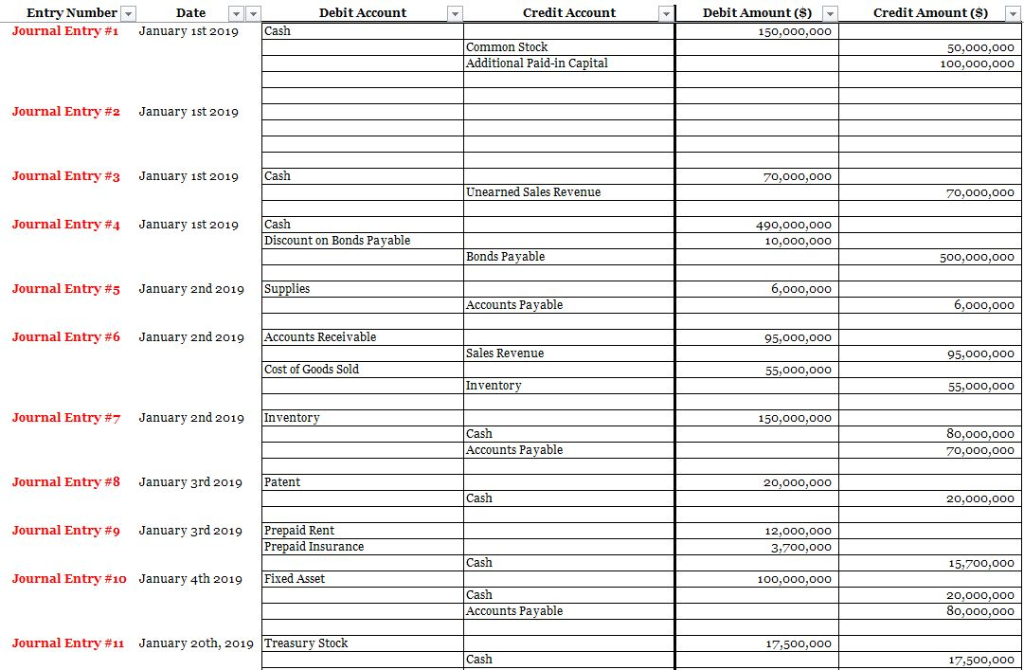

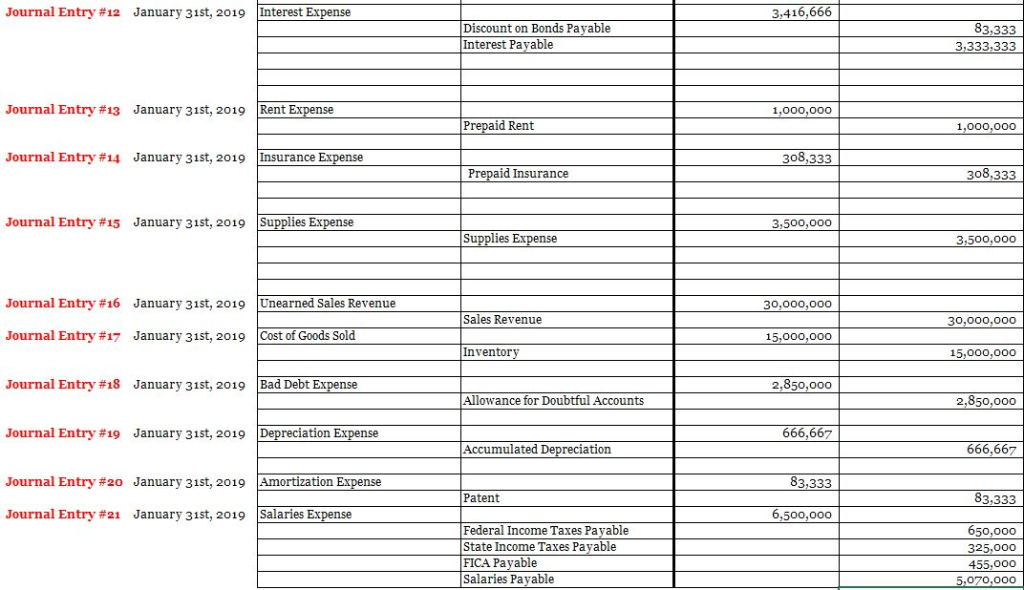

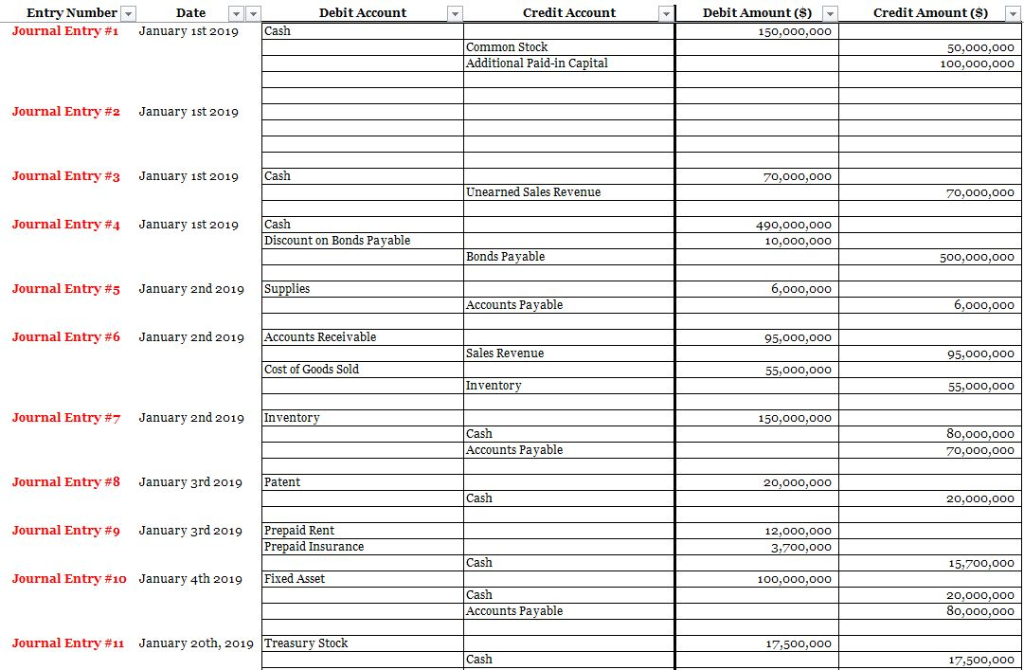

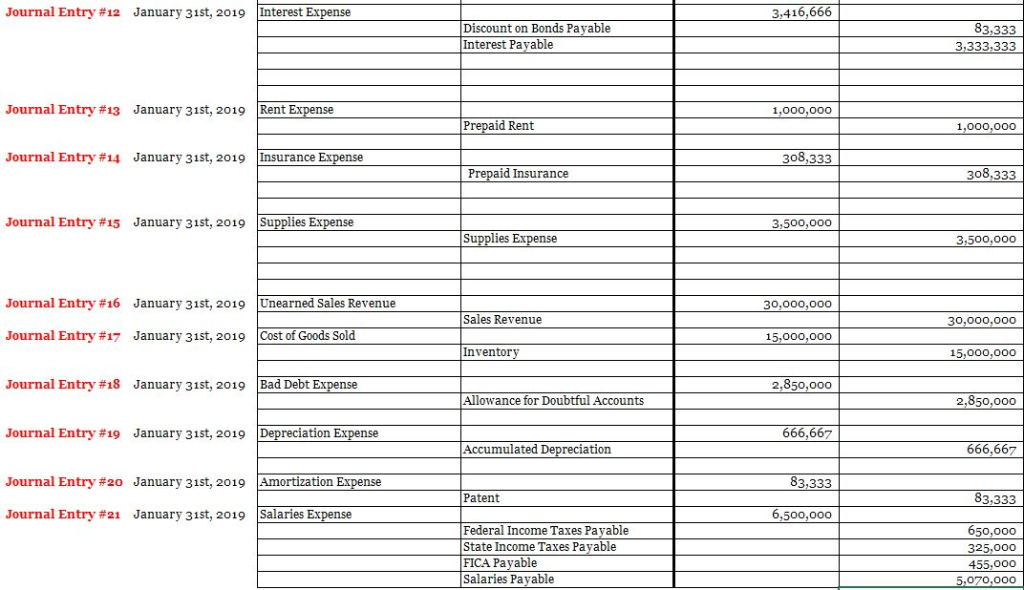

Journal Entries below:

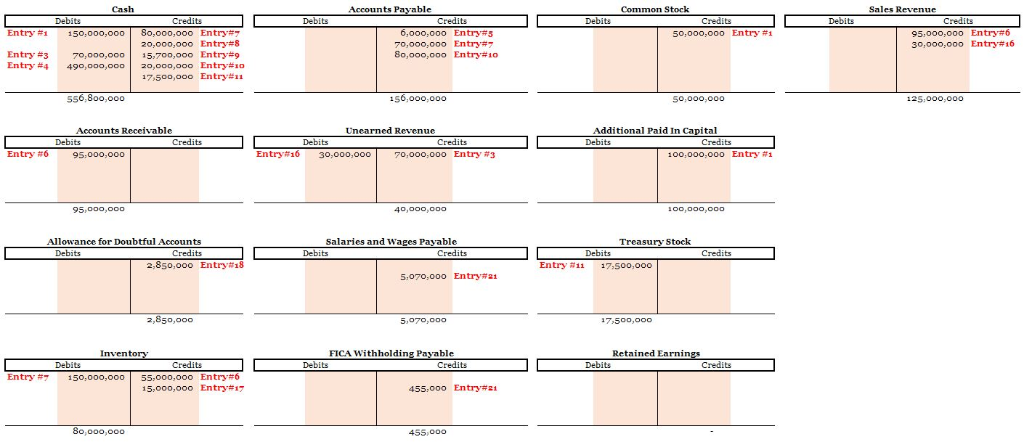

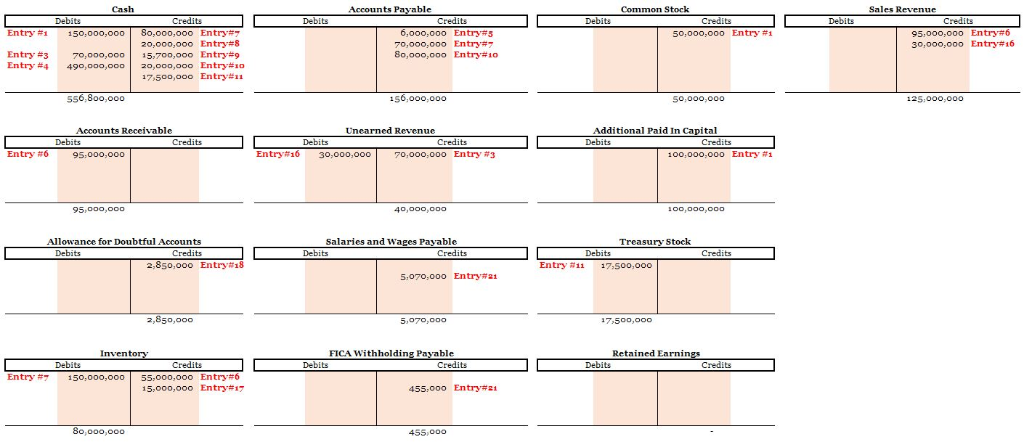

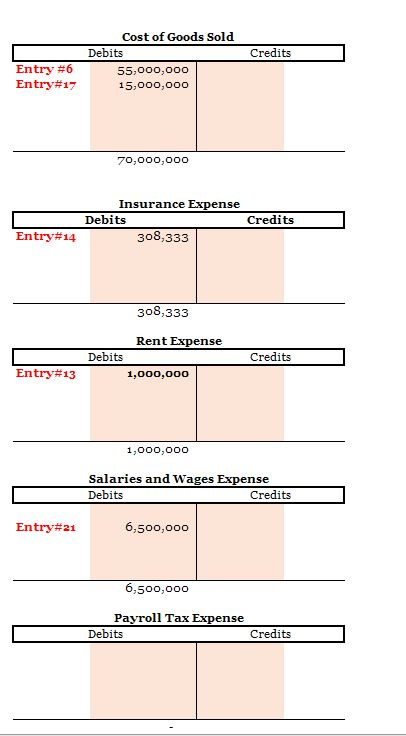

T-Accounts below:

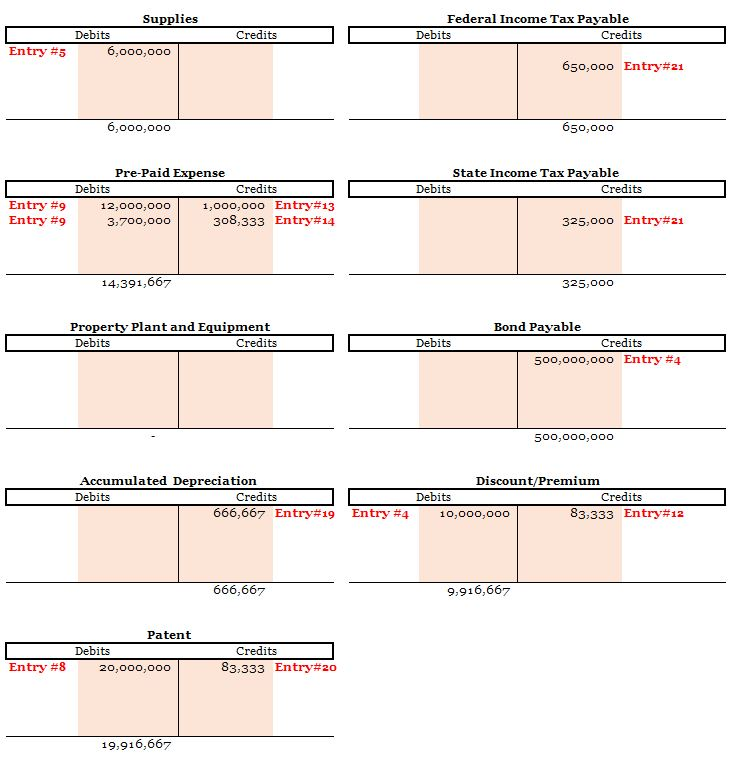

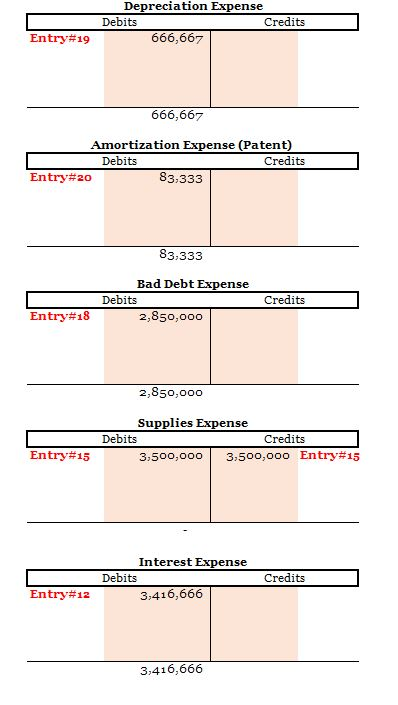

T-Accounts below:

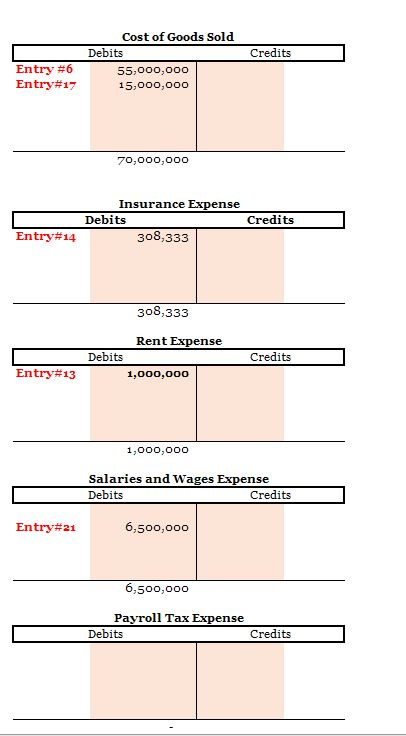

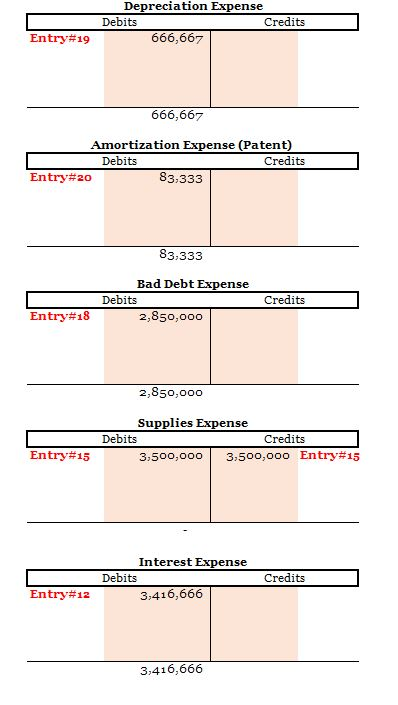

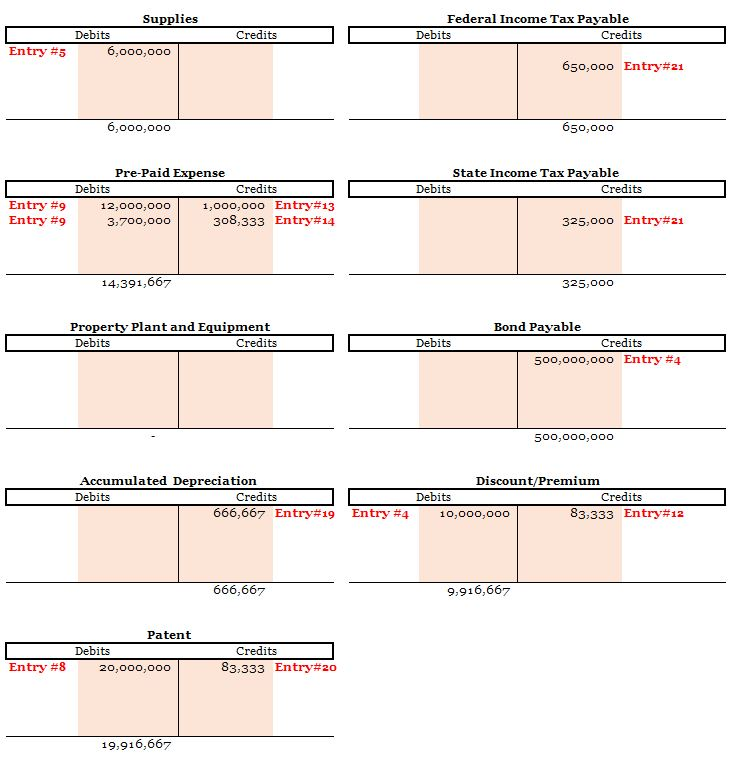

Debit Account Entry Number Journal Entry #1 Date Credit Account Debit Amount (S) Credit Amount (S) > January 1st 2019 Cash 150,000,000 Common Stock Additional Paid-in Capital 50,000,o00 100,00oo,000 Journal Entry #2 January 1st 2019 Journal Entry #3 January 1st 2019 Cash 70.000,000 Unearned Sales Revenue 70,000,000 Journal Entry #4 January 1st 2019 | Cash Discount on Bonds Payable 490,00o,o00 10,000,000 Bonds Payable 500,000,000 Journal Entry #5 January 2nd 2019 Supplies 6,000,00o Accounts Pavable 6,000,0oo Journal Entry #6 January 2nd 2019 Accounts Receivable 95,000,o00 Sales Revenue 95,000,000 Cost of Goods Sold Invento 55,000,000 Journal Entry #7 January 2nd 2019 Inventor 150,000,000 Cash Accounts Pavable 8o,ooo,ooo 70,000,000 Journal Entry #8 January 3rd 2019 Patent 20,000,o00 Cash 20,00o,000 Journal Entry #9 January 3rd 2019 aid Rent aid Insurance 12,000,000 3,700,0o0 Cash 15,700,000 Journal Entry #10 January 4th 2019 Fixed Asset 00.0oo,00O Cash Accounts Pavable 20.000,000 80,ooo,ooo Journal Entry #11 January 20th, 2019 |Treasury Stock 17,500,000 Cash 17,500,000 Journal Entry #12 January 31st, 2019 | Interest Ex 3,416,666 Discount on Bonds Payable Interest Pavable 83,333 3,333,333 Journal Entry #13 January 31st, 2019 Rent Expense 1,000,000 Prepaid Rent 1.000.000 Journal Entry #14 January 31st, 2019 | Insurance Expense aid Insurance 308,333 Journal Entry #15 January 31st, 2019 es Expense 3,500,ooo Supplies 3,500,0oo Journal Entry #16 January 31st, 2019 | Unearned Sales Revenue 3o,ooo,000 Sales Revenue 30,000,000 Journal Entry #17 |Cost of Goods Sold January 31st, 2019 15,000,000 Inventorv 15,000,000 Journal Entry #18 Bad Debt Expense 2,850,000o January 31st, 2019 Allowance for Doubtful Accounts 2,850,00o Journal Entry #19 January 31st, 2019 reciation Expense 666,667 Accumulated Depreciation 666,667 Journal Entry #20 January 31st, 2019 Amortization Expense 83,333 83,333 Patent Journal Entry #21 January 31st, 2019 Salaries Expense 6,500,000 Federal Income Taxes Pavable State Income Taxes Pavable FICA Payable Salaries Payable 650,000 325,o00o 455,00o 070,000 Cash Accounts Pavable Common Stock Sales Revenue Debits Credits Credits Debits Credits Debits Credi 50,000,000 Debits 150,000,000 180,000,000 20,000,000 70,000,000 | 15.700,000 6,000,000 70,000,000 80,000,000 Entry#5 Entry#7 Entry# 10 Entry#6 Entry#16 Entry #1 Entry#7 Entry#8 Entry#9 Entry #1 95,000,000 30,000,000 Entry #3 Entry-#4 490,000,000| 20,000,000 Entry#10 Entry#11 17,500,000 556 So,000,000 So,000,000 125:000,000 Accounts Receivable Uncarned Revenue Additional Paid In Capital Debits Debits Credits Debits Credits Credits #16 95,000 Entry #3 Entry #1 Entry #6 30,000,000 0,000,000 100,000,000 95,000,000 40,00o,000 Allowance for Doubtful Accounts Credits Salaries and Wa yable Treasury Stock Debits Debits Credits Debits Credits 2,850,000 Entry#18 Entry #11 17:500,000 Entry#21 5,070,000 5,070,000 7.500,000 FICA Withholdin able Retained Earnin Debits Credits Credits Debits Credits Debits Entry #7 150,000,000 | 55,000,000 Entry#6 Entry#17 455,000 Entry# 15,000,000 8o,ooo,ooo Supplies Federal Income Tax Payable Debits Credits Debits Credits Entry #5 6,000,ooo 650,000 Entry#21 650,00d 6,00O,000 Pre-Paid Expense State Income Tax Payable Debits Credits Debits Credits Entry #9 Entry #9 Entry# 13 Entry# 14 12,000,000 3:700,00o 1,000,000 308,333 Entry#21 325,000 14,391,667 325,o0o Property Plant and Equipment Bond Payable Debits Credits Debits Credits 500,000,000 Entry #4 500,ooo,o0o Accumulated Depreciation Debits Discount/Premium Credits Debits Credits 666,667 Entry #4 Entry# 19 10,000,000 83:333 Entry#i2 666,667 9,916,667 Patent Debits Credits 83.333 Entry#20 Entry #8 20,000,000 19,916,667 Cost of Goods Sold Debits Credits Entry #6 Entry# 17 55,000,00o 15,00o,00o 70,00o,O00 Insurance Expense Debits Credits 308,333 Entry# 14 308,333 Rent Expense Debits Credits Entry# 13 1.00O,000 1,000,0OO Salaries and Wages Expense Debits Credits 6,500,ooo Entry#21 6,500,000 Payroll Tax Expense Debits Credits Depreciation Expense Debits Credits Entry# 19 666,667 666,667 Amortization Expense (Patent) Debits Credits Entry#20 83:333 83:333 Bad Debt Expense Debits Credits Entry# 18 2,850,ooo 2,850,ooo Supplies Expense 3,500,000 | 3,500,000 Entry# 15 Debits Credits Entry# 15 Interest Expense Debits Credits Entry# 12 3,416,666 3,416,666

T-Accounts below:

T-Accounts below: