Answered step by step

Verified Expert Solution

Question

1 Approved Answer

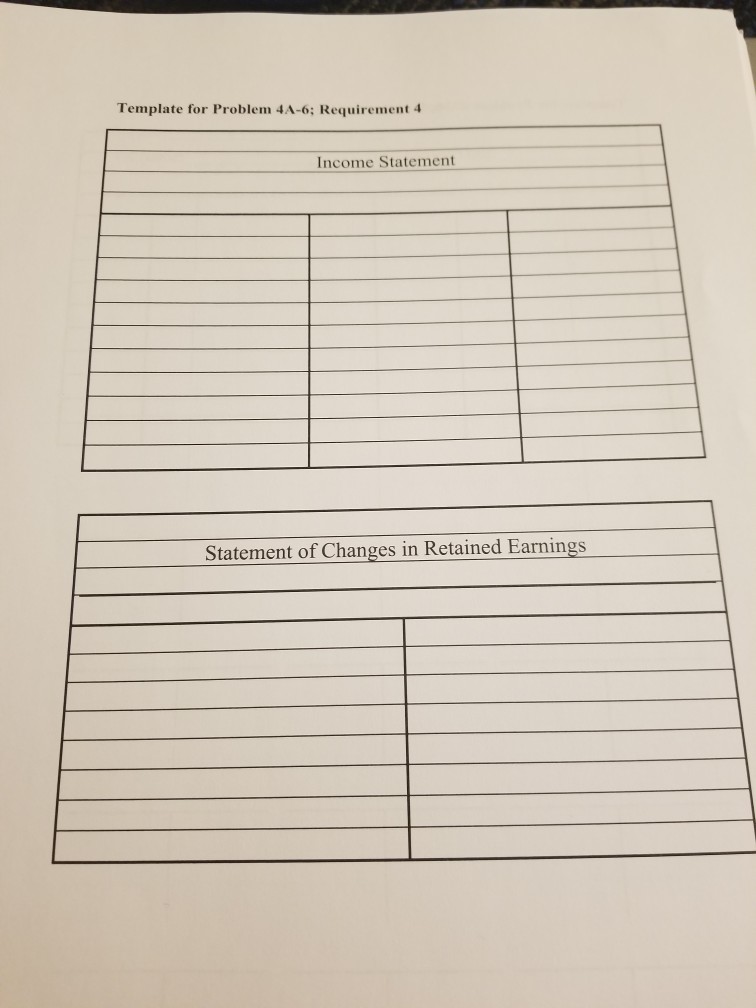

I asked this question yesterday and didn't really understand the way the answer was given. Could whoever answers it put it in a similar format

I asked this question yesterday and didn't really understand the way the answer was given. Could whoever answers it put it in a similar format as the sheets above. Thank you very much. I really appreciate it.

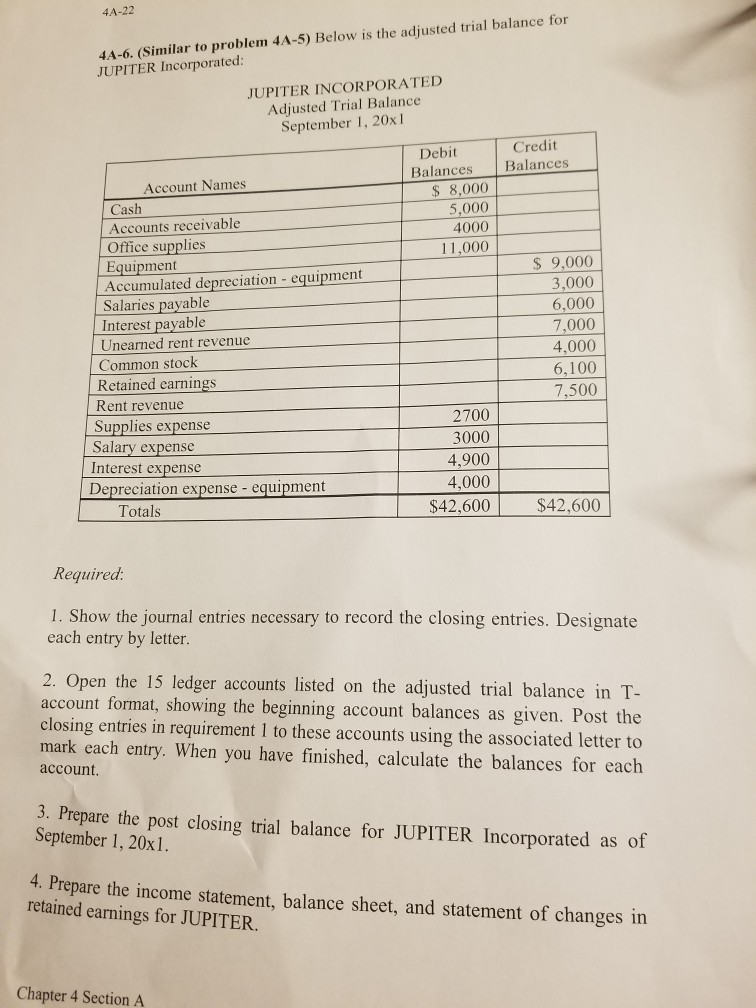

4A-22 4A-6. (Similar to problem 4A-5) Below is the adjusted trial balance for JUPITER Incorporated JUPITER INCORPORATED Adjusted Trial Balance September 1, 20x I Credit Debit BalancesBalances 8,000 5,000 4000 11,000 Account Names as Accounts receivable Office supplies Equipment Accumulated depreciation - equipment Salaries payable Interest payabl Unearned rent revenue Common stock Retained earnings S 9,000 3,000 6,000 7,000 4,000 6,100 7,500 Rent revenue 2700 3000 4,900 4,000 $42,600 Supplies expense Salary expense Interest expense Depreciation expense - equipment Totals $42,600 Required: 1. Show the journal entries necessary to record the closing entries. Designate each entry by letter 2. Open the 15 ledger accounts listed on the adjusted trial balance in T- account format, showing the beginning account balances as given. Post the closing entries in requirement 1 to these accounts using the associated letter to mark each entry. When you have finished, calculate the balances for each account. 3. Prepare the post closing trial balance for JUPITER Incorporated as of September 1 , 20x1 . 4. Prepare the income statement, balance sheet, and statement of changes in retained earnings for JUPITER. Chapter 4 Section AStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started