I attached March set if needed(last photo)

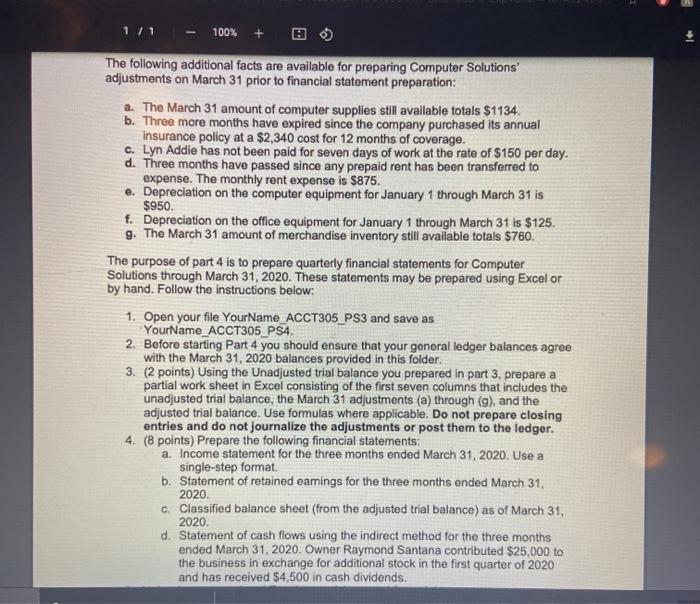

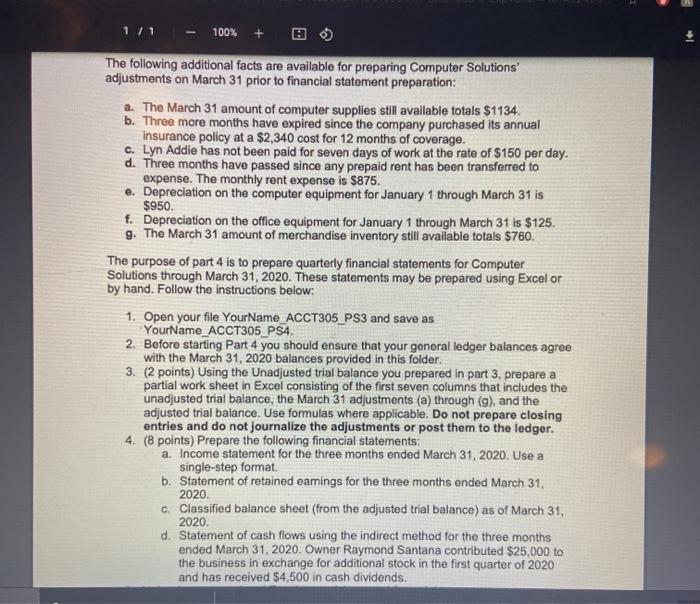

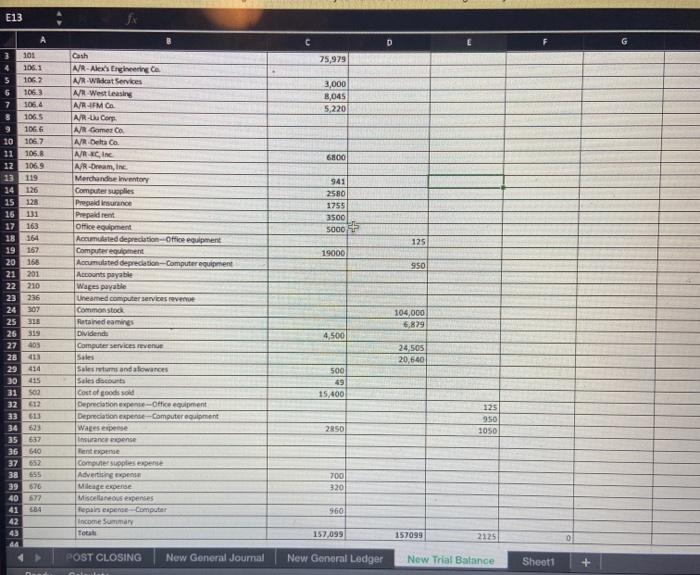

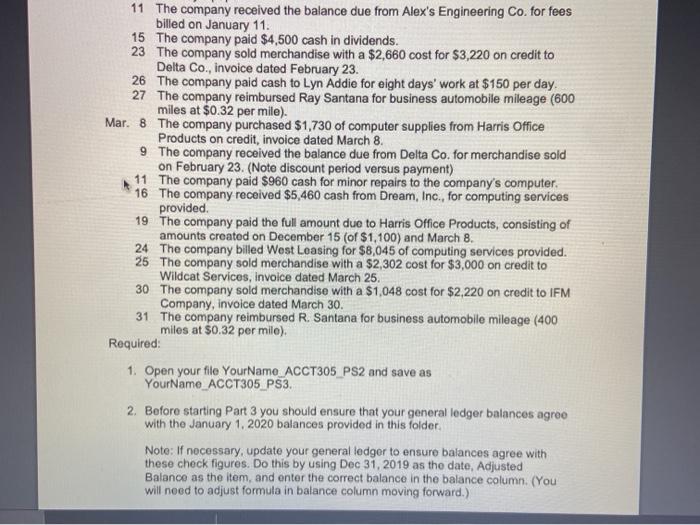

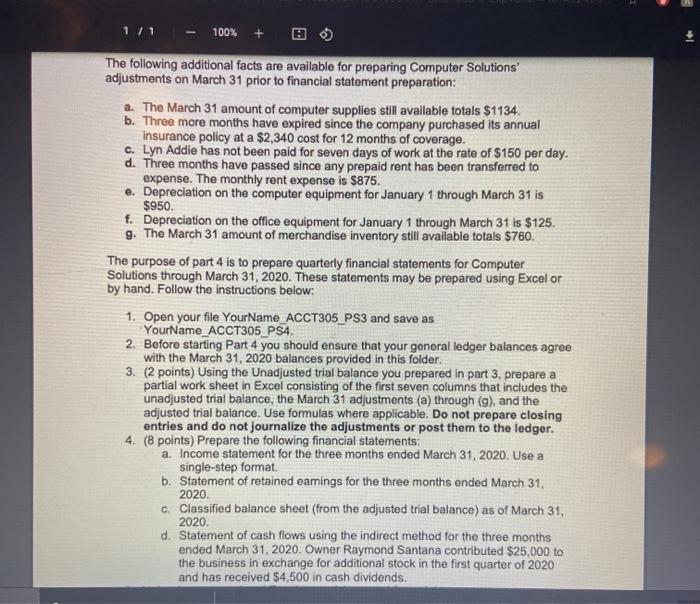

1/1 100% + 1 The following additional facts are available for preparing Computer Solutions adjustments on March 31 prior to financial statement preparation: a. The March 31 amount of computer supplies still available totals $1134 b. Three more months have expired since the company purchased its annual insurance policy at a $2,340 cost for 12 months of coverage. C. Lyn Addie has not been paid for seven days of work at the rate of $150 per day. d. Three months have passed since any prepaid rent has been transferred to expense. The monthly rent expense is $875. e. Depreciation on the computer equipment for January 1 through March 31 is $950. f. Depreciation on the office equipment for January 1 through March 31 is $125. g. The March 31 amount of merchandise inventory still available totals $760. The purpose of part 4 is to prepare quarterly financial statements for Computer Solutions through March 31, 2020. These statements may be prepared using Excel or by hand. Follow the instructions below: 1. Open your file YourName ACCT305_PS3 and save as YourName_ACCT305_PS4. 2. Before starting Part 4 you should ensure that your general ledger balances agree with the March 31, 2020 balances provided in this folder. 3. (2 points) Using the Unadjusted trial balance you prepared in part 3. prepare a partial work sheet in Excel consisting of the first seven columns that includes the unadjusted trial balance, the March 31 adjustments (a) through (9), and the adjusted trial balance. Use formulas where applicable. Do not prepare closing entries and do not journalize the adjustments or post them to the ledgor. 4. (8 points) Prepare the following financial statements: a. Income statement for the three months ended March 31, 2020. Use a single-step format. b. Statement of retained eamings for the three months ended March 31, 2020. c. Classified balance sheet (from the adjusted trial balance) as of March 31, 2020 d. Statement of cash flows using the indirect method for the three months ended March 31, 2020. Owner Raymond Santana contributed $25,000 to the business in exchange for additional stock in the first quarter of 2020 and has received $4,500 in cash dividends. E13 C D 3 75,979 5 7 3,000 3,045 5,220 9 10 11 101 106.1 1062 1063 106.4 106.5 106.6 106.7 105.8 106.9 119 126 128 11 163 6800 13 14 25 941 2580 1755 3500 5000 125 19000 950 167 166 201 210 236 307 395 Cash AR- Alex's Engineering A/R Wildcat Services A West Leasing A/R-FM CA A/R-Corp MR Gomes AR Dela Ca Aine AR-Dream, Merchande inventory Computer supplies Pregal insurance Prepaid rent Office equipment Acuted depreciation Office equipment Computer equipment Accumulated depreciation Computer equipment Accounts payable Wages payable Uneamed computer Services Common stock Retained eaming Dividende Computer services revenue Isoles Salems andalowances Sales con Cost of goods sold Depreciation expense-Office euiment Depreciation expense-Computer egiment Wages expense Insurancese nexpense Computer supplies expense Advertising expen Mileageexperte Miscellaneous expenses Repair expense Computer Income Summary Total 104,000 5,879 4,500 15 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 403 24 505 20,640 414 500 415 502 612 49 15.400 125 9:50 3050 623 2850 637 GLO 555 700 320 676 577 560 42 157,099 157099 2125 0 46 POST CLOSING New General Journal New General Ledger New Trial Balance Sheet1 + 11 The company received the balance due from Alex's Engineering Co. for fees billed on January 11. 15 The company paid $4,500 cash in dividends. 23 The company sold merchandise with a $2,660 cost for $3,220 on credit to Delta Co., invoice dated February 23. 26 The company paid cash to Lyn Addie for eight days' work at $150 per day 27 The company reimbursed Ray Santana for business automobile mileage (600 miles at $0.32 per mile) Mar. 8 The company purchased $1,730 of computer supplies from Harris Office Products on credit, invoice dated March 8. 9 The company received the balance due from Delta Co. for merchandise sold on February 23. (Note discount period versus payment) 11 The company paid $960 cash for minor repairs to the company's computer. 16 The company received $5,460 cash from Dream, Inc., for computing services provided 19 The company paid the full amount due to Harris Office Products, consisting of amounts created on December 15 (of $1,100) and March 8. 24 The company billed West Loasing for $8,045 of computing services provided. 25 The company sold merchandise with a $2,302 cost for $3,000 on credit to Wildcat Services, Invoice dated March 25. 30 The company sold merchandise with a $1,048 cost for $2,220 on credit to IFM Company, invoice dated March 30. 31 The company reimbursed R. Santana for business automobile mileage (400 miles at $0.32 per mile) Required: 1. Open your file Your Name_ACCT305 PS2 and save as YourName ACCT305_PS3. 2. Before starting Part 3 you should ensure that your general ledger balances agree with the January 1, 2020 balances provided in this folder Note: If necessary, update your general ledger to ensure balances agree with these check figures. Do this by using Dec 31, 2019 as the date, Adjusted Balance as the item, and enter the correct balance in the balance column. (You will need to adjust formula in balance column moving forward.) 1/1 100% + 1 The following additional facts are available for preparing Computer Solutions adjustments on March 31 prior to financial statement preparation: a. The March 31 amount of computer supplies still available totals $1134 b. Three more months have expired since the company purchased its annual insurance policy at a $2,340 cost for 12 months of coverage. C. Lyn Addie has not been paid for seven days of work at the rate of $150 per day. d. Three months have passed since any prepaid rent has been transferred to expense. The monthly rent expense is $875. e. Depreciation on the computer equipment for January 1 through March 31 is $950. f. Depreciation on the office equipment for January 1 through March 31 is $125. g. The March 31 amount of merchandise inventory still available totals $760. The purpose of part 4 is to prepare quarterly financial statements for Computer Solutions through March 31, 2020. These statements may be prepared using Excel or by hand. Follow the instructions below: 1. Open your file YourName ACCT305_PS3 and save as YourName_ACCT305_PS4. 2. Before starting Part 4 you should ensure that your general ledger balances agree with the March 31, 2020 balances provided in this folder. 3. (2 points) Using the Unadjusted trial balance you prepared in part 3. prepare a partial work sheet in Excel consisting of the first seven columns that includes the unadjusted trial balance, the March 31 adjustments (a) through (9), and the adjusted trial balance. Use formulas where applicable. Do not prepare closing entries and do not journalize the adjustments or post them to the ledgor. 4. (8 points) Prepare the following financial statements: a. Income statement for the three months ended March 31, 2020. Use a single-step format. b. Statement of retained eamings for the three months ended March 31, 2020. c. Classified balance sheet (from the adjusted trial balance) as of March 31, 2020 d. Statement of cash flows using the indirect method for the three months ended March 31, 2020. Owner Raymond Santana contributed $25,000 to the business in exchange for additional stock in the first quarter of 2020 and has received $4,500 in cash dividends. E13 C D 3 75,979 5 7 3,000 3,045 5,220 9 10 11 101 106.1 1062 1063 106.4 106.5 106.6 106.7 105.8 106.9 119 126 128 11 163 6800 13 14 25 941 2580 1755 3500 5000 125 19000 950 167 166 201 210 236 307 395 Cash AR- Alex's Engineering A/R Wildcat Services A West Leasing A/R-FM CA A/R-Corp MR Gomes AR Dela Ca Aine AR-Dream, Merchande inventory Computer supplies Pregal insurance Prepaid rent Office equipment Acuted depreciation Office equipment Computer equipment Accumulated depreciation Computer equipment Accounts payable Wages payable Uneamed computer Services Common stock Retained eaming Dividende Computer services revenue Isoles Salems andalowances Sales con Cost of goods sold Depreciation expense-Office euiment Depreciation expense-Computer egiment Wages expense Insurancese nexpense Computer supplies expense Advertising expen Mileageexperte Miscellaneous expenses Repair expense Computer Income Summary Total 104,000 5,879 4,500 15 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 403 24 505 20,640 414 500 415 502 612 49 15.400 125 9:50 3050 623 2850 637 GLO 555 700 320 676 577 560 42 157,099 157099 2125 0 46 POST CLOSING New General Journal New General Ledger New Trial Balance Sheet1 + 11 The company received the balance due from Alex's Engineering Co. for fees billed on January 11. 15 The company paid $4,500 cash in dividends. 23 The company sold merchandise with a $2,660 cost for $3,220 on credit to Delta Co., invoice dated February 23. 26 The company paid cash to Lyn Addie for eight days' work at $150 per day 27 The company reimbursed Ray Santana for business automobile mileage (600 miles at $0.32 per mile) Mar. 8 The company purchased $1,730 of computer supplies from Harris Office Products on credit, invoice dated March 8. 9 The company received the balance due from Delta Co. for merchandise sold on February 23. (Note discount period versus payment) 11 The company paid $960 cash for minor repairs to the company's computer. 16 The company received $5,460 cash from Dream, Inc., for computing services provided 19 The company paid the full amount due to Harris Office Products, consisting of amounts created on December 15 (of $1,100) and March 8. 24 The company billed West Loasing for $8,045 of computing services provided. 25 The company sold merchandise with a $2,302 cost for $3,000 on credit to Wildcat Services, Invoice dated March 25. 30 The company sold merchandise with a $1,048 cost for $2,220 on credit to IFM Company, invoice dated March 30. 31 The company reimbursed R. Santana for business automobile mileage (400 miles at $0.32 per mile) Required: 1. Open your file Your Name_ACCT305 PS2 and save as YourName ACCT305_PS3. 2. Before starting Part 3 you should ensure that your general ledger balances agree with the January 1, 2020 balances provided in this folder Note: If necessary, update your general ledger to ensure balances agree with these check figures. Do this by using Dec 31, 2019 as the date, Adjusted Balance as the item, and enter the correct balance in the balance column. (You will need to adjust formula in balance column moving forward.)