Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i attached the instructions below 1. On Naomi's sixth birthday, her parents put $24,000 into an investment account that promises to pay a fixed interest

i attached the instructions below

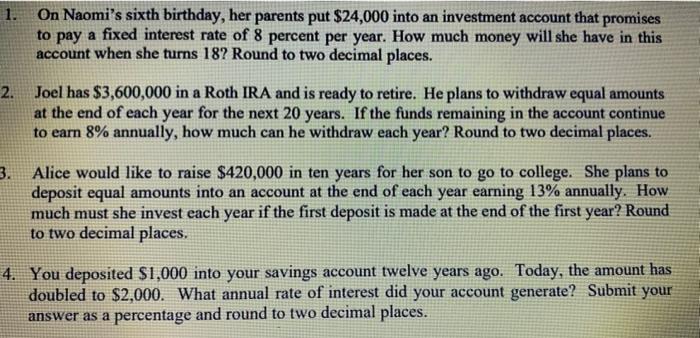

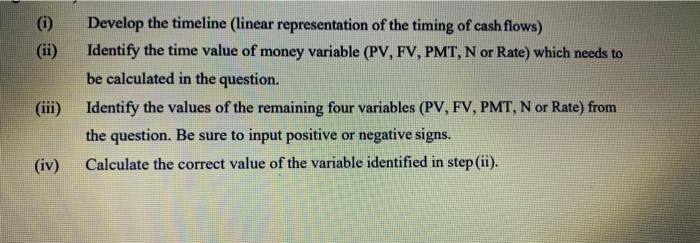

1. On Naomi's sixth birthday, her parents put $24,000 into an investment account that promises to pay a fixed interest rate of 8 percent per year. How much money will she have in this account when she turns 18? Round to two decimal places. 2. Joel has $3,600,000 in a Roth IRA and is ready to retire. He plans to withdraw equal amounts at the end of each year for the next 20 years. If the funds remaining in the account continue to earn 8% annually, how much can he withdraw each year? Round to two decimal places. 3. Alice would like to raise $420,000 in ten years for her son to go to college. She plans to deposit equal amounts into an account at the end of each year earning 13% annually. How much must she invest each year if the first deposit is made at the end of the first year? Round to two decimal places. 4. You deposited $1,000 into your savings account twelve years ago. Today, the amount has doubled to $2,000. What annual rate of interest did your account generate? Submit your answer as a percentage and round to two decimal places. Develop the timeline (linear representation of the timing of cash flows) Identify the time value of money variable (PV, FV, PMT, N or Rate) which needs to be calculated in the question. Identify the values of the remaining four variables (PV, FV, PMT, N or Rate) from the question. Be sure to input positive or negative signs. Calculate the correct value of the variable identified in step (ii). (iii) (iv)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started