Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I believe that I calculated A and B correctly. However, for part c if 70 % of people pay on day 30 it took away

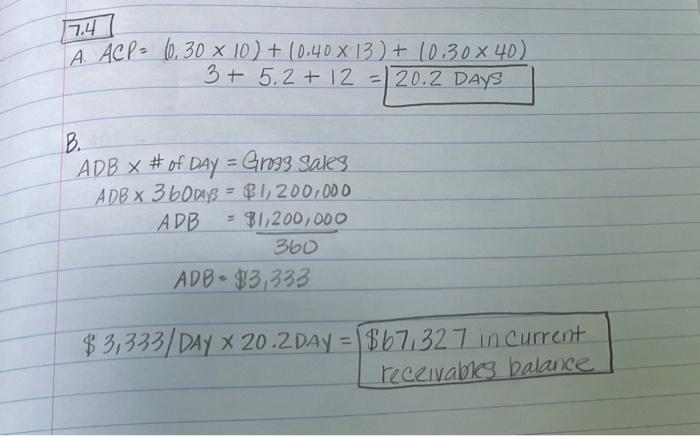

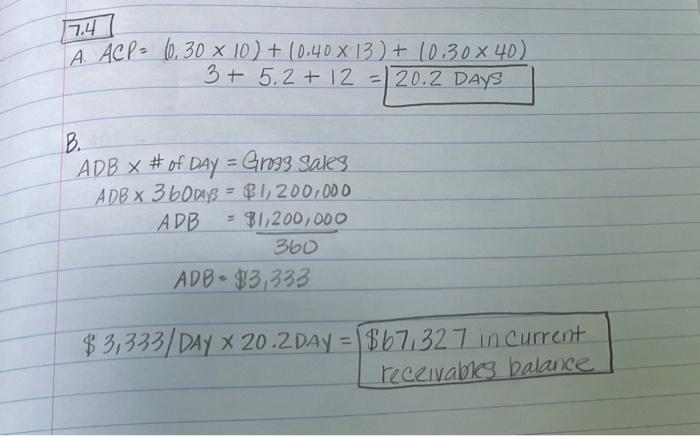

I believe that I calculated A and B correctly. However, for part c if 70 % of people pay on day 30 it took away the small % of accounts that paid on day 13. I'm not sure if i did parts c and d correctly.

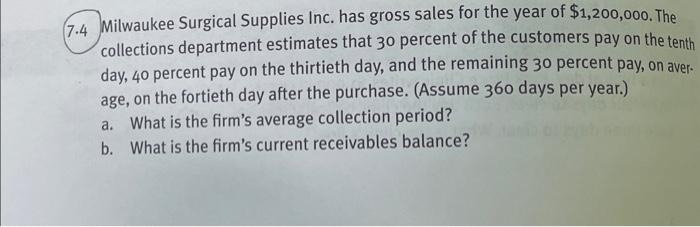

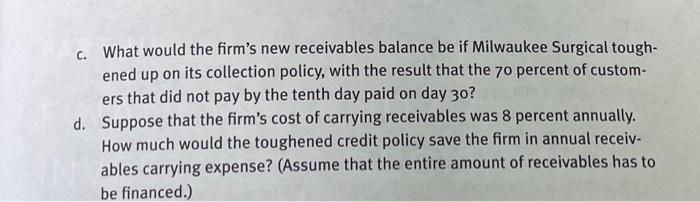

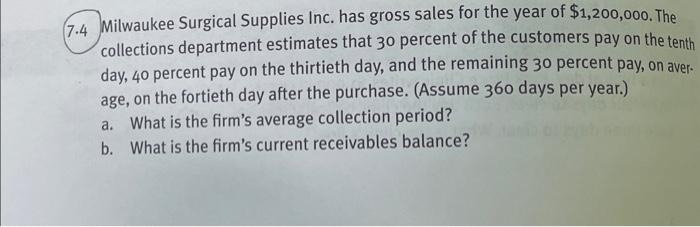

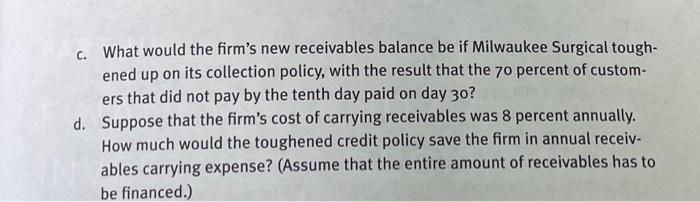

7.4 Milwaukee Surgical Supplies Inc. has gross sales for the year of $1,200,000. The collections department estimates that 30 percent of the customers pay on the tenth day, 40 percent pay on the thirtieth day, and the remaining 30 percent pay, on average, on the fortieth day after the purchase. (Assume 360 days per year.) a. What is the firm's average collection period? b. What is the firm's current receivables balance? c. What would the firm's new receivables balance be if Milwaukee Surgical toughened up on its collection policy, with the result that the 70 percent of customers that did not pay by the tenth day paid on day 30 ? d. Suppose that the firm's cost of carrying receivables was 8 percent annually. How much would the toughened credit policy save the firm in annual receivables carrying expense? (Assume that the entire amount of receivables has to be financed.) 7.4 A.ACP=(0.3010)+(0.4013)+(0.3040)3+5.2+12=20.2DAYS B. B.ADB#ofDAYADB360DABADBADB=9rosssales=$1,200,000=360$1,200,000=$3,333 $3,333/DAY20.2DAY=$67,327incurrentreceivablesbalance ACP=(0.3010)+(0.7030)=3+21=24DAYS $3,33324 DAYS =$79,992 $79,9928%$67,3278 $6399$5,386

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started