Answered step by step

Verified Expert Solution

Question

1 Approved Answer

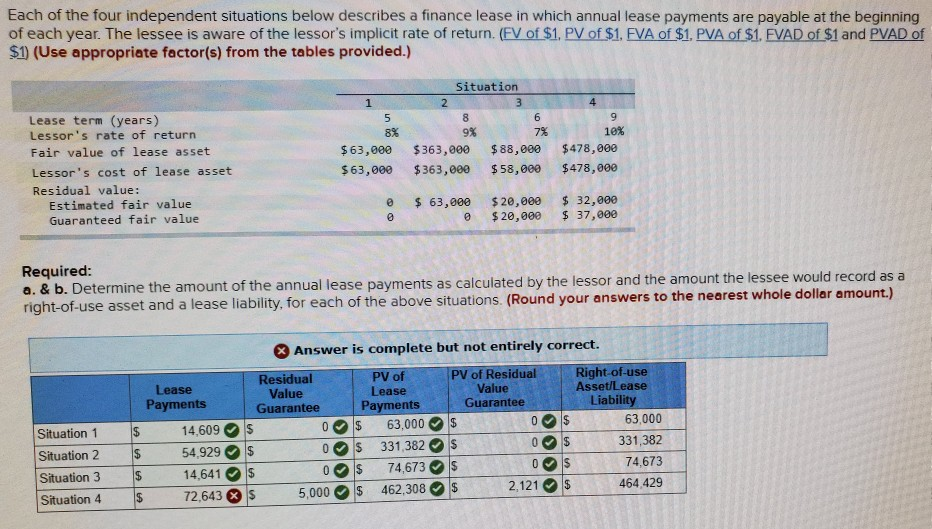

I can't figure out the lease payment of situation 4. Each of the four independent situations below describes a finance lease in which annual lease

I can't figure out the lease payment of situation 4.

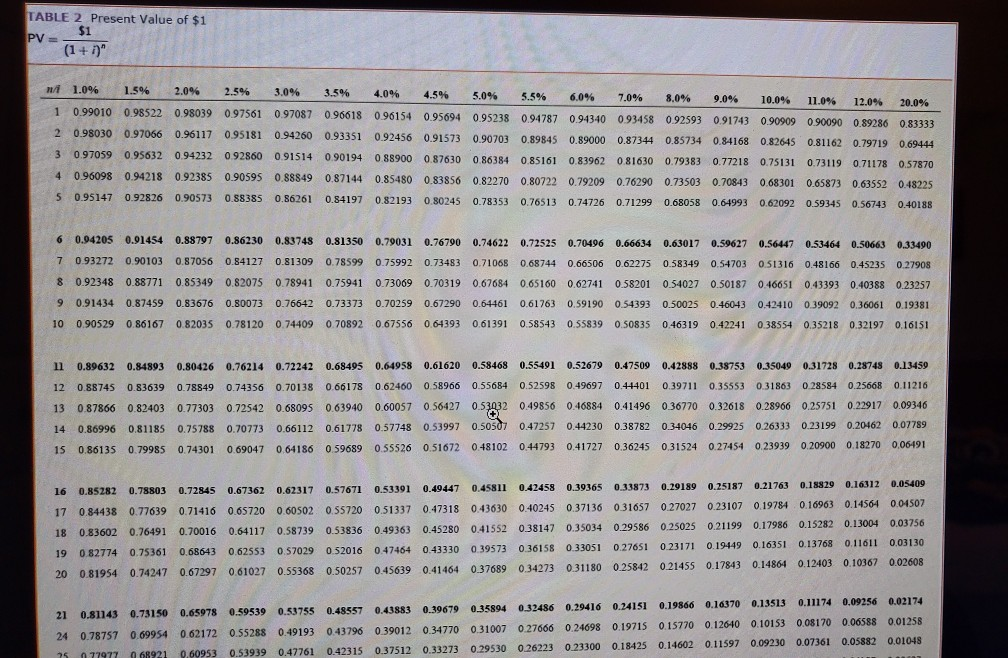

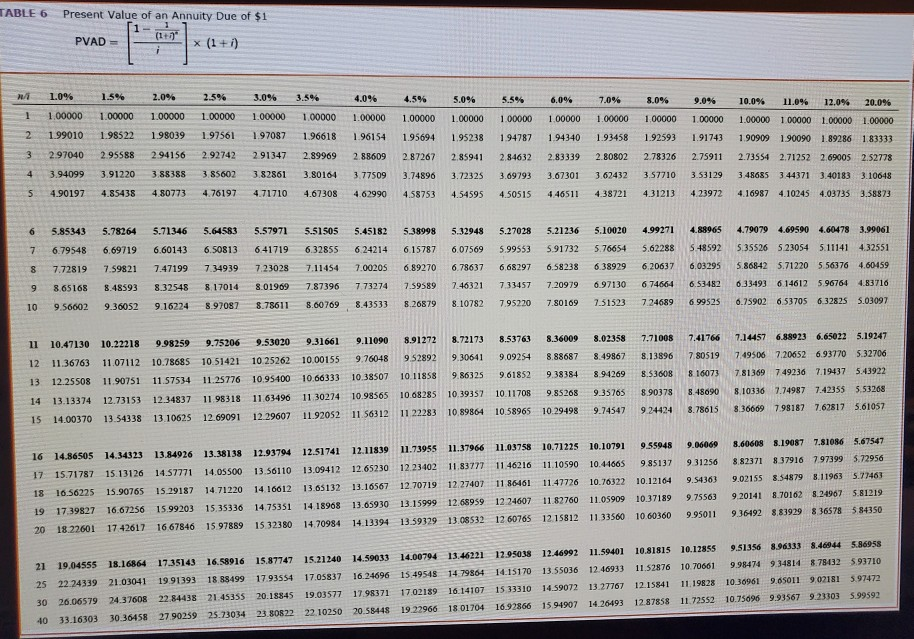

Each of the four independent situations below describes a finance lease in which annual lease payments are payable at the beginning of each year. The lessee is aware of the lessor's implicit rate of return. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Situation 3 4 9 Lease term (years) Lessor's rate of return Fair value of lease asset Lessor's cost of lease asset Residual value: Estimated fair value Guaranteed fair value 8% $63,000 $63,000 $363,000 $363,000 $88,000 $58,000 10% $478,000 $478,000 $ 63,000 0 0 $20,000 $20,000 $ 32,000 $ 37,000 Required: a. & b. Determine the amount of the annual lease payments as calculated by the lessor and the amount the lessee would record as a right-of-use asset and a lease liability, for each of the above situations. (Round your answers to the nearest whole dollar amount.) Answer is complete but not entirely correct. Situation 1 Situation 2 Situation 3 Lease Payments $ 14,609 $ 54.929 $ 14,641 $ 72,643 Residual Value Guarantee S 0 $ 0 $ 0 $ 5,000 PV of Lease Payments $ 63,000 $ 331 382 $ 74,673 $ 462,308 PV of Residual Value Guarantee $ 0 0 S 0 $ 2,121 Right-of-use Asset/Lease Liability $ 63,000 $ 331,382 $ 74,673 $ 464 429 TABLE 2 Present Value of $1 PV = a (1 + 7)" mi 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% 7.0% 8.0% 0.0% 0.0% 11.0% 12.0% 1 0.99010 0.98522 0.98039 097561 0.97087 0.96618 096154 0.95694 0.95238 094787 0.94340 093458 0.92593 0.91743 0.90909 0.90090 0.89286 0.83333 2 0.98030 0.97066 0.96117 0.95181 0.94260 0.93351 0.92456 0.91573 0.90703 0.89845 0.89000 0.87344 0.85734 0.84168 0.82645 0.81162 0.79719 0.69444 3 0.97059 0.95632 0.94232 092860 091514 0.90194 088900 0.87630 0.86384 0.85161 0.83962 081630 0.79383 0.77218 0.75131 0.73119 0.71178 0.57870 4 0.96098 0.94218 0.92385 0.90595 0.88849 0.87144 0.85480 0.83856 0.82270 0.80722 0.79209 0.76290 0.73503 0.70843 0.68301 0.65873 0.63552 0.48225 5 0.95147 0.92826 0.90573 0.58385 0.86261 0.54197 0.82193 0.80245 0.78353 0.76513 0.74726 0.71299 0.68058 0.64993 0.62092 0.59345 0.56743 0.40188 6 7 8 9 10 0.94205 0.91454 0.88797 0.86230 0.83748 0.81350 0.93272 0.90103 0.87056 0.84127 0.81309 0.78599 0.92348 0.88771 0.85349 0.82075 0.78941 0.75941 0.91434 0.87459 0.83676 0.80073 0.76642 0.73373 0.90529 0.86167 0.82035 0.78120 0.74409 0.70892 0.79031 0.76790 0.74622 0.72525 0.70496 0.66634 0.63017 0.59627 0.56447 0.53464 0.50663 0.33490 0.75992 0.73483 0.71068 0.68744 0.66506 0.62275 0.58349 0.54703 0.51316 0.48166 0.45235 0.27908 0.73069 0.70319 0.67684 0.65160 0.62741 0.58201 0.54027 0.50187 046651 0.43393 0.40388 0.23257 0.70259 0.67290 0.64461 0.61763 0.59190 0.54393 0.50025 0.46043 0.42410 0.39092 0.36061 0.19381 0.67556 0.64393 0.61391 0.58543 0.55839 0.50835 0.46319 0.42241 0.38554 0.35218 0.32197 0.16151 1 0.89632 12 0.88745 13 0.87866 14 0.86996 15 0.86135 0.84893 0.80426 0.76214 0.72242 0.68495 0.64958 0.61620 0.58468 0.55491 0.52679 0.47509 0.42888 0.38753 0.35049 0.31728 0.28748 0.13459 0.83639 0.78849 0.74356 0.70138 0.66178 0.62460 0.58966 0.55684 0.52598 0.49697 0.44401 0.39711 0.35553 0.31863 0.28584 0.25668 0.11216 0.82403 0.77303 0.72542 0.68095 0.63940 0.60057 0.56427 0.53032 0.49856 0.46884 0.41496 0.36770 0.32618 0.28966 0.25751 0.22917 0.09346 0.81185 0.75788 0.70773 0.66112 0.61778 0.57748 0.53997 0.50507 0.47257 0.44230 0.38782 0.34046 0.29925 0.26333 0.23199 0.20462 0.07789 0.79985 0.74301 0.69047 0.64186 0.59689 0.55526 0.51672 0.48102 0.44793 0.41727 0.36245 0.31524 0.27454 0.23939 0.20900 0.18270 0,06491 16 0.85282 0.78803 0.72845 0.67362 0.62317 0.57671 0.53391 0.49447 0.45811 0.42458 0.39365 0.33873 0.29189 0.25187 0.21763 0.18829 0.16312 0.05409 17 0.84438 0.77639 0.71416 0.65720 0.60502 0.55720 0.51337 0.47318 0.43630 0.40245 0.37136 0.31657 0.27027 0.23107 0.19784 0.16963 0.14564 0.04507 18 0.83602 0.76491 0.70016 0.64117 0.58739 0.53836 0.49363 0.45280 0.41552 0.38147 0.35034 0.29586 0.25025 0.21199 0.17986 0.15282 0.13004 0.03756 19 082774 0.75361 0.68643 0.62553 0.57029 0.52016 0.47464 0.43330 0.39573 0.36158 0.33051 0.27651 0.23171 0.19449 0.16351 0.13768 0.11611 0.03130 20 0.81954 0.74247 0.67297 0.61027 0.55368 0.50257 0.45639 0.41464 037689 0.34273 0.31180 0.25842 0.21455 0.17843 0.14864 0.12403 0.10367 0.02608 21 0.81143 0.73150 0.65978 24 0.78757 0.69954 0.62172 75 077977 068921 9.60953 0.59539 0.53755 0.48557 0.43883 0.39679 0.35894 0.32486 0.29416 0.24151 0.19866 0.55288 0.49193 0.43796 039012 0.34770 0.31007 0.27666 0.24698 0.19715 0.15770 0.53939 0.47761 0.42315 0.37512 0.33273 0.29530 0.26223 0.233000.18425 0.14602 0.16370 0.13513 0.11174 0.09256 0.02174 0.12640 0.10153 0.08170 0.06588 0.01258 0.11597 0.09230 0.07361 0.05882 0.01048 ABLE 6 Present Value of an Annuity Due of $1 1- PVAD = X (1+i) 5.0% 5.5% 6.0% 70% 8.0% 0.0% 10.0% 11.0% 12.0% 20.0% 1.0% 1.00000 1.99010 297040 3.94099 4.90197 1.5% 1.00000 1.98522 295588 3.91220 4.85438 2.0% 2.5% 1.000001.00000 1.98039 1.97561 294156 2.92742 3.88388 3.85602 4.80773 4.76197 3.0% 100000 197087 291347 3.82861 4.71710 3.5% 4.0% 4.5% 100000 100000 100000 196618 9 6154 195694 2.89969285609 287267 3.80164 3.775093.74896 4.67308 4.62990 4.58753 3 4 100000 1.95238 2.85941 3.72325 4.54595 100000 100000 194787194340 2.84632 283339 3.69793 3.67301 4.50515 446511 100000 100000 1.93458 1.92593 2.80802 2.78326 3.62432357710 4.38721 4.31213 1.00000 1.91743 2.75911 3.53129 4.23972 1.00000 100000 100000 1 90909 1.90090 1.89286 2.73554 2.71252 2.69005 348685 3.44371 3.40183 4.16987 4.10245 4.03735 1.00000 183333 2.52778 3.10618 3.58873 5 5.85343 5.78264 5.71346 5.64583 5.57971 5.51505 5.451825.38998 6.79548 6.69719 6.60143 6.50813641719 632855 6.24214 7.72819 759821 747199734939 723028 7.11454 7.00205 689270 865168 8.48593 8.32548 817014 8.01989787396 7.73274 7.59589 9.566029.360529.16224 8.97087 3.78611 8607698.43533 8.26879 5.32948 5.27028 5.21236 5.10020 4.99271 4.88965 4.79079 4.69590 4.60478 3.99061 6,07569 5.99553591732 5.76654 5.62288 548592535526 5.23054 511141432551 6.78637668297658238 638929620637 6.03295 586542 5.71220 5.563764 .80459 7.46321 733457 7.20979 6971306746646.53482633493 614612 5.96764 4.83716 8.10782 7.95220 7.801697.51523 724689 699525 6.75902 6.53705 6.32825 5.03097 9 10 11 10.47130 1211.36763 13 12 25508 14 13.13374 15 14.00370 10.22218 9.98259 9.75206 9.53020 9.31661 9.110908.91272 8.72173 8.537638.360098.02358 7.71008 1107112 10.78685 10 51421 10.2526210.00155 9.76048 9528929,306419.09254 8.886878.49867 8.13896 11.90751 11.57534 11.25776 10 95400 10.66333 10.38507 10.11858 9.86325 9.61852938384 8.94269 8.53608 12.73153 12 34837 11.98318 11.63496 11 30274 10.98565 10 68285 10.39357 10.11708 9.85268 9.35765 890378 13.54338 13 10625 12.69091 12.29607 11.92052 11 56312 11 22283 10.89864 10.58965 10.29498 9.74547924424 7.41766 7.14457 6.88923 6.65022 5.19247 7.80519749506 720652 693770 5.32706 816073 7.81369 749236 7.19437543922 3.48690 8.10336 7.74987 7.42355 5.53268 8.786158.36609 798187 7.62817 5.61057 16 14.86505 17 15.71787 18 16.56225 19 1739827 2018 22601 14.34323 15 13126 15.90765 16,67256 17 42617 13.84926 13.38138 12.93794 14.57771 14.05500 13.56110 15.29187 14.71220 14 16612 15 99203 15 35336 14.75351 16 67846 15 978891532380 12.51741 13.09412 13.65132 14 18968 14.70984 12.11839 11.73955 11.37966 11.03758 10.71225 10.10791 9.55948 12.65230 12 2340211 83777 1146216 11.10590 10.44665 9.85137 13.16567 12.70719 12 274071186461 11.47726 10.76322 10.12164 13.659301315999 12689591224607 11.82760 11.05909 10.37189 1413394 13.59329 13.08532 12 60765 12 15812 1133560 1060360 931256 9.54363 9.75563 9.95011 8.60608 3.19087 7.81086 5.67547 8.82371 37916 797399 5.72956 9.02155 8.54879 8.11963 5.77465 9.20141 70162 8.24967 5.81219 9.36492 8.83929 83657854150 21 25 30 40 19.04555 22 24339 26.06579 33.16303 18.16864 21.03041 24 37608 30 36458 17.35143 16.58916 15.87747 15.21240 14.59033 14.00794 19 91393 18.88499 17.93554 17.05837 16.24696 15.49548 22 84438 21.4535520.18845 19.03577 17.983711702189 27 90259 25.73034 23 80822 22.10250 20.58443 19 22966 13.46221 12.95038 1479864 14.15170 16.14107 1533310 18 01704 16.92866 12.46992 11.59401 10.81815 10.12855 9.51356 8.96333 8.469445.86958 13.55036 12.46933 11.52876 10.706619.98474 9.348148.78432 5.93710 14.5907213.27767 12.15841 11.19828 10.30961 9.6501902181 3.97472 1594907 14.26493 12.87858 11.72552 10.7509 9.93567 923303 5.99592Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started