Question

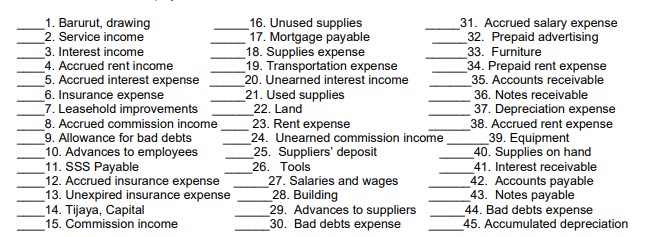

I. CLASSIFICATION OF ACCOUNTS INSTRUCTION: Indicate on the blank the abbreviations of classification of accounts as follows: I for Income or revenue; Ex for expenses;

I. CLASSIFICATION OF ACCOUNTS

INSTRUCTION: Indicate on the blank the abbreviations of classification of accounts as follows: I for Income or revenue; Ex for expenses; CA for Current assets, CCA for Contra current assets; NCA for Non-current assets; CNCA - for Contra-Non-current assets; CL for Current liabilities; NCL for Non-current liabilities and EQ for Equity.

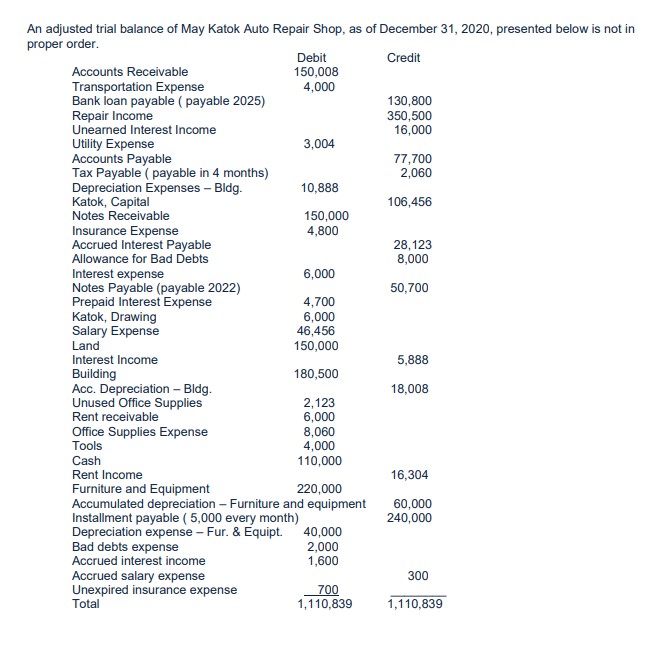

II. SERVICE BUSINESS

PREPARATION OF INCOME STATEMENT, STATEMENT OF CHANGES IN EQUITY AND STATEMENT OF FINANCIAL POSITION

INSTRUCTION: You are required to compute the data and the correct answer

1 - The total income or revenue is P __________________

2 - The total operating expenses is P __________________

3 The net income or (net loss) is P __________________

4 The total current assets is P __________________

5 - The total non-current assets is P __________________

6. Total assets P __________________

7. Total current liabilities P__________________

8. Total non-current liabilities P__________________

9. Total liabilities P__________________

10. Katok, capital, end P__________________

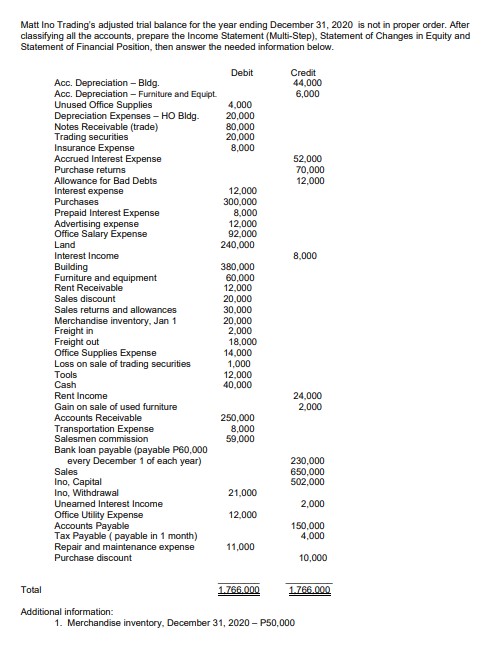

III. MERCHANDISING BUSINESS

PREPARATION OF INCOME STATEMENT, STATEMENT OF CHANGES IN EQUITY, AND BALANCE SHEET

INSTRUCTION: Answer the following

FOR 2020

1. - The net sales is P ______________

2. - The cost of sales or cost of goods sold is P __________________

3. - The other income is P _________________

4. - The selling expense is P _________________

5. - The administrative expense is P _________________

6. - The total other expenses is P _________________

7. - The finance cost is P ________________

8.- The net income is P _______________

9 The total current assets as of December 31, 2020 is P ________________

10 - The total non-current assets as of December 31, 2020 is P ______________

11 - The total assets as of December 31, 2020 is P _________________

12 - The total current liabilities as of December 31, 2020 is P ____________________

13 - The total non-current liabilities as of December 31, 2020 is P _________________

14 - The total liabilities as of December 31, 2020 is P ______________

15 - The total owners equity as of December 31, 2020 is P ________________

1. Barurut, drawing 2. Service income 3. Interest income 4. Accrued rent income 5. Accrued interest expense 6. Insurance expense 7. Leasehold improvements 8. Accrued commission income 9. Allowance for bad debts 10. Advances to employees 11. SSS Payable 12. Accrued insurance expense 13. Unexpired insurance expense 14. Tijaya, Capital 15. Commission income 16. Unused supplies 17. Mortgage payable 18. Supplies expense 19. Transportation expense 20. Unearned interest income 21. Used supplies 22. Land 23. Rent expense 24. Unearned commission income 25. Suppliers' deposit 26. Tools 27. Salaries and wages 28. Building 29. Advances to suppliers 30. Bad debts expense 31. Accrued salary expense 32. Prepaid advertising 33. Furniture 34. Prepaid rent expense 35. Accounts receivable 36. Notes receivable 37. Depreciation expense 38. Accrued rent expense _39. Equipment 40. Supplies on hand 41. Interest receivable 42. Accounts payable 43. Notes payable 44. Bad debts expense 45. Accumulated depreciation An adjusted trial balance of May Katok Auto Repair Shop, as of December 31, 2020, presented below is not in proper order. Debit Credit Accounts Receivable 150,008 Transportation Expense 4,000 Bank loan payable (payable 2025) 130,800 Repair Income 350,500 Unearned Interest Income 16,000 Utility Expense 3,004 Accounts Payable 77,700 Tax Payable payable in 4 months) 2,060 Depreciation Expenses - Bldg. 10,888 Katok, Capital 106,456 Notes Receivable 150,000 Insurance pense 4,800 Accrued Interest Payable 28,123 Allowance for Bad Debts 8,000 Interest expense 6,000 Notes Payable (payable 2022) 50,700 Prepaid Interest Expense 4,700 Katok, Drawing 6,000 Salary Expense 46,456 Land 150,000 Interest Income 5,888 Building 180,500 Acc. Depreciation - Bldg. 18,008 Unused Office Supplies 2,123 Rent receivable 6,000 Office Supplies Expense 8,060 Tools 4,000 Cash 110,000 Rent Income 16,304 Furniture and Equipment 220,000 Accumulated depreciation - Furniture and equipment 60,000 Installment payable ( 5,000 every month) 240,000 Depreciation expense - Fur & Equipt. 40,000 Bad debts expense 2,000 Accrued interest income 1,600 Accrued salary expense Unexpired insurance expense 700 Total 1,110,839 1,110,839 300 Matt Ino Trading's adjusted trial balance for the year ending December 31, 2020 is not in proper order. After classifying all the accounts, prepare the Income Statement (Multi-Step), Statement of Changes in Equity and Statement of Financial Position, then answer the needed information below. Credit 44,000 6,000 52,000 70,000 12.000 8,000 Debit Acc. Depreciation - Bldg. Acc. Depreciation - Furniture and Equipt. Unused Office Supplies 4,000 Depreciation Expenses - HO Bldg. 20,000 Notes Receivable (trade) 80,000 Trading securities 20,000 Insurance Expense 8,000 Accrued Interest Expense Purchase returns Allowance for Bad Debts Interest expense 12,000 Purchases 300,000 Prepaid Interest Expense 8,000 Advertising expense 12,000 Office Salary Expense 92,000 Land 240,000 Interest Income Building 380,000 Furniture and equipment 60,000 Rent Receivable 12,000 Sales discount 20,000 Sales returns and allowances 30,000 Merchandise inventory, Jan 1 20.000 Freight in 2,000 Freight out 18,000 Office Supplies Expense 14,000 Loss on sale of trading securities 1,000 Tools 12.000 Cash 40,000 Rent Income Gain on sale of used furniture Accounts Receivable 250,000 Transportation Expense 8,000 Salesmen commission 59,000 Bank loan payable (payable P60,000 every December 1 of each year) Sales Ino, Capital Ino, Withdrawal 21,000 Uneamed Interest Income Office Utility Expense 12,000 Accounts Payable Tax Payable (payable in 1 month) Repair and maintenance expense 11,000 Purchase discount 24,000 2.000 230,000 650,000 502.000 2,000 150,000 4,000 10,000 Total 1.766.000 1.766.000 Additional information: 1. Merchandise inventory, December 31, 2020-P50,000 1. Barurut, drawing 2. Service income 3. Interest income 4. Accrued rent income 5. Accrued interest expense 6. Insurance expense 7. Leasehold improvements 8. Accrued commission income 9. Allowance for bad debts 10. Advances to employees 11. SSS Payable 12. Accrued insurance expense 13. Unexpired insurance expense 14. Tijaya, Capital 15. Commission income 16. Unused supplies 17. Mortgage payable 18. Supplies expense 19. Transportation expense 20. Unearned interest income 21. Used supplies 22. Land 23. Rent expense 24. Unearned commission income 25. Suppliers' deposit 26. Tools 27. Salaries and wages 28. Building 29. Advances to suppliers 30. Bad debts expense 31. Accrued salary expense 32. Prepaid advertising 33. Furniture 34. Prepaid rent expense 35. Accounts receivable 36. Notes receivable 37. Depreciation expense 38. Accrued rent expense _39. Equipment 40. Supplies on hand 41. Interest receivable 42. Accounts payable 43. Notes payable 44. Bad debts expense 45. Accumulated depreciation An adjusted trial balance of May Katok Auto Repair Shop, as of December 31, 2020, presented below is not in proper order. Debit Credit Accounts Receivable 150,008 Transportation Expense 4,000 Bank loan payable (payable 2025) 130,800 Repair Income 350,500 Unearned Interest Income 16,000 Utility Expense 3,004 Accounts Payable 77,700 Tax Payable payable in 4 months) 2,060 Depreciation Expenses - Bldg. 10,888 Katok, Capital 106,456 Notes Receivable 150,000 Insurance pense 4,800 Accrued Interest Payable 28,123 Allowance for Bad Debts 8,000 Interest expense 6,000 Notes Payable (payable 2022) 50,700 Prepaid Interest Expense 4,700 Katok, Drawing 6,000 Salary Expense 46,456 Land 150,000 Interest Income 5,888 Building 180,500 Acc. Depreciation - Bldg. 18,008 Unused Office Supplies 2,123 Rent receivable 6,000 Office Supplies Expense 8,060 Tools 4,000 Cash 110,000 Rent Income 16,304 Furniture and Equipment 220,000 Accumulated depreciation - Furniture and equipment 60,000 Installment payable ( 5,000 every month) 240,000 Depreciation expense - Fur & Equipt. 40,000 Bad debts expense 2,000 Accrued interest income 1,600 Accrued salary expense Unexpired insurance expense 700 Total 1,110,839 1,110,839 300 Matt Ino Trading's adjusted trial balance for the year ending December 31, 2020 is not in proper order. After classifying all the accounts, prepare the Income Statement (Multi-Step), Statement of Changes in Equity and Statement of Financial Position, then answer the needed information below. Credit 44,000 6,000 52,000 70,000 12.000 8,000 Debit Acc. Depreciation - Bldg. Acc. Depreciation - Furniture and Equipt. Unused Office Supplies 4,000 Depreciation Expenses - HO Bldg. 20,000 Notes Receivable (trade) 80,000 Trading securities 20,000 Insurance Expense 8,000 Accrued Interest Expense Purchase returns Allowance for Bad Debts Interest expense 12,000 Purchases 300,000 Prepaid Interest Expense 8,000 Advertising expense 12,000 Office Salary Expense 92,000 Land 240,000 Interest Income Building 380,000 Furniture and equipment 60,000 Rent Receivable 12,000 Sales discount 20,000 Sales returns and allowances 30,000 Merchandise inventory, Jan 1 20.000 Freight in 2,000 Freight out 18,000 Office Supplies Expense 14,000 Loss on sale of trading securities 1,000 Tools 12.000 Cash 40,000 Rent Income Gain on sale of used furniture Accounts Receivable 250,000 Transportation Expense 8,000 Salesmen commission 59,000 Bank loan payable (payable P60,000 every December 1 of each year) Sales Ino, Capital Ino, Withdrawal 21,000 Uneamed Interest Income Office Utility Expense 12,000 Accounts Payable Tax Payable (payable in 1 month) Repair and maintenance expense 11,000 Purchase discount 24,000 2.000 230,000 650,000 502.000 2,000 150,000 4,000 10,000 Total 1.766.000 1.766.000 Additional information: 1. Merchandise inventory, December 31, 2020-P50,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started