Answered step by step

Verified Expert Solution

Question

1 Approved Answer

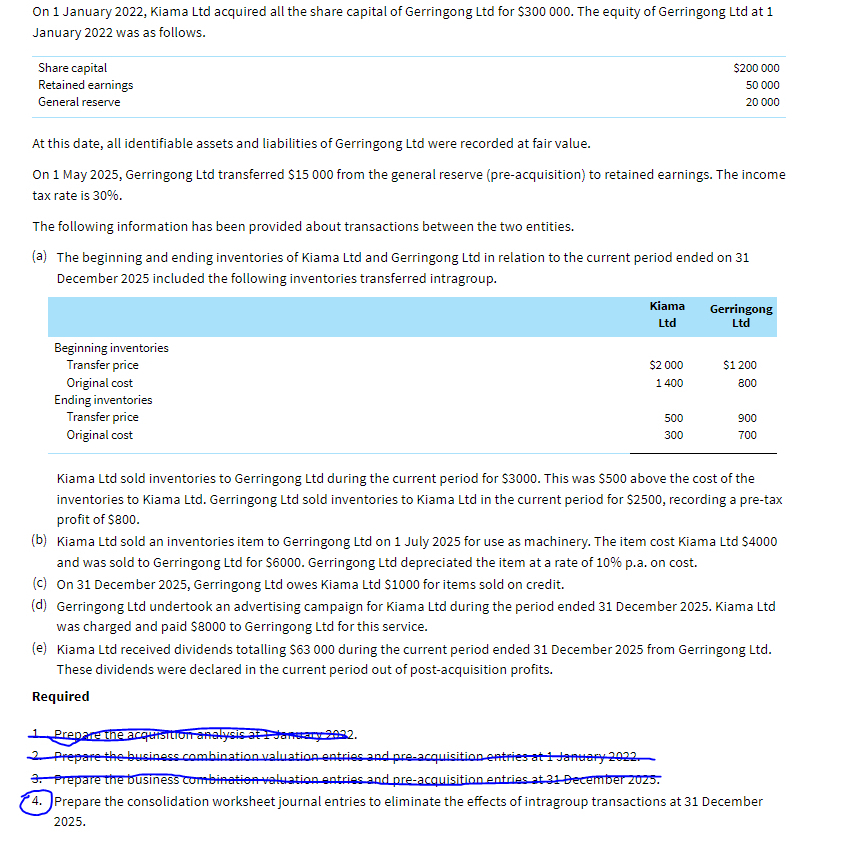

On 1 January 2 0 2 2 , Kiama Ltd acquired all the share capital of Gerringong Ltd for $ 3 0 0 0 0

On January Kiama Ltd acquired all the share capital of Gerringong Ltd for $ The equity of Gerringong Ltd at

January was as follows.

Share capital

Retained earnings

General reserve

At this date, all identifiable assets and liabilities of Gerringong Ltd were recorded at fair value.

On May Gerringong Ltd transferred $ from the general reserve preacquisition to retained earnings. The income

tax rate is

The following information has been provided about transactions between the two entities.

a The beginning and ending inventories of Kiama Ltd and Gerringong Ltd in relation to the current period ended on

December included the following inventories transferred intragroup.

Kiama Ltd sold inventories to Gerringong Ltd during the current period for $ This was $ above the cost of the

inventories to Kiama Ltd Gerringong Ltd sold inventories to Kiama Ltd in the current period for $ recording a pretax

profit of $

b Kiama Ltd sold an inventories item to Gerringong Ltd on July for use as machinery. The item cost Kiama Ltd $

and was sold to Gerringong Ltd for $ Gerringong Ltd depreciated the item at a rate of pa on cost

c On December Gerringong Ltd owes Kiama Ltd $ for items sold on credit.

d Gerringong Ltd undertook an advertising campaign for Kiama Ltd during the period ended December Kiama Ltd

was charged and paid $ to Gerringong Ltd for this service.

e Kiama Ltd received dividends totalling $ during the current period ended December from Gerringong Ltd

These dividends were declared in the current period out of postacquisition profits.

Required

Prepare the business combination valuationsontriesand preacquisition entriesat December

Prepare the consolidation worksheet journal entries to eliminate the effects of intragroup transactions at December

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started