I could really use help with this financial accounting homework please.

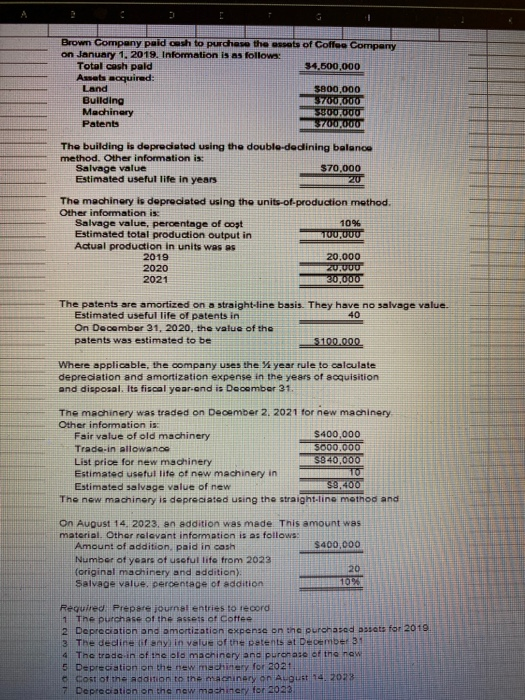

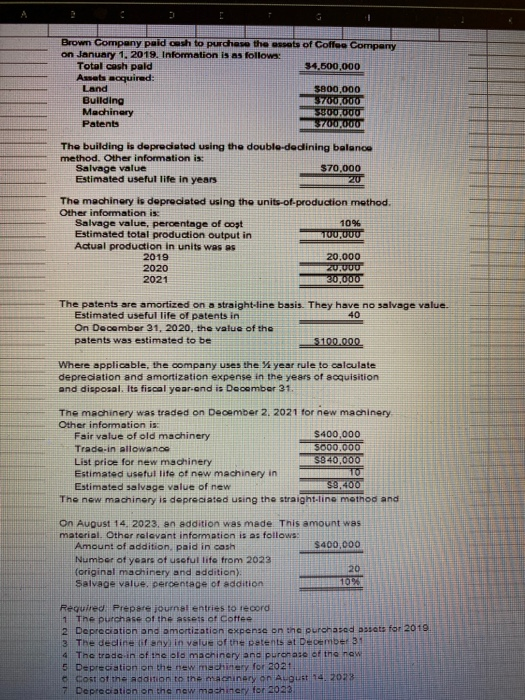

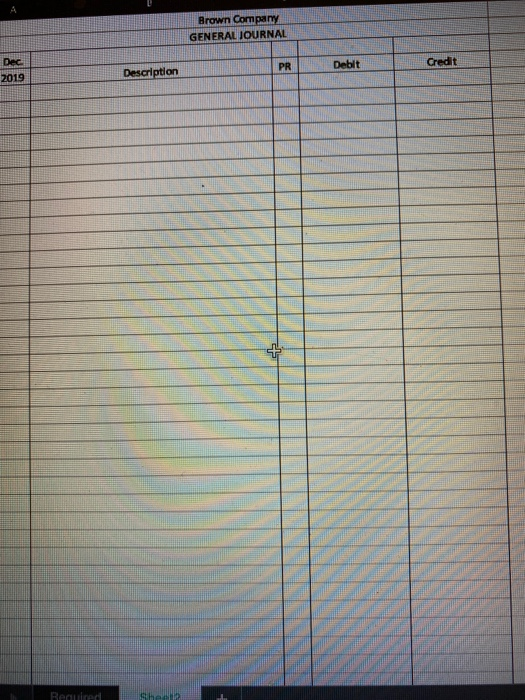

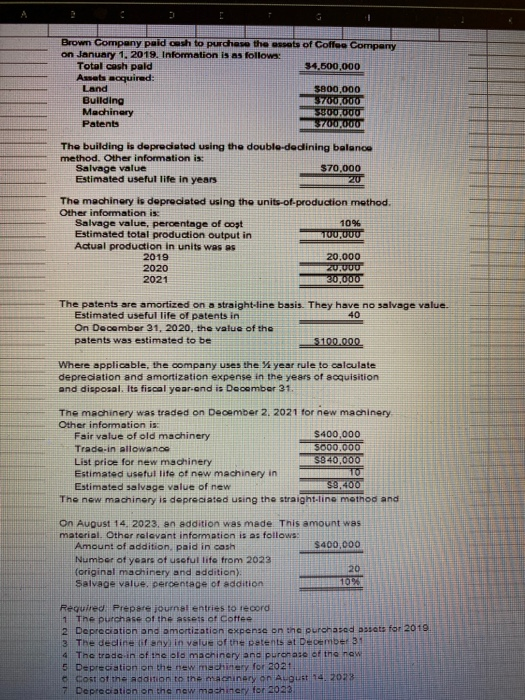

Brown Company paid cash to purchase the essats of Coffee Company on January 1, 2019. Information is as follows: Total cash pald $4.500.000 Assets acquired: Land 3800,000 Building 3700000 Machinery $800.000 Patents 700.000 The building is deprecated using the double-dedining balance method. Other information is: Salvage value $70,000 Estimated useful life in years 20 The machinery is depreciated using the units-of-production method. Other information is: Salvage value, percentage of cost 1096 Estimated total production output in TOURU00 Actual production in units was as 2019 20.000 2020 ZU.UUU 2021 30,000 The patents are amortized on a straight-line basis. They have no salvage value. Estimated useful life of patents in On December 31, 2020, the value of the patents was estimated to be $100.000 Where applicable, the company uses the year rule to calculate depreciation and amortization expense in the years of scquisition and disposal. Its fiscal year and is December 31. The machinery was traded on December 2. 2021 for new machinery Other information is Fair value of old machinery $400,000 Trade-in allowance S000.000 List price for new machinery $340,000 Estimated useful life of new machinery in TO Estimated salvage value of new $8.400 The new machinery is depreciated using the straight-line method and On August 14, 2023, an addition was made. This amount was material. Other relevant information is as follows: Amount of addition, paid in cash $400,000 Number of years of useful lite from 2023 (original machinery and addition) 20 Salvage value, percentage of addition Required. Prepste journal entries to record 1 The purchase of the assess at Cottee 2 Depreciation and amortization expense on the purchased assets for 3 The decline of any in value of the patents at December 31 4 The trade in of the old machinery and purenate of the new 5 Depreciation on the new mechinery for 2021 o cost of the addition to the machinery On Agu 14.20 7 Depreciation on the new machinery for 2023 Brown Company GENERAL JOURNAL 2019 Description ebit . / / / 7 Brown Company paid cash to purchase the essats of Coffee Company on January 1, 2019. Information is as follows: Total cash pald $4.500.000 Assets acquired: Land 3800,000 Building 3700000 Machinery $800.000 Patents 700.000 The building is deprecated using the double-dedining balance method. Other information is: Salvage value $70,000 Estimated useful life in years 20 The machinery is depreciated using the units-of-production method. Other information is: Salvage value, percentage of cost 1096 Estimated total production output in TOURU00 Actual production in units was as 2019 20.000 2020 ZU.UUU 2021 30,000 The patents are amortized on a straight-line basis. They have no salvage value. Estimated useful life of patents in On December 31, 2020, the value of the patents was estimated to be $100.000 Where applicable, the company uses the year rule to calculate depreciation and amortization expense in the years of scquisition and disposal. Its fiscal year and is December 31. The machinery was traded on December 2. 2021 for new machinery Other information is Fair value of old machinery $400,000 Trade-in allowance S000.000 List price for new machinery $340,000 Estimated useful life of new machinery in TO Estimated salvage value of new $8.400 The new machinery is depreciated using the straight-line method and On August 14, 2023, an addition was made. This amount was material. Other relevant information is as follows: Amount of addition, paid in cash $400,000 Number of years of useful lite from 2023 (original machinery and addition) 20 Salvage value, percentage of addition Required. Prepste journal entries to record 1 The purchase of the assess at Cottee 2 Depreciation and amortization expense on the purchased assets for 3 The decline of any in value of the patents at December 31 4 The trade in of the old machinery and purenate of the new 5 Depreciation on the new mechinery for 2021 o cost of the addition to the machinery On Agu 14.20 7 Depreciation on the new machinery for 2023 Brown Company GENERAL JOURNAL 2019 Description ebit . / / / 7