i did some of the work.

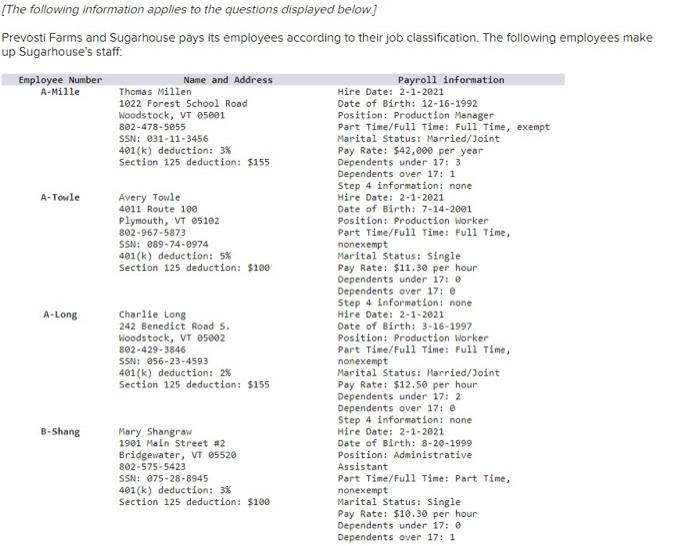

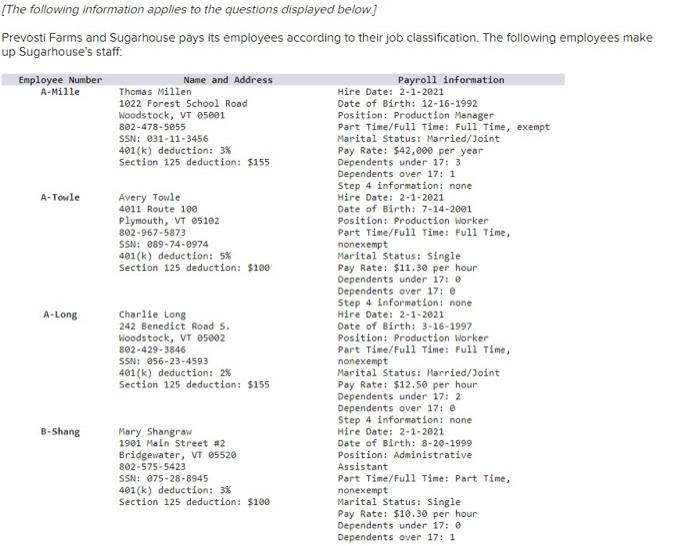

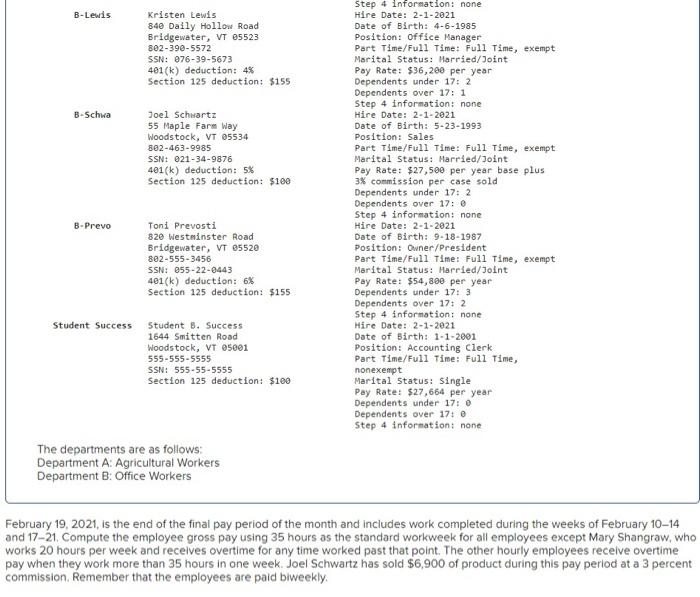

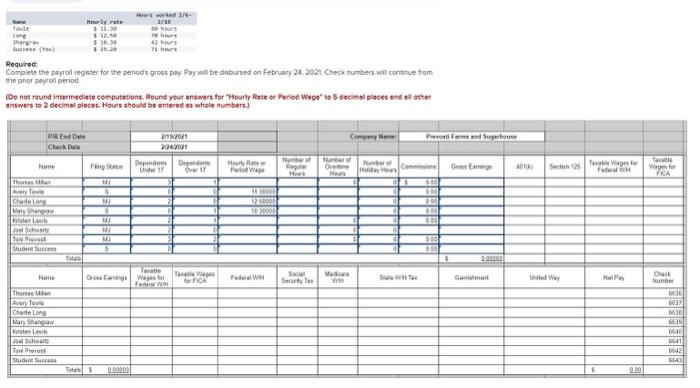

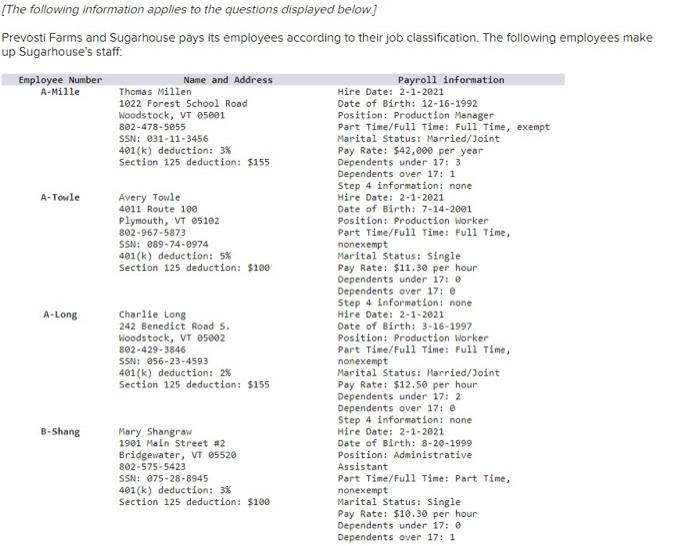

[The following information applies to the questions displayed below.] Prevosti Farms and Sugarhouse pays its employees according to their job classification. The following employees make up Sugarhouse's staff: \begin{tabular}{|c|c|} \hline B-Lewis & \begin{tabular}{l} Kristen Lewis \\ 840 Daily Hollow Road \\ Bridgewater, VT 05523 \\ 8023905572 \\ \$SN: 076395673 \\ 401(k) deduction: 4% \\ Section 125 deduction: $155 \end{tabular} \\ \hline B-Schwa & \begin{tabular}{l} Joel Schwartz \\ 55 Maple Farm Way \\ Woodstock, VT 05534 \\ 8024639985 \\ 5SNt 021349876 \\ 401(k) deduction: 5% \\ Section 125 deduction: $100 \end{tabular} \\ \hline B-Prevo & \begin{tabular}{l} Toni Prevosti \\ 820 Westminster Road \\ Bridgewater, VT 05520 \\ 8025553456 \\ 55N : 055220443 \\ 401(k) deduction: 6K \\ Section 125 deduction: $155 \end{tabular} \\ \hline Student Success & \begin{tabular}{l} Student B. Success \\ 1644 Smitten Rosd \\ Woodstock, VT 95001 \\ 5555555555 \\ SSN: 555555555 \\ Section 125 deduction: $100 \end{tabular} \\ \hline \begin{tabular}{l} departments ar \\ artment A: Agri \\ artment B: Offic \end{tabular} & \begin{tabular}{l} as follows: \\ iltural Workers \\ Workers \end{tabular} \\ \hline \end{tabular} Step 4 information: none Hire Date: 2-1-2021 Date of Birth: 461985 Position: office Manager Part Time/Full Time: Full Time, exempt Marital Status: Married/Joint Poy Rate: \$36,200 per year Dependents under 17:2 Dependents over 17: 1 Step 4 information: none Hire Date: 2-1-2021 Date of Birth: 5231993 Position: Sales Part Tlme/Full Time: Full Time, exempt Marital Status: Married/Joint Pay Rate: $27,500 per year base plus 3% commission per case sold Dependents under 17:2 Dependents over 17: 8 Step 4 information: none Hire Date: 2-1-2821 Dote of Birth: 9-18-1987 Position: Owner/President Part Time/Full Time: Full Time, exempt Marital status: Harried/Joint Pay Rate: $54,800 per year Dependents under 17: 3 Dependents over 17: 2 Step 4 information: none Hire Date: 2-1-2021 Date of Birth: 1-1-2001 Position: Accounting Clerk Part Time/Full Time: Full Time, nonexempt Marital status: Single Pay Rate: $27,664 per year Dependents under 17: 0 Dependents over 17 : 0 step 4 Information: none The departments are as follows: Department A: Agricultural Workers Department B: Office Workers February 19,2021 , is the end of the final pay period of the month and includes work completed during the weeks of February 1014 and 17-21. Compute the employee gross pay using 35 hours as the standard workweek for all employees except Mary Shangraw, who works 20 hours per week and recelves overtime for any time worked past that point. The other hourly employees recelve overtime pay when they work more than 35 hours in one week. Joel Schwartz has sold $6,900 of product during this pay period at a 3 percent commission. Remember that the employees are paid biweekly. Required: Complete the poyrol iegistes for the penods gross poy. Pay will be dnbursed on Februscy 24,2021 Check numbers wil continue from the phiar paycol period. antwers to 2 decimel ploces. Heurs should be entered as whole numbers.]