Answered step by step

Verified Expert Solution

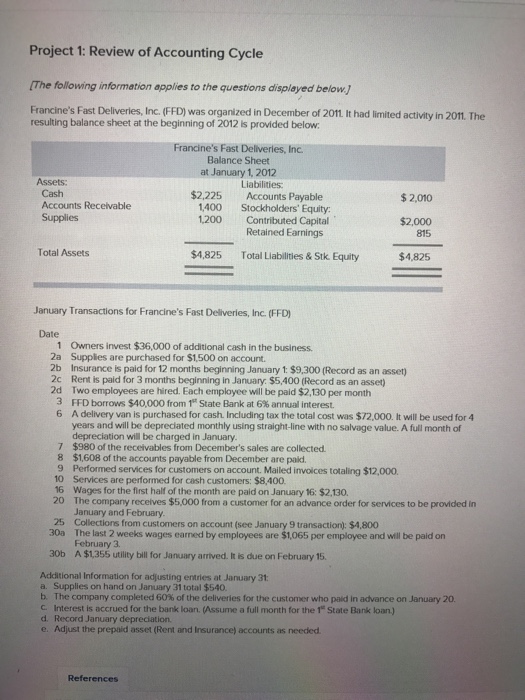

Question

1 Approved Answer

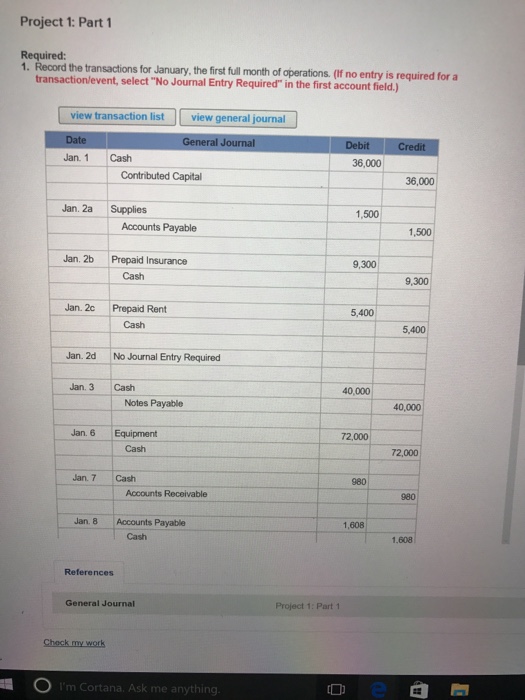

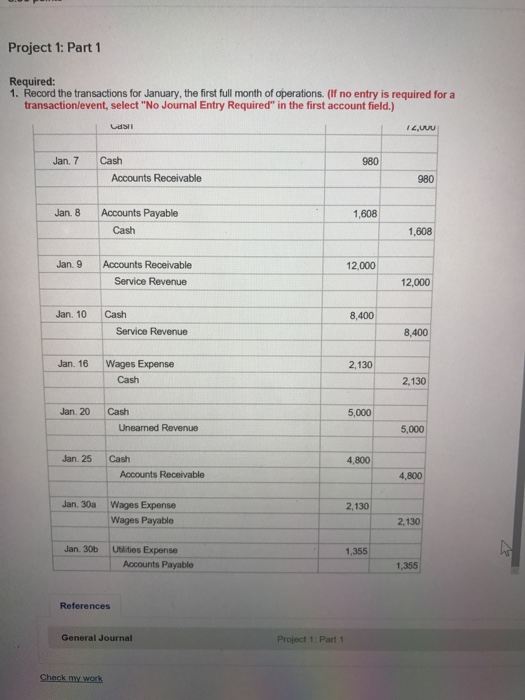

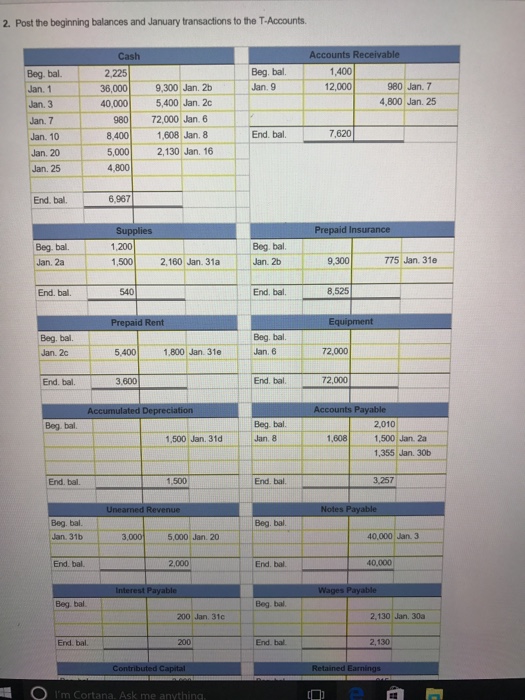

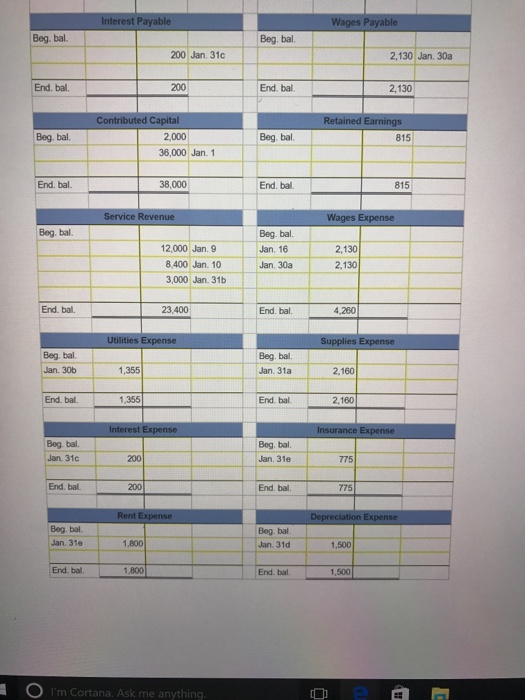

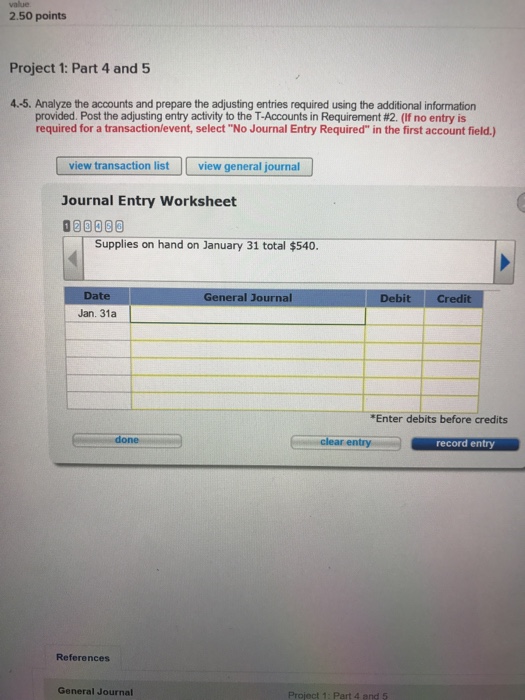

I did the first journal entry for January 1 till january 30b. And i solved the T accounts. All the data entered is correct. I

I did the first journal entry for January 1 till january 30b. And i solved the T accounts. All the data entered is correct. I just need help with the second journal entry please. I already posted the adjusting entry to the t accounts i just dont know what to write in the journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started