Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I didn't get the answer correctly... i cannot figure it out... I'd give up... INTIPALLUI IIVET LUI Y Liidriges UI AUSUI PLIULUSLY ITILUIT. DIVISIUIDI FIUNILADILY

I didn't get the answer correctly... i cannot figure it out... I'd give up...

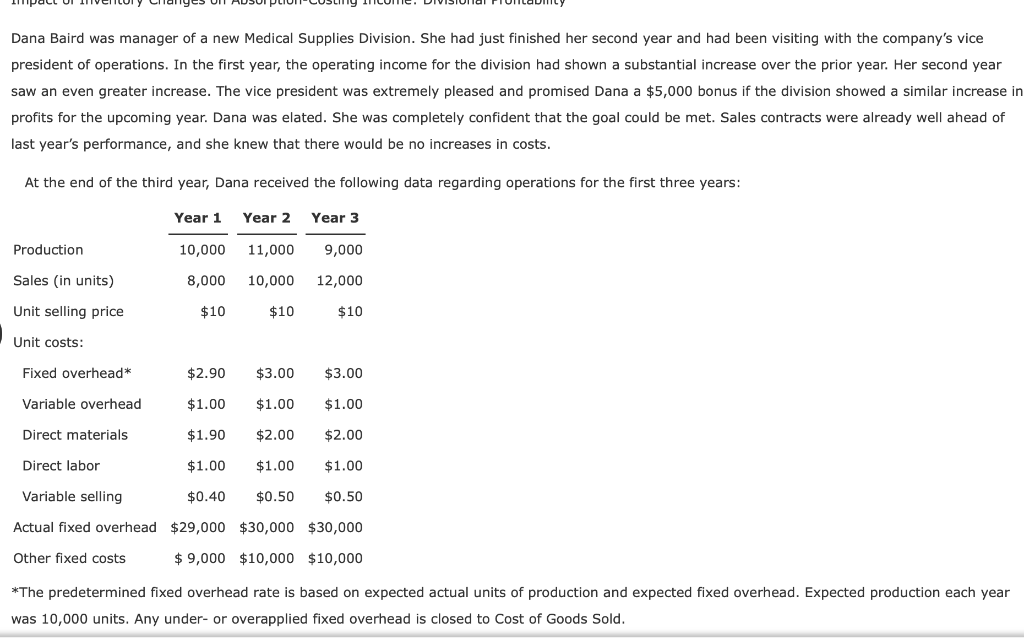

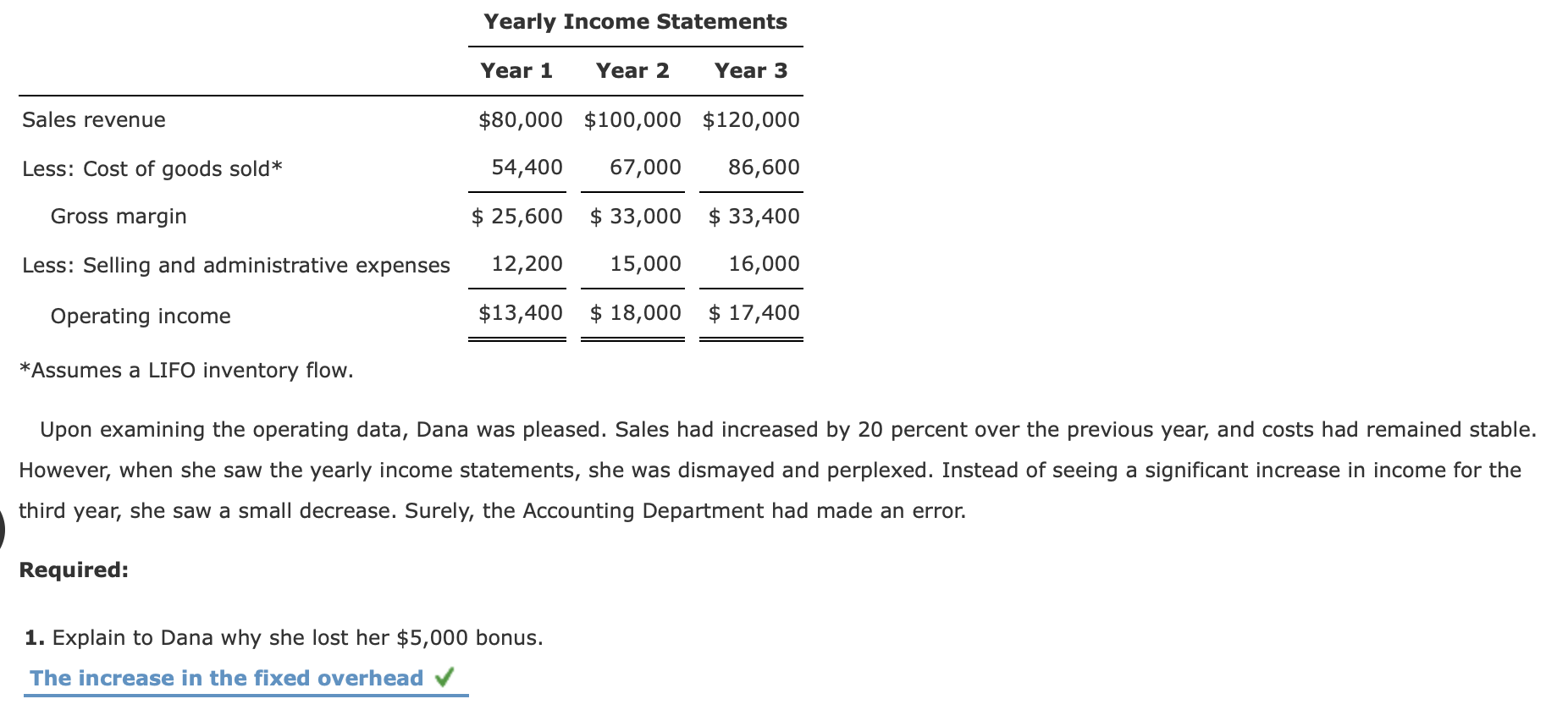

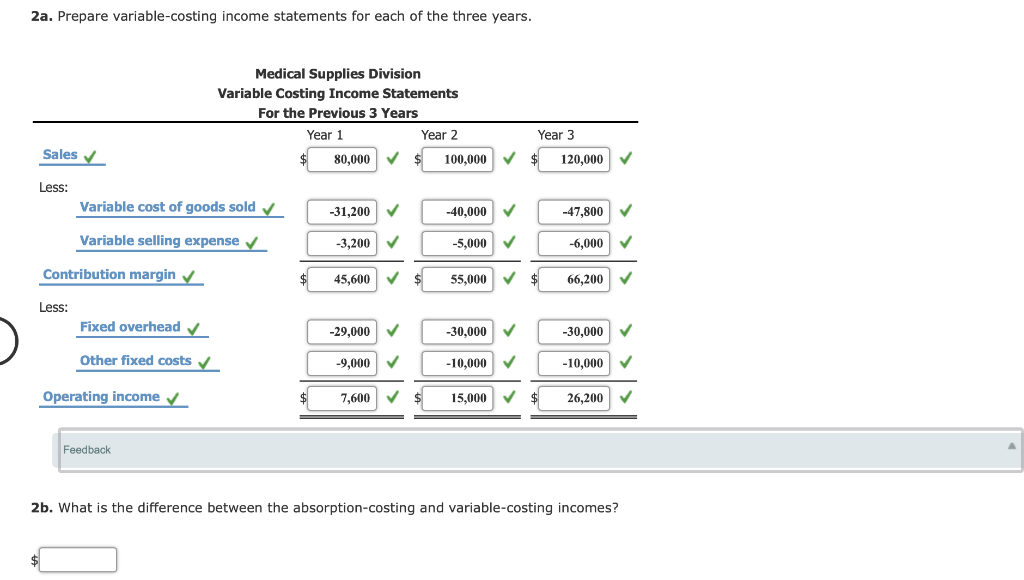

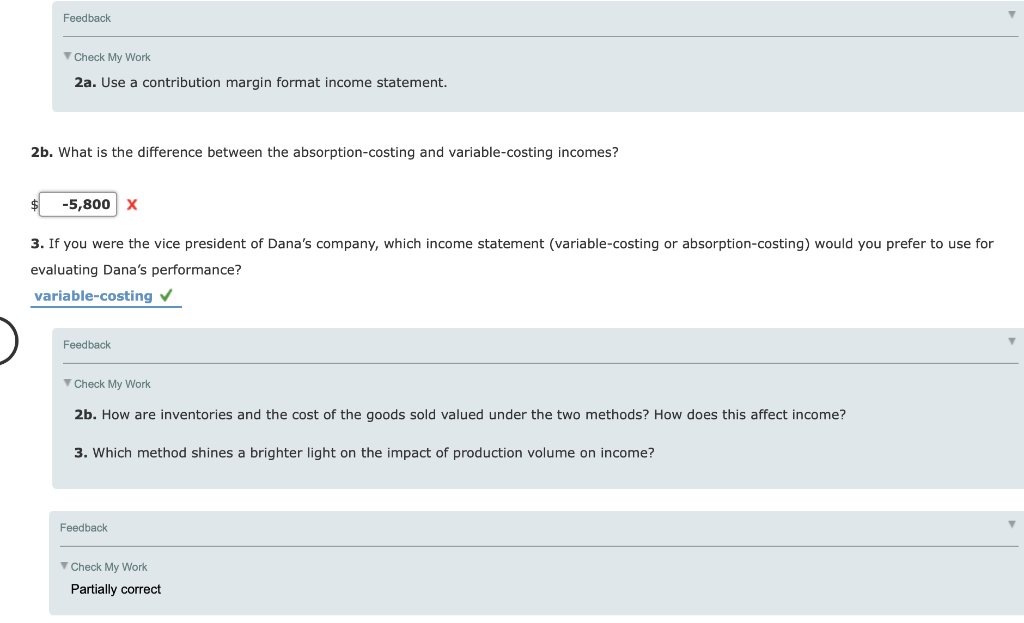

INTIPALLUI IIVET LUI Y Liidriges UI AUSUI PLIULUSLY ITILUIT. DIVISIUIDI FIUNILADILY Dana Baird was manager of a new Medical Supplies Division. She had just finished her second year and had been visiting with the company's vice president of operations. In the first year, the operating income for the division had shown a substantial increase over the prior year. Her second year saw an even greater increase. The vice president was extremely pleased and promised Dana a $5,000 bonus if the division showed a similar increase in profits for the upcoming year. Dana was elated. She was completely confident that the goal could be met. Sales contracts were already well ahead of last year's performance, and she knew that there would be no increases in costs. At the end of the third year, Dana received the following data regarding operations for the first three years: Production Year 1 10,000 8,000 $10 Year 2 11,000 10,000 $10 Year 3 9,000 12,000 $10 Sales (in units) Unit selling price Unit costs: Fixed overhead* $2.90 $3.00 $3.00 Variable overhead $1.00 $1.00 $1.00 Direct materials $1.90 $2.00 $2.00 Direct labor $1.00 $1.00 $1.00 Variable selling $0.40 $0.50 $0.50 Actual fixed overhead $29,000 $30,000 $30,000 Other fixed costs $9,000 $10,000 $10,000 *The predetermined fixed overhead rate is based on expected actual units of production and expected fixed overhead. Expected production each year was 10,000 units. Any under- or overapplied fixed overhead is closed to Cost of Goods Sold. Yearly Income Statements Year 1 Year 2 Year 3 Sales revenue Less: Cost of goods sold* $80,000 $100,000 $120,000 54,400 67,000 86,600 $ 25,600 $ 33,000 $33,400 Gross margin Less: Selling and administrative expenses 12,200 15,000 16,000 Operating income $13,400 $ 18,000 $ 17,400 *Assumes a LIFO inventory flow. Upon examining the operating data, Dana was pleased. Sales had increased by 20 percent over the previous year, and costs had remained stable. However, when she saw the yearly income statements, she was dismayed and perplexed. Instead of seeing a significant increase in income for the third year, she saw a small decrease. Surely, the Accounting Department had made an error. Required: 1. Explain to Dana why she lost her $5,000 bonus. The increase in the fixed overhead 2a. Prepare variable-costing income statements for each of the three years. Medical Supplies Division Variable Costing Income Statements For the Previous 3 Years Year 1 Year 2 $ 80,000 $ 100,000 Sales Year 3 $ 120,000 Less: Variable cost of goods sold -31,200 -40,000 -47,800 Variable selling expense 1 -3,200 -5,000 -6,000 Contribution margin $ 45,600 $ 55,000 $ 66,200 Less: Fixed overhead -29,000 -30,000 -30,000 Other fixed costs -9,000 -10,000 -10,000 Operating income 7,600 $ 15,000 $ 26,200 Feedback 2b. What is the difference between the absorption-costing and variable-costing incomes? Feedback Check My Work 2a. Use a contribution margin format income statement. 2b. What is the difference between the absorption-costing and variable-costing incomes? $ -5,800 x 3. If you were the vice president of Dana's company, which income statement (variable-costing or absorption-costing) would you prefer to use for evaluating Dana's performance? variable-costing Feedback Check My Work 2b. How are inventories and the cost of the goods sold valued under the two methods? How does this affect income? 3. Which method shines a brighter light on the impact of production volume on income? Feedback Check My Work Partially correctStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started