Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I do not how to do them, please help me.... And Thanks! Q 3.24: How does the initial accumulation of materials, labor, and overhead costs

I do not how to do them, please help me....

And

Thanks!

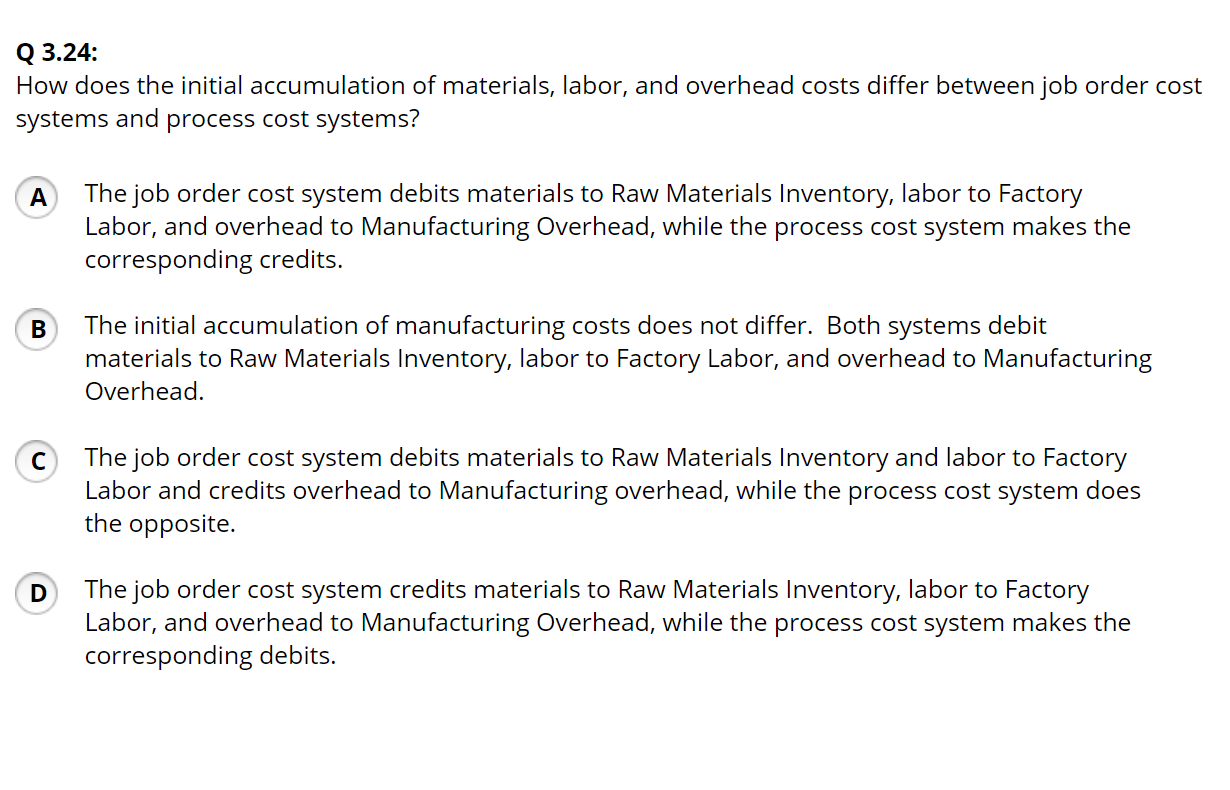

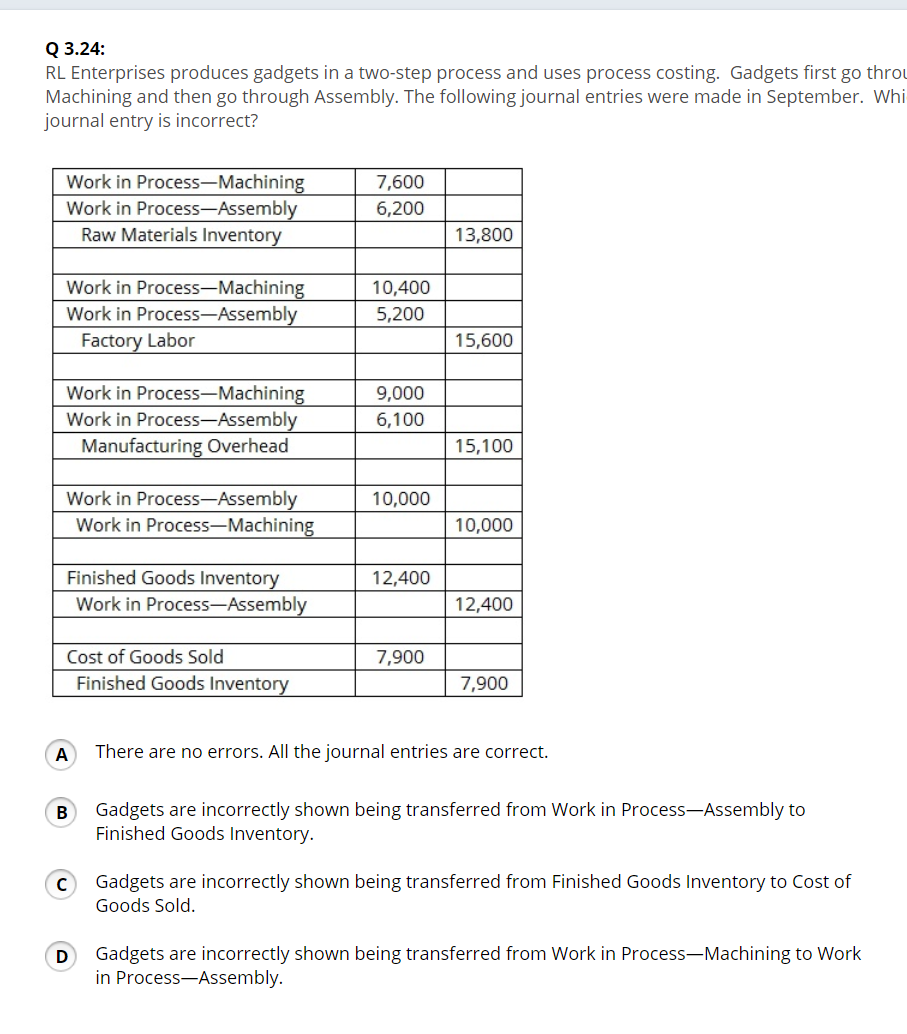

Q 3.24: How does the initial accumulation of materials, labor, and overhead costs differ between job order cost systems and process cost systems? A The job order cost system debits materials to Raw Materials Inventory, labor to Factory Labor, and overhead to Manufacturing Overhead, while the process cost system makes the corresponding credits. B The initial accumulation of manufacturing costs does not differ. Both systems debit materials to Raw Materials Inventory, labor to Factory Labor, and overhead to Manufacturing Overhead. C The job order cost system debits materials to Raw Materials Inventory and labor to Factory Labor and credits overhead to Manufacturing overhead, while the process cost system does the opposite. D The job order cost system credits materials to Raw Materials Inventory, labor to Factory Labor, and overhead to Manufacturing Overhead, while the process cost system makes the corresponding debits. Q 3.24: RL Enterprises produces gadgets in a two-step process and uses process costing. Gadgets first go throu Machining and then go through Assembly. The following journal entries were made in September. Whi journal entry is incorrect? Work in Process-Machining Work in Process-Assembly Raw Materials Inventory 7,600 6,200 13,800 Work in Process-Machining Work in Process-Assembly Factory Labor 10,400 5,200 15,600 Work in Process-Machining Work in Process-Assembly Manufacturing Overhead 9,000 6,100 15,100 10,000 Work in ProcessAssembly Work in Process-Machining 10,000 12,400 Finished Goods Inventory Work in Process-Assembly 12,400 7,900 Cost of Goods Sold Finished Goods Inventory 7,900 A There are no errors. All the journal entries are correct. B Gadgets are incorrectly shown being transferred from Work in Process-Assembly to Finished Goods Inventory. Gadgets are incorrectly shown being transferred from Finished Goods Inventory to Cost of Goods Sold. D Gadgets are incorrectly shown being transferred from Work in Process Machining to work in Process-AssemblyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started