Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i dont understand how to solve # 19 & # 18. can someone help explain this to me and how to solve? Smith Company experienced

i dont understand how to solve # 19 & # 18. can someone help explain this to me and how to solve?

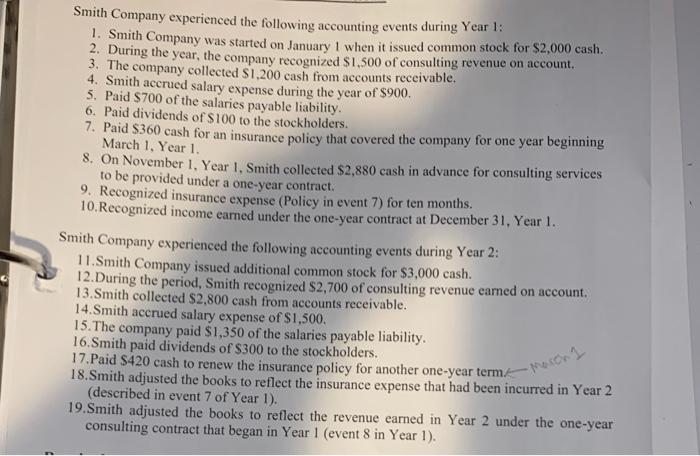

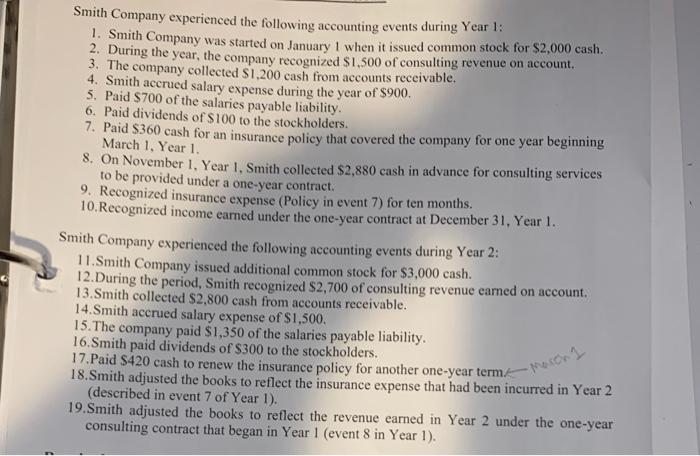

Smith Company experienced the following accounting events during Year 1: 1. Smith Company was started on January 1 when it issued common stock for $2,000 cash. 2. During the year, the company recognized $1,500 of consulting revenue on account. 3. The company collected $1,200 cash from accounts receivable, 4. Smith accrued salary expense during the year of $900. 5. Paid $700 of the salaries payable liability. 6. Paid dividends of $100 to the stockholders. 7. Paid S360 cash for an insurance policy that covered the company for one year beginning March 1, Year 1. 8. On November 1, Year 1, Smith collected $2,880 cash in advance for consulting services to be provided under a one-year contract. 9. Recognized insurance expense (Policy in event 7) for ten months. 10. Recognized income earned under the one-year contract at December 31, Year 1. Smith Company experienced the following accounting events during Year 2: 11. Smith Company issued additional common stock for $3,000 cash. 12. During the period, Smith recognized $2,700 of consulting revenue eamed on account. 13.Smith collected $2,800 cash from accounts receivable. 14.Smith accrued salary expense of $1,500. 15. The company paid $1,350 of the salaries payable liability. 16. Smith paid dividends of $300 to the stockholders. 17. Paid $420 cash to renew the insurance policy for another one-year term 18.Smith adjusted the books to reflect the insurance expense that had been incurred in Year 2 (described in event 7 of Year 1). 19.Smith adjusted the books to reflect the revenue earned in Year 2 under the one-year consulting contract that began in Year 1 (event 8 in Year 1)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started