I don't understand what is being asked for in the Analysis Component for problem 5-2A in Accounting Fundamental Principles, Volume 1, 16th Edition on page 375. Any assistance would be great.

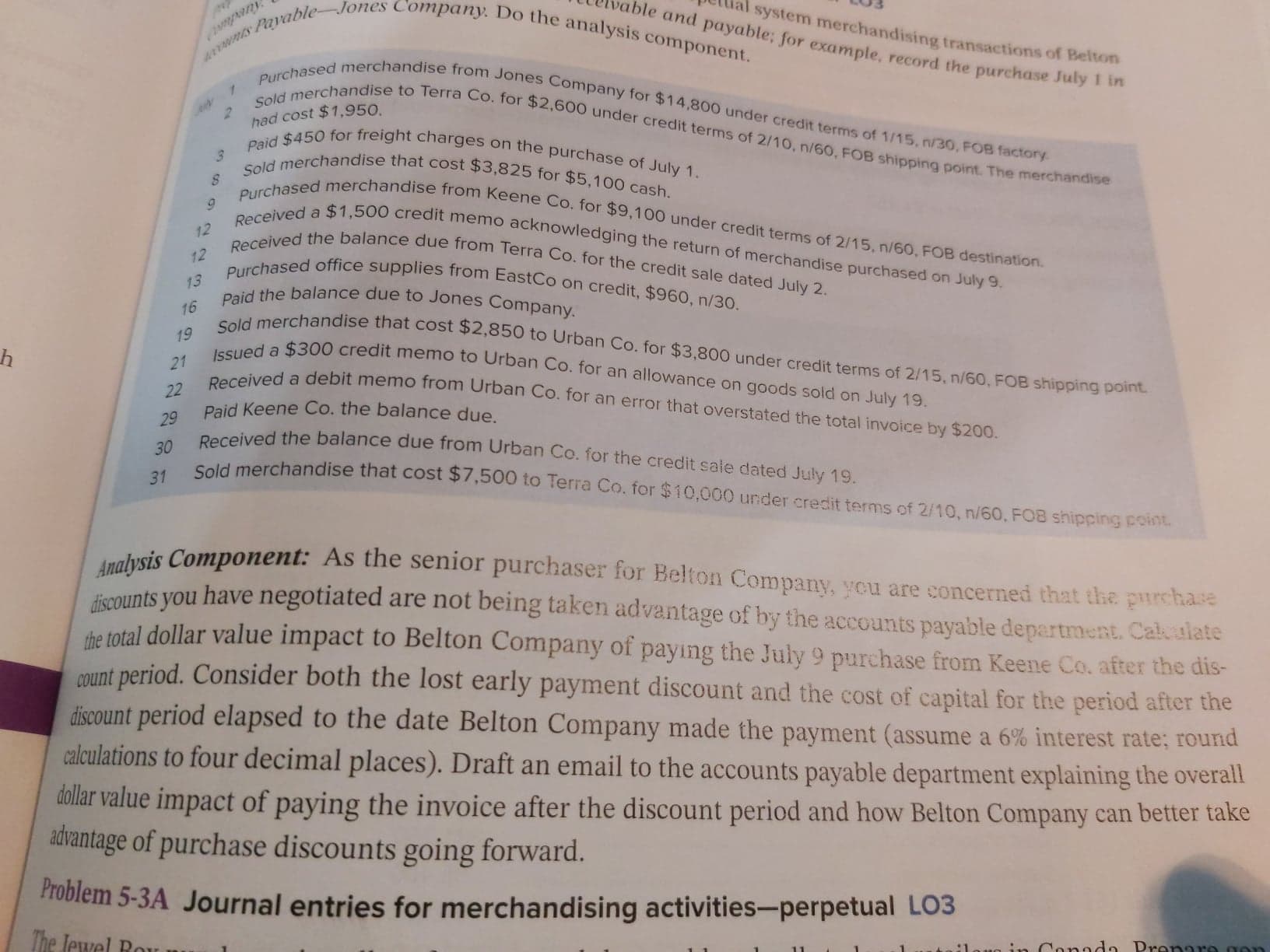

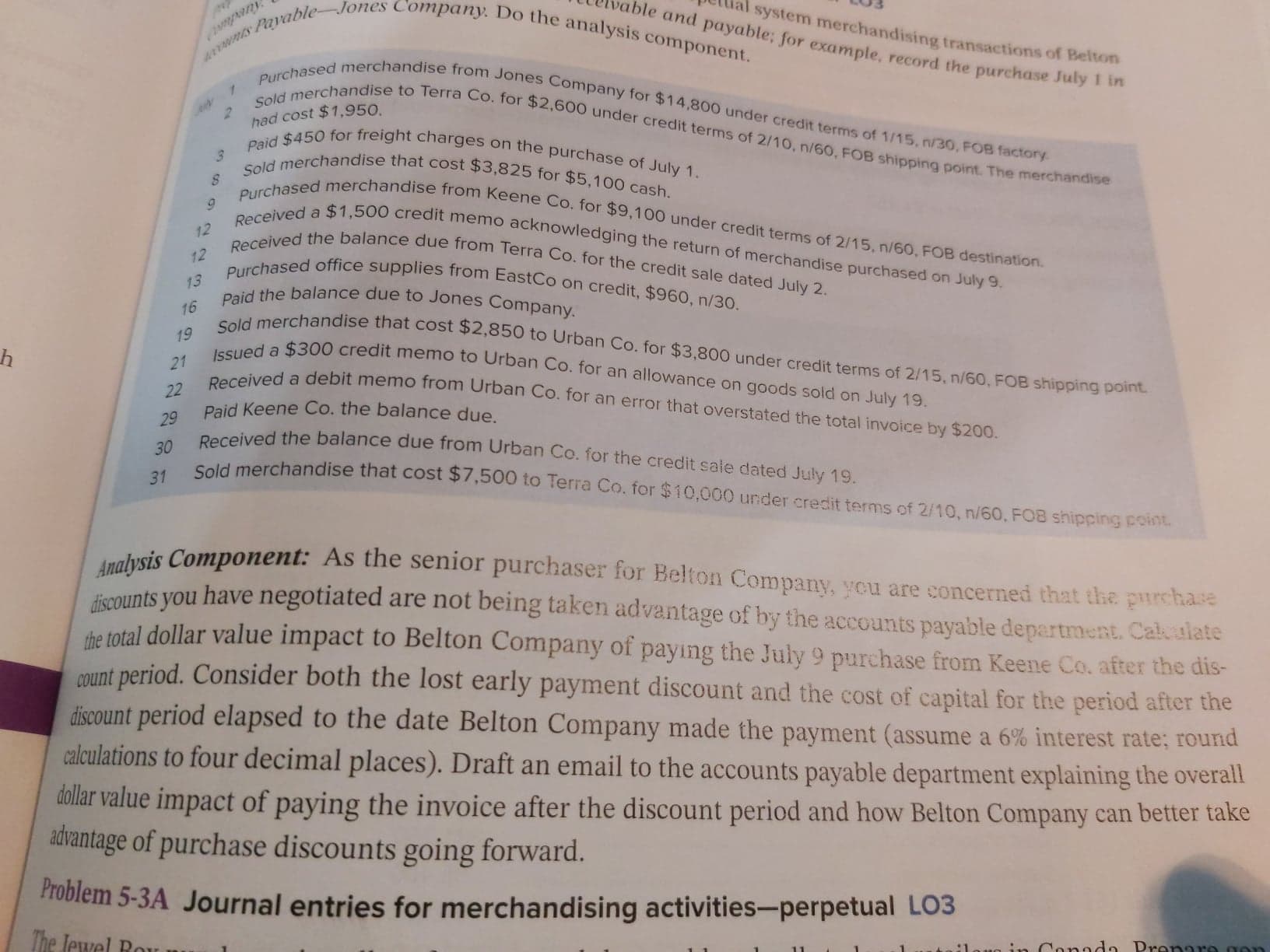

1 2 had cost $1,950. 3 able and payable; for example, record the purchase July 1 in system merchandising transactions of Belton US Pavable-Jones Company. Do the analysis component. Purchased merchandise from Jones Company for $14,800 under credit terms of 1/15, 130, FOB factory Sold merchandise to Terra Co. for $2.600 under credit terms of 2010. n/60, FOB shipping point. The merchandise Paid $450 for freight charges on the purchase of July 1. Sold merchandise that cost $3,825 for $5,100 cash. Purchased merchandise from Keene Co. for $9,100 under credit terms of 2/15, n/60, FOB destination Received a $1,500 credit memo acknowledging the return of merchandise purchased on July 9. Received the balance due from Terra Co. for the credit sale dated July 2. Purchased office supplies from EastCo on credit, $960, n/30. Paid the balance due to Jones Company. Sold merchandise that cost $2,850 to Urban Co. for $3,800 under credit terms of 2/15, n/60, FOB shipping point Issued a $300 credit memo to Urban Co. for an allowance on goods sold on July 19. 8 9 12 12 13 16 19 h 21 22 29 Received a debit memo from Urban Co. for an error that overstated the total invoice by $200. Paid Keene Co. the balance due. Received the balance due from Urban Co. for the credit sale dated July 19. Sold merchandise that cost $7,500 to Terra Co. for $10,000 under credit terms of 2/10, 1/60, FOB shipping point 30 31 Analysis Component: As the senior purchaser for Betton Company, you are concerned that the purchase discounts you have negotiated are not being taken advantage of by the accounts payable department. Cal slate the total dollar value impact to Belton Company of paying the July 9 purchase from Keene Co. after the dis- count period. Consider both the lost early payment discount and the cost of capital for the period after the discount period elapsed to the date Belton Company made the payment (assume a 6% interest rate; round calculations to four decimal places). Draft an email to the accounts payable department explaining the overall dollar value impact of paying the invoice after the discount period and how Belton Company can better take advantage of purchase discounts going forward. Problem 5-3A Journal entries for merchandising activities-perpetual LO3 The Jewel R oned Dronero