I don't want to answer to be handwriting

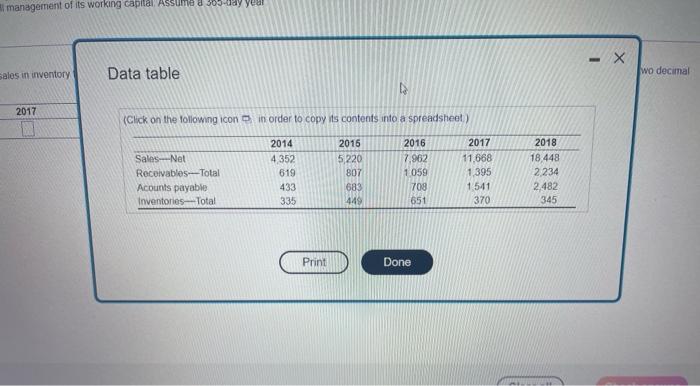

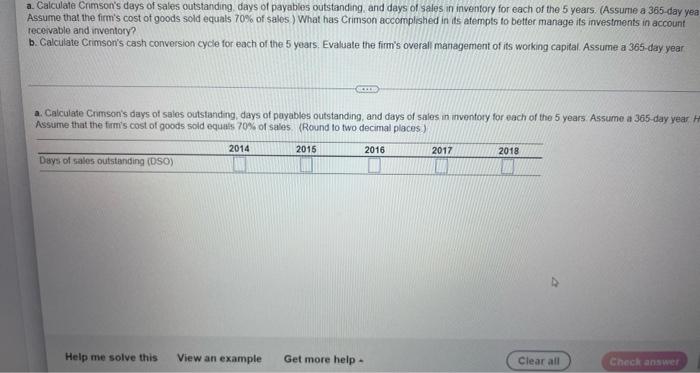

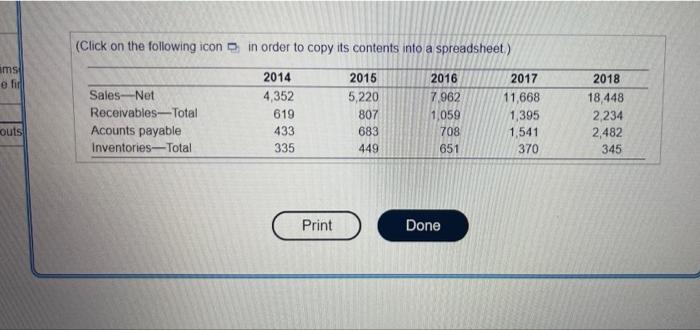

i management of its working capital Assume a 305-0ay year - X salos in inventory Data table wo decimal 2017 (Click on the following icon in order to copy its contents into a spreadsheet) Sales-Net Receivables-Total Acounts payable Inventories Total 2014 4352 619 433 335 2015 5,220 807 683 449 2016 7,962 1059 709 651 2017 11.668 1,395 1541 370 2018 18 448 2,234 2.482 345 Print Done a. Calculate Crimson's days of sales outstanding days of payables outstanding and days of sales in inventory for each of the 5 years. (Assume a 365-day yea Assume that the firm's cost of goods sold equals 70% of sales) What has Crimson accomplished in its atempts to better manage its investments in account receivable and inventory? b. Calculate Crimson's cash conversion cycle for each of the 5 years. Evaluate the firm's overall management of its working capital Assume a 365 day year a. Calculate Crimson's days of sales outstanding days of payables outstanding, and days of sales in inventory for each of the 5 years. Assume a 365 day year H Assume that the firm's cost of goods sold equals 70% of sales (Round to two decimal places) 2014 2015 2016 2017 2018 Days of sales outstanding (DSO) Help me solve this View an example Get more help Clear all Check answer (Cash conversion cycle) Historical data for the firm's sales accounts receivable, inventories, and accounts payable for the Crimson Mig Company follow a. Calculate Crimson's days of sales outstanding days of payables outstanding, and days of sales in inventory for each of the 5 years. (Assume a 365-day year Hint Assume that the firm's cost of goods sold equals 70% of sales) What has Crimson accomplished in its atempts to better manage its investments in account receivable and inventory? b. Calculate Crimson's cash conversion cyde for each of the 5 years Evaluate the firm's overall management of its working capitul. Assume a 365-day year. a. Calculate Crimson's days of sales outstanding, days of payables outstanding and days of sales in inventory for each of the 5 years. Assume a 365 day yeur. Mint Assume that the firm's cost of goods sold equals 70% of sales (Round to two decimal places) 2014 2015 2016 2017 2018 Days of sales outstanding (DSO) (Click on the following icon in order to copy its contents into a spreadsheet) ams e fid 2016 Sales Net Receivables-Total Acounts payable Inventories-Total 2014 4,352 619 433 335 2015 5,220 807 683 449 7962 1059 708 651 2017 11,668 1,395 1,541 370 2018 18,448 2,234 2,482 345 outs Print Done (Cash conversion cycle) Historical data for the firm's sales, accounts receivable, inventories, and accounts payable for the Crmson Mig Company follow a. Calculate Crimson's days of sales outstanding days of payables outstanding and days of sales in inventory for each of the 5 years (Assume a 365-day year Hint Assume that the firm's cost of goods sold equals 70% of sales. What has Crimson accomplished in its atempts to better manage its investments in account receivable and inventory? b. Calculato Crimson's cash conversion cycle for each of the 5 years Evaluate the firm's overall management of is working capital Assumo 365-day year: a. Calculate Comson's days of sales outstanding days of payablos outstanding and days of sales in inventory for each of the 5 years Assume a 305 day year Mint Assume that the firm's cost of goods sold equals 70% of sales (Round to two decimal places) 2014 2015 2016 2017 2018 Days of sales outstanding (OSO) (Cash conversion cyclo) Historical data for the firm's sales, accounts receivable, inventories, and accounts payable for the Crimson Mig Company follow a. Calculate Crimson's days of sales outstanding days of payables outstanding, and days of sales in inventory for each of the years. (Assume a 365-day your Hint Assume that the firm's cost of goods sold equals 70% of sales) What has Crimson accomplished in its atempts to better manage its investments in account receivable and inventory? b. Calculate Crimson's cash conversion cycle for each of the 5 years Evaluato the firm's overall management of its working capital Assumo a 365 day year 3: a. Calculate Crimson's days of sales outstanding days of payables outstanding and days of sales in inventory for each of the 5 years. Assume a 385-day year. Hint Assume that the firm's cost of goods sold equals 70% of sales (Round to two decimal places.) 2014 2015 2016 2017 2018 Days of sales outstanding (OSO)