I. Efficient Two Asset Portfolios Assume that the expected return on asset 1 is 5% and the expected return on asset 2 is 4%.

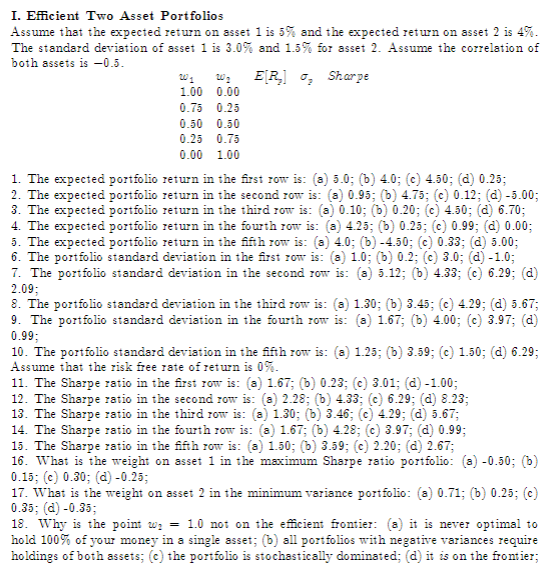

I. Efficient Two Asset Portfolios Assume that the expected return on asset 1 is 5% and the expected return on asset 2 is 4%. The standard deviation of asset 1 is 3.0% and 1.5% for asset 2. Assume the correlation of both assets is -0.5. 201 1.00 0.00 E[R] , Sharpe 0.75 0.25 0.50 0.50 0.25 0.75 0.00 1.00 1. The expected portfolio return in the first row is: (a) 5.0; (b) 4.0; (c) 4.50; (d) 0.25; 2. The expected portfolio return in the second row is: (a) 0.95; (b) 4.75; (c) 0.12; (d) -5.00; 3. The expected portfolio return in the third row is: (a) 0.10; (b) 0.20; (c) 4.50; (d) 6.70; 4. The expected portfolio return in the fourth row is: (a) 4.25; (b) 0.25; (c) 0.99; (d) 0.00; 5. The expected portfolio return in the fifth row is: (a) 4.0; (b) -4.50; (c) 0.33; (d) 5.00; 6. The portfolio standard deviation in the first row is: (a) 1.0; (b) 0.2; (c) 3.0; (d) -1.0; 7. The portfolio standard deviation in the second row is: (a) 5.12; (b) 4.33; (c) 6.29; (d) 2.09; 8. The portfolio standard deviation in the third row is: (a) 1.30; (b) 3.45; (c) 4.29; (d) 5.67; 9. The portfolio standard deviation in the fourth row is: (a) 1.67; (b) 4.00; (c) 3.97; (d) 0.99; 10. The portfolio standard deviation in the fifth row is: (a) 1.25; (b) 3.59; (c) 1.50; (d) 6.29; Assume that the risk free rate of return is 0%. 11. The Sharpe ratio in the first row is: (a) 1.67; (b) 0.23; (c) 3.01; (d) -1.00; 12. The Sharpe ratio in the second row is: (a) 2.28; (b) 4.33; (c) 6.29; (d) 8.23; 13. The Sharpe ratio in the third row is: (a) 1.30; (b) 3.46; (c) 4.29; (d) 5.67; 14. The Sharpe ratio in the fourth row is: (a) 1.67; (b) 4.28; (c) 3.97; (d) 0.99; 15. The Sharpe ratio in the fifth row is: (a) 1.50; (b) 3.59; (c) 2.20; (d) 2.67; 16. What is the weight on asset 1 in the maximum Sharpe ratio portfolio: (a) -0.50; (b) 0.15; (c) 0.30; (d) -0.25; 17. What is the weight on asset 2 in the minimum variance portfolio: (a) 0.71; (b) 0.25; (c) 0.35; (d) -0.35; 18. Why is the point w 1.0 not on the efficient frontier: (a) it is never optimal to hold 100% of your money in a single asset; (b) all portfolios with negative variances require holdings of both assets; (c) the portfolio is stochastically dominated; (d) it is on the frontier;

Step by Step Solution

3.37 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Lets solve these questions step by step 1 The expected portfolio return in the first row can be calculated using the formula for a twoasset portfolio ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started