Question

I EII WuTR 20,000 In addition to the preceding differential costs, FMW allocates fixed general and administrative costs to workshops such as these on a

I EII WuTR\ 20,000\ In addition to the preceding differential costs, FMW allocates fixed general and administrative costs to workshops such as these on a direct-labor-cost basis, at a rate of 125 percent of direct labor costs (excluding design costs). For example, if direct labor costs are

$100. FMW would also charge the job

$125for general and administrative costs. FMW prices workshops at cost plus a 25 percent fee with a 10 percent surcharge on total costs (not including the fee) if only one workshop is given. Cost equals the design costs plus materials costs plus differential labor costs plus allocated fixed costs for the purpose of setting the price to quote prospective customers. FMW is not limited by any labor or other capacity constraint.\ Requlred:\

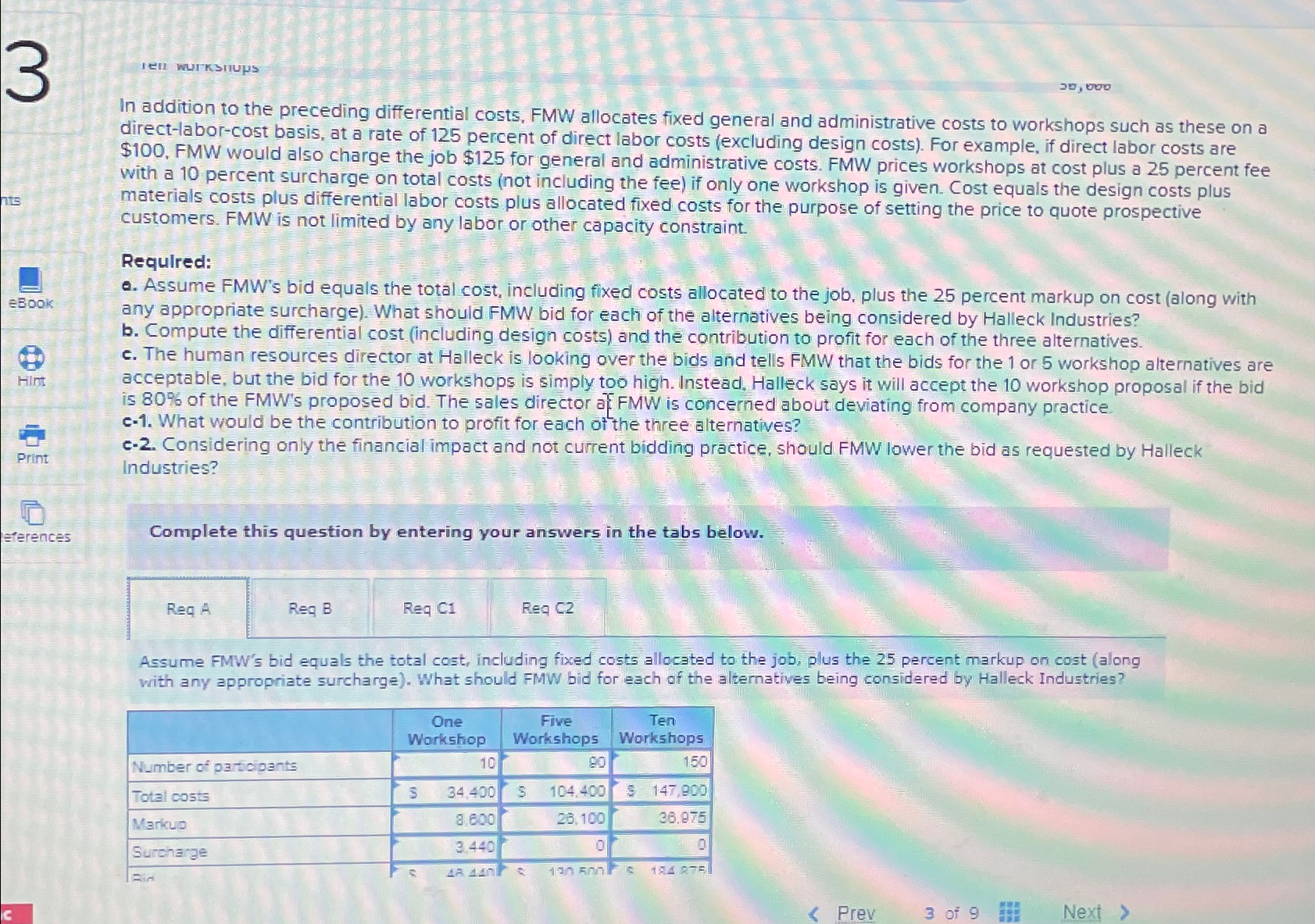

*. Assume FMW's bid equals the total cost, including fixed costs allocated to the job, plus the 25 percent markup on cost (along with any appropriate surcharge). What should FMW bid for each of the alternatives being considered by Halleck Industries?\ b. Compute the differential cost (including design costs) and the contribution to profit for each of the three alternatives.\ c. The human resources director at Halleck is looking over the bids and tells FMW that the bids for the 1 or 5 workshop alternatives are acceptable, but the bid for the 10 workshops is simply too high. Instead. Halleck says it will accept the 10 workshop proposal if the bid is

80%of the FMW's proposed bid. The sales director a FMW is concerned about deviating from company practice.\ c-1. What would be the contribution to profit for each of the three alternatives?\ c-2. Considering only the financial impact and not current bidding practice, should FMW lower the bid as requested by Halleck Industries?\ Complete this question by entering your answers in the tabs below.\ Req A\ Req B\ Req C1\ Req

C_(2)\ Assume FMW's bid equals the total cost, including fixed costs allocated to the job, plus the 25 percent markup on cost (along with any appropriate surcharge). What should FMW bid for each of the altematives being considered by Halleck Industries?\ \\\\table[[,\\\\table[[One],[Workshop]],\\\\table[[Five],[Workshops]],\\\\table[[Ten],[Workshops]]],[Number of paricipants,,10,,80,,150],[Total costs,5,34,400,

s,104,400,$,147,900],[Markuo,,8.600,,26,100,,36,975],[Surcharge,,3.440,,0,,0],[,

=,

A\\\\Delta AnI,

/bar (z),,,]]\ Prev\ 3 of 9\ If:\ Next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started