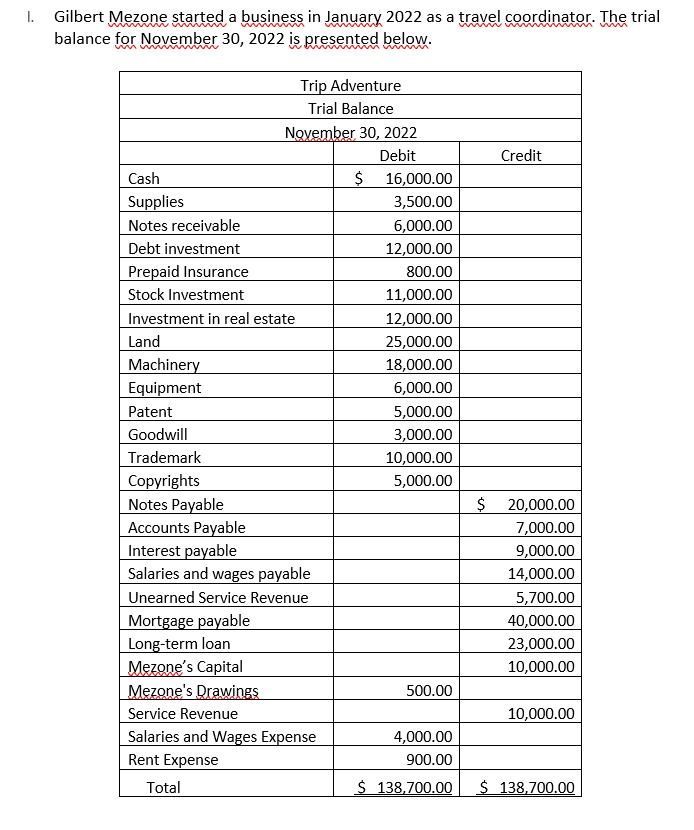

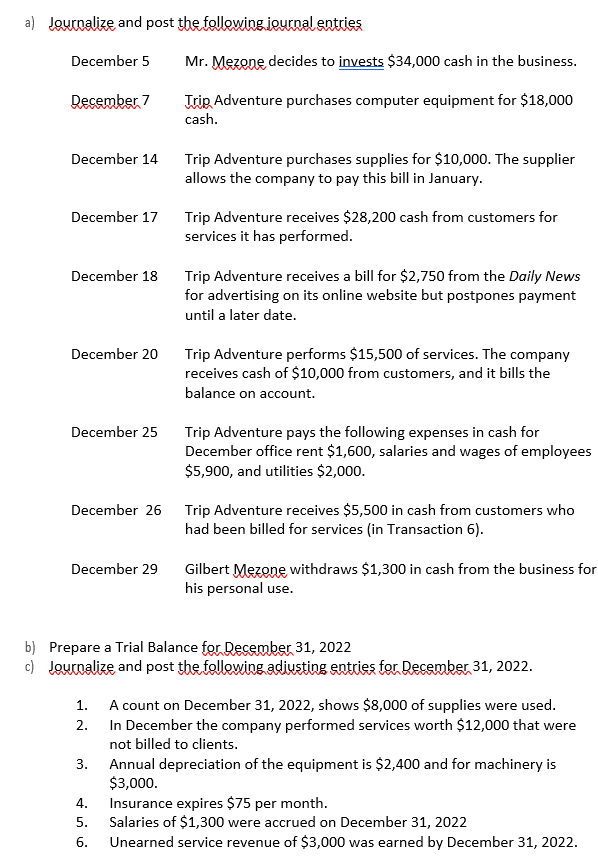

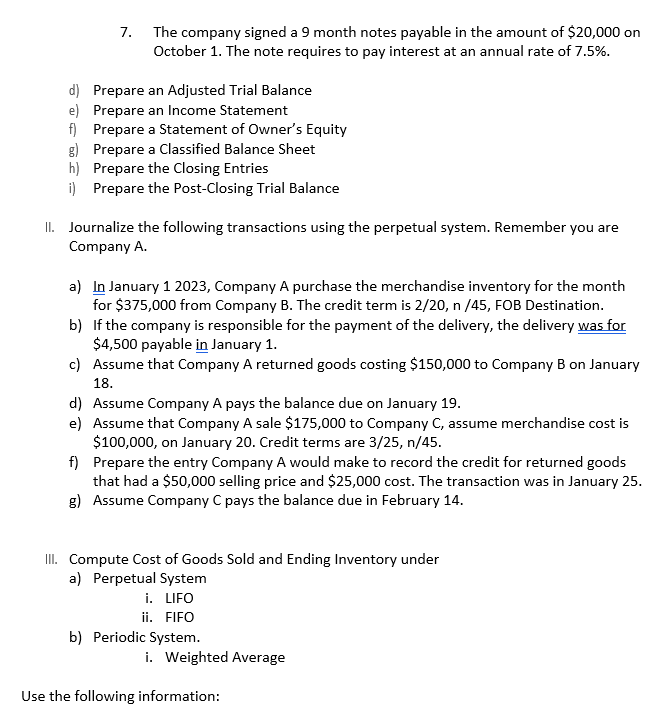

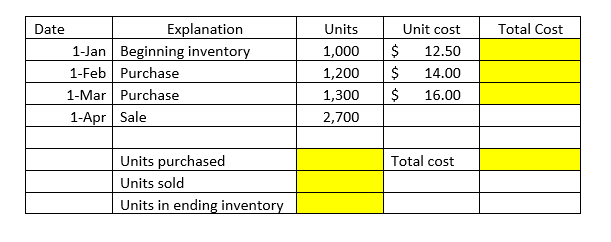

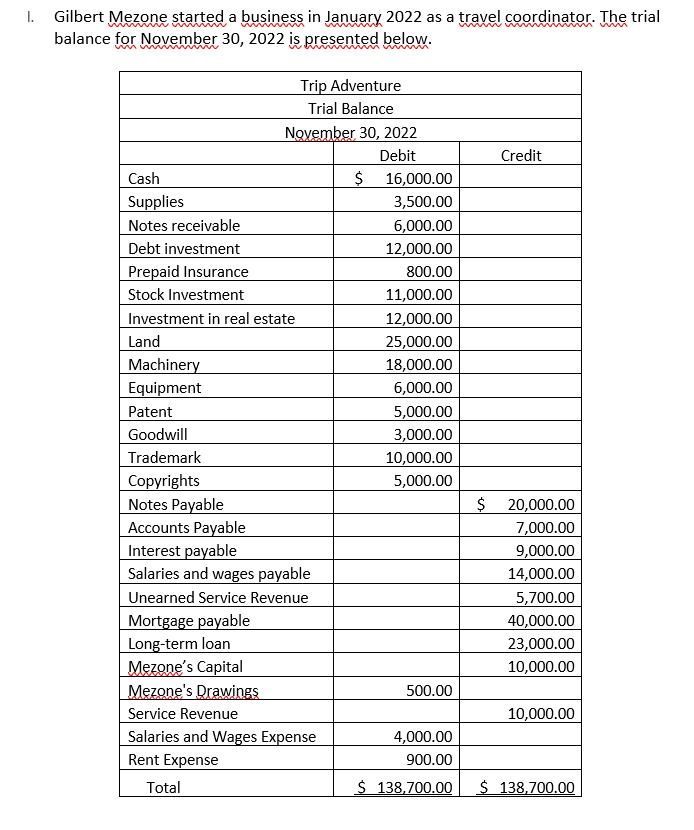

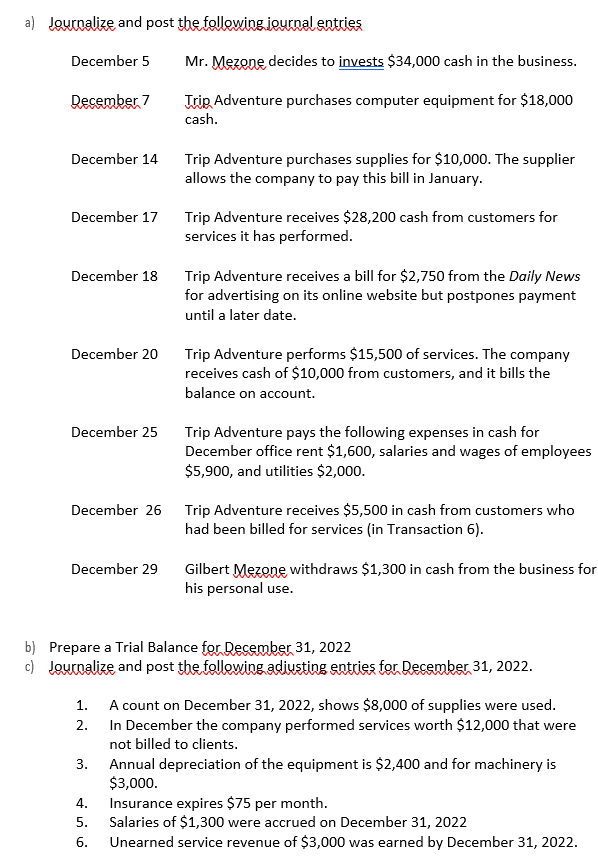

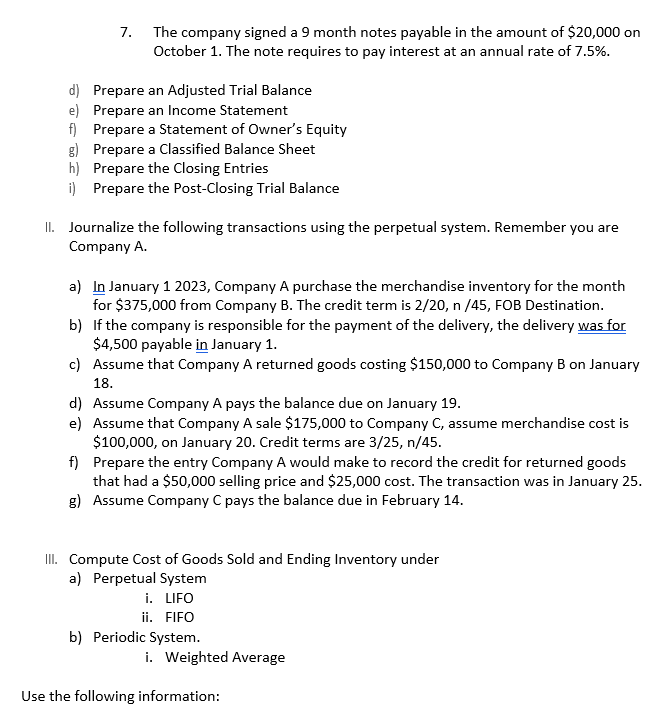

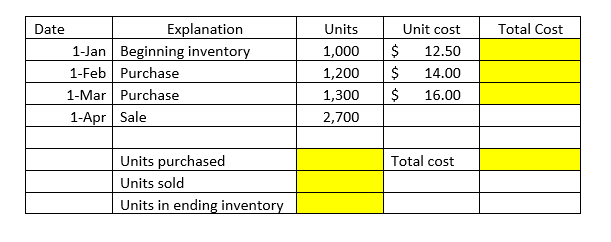

I. Gilbert Mezone started a business in January 2022 as a travel coordinator. The trial balance a) Journalize and post the follewing journal entries December 5 Mr. Mezone decides to invests $34,000 cash in the business. December 7 Trip Adventure purchases computer equipment for $18,000 cash. December 14 Trip Adventure purchases supplies for $10,000. The supplier allows the company to pay this bill in January. December 17 Trip Adventure receives $28,200 cash from customers for services it has performed. December 18 Trip Adventure receives a bill for $2,750 from the Daily News for advertising on its online website but postpones payment until a later date. December 20 Trip Adventure performs $15,500 of services. The company receives cash of $10,000 from customers, and it bills the balance on account. December 25 Trip Adventure pays the following expenses in cash for December office rent $1,600, salaries and wages of employees $5,900, and utilities $2,000. December 26 Trip Adventure receives $5,500 in cash from customers who had been billed for services (in Transaction 6). December 29 Gilbert Mezone withdraws $1,300 in cash from the business for his personal use. b) Prepare a Trial Balance for Recember 31, 2022 c) Journalize and post the follewing adjusting entries for Recember 31, 2022. 1. A count on December 31,2022 , shows $8,000 of supplies were used. 2. In December the company performed services worth $12,000 that were not billed to clients. 3. Annual depreciation of the equipment is $2,400 and for machinery is $3,000. 4. Insurance expires $75 per month. 5. Salaries of $1,300 were accrued on December 31, 2022 6. Unearned service revenue of $3,000 was earned by December 31, 2022. 7. The company signed a 9 month notes payable in the amount of $20,000 on October 1 . The note requires to pay interest at an annual rate of 7.5%. d) Prepare an Adjusted Trial Balance e) Prepare an Income Statement f) Prepare a Statement of Owner's Equity g) Prepare a Classified Balance Sheet h) Prepare the Closing Entries i) Prepare the Post-Closing Trial Balance II. Journalize the following transactions using the perpetual system. Remember you are Company A. a) In January 1 2023, Company A purchase the merchandise inventory for the month for $375,000 from Company B. The credit term is 2/20,n/45, FOB Destination. b) If the company is responsible for the payment of the delivery, the delivery was for $4,500 payable in January 1. c) Assume that Company A returned goods costing $150,000 to Company B on January 18. d) Assume Company A pays the balance due on January 19 . e) Assume that Company A sale $175,000 to Company C, assume merchandise cost is $100,000, on January 20. Credit terms are 3/25,n/45. f) Prepare the entry Company A would make to record the credit for returned goods that had a $50,000 selling price and $25,000 cost. The transaction was in January 25 . g) Assume Company C pays the balance due in February 14. III. Compute Cost of Goods Sold and Ending Inventory under a) Perpetual System i. LIFO ii. FIFO b) Periodic System. i. Weighted Average I. Gilbert Mezone started a business in January 2022 as a travel coordinator. The trial balance a) Journalize and post the follewing journal entries December 5 Mr. Mezone decides to invests $34,000 cash in the business. December 7 Trip Adventure purchases computer equipment for $18,000 cash. December 14 Trip Adventure purchases supplies for $10,000. The supplier allows the company to pay this bill in January. December 17 Trip Adventure receives $28,200 cash from customers for services it has performed. December 18 Trip Adventure receives a bill for $2,750 from the Daily News for advertising on its online website but postpones payment until a later date. December 20 Trip Adventure performs $15,500 of services. The company receives cash of $10,000 from customers, and it bills the balance on account. December 25 Trip Adventure pays the following expenses in cash for December office rent $1,600, salaries and wages of employees $5,900, and utilities $2,000. December 26 Trip Adventure receives $5,500 in cash from customers who had been billed for services (in Transaction 6). December 29 Gilbert Mezone withdraws $1,300 in cash from the business for his personal use. b) Prepare a Trial Balance for Recember 31, 2022 c) Journalize and post the follewing adjusting entries for Recember 31, 2022. 1. A count on December 31,2022 , shows $8,000 of supplies were used. 2. In December the company performed services worth $12,000 that were not billed to clients. 3. Annual depreciation of the equipment is $2,400 and for machinery is $3,000. 4. Insurance expires $75 per month. 5. Salaries of $1,300 were accrued on December 31, 2022 6. Unearned service revenue of $3,000 was earned by December 31, 2022. 7. The company signed a 9 month notes payable in the amount of $20,000 on October 1 . The note requires to pay interest at an annual rate of 7.5%. d) Prepare an Adjusted Trial Balance e) Prepare an Income Statement f) Prepare a Statement of Owner's Equity g) Prepare a Classified Balance Sheet h) Prepare the Closing Entries i) Prepare the Post-Closing Trial Balance II. Journalize the following transactions using the perpetual system. Remember you are Company A. a) In January 1 2023, Company A purchase the merchandise inventory for the month for $375,000 from Company B. The credit term is 2/20,n/45, FOB Destination. b) If the company is responsible for the payment of the delivery, the delivery was for $4,500 payable in January 1. c) Assume that Company A returned goods costing $150,000 to Company B on January 18. d) Assume Company A pays the balance due on January 19 . e) Assume that Company A sale $175,000 to Company C, assume merchandise cost is $100,000, on January 20. Credit terms are 3/25,n/45. f) Prepare the entry Company A would make to record the credit for returned goods that had a $50,000 selling price and $25,000 cost. The transaction was in January 25 . g) Assume Company C pays the balance due in February 14. III. Compute Cost of Goods Sold and Ending Inventory under a) Perpetual System i. LIFO ii. FIFO b) Periodic System. i. Weighted Average