Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i got part A correct, i am stuck on the rest of the question. I accidentally marked on the page. i was just showing that

i got part A correct, i am stuck on the rest of the question. I accidentally marked on the page. i was just showing that I got A done, but then stuck.

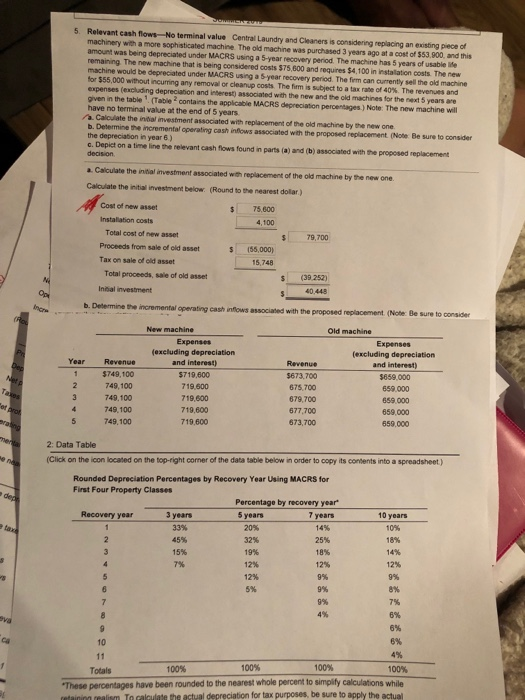

Relevant cash flow No terminale Central Laundry and Cleaners is considering replacing an existing pece of machinery w more sophisticated machine The old machine was purchased 3 years ago at a cost of $5300, and this amount was being depreciated under MACRS using a 5-year recovery period. The machine has 5 years of us remaining the new machine that is being considered costs $75,500 and requires $4,100 in installation costs. The new e machine would be deprecated under MACRS using a 5 year recovery period. The firm can currently sell the old machine for $55,000 without incurring any removal or cleanup costs. The firm is subject to a tax rate of 40%. The revenues and expenses (excluding depreciation and interest associated with the new and the old machines for the next 5 years are given in the table Table contains the applicable MACRS depreciation percentages) Note: The new machine will have no terminal value at the end of 5 years Calculate the initial investment associated with replacement of the old machine by the new one b. Determine the incremental operating cash inflows associated with the proposed replacement Not Be sure to consider the depreciation in year 6) c. Depict on a timeline the relevant cash flows found in parts and cited the proposed replacement Calculate the in v estment associated with replacement of the old machine by the new one. Calculate the initial investment below (Round to the nearest dolar) Cost of new asset $ 75.000 Installation costs 4,100 Total cost of new asset $ 79,700 Proceeds from sale of old asset s (56,000) Tax on sale of old asset 15 748 Total proceeds of old asset $ 002 Inicial investment 40 44 Den enement operating cash fows s ed with the proposed replacement. (Not Be sure to consider Revenue $740 100 749 100 New machine Expenses (excluding depreciation and interest) 5710 600 719.500 719.600 719.500 719.600 Revenue 5673.700 675.700 679.700 677,700 673,700 Old machine Expenses (excluding depreciation and interest) 3850 000 650.000 659.000 659 000 559.000 749.100 749 100 749.100 2. Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year Recovery year 3 years 5 years 7 years 10 years 20% 14% 18% 25% 18% 19% 12% 123 12% 9% 125 5% 8% 7% 6% 6% Total 100% 100% 100% 100% These percentages have been founded to the nearest whole percent to simply calculations while ca Tocal the actual depreciation for tax purposes, be sure to apply the actual Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started