Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I got these wrong, please help and explain. Question 2: A bundle of consumer goods in Mexico costs MXN 500 and the same bundle of

I got these wrong, please help and explain.

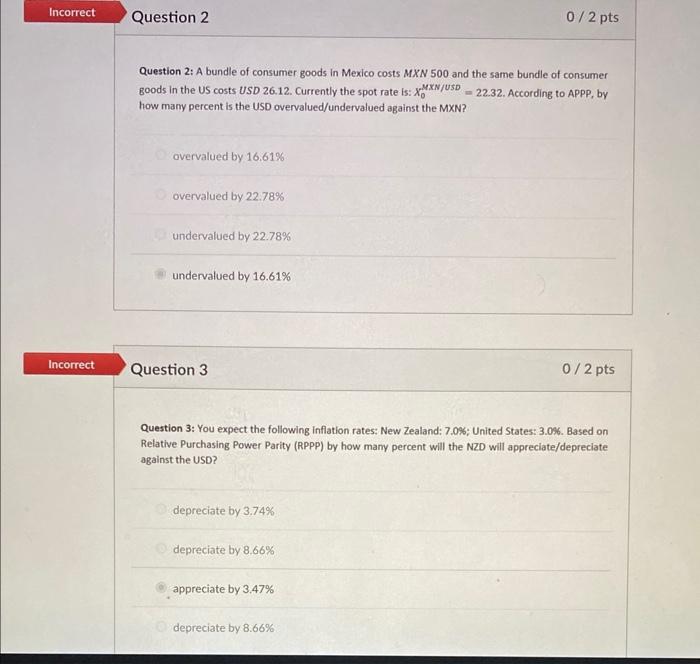

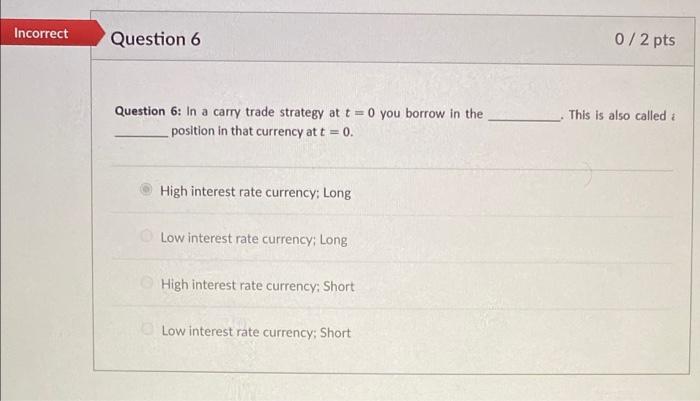

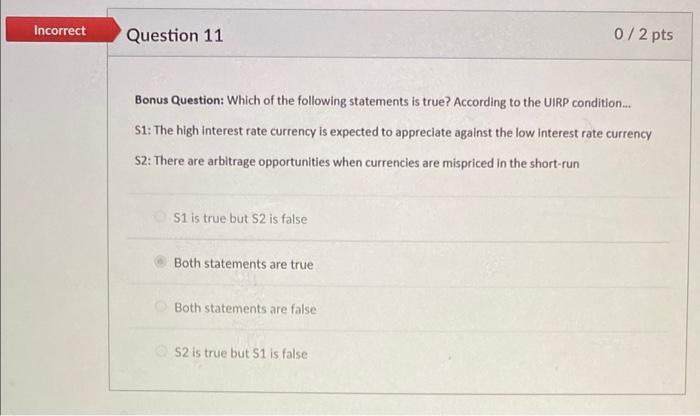

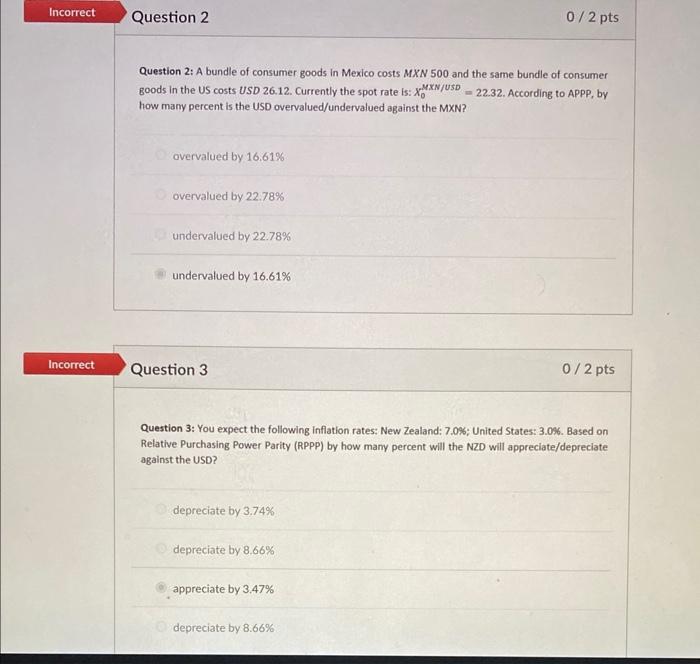

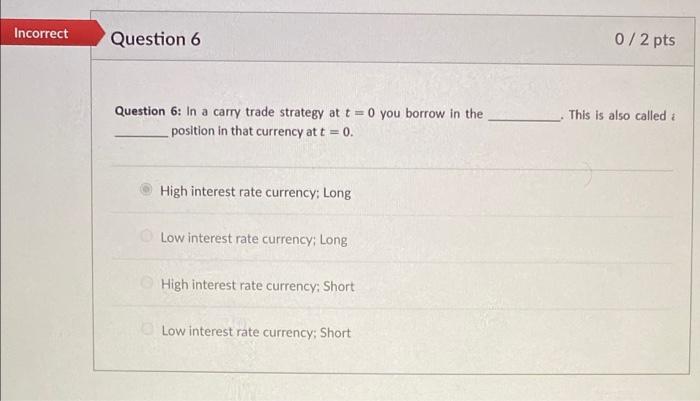

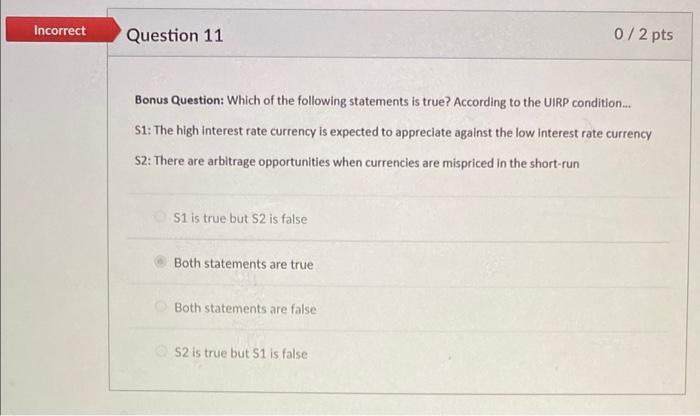

Question 2: A bundle of consumer goods in Mexico costs MXN 500 and the same bundle of consumer goods in the US costs USD 26.12. Currently the spot rate is: X0MXN/USD=22.32. According to APPP, by how many percent is the USD overvalued/undervalued against the MXN? overvalued by 16.61% overvalued by 22.78% undervalued by 22.78% undervalued by 16.61% Question 3 0/2 pts Question 3: You expect the following inflation rates: New Zealand: 7.0\%; United States: 3.0\%. Based on Relative Purchasing Power Parity (RPPP) by how many percent will the NZD will appreciate/depreciate against the USD? depreciate by 3.74% depreciate by 8.66% appreciate by 3.47% depreciate by 8.66% Question 6: In a carry trade strategy at t=0 you borrow in the This is also called : position in that currency at t=0. High interest rate currency; Long Low interest rate currency; Long High interest rate currency: Short Low interest rate currency; Short Bonus Question: Which of the following statements is true? According to the UIRP condition... S1: The high interest rate currency is expected to appreciate against the low interest rate currency \$2: There are arbitrage opportunities when currencies are mispriced in the short-run S1 is true but S2 is false Both statements are true Both statements are false $2 is true but $1 is false

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started