Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I had more struggle with explaining part b, so that's the one I'm really focused on. Consider the following 2022 financial statements for Rocket Inc.

I had more struggle with explaining part b, so that's the one I'm really focused on.

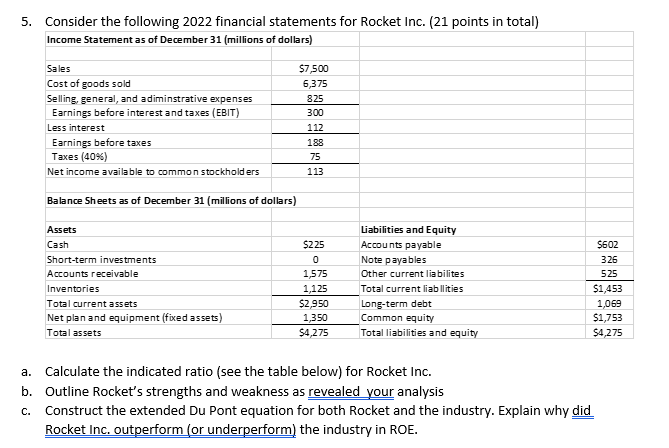

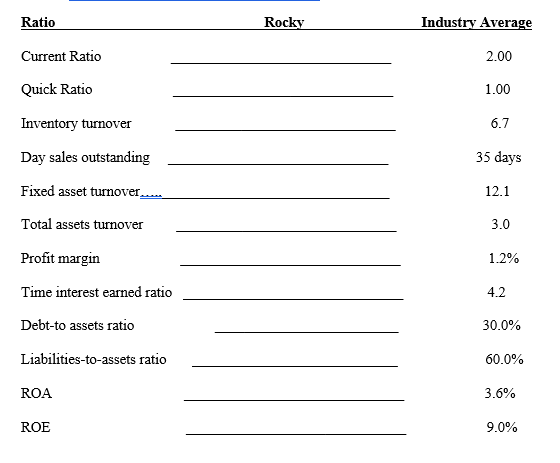

Consider the following 2022 financial statements for Rocket Inc. (21 points in total) Calculate the indicated ratio (see the table below) for Rocket Inc. . Outline Rocket's strengths and weakness as revealed your analysis . Construct the extended Du Pont equation for both Rocket and the industry. Explain why did Rocket Inc. outperform (or underperform) the industry in ROE. \begin{tabular}{|c|c|c|} \hlineRatio & Rocky & Industry Average \\ \hline Current Ratio & & 2.00 \\ \hline Quick Ratio & & 1.00 \\ \hline Inventory turnover & & 6.7 \\ \hline Day sales outstanding & & 35 days \\ \hline Fixed asset turnover & & 12.1 \\ \hline Total assets turnover & & 3.0 \\ \hline Profit margin & & 1.2% \\ \hline Time interest earned ratio & & 4.2 \\ \hline Debt-to assets ratio & & 30.0% \\ \hline Liabilities-to-assets ratio & & 60.0% \\ \hline ROA & & 3.6% \\ \hline ROE & & 9.0% \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started