Answered step by step

Verified Expert Solution

Question

1 Approved Answer

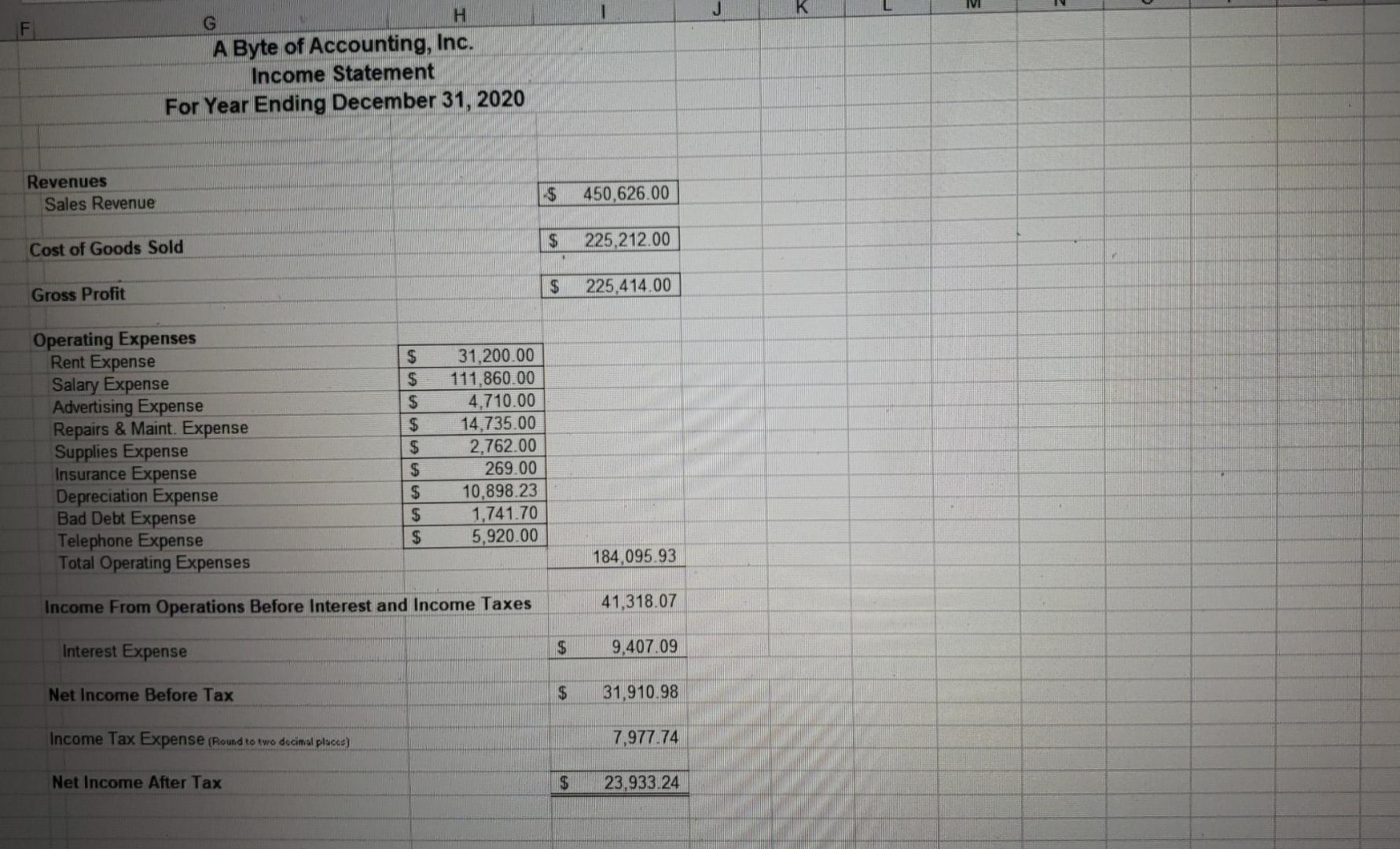

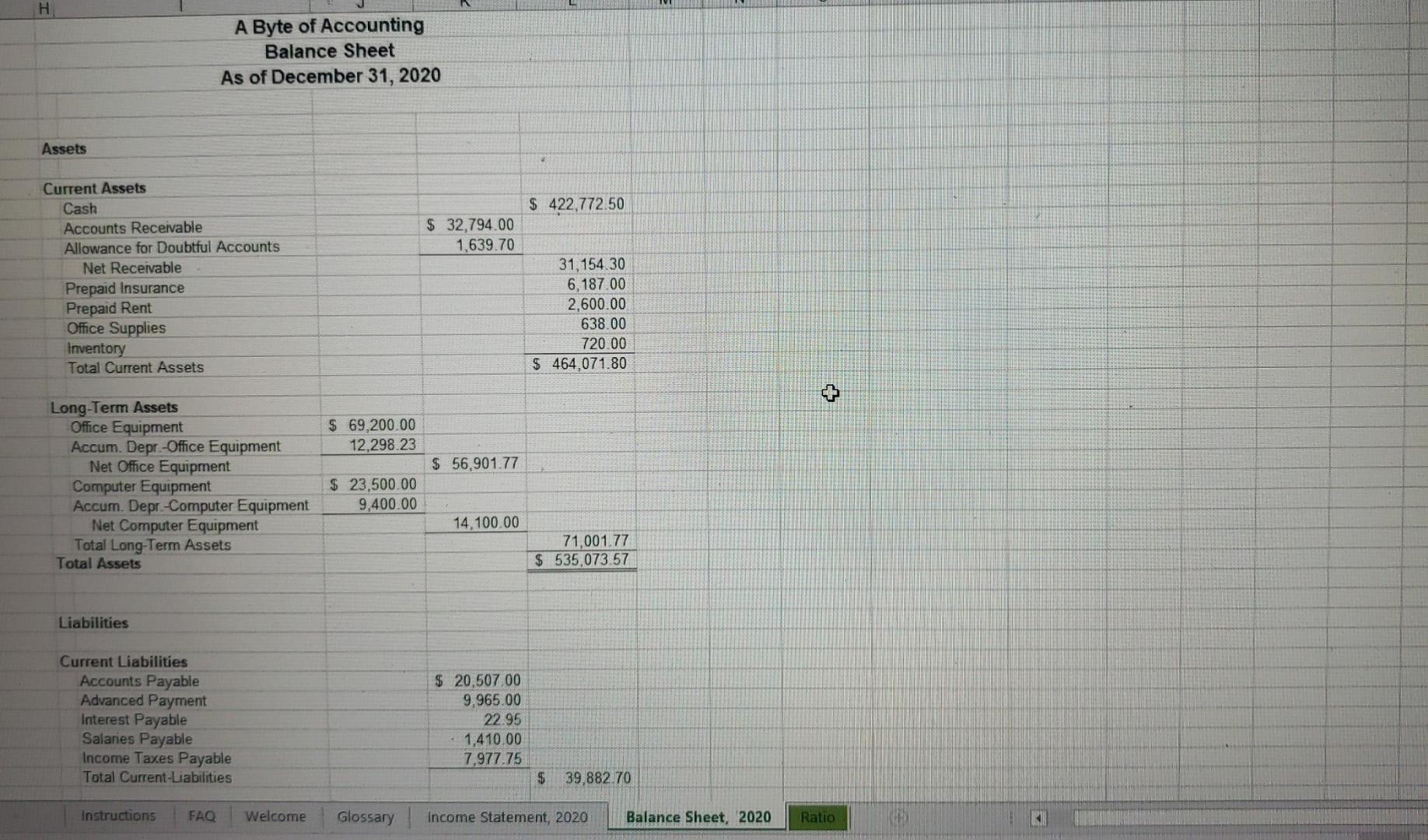

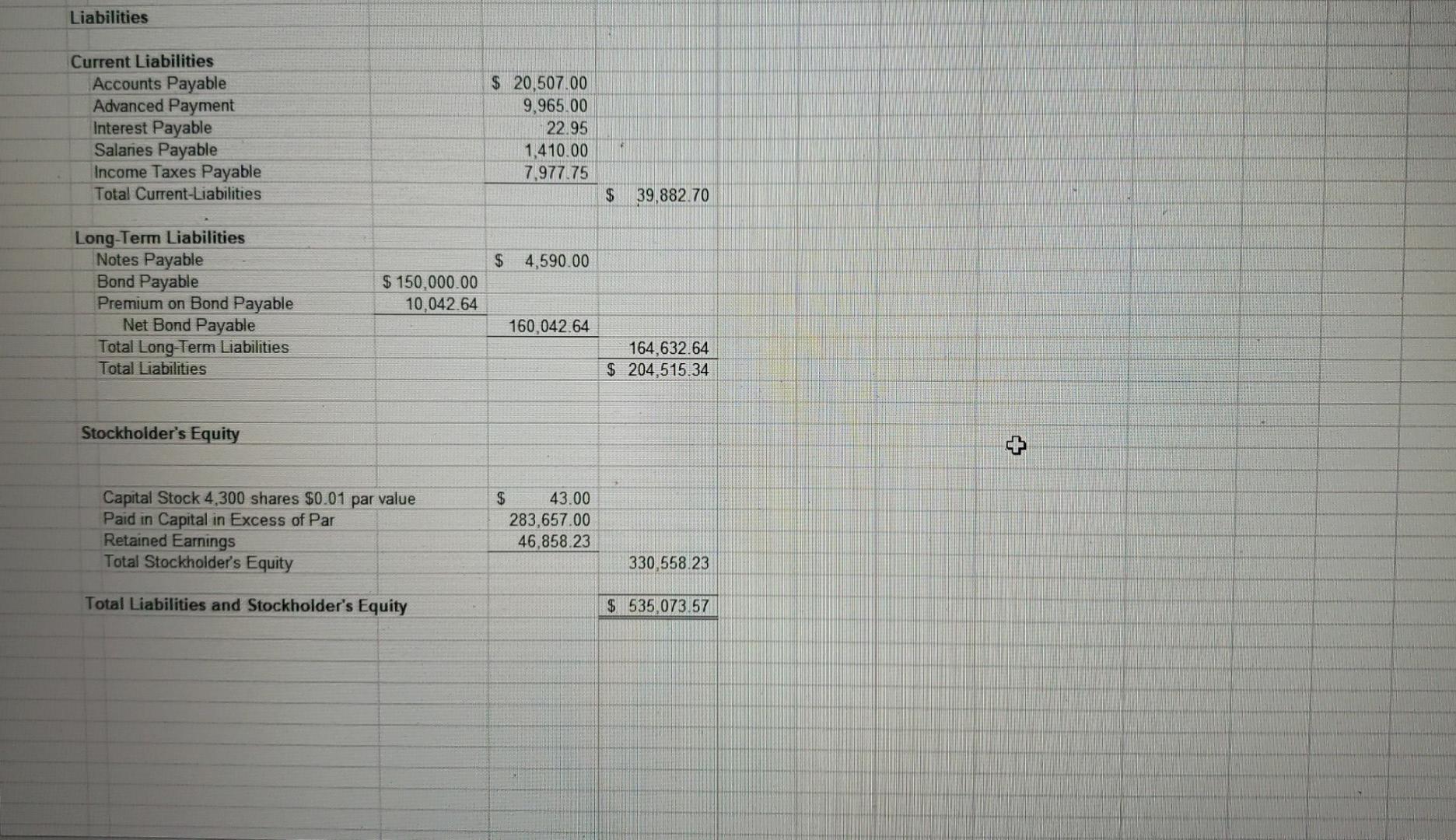

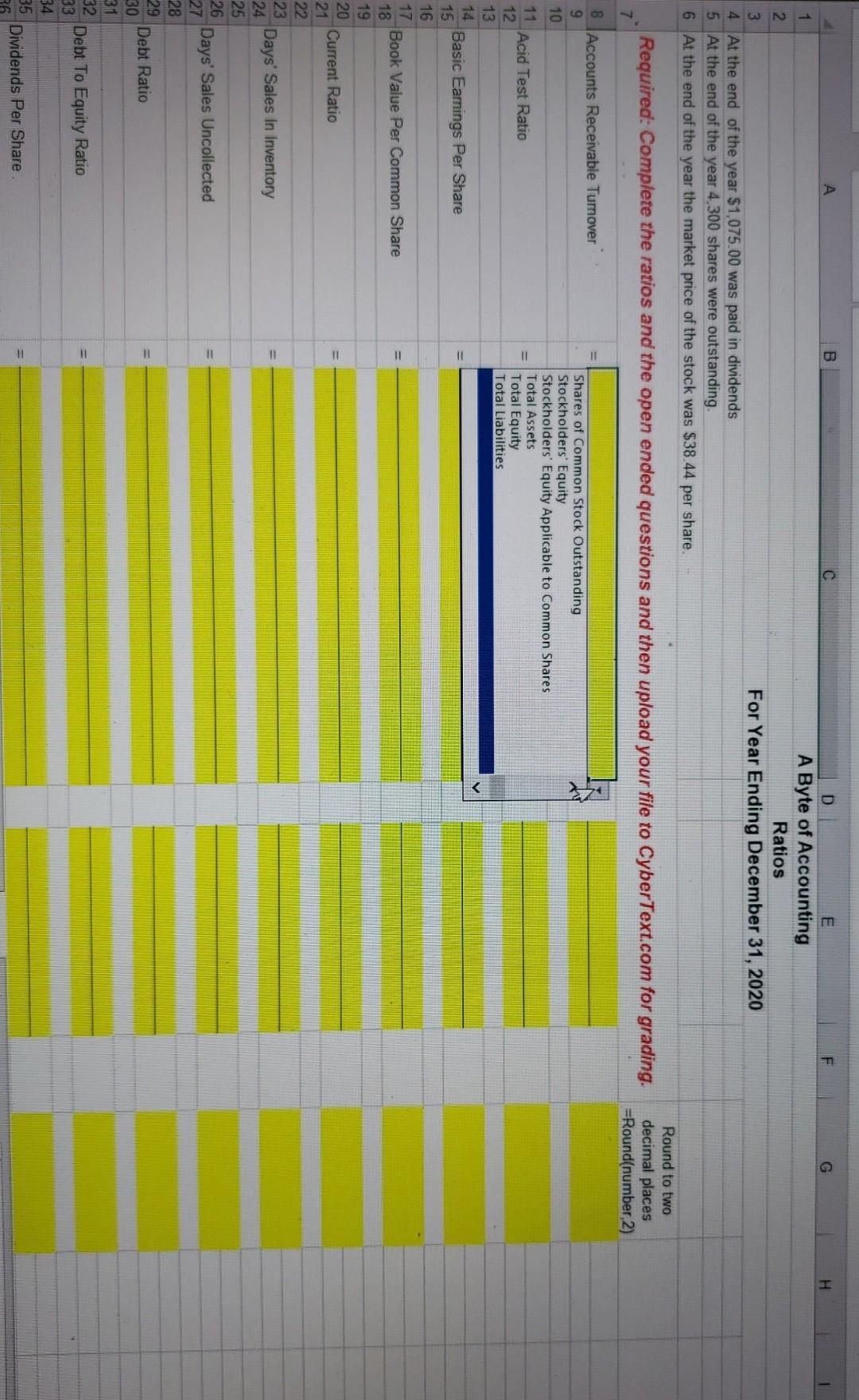

I had to repost my question it was never answered yesterday 2 G H A Byte of Accounting, Inc. Income Statement For Year Ending December

I had to repost my question it was never answered yesterday

2 G H A Byte of Accounting, Inc. Income Statement For Year Ending December 31, 2020 Revenues Sales Revenue $ 450,626.00 $ 225,212.00 Cost of Goods Sold $ Gross Profit 225,414.00 Operating Expenses Rent Exper Salary Expense Advertising Expense Repairs & Maint. Expense Supplies Expense Insurance Expense Depreciation Expense Bad Debt Expense Telephone Expense Total Operating Expenses $ $ $ $ $ $ $ $ $ 31.200.00 111,860.00 4,710.00 14,735.00 2,762.00 269.00 10,898.23 1,741.70 5,920.00 184,095.93 Income From Operations Before Interest and Income Taxes 41,318.07 Interest Expense $ 9,407.09 Net Income Before Tax $ 31,910.98 Income Tax Expense (Round to wo decimal place) 7,977.74 Net Income After Tax $ 23.933.24 H A Byte of Accounting Balance Sheet As of December 31, 2020 Assets $ 422,772.50 $ 32,794.00 1,639.70 Current Assets Cash Accounts Receivable Allowance for Doubtful Accounts Net Receivable Prepaid Insurance Prepaid Rent Office Supplies Inventory Total Current Assets 31,154.30 6,187.00 2,600.00 638.00 720.00 $ 464,071.80 $ 69,200.00 12,298.23 $ 56.901.77 Long-Term Assets Office Equipment Accum. Depr.-Office Equipment Net Office Equipment Computer Equipment Accum. Depr.-Computer Equipment Net Computer Equipment Total Long-Term Assets Total Assets $ 23,500.00 9,400.00 14,100.00 71,001.77 $ 535,073.57 Liabilities Current Liabilities Accounts Payable Advanced Payment Interest Payable Salaries Payable Income Taxes Payable Total Current-Liabilities $ 20,507.00 9,965.00 22.95 1,410.00 7,977.75 $ 39,882.70 Instructions FAQ Welcome Glossary Income Statement, 2020 Balance Sheet, 2020 Ratio Liabilities Current Liabilities Accounts Payable Advanced Payment Interest Payable Salaries Payable Income Taxes Payable Total Current-Liabilities $ 20,507.00 9,965.00 22.95 1,410.00 7,977.75 $ 39,882.70 $ 4,590.00 Long-Term Liabilities Notes Payable Bond Payable Premium on Bond Payable Net Bond Payable Total Long-Term Liabilities Total Liabilities $ 150,000.00 10,042.64 160,042.64 164,632.64 $ 204,515.34 Stockholder's Equity + Capital Stock 4,300 shares $0.01 par value Paid in Capital in Excess of Par Retained Earnings Total Stockholder's Equity $ 43.00 283,657.00 46,858.23 330,558.23 Total Liabilities and Stockholder's Equity $ 535,073.57 c F H AWN D E A Byte of Accounting Ratios For Year Ending December 31, 2020 4 At the end of the year $1,075,00 was paid in dividends 5 At the end of the year 4,300 shares were outstanding 6 At the end of the year the market price of the stock was $38.44 per share. Required: Complete the ratios and the open ended questions and then upload your file to CyberText.com for grading. Round to two decimal places =Round(number,2) 7 Shares of Common Stock Outstanding Stockholders' Equity Stockholders' Equity Applicable to Common Shares Total Assets Total Equity Total Liabilities = 8 Accounts Receivable Turnover 9 10 11 Acid Test Ratio 12 13 14 Basic Earnings Per Share 15 16 17 Book Value Per Common Share 18 19 20 Current Ratio 21 22 23 Days' Sales In Inventory 24 25 26 Days' Sales Uncollected 27 28 29 Debt Ratio 30 31 32 Debt To Equity Ratio 33 34 35 Dividends Per Share 37 38 Dividend Yield 39 40 41 Fixed Asset Turnover Ratio 42 43 44 Gross Margin Ratio 45 46 47 Inventory Turnover 48 49 50 Operating Margin Ratio 51 52 53 Price Earnings Ratio 54 55 56 Profit Margin 57 58 59 Retum on Assets 60 61 62 Time Interest Earned 63 64 65 Total Asset Turnover 66 67 68 Use complete sentences to complete the fill in questions 69 70 Interpret and explain this company's 71 Current Ratio 72 73 74 75 76 Instructions FAQ Welcome Glossary Ratio Balance Sheet, 2020 Income Statement, 2020 Ready LO d A 19Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started