I have a few unanswered questions

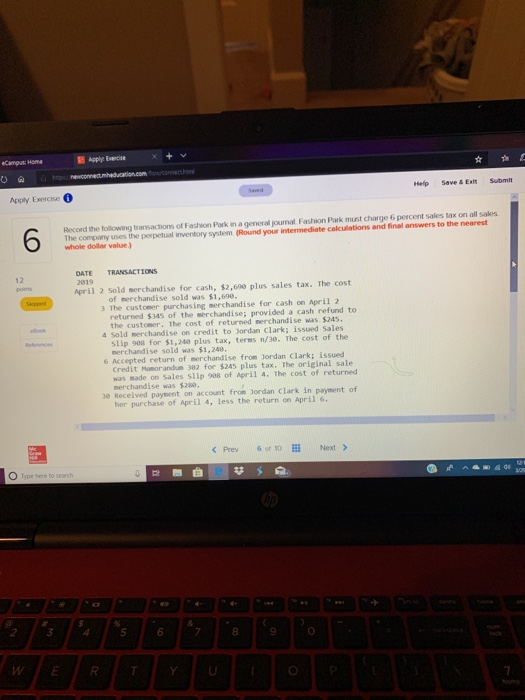

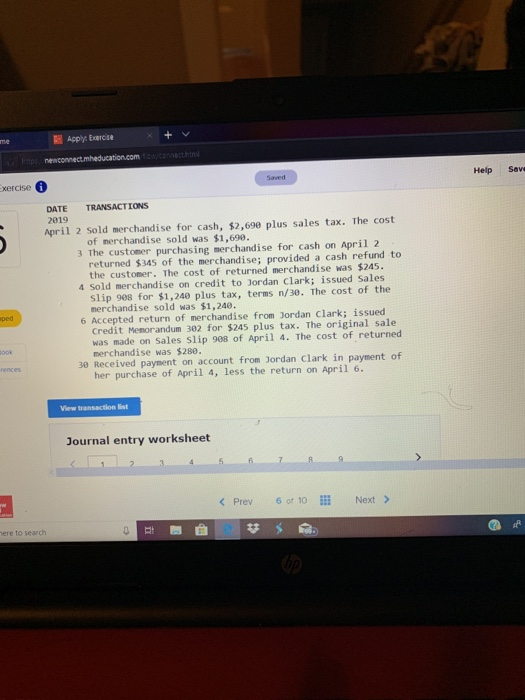

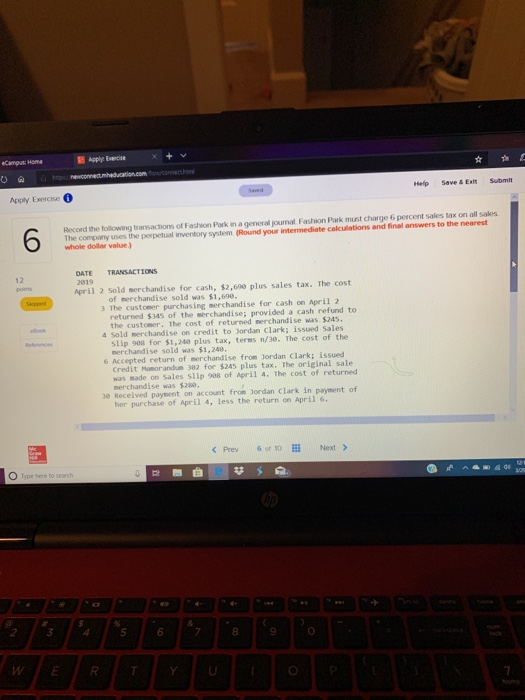

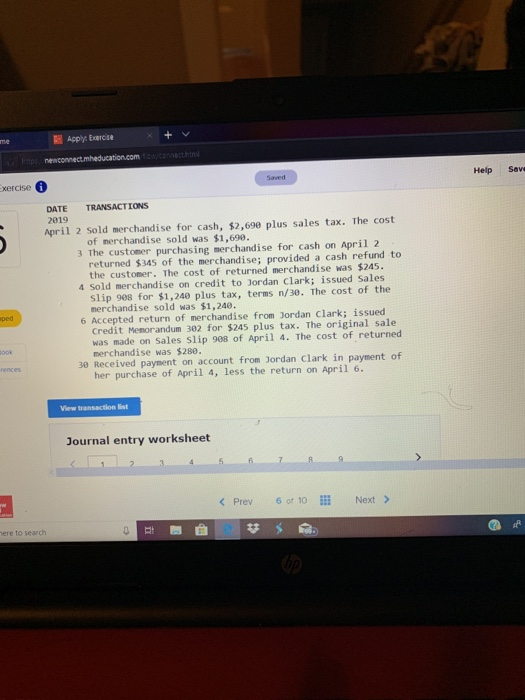

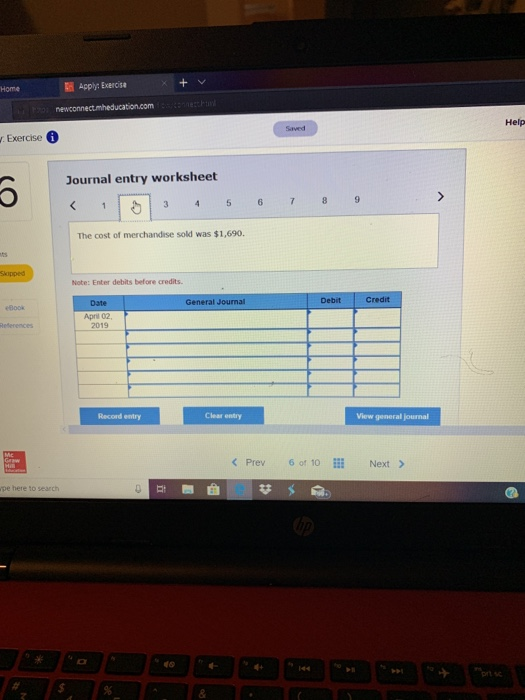

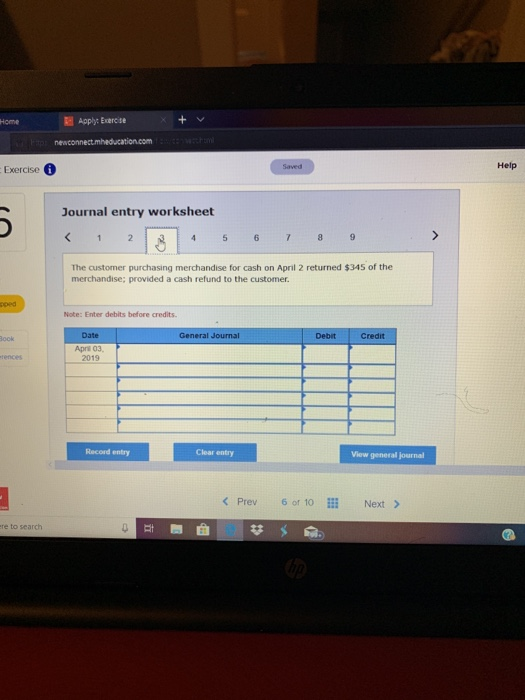

Campus Home Apple Excise o a Help Save & Extt Submit Apply Exercise Record the following transactions of Fashion Park in a general journal Fashion Park must charge 6 percent sales tax on all saks The company uses the perpetual inventory system (Round your intermediate calculations and final answers to the nearest whole dollar value) DATE TRANSACTIONS 2019 April 2 Sold merchandise for cash, $2,690 plus sales tax. The cost 12 of nerchandise sold was $1,690 3 The customer purchasing serchandise for cash on April 2 4 Sold merchandise on credit to Jordan clark; issued sales 6 Accepted return of merchandise from Jordan Clark; issued 30 Received payment on account from Jordan Clark in payment of returned $345 of the merchandise; provided a cash refund to the customer. The cost of returned nerchandise was $245 slip 908 for $1,240 plus tax, terms n/30. The cost of the merchandise sold was $1,240. Credit Mamorandun 382 for $245 plus tax. The original sale was made on Sales slip 908 of April 4. The cost of returned nerchandise was $280, her purchase of April 4, less the return on April 6

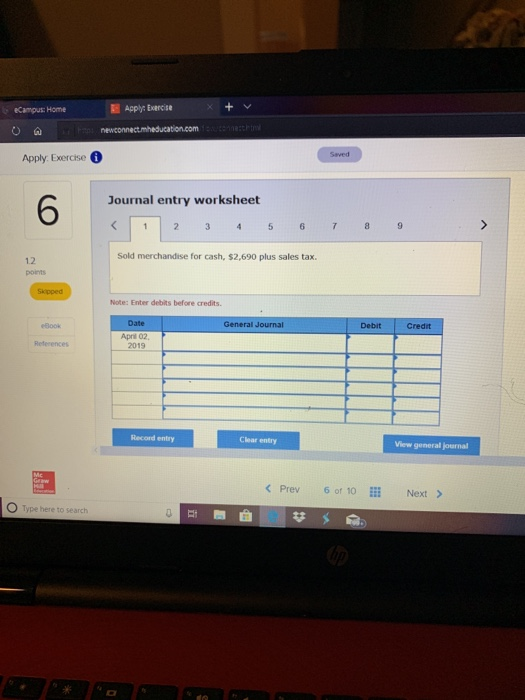

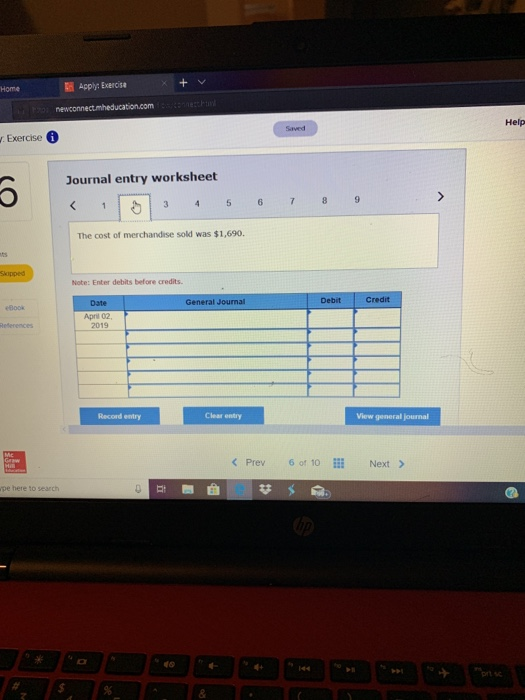

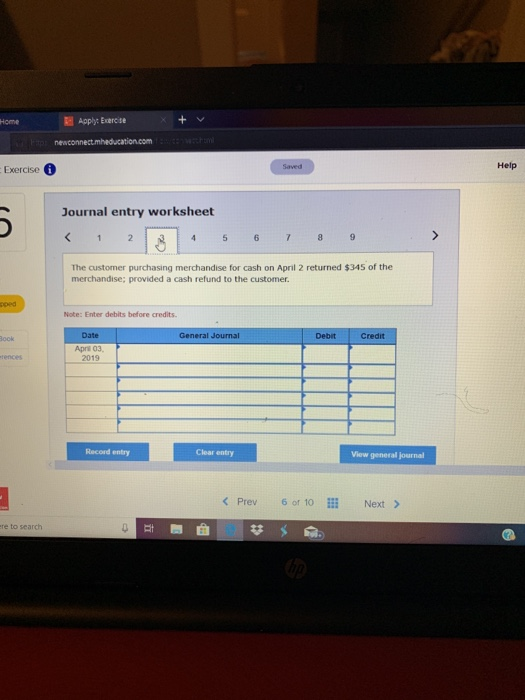

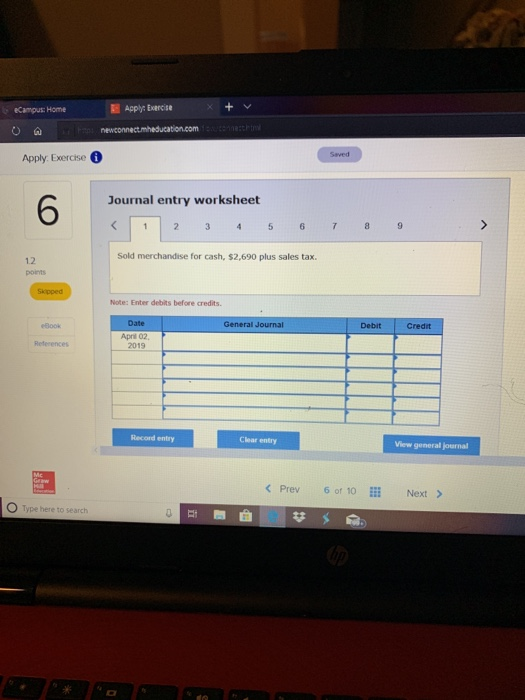

6 8 Apply Exercise xercise Help Sav DATE TRANSACTIONS 2019 April 2 Sold merchandise for cash, $2,698 plus sales tax. The cost of nerchandise sold was $1,690. 3 The customer purchasing merchandise for cash on April 2 returned $345 of the merchandise; provided a cash refund to the custoner. The cost of returned merchandise was $245. 4 Sold merchandise on credit to Jordan Clark; issued Sales slip 908 for $1,240 plus tax, terms n/30. The cost of the merchandise sold was $1,249. ped 6 Accepted return of merchandise from Jordan Clark; issued Credit Menorandum 302 for $245 plus tax. The original sale was made on sales slip 908 of April 4. The cost of returned merchandise was $280 30 Received payment on account from Jordan Clark in payment of her purchase of April 4, less the return on April 6. Journal entry worksheet ere to search eCampus: Home Appe Exercise Apply. Exercise 6 Journal entry worksheet Sold merchandise for cash, $2,690 plus sales tax. 1.2 points Note: Enter debits before credits. eBook Date General Journal Debit Credit Apni 02, 2019 Record entry Clear entry View general journal Type here to search Home Apply: Exeros Help Saved . Exercise G Journal entry worksheet The cost of merchandise sold was $1,690. Note: Enter debits before credits. General Journal DebitCredit Date Apri 02, 2019 Record entry Clear entry View general journal pe here to search 8 Home R Apply: Exercise Help Exercise Journal entry worksheet The customer purchasing merchandise for cash on April 2 returned $345 of the merchandise; provided a cash refund to the customer. Note: Enter debits before credits Date Debit Credit Apri 03, 2019 Record entry Clear entry View general journal re to search