I have a question about #9. The answer is $1700( 19600-17600). Can you please explain to me? Thanks.

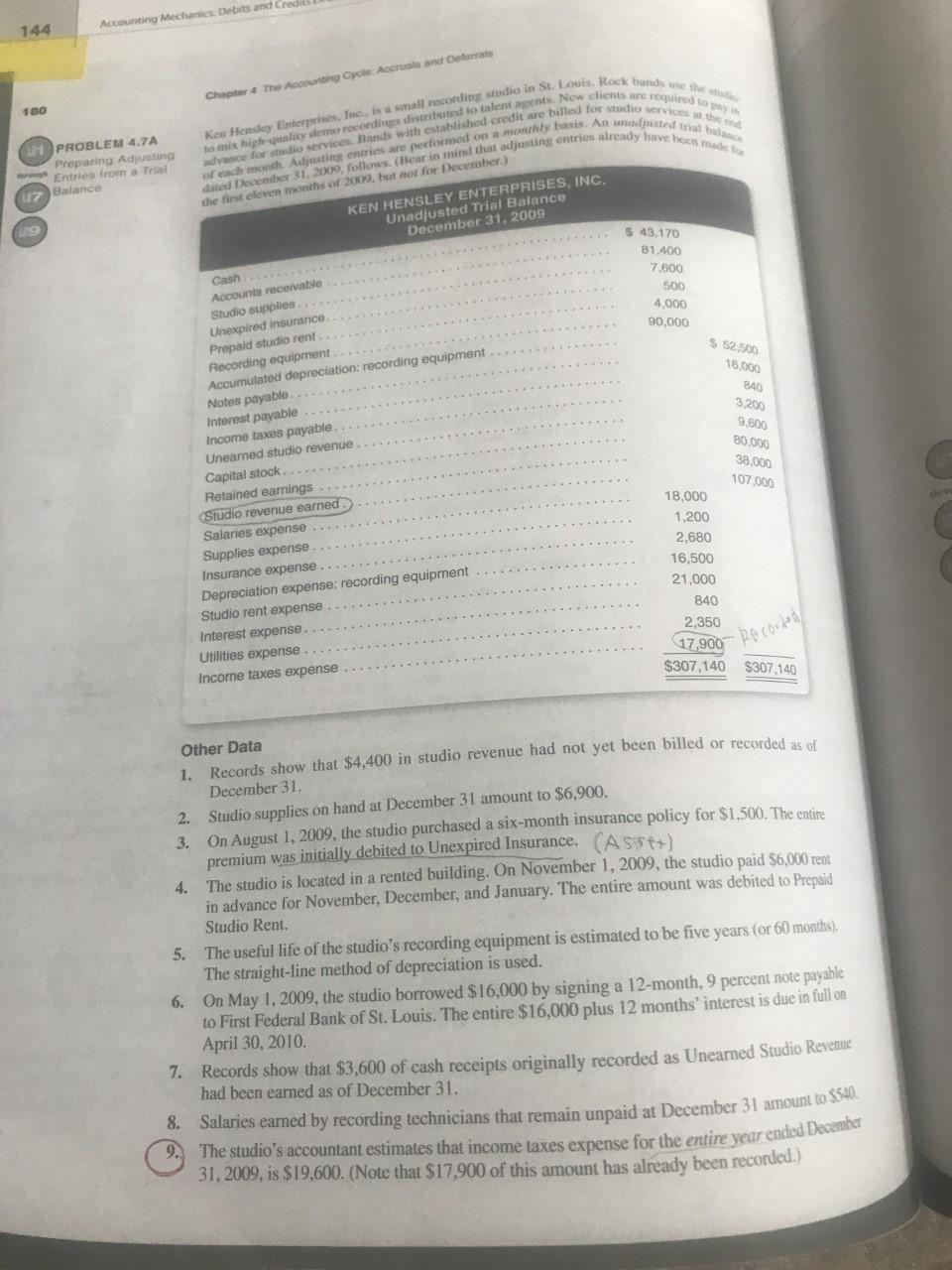

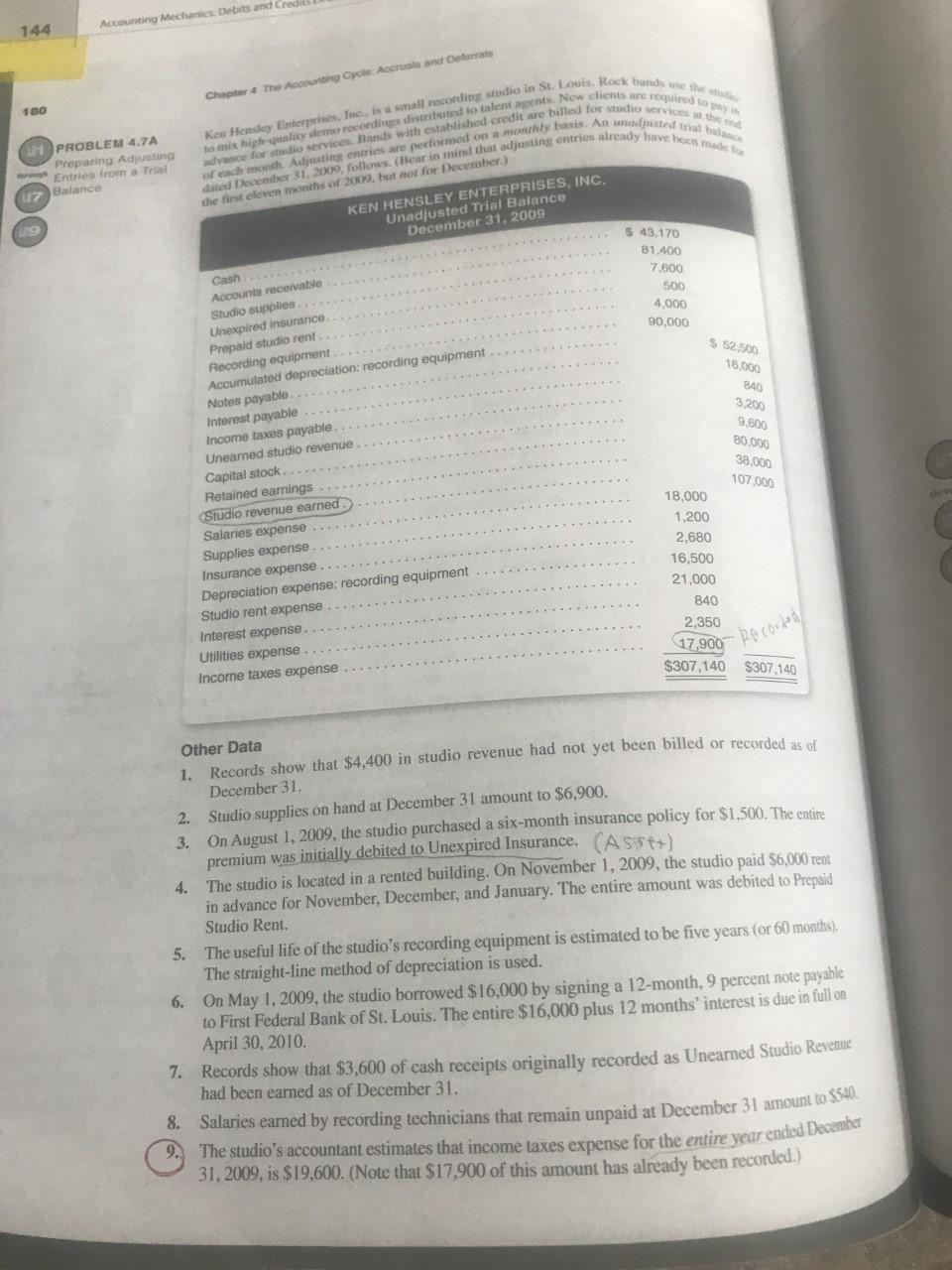

144 Accounting Mechanics Debits and Credits Chapter 4 The Accounting Art and Deformas 180 Ken Hendy Enterprises, Inc. is a small recording studio in St. Louis, Rock band the a mis high-quality demo recordings distributed to talent agents. Now clients are required dance for services with extablished credit are bulled for studio verit of each month. Adhosting entries are performed on a monthly basis. An uuted to be de Desember 31, 2009. follows. (Hear in mind that adjusting entries already have been made 117 Balance $ 43,170 B1,400 7.500 500 4,000 90.000 11 PROBLEM 4.7A Preparing Adjusting Entries from a Tral the first leven months of 2009, hat not for December) KEN HENSLEY ENTERPRISES, INC. Unadjusted Trial Balance December 31, 2009 Cash Accounts receivable Studio supplies Unexpired insurance Prepaid studio rent Recording equipment Accumulated depreciation recording equipment Notes payable Interest payable Income taxes payable Unearned studio revenue Capital stock Retained earnings Studio revenue earned Salaries expense Supplies expense Insurance expense. Depreciation expense: recording equipment Studio rent expense Interest expense Utilities expense Income taxes expense $ 52,500 18.000 840 3200 9,800 80.000 38,000 107.000 18,000 1,200 2,680 16,500 21,000 840 2,350 17,900 $307,140 $307,140 Other Data 1. Records show that $4,400 in studio revenue had not yet been billed or recorded as of December 31. 2. Studio supplies on hand at December 31 amount to $6,900. 3. On August 1, 2009, the studio purchased a six-month insurance policy for $1,500. The entire premium was initially debited to Unexpired Insurance. CA 550) 4. The studio is located in a rented building. On November 1, 2009, the studio paid $6,000 rent in advance for November, December, and January. The entire amount was debited to Prepaid Studio Rent 5. The useful life of the studio's recording equipment is estimated to be five years (or 60 months) The straight-line method of depreciation is used. 6. On May 1, 2009, the studio borrowed $16,000 by signing a 12-month, 9 percent note payable to First Federal Bank of St. Louis. The entire $16,000 plus 12 months' interest is due in full on April 30, 2010. 7. Records show that $3,600 of cash receipts originally recorded as Unearned Studio Revenue had been earned as of December 31. 8. Salaries earned by recording technicians that remain unpaid at December 31 amount to $540. The studio's accountant estimates that income taxes expense for the entire year ended December 31, 2009, is $19,600. (Note that $17,900 of this amount has already been recorded.)