Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the present worth of the do nothing option = 0 the duration of window analysis is 15 years use this interest rate =8.32% the difference

the present worth of the do nothing option = 0

the duration of window analysis is 15 years

use this interest rate =8.32%

the difference in present worth between Option A and Option B over the analysis window= 10.28 millions

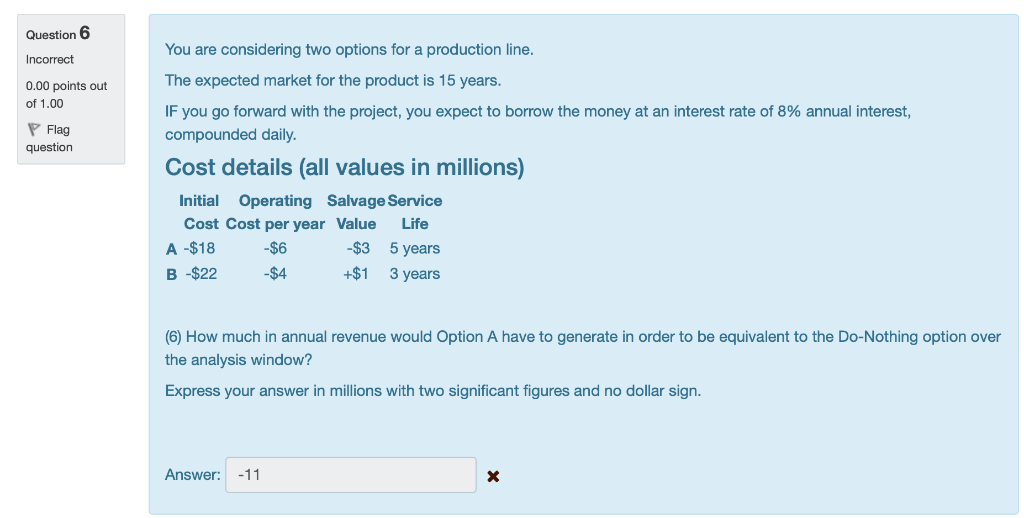

Question 6 ncorrect 0.00 points out of 1.00 You are considering two options for a production line. The expected market for the product is 15 years. IF you go forward with the project, you expect to borrow the money at an interest rate of 8% annual interest, compounded daily. Cost details (all values in millions) Flag question nitial Operating Salvage Service Cost Cost per year Value A -$18 -$6 B -$22 -$4 Life $3 5 years $1 3 years (6) How much in annual revenue would Option A have to generate in order to be equivalent to the Do-Nothing option over the analysis window? Express your answer in millions with two significant figures and no dollar sign Answer: 11

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started